Published on September 13, 2023 by Pankaj Bukalsaria and Oliva Rath

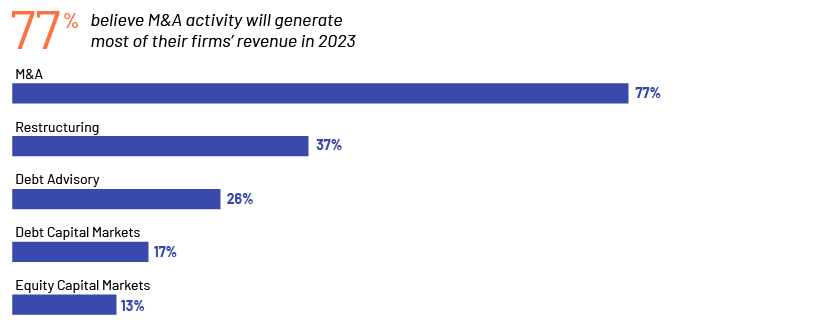

While M&A activity remained muted in 1H 2023 due to market uncertainty and volatility, it led to more attractive valuations; this may boost the deal pipeline in 2H 2023. With valuations reset, less competition for deals, and new assets coming to market (including from distressed situations), we believe many C-suite executives and boards will adopt M&A as part of their strategy in the coming months and years.

The twin evils of geopolitical tensions and economic uncertainty have certainly created headwinds but have also generated ample dealmaking opportunities. Whether an investment bank provides financing, advisory services, or both, it would be uniquely positioned to source and facilitate many strategic deals.

FACTORS THAT ARE EXPECTED TO STEER THE M&A ACTIVITY

Private equity firms have raised record levels of dry powder that have yet to be invested

Global private equity dry powder reached a record high of USD1.3tn, and venture capital dry powder is estimated at USD580bn. Although the vulnerability of leveraged loans to higher inflation and interest rates has made raising financing difficult, leading to a slowdown in buyout activity, private equity firms are expected to find alternative ways to finance important deals

Companies are likely to invest in strengthening their global supply chains

The pandemic, trade tensions between the US and China and varying economic conditions across the globe dampened dealmaking significantly in 2022. Companies are now seeking to make their supply chains more robust and resistant to headwinds.

-

Many plan to invest in restructuring to streamline their supply chains

-

Numerous cross-border investments are planned, aiming to fortify global supply chains

-

With technology becoming increasingly important at almost every point of the supply chain, it is viewed as another key component of acquisition strategies

According to Deloitte Consulting Report on The Role of Supply Chains in M&A, some of the top sectors with supply-chain synergies as a large percentage of overall deal synergies are as follows:

Lower valuations make corporate separations more likely

Uncertainty or market volatility may lead to a drag on dealmaking activity, but this could also be the time when valuations become more appealing and opportunity knocks. Lower valuations make assets more attractive, so high-value assets trapped inside larger corporates may opt for separation.

Banks and direct lenders would remain open for business as they sit on large piles of spare cash

As financial tightening in 2022 and the previous couple of years (introduced to manage inflation due to the stimulus packages offered during the pandemic) resulted in limited lending for high-yield bond issuers, banks and direct lenders are now open for business with substantial cash positions.

-

Both bankers and direct lending fund managers are ready to pitch debt packages to facilitate calculatedly picked M&A situations

-

Banks’ bridge books have a lot of spare capacity they are likely to use to enable strategic high-quality deals in 2023

We expect “companies that have debt portability clauses to also become more attractive to buyers because such clauses allow sellers to dispose of assets without having to repay the debt at deal closure”

Market challenges and uncertainties have often inspired innovation and encouraged companies to take bold actions. Download the full survey report now

Tags:

What's your view?

About the Authors

Pankaj has over fifteen years of experience in investment banking. He oversees multiple client engagements on front office research and analytics support across Corporate Finance / M&A, Capital markets including Islamic products, and Restructuring & Debt advisory. He has significant experience in working on Oil & Gas, Metals & Mining, Fintech and FIG sectors. A significant aspect of his work involves white boarding client requirements, proposing solutions and onboarding and managing client relationships across the globe, with focus on the Middle East, Africa and Asia. Prior to Acuity, he worked with UBS IB offshore team in India, where he led the set up and transition of Global Energy team..Show More

Oliva joined Acuity Knowledge Partners’ investment banking team in 2020. Well-rounded professional with 12+ years of experience in Investment Banking and Financial Services firms.

She has supported investment bankers on various pitches involving company/industry research, preparation of strategic research reports, pitchbooks, pre-IPO reports and investor PDIEs, competitive landscaping, market sizing & segmentation, case studies, macro-economic studies, and in-depth industry insights.

Extensive exposure in cross-industries primarily including FinTech, Insurance, Asset Management, Oil & Gas, Real Estate, Industrials, and Utilities. She has hands-on experience with prominent databases like Dealogic, Capital IQ, Factiva, FactSet, Pitchbook, and Crunchbase, along with other key industry associations.

Like the way we think?

Next time we post something new, we'll send it to your inbox