Published on May 6, 2024 by Himasha Fernando

Navigating the world of structured finance management solutions

Structured finance is a form of financing that combines a range of financial instruments to reshape the conventional and traditional financial landscape. Through the field of structured finance, investors gain access to tailored investment opportunities, and companies unlock new channels for raising capital while mitigating risk. In the current challenging financial world, structured finance management solutions are essential to meet the diverse and evolving needs of corporates and financial institutions (FIs). In this article, we dive into the world of structured finance management solutions and discover how they have become a game changer for corporates and FIs.

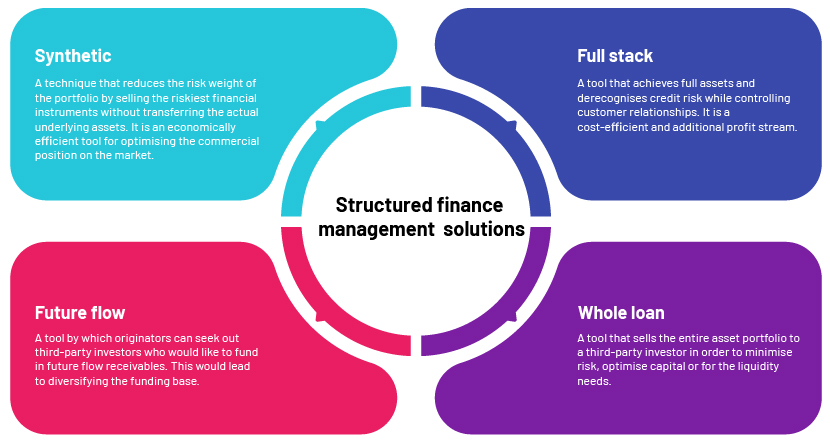

Structured finance management solutions available to clients include synthetic securitisation, full-stack securitisation, future flow securitisation and whole loan sale securitisation. We discuss them briefly below:

Below, we explore the structural features of future flow securitisation, its role in asset management, positive and negative implications, and real-world examples of successful future flow partnerships.

Beyond traditional financing: a journey into future flow securitisation solutions

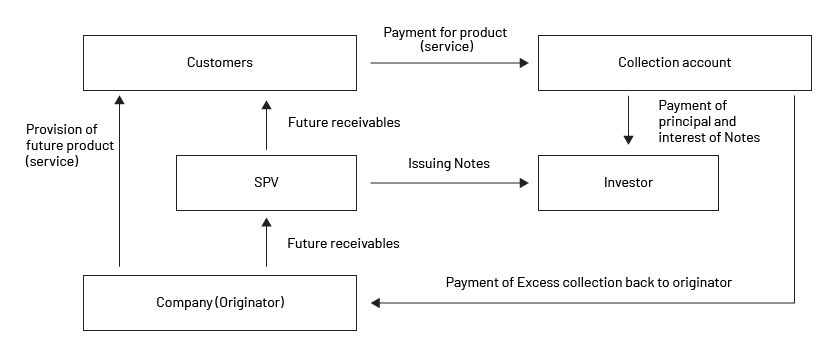

In simple terms, future flow securitisation is where FIs issue debt instruments secured by payments on future flow receivables. It is a tool by which originators seek out third-party investors who would like to fund in future flow receivables. Commonly used future flow receivables include future financial flows from international credit cards, foreign direct investments, future export receivables, family remittances and tourism-related cashflow. This technique enables companies to grow their capital via access to immediate funds while providing investors with access to high-quality assets. The assets are then derecognised from the client’s balance sheets, and future receivables are transferred as a true sale to a special-purpose vehicle (SPV), which is a separate legal entity created to handle the securitisation. The SPV then issues to the investors bonds that are secured by future receivables while the originator remains as the servicer. The structure of a typical future flow transaction is as follows:

Source: Establishment of rating methodology for future flow securitisation: Japan Credit Rating Agency

Unveiling the bright side of future flow securitisation

Future flow securitisation offers several advantages compared to other traditional securitisation such as the following:

-

Fosters long-term partnerships. One of the inherent advantages of future flow securitisation is that it encourages long-term partnerships between the originators and the investors participating in the securitisation. Additionally, future financial assets align with the interests of long-term investors. Given that the securities being offered are based on prolonged future revenue streams, investors have a good opportunity to engage in long-term partnerships. For example, in 2002, the World Bank issued USD250m worth of bonds backed by future flow securitisation through an SPV to provide a long-term financing source for Central America.

-

Diversifies funding sources. This can be considered as an alternative funding source that reduces reliance on traditional forms of financing. Future flow securitisation allows multiple issuances and enables the involvement of multiple investors. It also creates a diverse and dynamic financial portfolio across countries and sectors while supporting global expansion strategies. In 2018, IDB Bank approved notes backed by future flows of USD50m with a 10-year term; these were oversubscribed, with the participation of multiple investors.

-

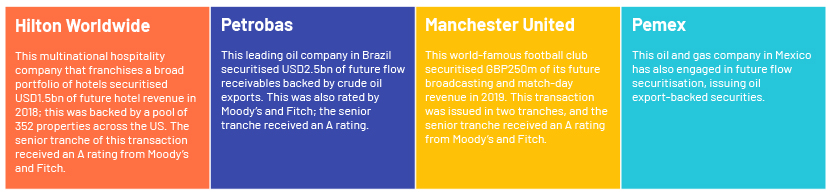

Enhances credit rating. Future flow securitisation would result in a higher credit rating due to the following factors. Through risk segmentation, companies isolate specific revenue streams that create a distinct financial structure separate from other obligations, enabling investors to anticipate future cash inflows and improve the stability of the financial structure, resulting in a higher credit rating. Furthermore, these agreements include additional protection for investors such as credit enhancements, additional guarantees and letters of credit to attract investors, which would have a positive impact on the company’s rating. Pemex Finance Ltd, an oil and gas company in Mexico, received a rating of BBB from S&P for future oil-backed securities; this was three notches above the rating for Mexican sovereign debt.

-

Offers financial flexibility. This contributes to financial flexibility through customised financing structures tailored to investors’ unique financial needs, the ability to invest in a diverse range of future assets and transferring risk and mitigating risk exposure to uncertainties. Therefore, this can be considered as a strategic tool for financial flexibility in an evolving financial environment. The Financial Regulatory Authority amended the Capital Markets Act in 2022 to raise capital by selling securitised bonds to investors after pooling future flows. Likewise, future flow securitisation could be customised to meet the specific financial needs of originators and investors.

Tackling the challenges in future flow securitisation

The following are some of the key constraints to adopting future flow securitisation:

-

Complex structure. These transactions are complex and challenging and require expert knowledge of securitisation. This limits adoption of such tools, especially by inexperienced issuers. It also involves unpredictability due to anticipated future cashflow, which is subject to volatility, negatively impacting the performance of future assets.

-

IFRS implications. This involves derecognising assets from client balance sheets, according to IFRS 9, which sets out specific guidelines for derecognising financial assets. It is essential that the criteria be met to accurately reflect an organisation’s financial position.

-

Regulatory risks. When adopting future flow securitisation, the associated legal considerations and regulatory compliance need to be considered. These would impact future flows, based on differences in jurisdiction and evolving regulatory environments.

Transparency in financial reporting is crucial for future flow security transactions. The financial crisis of 2007 highlighted shortcomings in disclosures of financial assets, especially those involving securitised assets. IFRS 9 has implications for securitisation firms. Barclays Bank, for example, has revised its annual reports for 2011 and 2012, considering the new IFRS 10 consolidation requirements for better presentation of financial-asset disclosures. The constraints mentioned above could be mitigated through transparent reporting and disclosure, assessments, professional guidance and legal due diligence.

Success stories of future flow securitisation transactions

The first future flow transaction was in the late 1980s, by Mexican phone company Telmex. A number of future flow securitisation transactions have taken place globally since then. The following are examples of notable future flow transactions from 2000 to 2023:

The examples mentioned above are just a few of the successful future flow securitisations so far. An emerging trend is governments in certain countries such as Indonesia facilitating the framework for a pilot phase of future flow securitisation in the public sector through public service agencies. This would enable governments to diversify funding and minimise the cost of capital through secured financing while sharing risk with the private sector.

How Acuity Knowledge Partners can help

We are experienced in reviewing securitised portfolios, tracking performance triggers and evaluating risks in securitisation transactions, helping our banking clients to optimise their advisory roles in structured finance management. We help assess the creditworthiness of securities and independently evaluate the credit risk embedded in these transactions. This enhances investor confidence and influences investor perception of future flow securities significantly.

As we monitor portfolios closely, investors' reliance on these transactions would improve, and more investors would be attracted to Structured Finance Services.

Sources:

-

Financing Development Through Future-Flow Securitization (worldbank.org)

-

What is a future flow securitization and what are the benefits? | IDB Invest

-

Enterprise Explains: Future flow securitization | Enterprise

-

Assessing Financial Reporting Transparency of Securitization Transactions | CFA Institute

-

Developing a Framework of Government Future Flow Securitization Through Public Service

-

Future Flow Securitization Rating Criteria (fitchratings.com)

-

Establishment of rating methodology for future flow securitisation: Japan Credit Rating Agency

Tags:

What's your view?

About the Author

Himasha is an Associate attached to the Lending Services Division at Acuity Knowledge Partners. She is currently part of the Asset Securitization team, undertaking monthly/quarterly analysis of special purpose vehicles, credit reviews, risk raters, covenant monitoring, approval package creations and other credit workflows for a leading European Bank. Prior to joining Acuity Knowledge Partners, she worked as an Intern at the ministry of finance Sri Lanka and at a leading international bank. She holds a bachelor's degree in Accounting from the University of Sri Jayewardenepura. She also is a CIMA passed finalist.

Like the way we think?

Next time we post something new, we'll send it to your inbox