Drive revenue growth with financial

services technology solutions

Digital and AI-led organisations are rapidly widening the gap with other industry players as they transform their business using technology.

There is a desire to do more with less as financial services leadership navigates through a volatile and turbulent market amid a number of headwinds. In this radically changing environment, embracing innovation at pace and scale is crucial if an organisation is to thrive.

Digital and AI transformation requires a continued shift in both technology and mindset. Leaders who focus on execution, i.e., tightly integrating business and technology, are able to multiply the benefits that financial services technology solutions adoption lends to their business.

Transform your business model with our financial services technology consulting

Acuity supports digital transformational needs of the financial services industry by serving as a trusted partner who can combine technology and domain expertise to deliver real business outcomes such as enhanced customer expereince, better risk management, and faster decision making.

Acuity has been supporting tech leaders in the banking and capital markets domain to address these challenges since 2005. With our financial services technology consulting, we collaborate with tech decision-makers to transform business models that enable them to reduce tech debt, execute highly bespoke automations, generate unique insights and deliver enterprise-level applications.

The DTS value proposition

1000+ Technologists

- 700 Software Engineers

- 250 Data Scientists, Engineers & Visualizers

- 100 Quality Assurance Engineers

- 75 Project Managers / Scrum Master

5700+ Domain Specialists

- 1800 Investment Banking

- 800 Commercial and Retail Banking

- 1300 Asset and Wealth Management

- 850 Private Markets

- 600 Consulting & Corporates

8 Delivery Centers

- San Jose - Costa Rica

- Frankfurt - Germany

- Zurich - Switzerland

- Bangalore, Pune, Gurgaon - India

- Colombo - Sri Lanka

- Beijing - China

Who we serve

Corporate, Commercial and Investment Banks

Asset Management

Private Markets

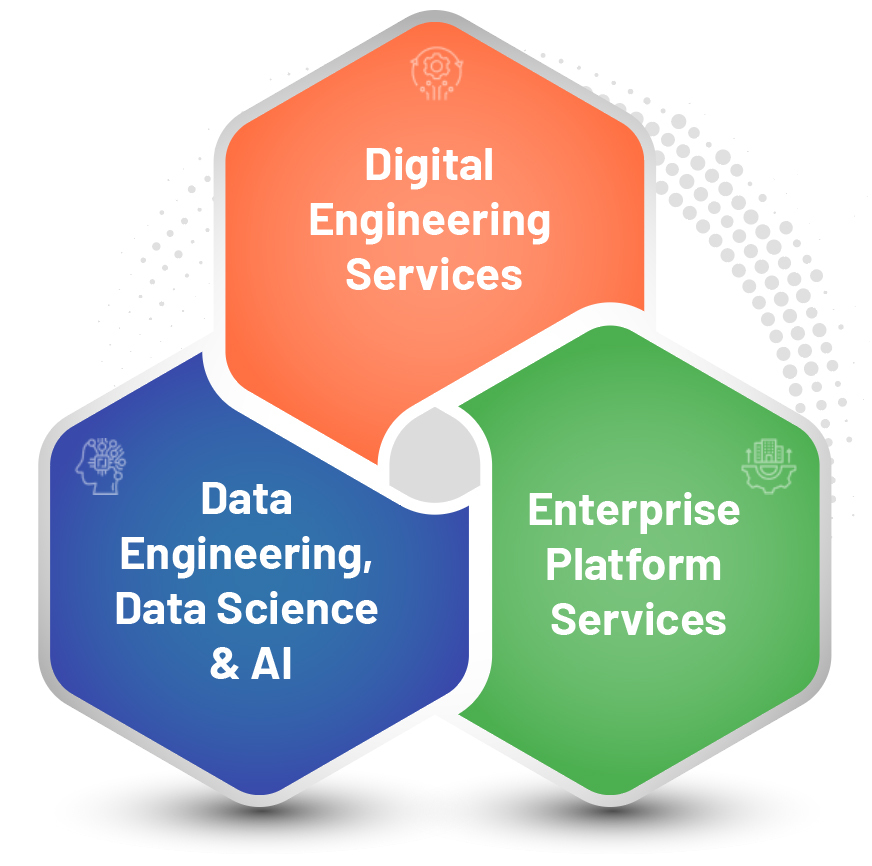

Our financial services technology offerings

Digital Engineering Services

- Platform Development & Enhancement

- Quality Assurance, Testing & Project Management

- Cloud Transformation, Development & Support

- DevOps Implementation & Support

- Application Life Cycle Management

- Business Process Automation & RPA

Data Engineering, Data Science & AI

- AI – NLP, LLMs, Deep Learning

- Machine Learning & Advanced Analytics

- Data Analytics & Business Intelligence

- Data Platform Engineering

- Data Management

- Quantitative Analysis

Enterprise Platform Services

- COTS/SaaS Platform Implementation

- Customizations, Configurations & Enhancements

- Platform Integrations

- Change Management

- Data Migration & Data Quality

- Platform Support

Why Acuity?

Accelerate time to market

Accelerate product or service launches by streamlining processes and utilizing real-time data insights.

Drive Revenue growth

Drive growth by optimizing pricing strategies, tailoring offerings, and identifying new revenue opportunities through data analysis.

Enhance Operational Efficiency

Improve productivity and resource allocation while reducing errors through automated processes and data-driven decision-making.

Faster C-Level Decision

Empower decision-makers with real-time data and analytics for informed, timely responses to market changes and opportunities.

Our Platform Expertise

Meet our experts

Frequently Asked Questions

Acuity Knowledge Partners’ Data & Technology Services (DTS) provide comprehensive support to financial institutions through a variety of specialised solutions. Here are some key ways they assist:

- Digital Engineering Services: Help in platform development, enhancement, and cloud transformation. This includes DevOps implementation and support, application lifecycle management, and business process automation.

- Data Engineering, Data Science & AI: Acuity offers advanced analytics, machine learning, and AI solutions, including natural language processing (NLP) and deep learning along with data management, and quantitative analysis.

- Enterprise Platform Services: This includes the implementation and customization of commercial off-the-shelf (COTS) and SaaS platforms, platform customizations, integrations, change management, data migration, and data quality.

Acuity’s financial services technology consulting can drive revenue growth in several impactful ways:

- With dedicated teams of off-shore experts, Acuity delivers higher cost savings for the outcomes that are delivered.

- Enhancing Operational Efficiency: By streamlining processes and integrating cutting-edge technologies, Acuity helps institutions reduce costs and improve operational efficiency, which in turn can boost revenue.

- Acuity leverages data and analytics to deliver in-depth quantitative pitches that help increase revenue growth.

- Accelerating Product Launches: Acuity’s expertise in digital transformation and technology integration allows financial institutions to bring new products and services to market more quickly, capturing market share and driving growth.

Acuity leverages AI and data science to provide advanced analytics, enhance risk management, automate business processes, and improve customer experiences for financial institutions. It uses AI-driven insights for better decision-making, automates routine tasks to increase efficiency, and employs AI for personalised customer interactions. Additionally, it analyses ESG data using NLP to support informed investing decisions, helping institutions optimise operations, reduce costs, and drive revenue growth.