Who We Are

Acuity Knowledge Partners works with global banks and advisory firms, offering tailored support across the banking value chain – including front-, middle- and back-office support. This encompasses all facets of banking – from advisory, credit analysis and equity research to loan origination and portfolio monitoring. Our commercial banking solutions are designed to meet the specific needs of each client.

We deliver specialised solutions that streamline operations, manage risks and enhance decision-making. Our expertise in optimising processes, ensuring compliance and driving growth empowers banks to stay competitive in a rapidly evolving financial landscape. Combining deep industry knowledge with innovative technology, we help banks and advisory firms improve efficiency and achieve their strategic goals across functions.

Key Highlights in Numbers

Industry Shifts Redefining the Banking Landscape

Who We Serve

Our Service Offerings

M&A & Advisory

The full suite of M&A services to investment banks and boutique advisory firms, offering end-to-end research and analytics support from deal origination to execution

Learn MoreLending Services

Tailored corporate and commercial lending solutions blending credit expertise, industry-leading practices and cutting-edge technology

Learn More- Support across Loan Books

- Services across the Lending Value Chain

Capital Markets and Lending / Financing Solutions

Empowering banks with comprehensive offshore services for efficient lending and financing

Learn MoreGlobal Markets Operations

End-to-end support across the global market function including trade desk research, prime brokerage and custodian operations, trade operations, loan operations, treasury and cash management, and product control and reporting

Learn MoreInvesting Activities

Bespoke research and analytics powered by fundamental research and analysis, and technology-driven insights for primary financing activities

Learn MoreSpecialised Support

Enhancing efficiencies with our critical support functions including treasury and cash management, presentations and graphics, library functions, paralegal services and middle-office and back-office support

Learn MoreSell-side Research Support

Customised and tech-powered research solutions for operational agility and a competitive edge.

Learn MoreOur Perspective

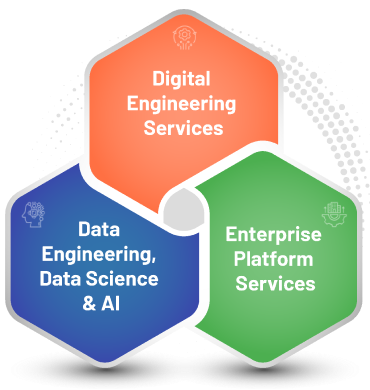

Data and Technology

Services (DTS)

delivering contextual digital solutions and insights to banking

The asset management industry is presently faced with several technological challenges as it adapts to a rapidly changing landscape. Navigating these challenges requires a strategic approach and a willingness to embrace change and innovation. Some of the challenges common to the industry are:

Investment Banking and Advisory

- M&A

- ECM

- DCM

- M&A analytics platform powered by internal and market data sets to ensure AI readiness, derive insights at scale, replicable across group

- ECM analytics to predict investor participation and demand for equity offerings

- Process automation and platform implementation for IB workflow

Global Markets

- Pre-Trade

- Execution

- Post-Trade

- Research

- Unique insights from predictive analytics by leveraging alternative data and proprietary data to differentiate equity research

- Platform reengineering of fixed income trading group for RFQ management

- Bespoke application development and deployment for research, trade, operations, and risk functions

Lending Services

- Origination

- Underwriting

- Lending Operations

- Monitoring

- Enhanced credit governance by leveraging robust data centralization and intuitive BI dashboards

- Improved portfolio monitoring by bespoke and automated digital solutions

- Data modernization to integrate market data sources and platforms for efficient loan management systems

Technology Offering for Banking Clients

Key Differentiators

Domain-centric solutions

3,000+ subject-matter experts working closely with 220+ banking clients across geographies including the US, Europe, the Middle East, Asia and Australia

Flexible engagement models

Customised coverage for clients including weekend support, extended-hours coverage and multilingual support

Strong automation capabilities

Diverse capabilities in developing and implementing bespoke banking solutions and cutting-edge technology to improve efficiency and turnaround time for banking clients.

Success Stories

What Our Customers Say About Us

Awards/Recognitions

Acuity Knowledge Partners Wins Prestigious 2024 European Credit Award for ‘Portfolio Management System of the Year’

View more