Published on February 13, 2023 by Shubha Kamath and Vishal Kashyap

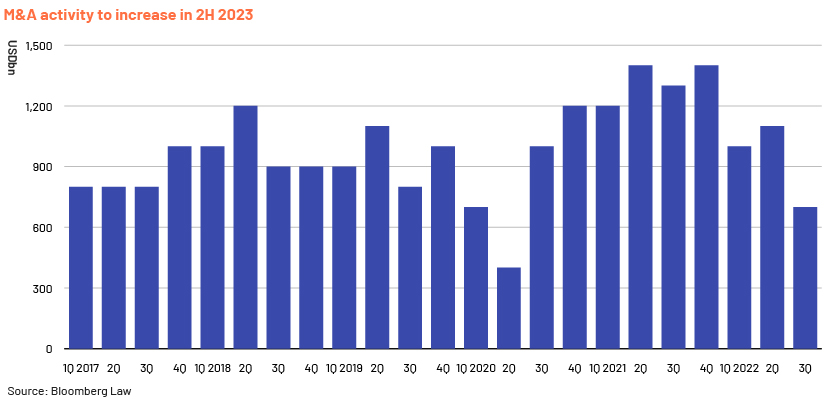

M&A activity slowed significantly in 2022. The total value of M&A fell 37% to USD3.66tn by 20 December 2022, after hitting an all-time high of USD5,900bn in 2021. The challenging economic environment, with the war in Ukraine and high inflation, led to volatility in equity markets, an increase in interest rates and economic uncertainty. Global deal volume was down for three consecutive quarters, with 3Q 2022 marking the third-lowest quarter since 2017 after the fall in 1Q and 2Q 2020 fall due to the effects of the pandemic.

M&A reached a historic high in 2021, and it was difficult to match these levels in 2022 or so far in 2023. The pandemic-infused cash injections, soaring stock-market valuations and large buyout funds led to record levels in 2021. Purchasing power reduced in 2022, which saw lower equity valuations and increased cost of acquisitions with high financing costs.

Despite these headwinds, we believe 2023 will be a strong year for M&A activity. Deal values and valuations will likely fall due to recessionary trends until mid-2023, but the second half will likely see good growth. Key drivers of the recovery are as follows:

-

Banks and direct lenders remain open for business, well equipped with cash, as financial tightening in 2022 limited lending for high-yield bonds issuers

-

Private equity firms have raised record levels of dry powder – this capital committed has yet to be invested

What will impact deals in 2023

Distressed-company buyout:

Companies survived 2022 with cash reserves accumulated in 2021. However, as these reserves were depleted and due to the high cost of borrowing, they shifted towards cash preservation and layoffs in 4Q 2022. This is likely to result in distressed companies being sold and non-core assets being divested. This presents an opportunity to financial sponsors and big companies looking to expand existing product/service lines and geographical footprint.

Supply-chain disruptions:

Supply-chain disruptions have been the catalyst for businesses to invest in nearshoring and reinvent their supply chains. Companies trying to optimise their supply chains may seek acquisitions to secure vertical supply-chain elements or bring crucial supply-chain elements closer in order to reduce fulfilment time. Technology is becoming increasingly important at almost every point of the supply chain. Another key component of acquisition strategies with a supply-chain focus may be the purchase of technology processes that promote supply-chain optimisation and efficiency. This year will likely see acquisitions that enable digital advancement and technological transformation on the supply side.

Futuristic technology:

Although tech stocks were beaten down in 2022 after a strong run amid the pandemic, it may still be the most-sought-after sector. Crypto assets, the metaverse, non-fungible tokens (NFTs) and Web3 could be exciting areas to watch in 2023. Technology-enhanced deals will likely continue to gain traction, accompanied by growing regulatory scrutiny to prevent antitrust and data privacy issues. One such success was Nike, which acquired digital asset developer RTFKT to drive deeper engagement with its customers by packaging virtual sneakers. Real estate investment trust (REIT) and gaming accounted for 45% of M&A advisory fee revenue in 2022; this may remain a trending area. REITs are a good hedge against inflation, while gaming metaverse platforms have become a trending topic as big IT companies acquire metaverse platforms. New technologies that set new industry standards would continue to drive M&A deals in the technology sector.

ESG:

As investors take more interest in ESG and consider it a financial driver, companies may look to divest carbon-intensive assets. ESG is quickly moving to the top of business agendas and is increasingly on the minds of regulators, investors, customers and employees. Customers' enthusiasm and acceptance of a company's ESG strategy present an opportunity to elevate deal value. Financially strong companies may also look to acquire thematically strong assets to increase their ESG scores and comply with increasing regulations. ESG is becoming a symbol corporate quality as it increases in significance.

Lower equity valuations would continue to weaken the currency of buyers. This may require them to raise equity at lower prices to fund M&A deals and expand at reduced rates. On the other hand, distressed companies with low valuations may become targets for aggressive investors.

Big corporations are sitting on piles of cash looking to fund deals and diversify their businesses. Creditors are being extremely cautious when providing loans for risky transactions as interest rates rise. This has resulted in a lag in M&A activity as big players wait for economic uncertainty to fade and markets to stabilise to make their move. Buyers will likely look more closely at targets that demonstrate profitable growth and consistent cashflow.

In 2023, buyers are likely to focus on the smaller deals as recessionary fears trigger the “lipstick effect”, i.e., when economic downturns result in increased spending on smaller and more affordable products, rather than on big-ticket and more expensive deals/goods. The economy is poised to recover by mid-2023 as Federal Reserve officials forecast inflation rates to reverse. Deal activity will likely remain flat at 2022 levels in the first half of 2023. Stabilised valuations in the second half of 2023 would put pressure on private equity firms to invest their dry powder, boosting opportunities for financial sponsors and strategic buyers.

How Acuity Knowledge Partners can help

We support investment banks across the globe with a full suite of services, offering end-to-end support from deal origination to execution. Years of experience in working with global and regional investment banks and advisory firms enable us to do this as an extension of their teams, offering timely and accurate insights, and valuation and due diligence support to maintain a competitive advantage.

Sources:

-

https://www.spglobal.com/marketintelligence/en/news-insights/research/the-big-picture-2023-

-

https://www.insurtechinsights.com/global-ma-outlook-2023-smaller-deals-and-slower-pace/

-

https://www.fa-mag.com/news/lower-valuations-and-slower-m-a-activity-expected-in-2023--

-

https://www.wtwco.com/en-GB/News/2022/12/global-m-and-a-outlook-2023-smaller-deals-

-

https://www.cnbc.com/advertorial/2022/12/12/ey-ma-outlook-for-2023-despite-headwinds-

What's your view?

About the Authors

Shubha Kamath has over 6+ years of experience working across different value chain in the Investment Banking domain. Currently, supports Consumer and retail team for a U.S. based mid-market Investment Bank, in Bangalore. She has good exposure working through the deal life cycle, including deal origination to deal execution. She has experience working on different pitchbooks, evaluating business dynamics and CIMs. She has extensive knowledge in financial modelling and capital structure analysis. Prior to joining Acuity, she was part of sell side research team of Crisil Ltd. She holds a Master’s degree in Business Administration in Finance.

Vishal Kashyap has over 3+ years of experience working across various stages of the deal making process. Currently, supports M&A group for a U.S. based mid-market Investment Bank, in Bangalore. He carries good experience, working on different products in the IB value chain. He is well versed in making teasers, industry research, SOTP analysis, WACC analysis and valuation model. Previously worked with Verity Knowledge Solution and Deloitte, and holds a Post Graduate Diploma in Management in Finance.

Like the way we think?

Next time we post something new, we'll send it to your inbox