Strategic Private Equity and Venture Capital Consulting Partner

We provide private equity, consulting, private credit, and venture capital consulting services to firms seeking the flexibility to manage highly volatile workflows on either a retainer or a project-specific basis. We work as an extended arm of our clients, ensuring all regular and critical functions of the funds, such as opportunity screening, due diligence, periodic reporting, business development, portfolio monitoring and writing whitepapers, are carried out irrespective of spikes in investment activity.

Our Private Equity and Venture Capital Expertise in Numbers

Comprehensive Private Equity and Venture Capital Solutions

Comprehensive solutions tailored to streamline Private Market operations, from strategy to execution

End-to-End Support

Private Equity

Private Equity

Due diligence, financial modelling, portfolio management and deal origination services to enhance private equity investment strategies

Know more

Private Credit

Private Credit

Credit analysis, underwriting support, covenant monitoring and portfolio management for private credit investors and lenders

Know more

Venture Capital

Venture Capital

Deal sourcing, due diligence, market research and portfolio company monitoring for venture capital firms

Know more

Funds of Funds

Funds of Funds

Research, due diligence, risk assessment and performance analysis for funds of funds managers

Know more

Real Estate

Real Estate

Investment analysis, asset management, market research and financial modelling for real estate market participants

Know more

Infrastructure

Infrastructure

Project finance modelling, deal analysis, market intelligence and asset management support for infrastructure investors

Know more

ESG

ESG

ESG integration, reporting, thematic research and regulatory compliance services to align investments with environmental, social and governance criteria

Know more

Private Equity Secondary Fund

Private Equity Secondary Fund

Secondary transactions, with valuation analysis, portfolio assessment and due diligence for private equity secondary funds

Know moreOperational Support

Paralegal

Paralegal

Legal research, documentation, due diligence and compliance support to enhance efficiency of legal teams within financial sector

Know more

Investment Compliance

Investment Compliance

Regulatory monitoring, compliance reporting, trade surveillance and risk assessment services to ensure adherence to investment guidelines and regulations

Know more

Portfolio Management and

Fund Operations

Portfolio Management and

Fund Operations

Performance analysis, risk management, trade support and operational due diligence to optimise portfolio management and fund operations

Know more

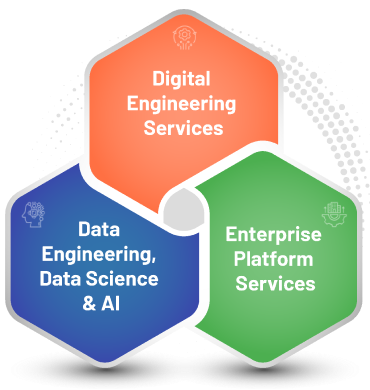

Technology (DTS)

Technology (DTS)

Custom technology solutions, including software development, data management and analytics, to empower financial firms with advanced technology capabilities

Know moreTrending In Private Equity and Venture Capital

Embracing Technology Responsibly in Private Markets

The private market sector is currently grappling with numerous technological challenges as it navigates a rapidly evolving landscape. Addressing these challenges calls for a strategic mindset and a readiness to embrace change and innovation. Some challenges inherent in the industry are:

Digital Transformation

Data integration and Management

Regulatory Compliance

Adoption of Advanced Analytics

Automation and Efficiency

Spotlight on Private Equity & Venture Capital Consulting

One-stop shop for private equity & venture capital

One-stop solution provider for private equity, private credit and venture capital firms, with expertise and service offerings to support all aspects of investment life cycle across value chain

Strong private equity & venture capital domain expertise to undertake complex tasks

Extensive experience in supporting clients through direct, secondary, fund of funds (FoFs), private credit and primary fund investments across major private markets and asset classes

Strategic and consultative approach

Experienced in helping realise long-term growth strategies by identifying opportunities and optimising portfolio performance

Experienced team to undertake complex tasks

Highly experienced and effective analysts who undertake intense tasks, including commercial due diligence, investment due diligence, valuation analysis, building complex distribution models and exploration of previous transactions

Success Stories

Meet Our Experts

Frequently Asked Questions

Acuity Knowledge Partners utilises a range of advanced tools and data sources for venture capital due diligence. We employ financial databases like Bloomberg, PitchBook, and Capital IQ for comprehensive market and financial data. Additionally, we use industry-specific databases and proprietary analytics platforms to gather insights on market trends, competitive landscapes, and emerging technologies. Acuity also leverages advanced data analytics tools, such as Python and R, for financial modeling and scenario analysis. Furthermore, we access public records, regulatory filings, and expert networks to validate information and ensure thorough due diligence, enabling venture capital firms to make well-informed investment decisions.

How can our portfolio monitoring services help improve the performance tracking of your portfolio companies?

Acuity's portfolio monitoring services enhance performance tracking of portfolio companies by providing detailed, real-time insights and analytics. They utilise advanced data analytics tools to track key performance indicators (KPIs), financial metrics, and market trends. Acuity's team conducts regular performance reviews, benchmarking against industry standards, and identifying areas for improvement. The services offer customised dashboards and reports, enabling clear visibility into each company's performance. Additionally, Acuity provides strategic recommendations based on data-driven insights, helping to optimise operations and drive growth. This comprehensive monitoring ensures proactive management, timely decision-making, and ultimately, improved performance and returns for the portfolio companies.

What benefits can VC firms expect from Acuity’s deal-sourcing services in terms of visibility and investment opportunities?

VC firms can expect significant benefits from Acuity’s deal-sourcing services, including enhanced visibility and access to high-quality investment opportunities. Acuity leverages extensive market research, industry networks, and advanced analytics to identify promising startups and emerging sectors. Their comprehensive approach ensures a steady pipeline of vetted deals, reducing the time and effort required for sourcing. By providing detailed insights and due diligence support, Acuity helps VC firms make informed decisions and identify high-potential investments early. This proactive and data-driven deal-sourcing strategy enhances the firm's competitive edge, enabling them to capitalise on lucrative opportunities and achieve superior investment returns.

How does Acuity Knowledge Partners reduce the time taken to close deals through customised due diligence frameworks?

Acuity's portfolio monitoring services enhance performance tracking of portfolio companies by providing detailed, real-time insights and analytics. They utilise advanced data analytics tools to track key performance indicators (KPIs), financial metrics, and market trends. Acuity's team conducts regular performance reviews, benchmarking against industry standards, and identifying areas for improvement. They offer customised dashboards and reports, enabling clear visibility into each company's performance. Additionally, Acuity provides strategic recommendations based on data-driven insights, helping to optimise operations and drive growth. This comprehensive monitoring ensures proactive management, timely decision-making, and ultimately, improved performance and returns for the portfolio companies

How does Acuity Knowledge Partners assist venture capital outsourcing firms in identifying investment opportunities?

Acuity Knowledge Partners assists venture capital outsourcing firms in identifying investment opportunities by scanning a relevant pool of companies that fits the investment objectives of clients. Acuity also helps with providing comprehensive research and analytical support. We leverage our expertise in market analysis, financial modeling, and due diligence to evaluate potential investments. Acuity's team conducts in-depth industry and competitive landscape assessments, identifying emerging trends and high-growth sectors. Thus, Acuity helps venture capital firms make informed decisions, optimise their investment strategies, and enhance their overall efficiency, ultimately driving better returns on investment. With this support, clients are able to reduce time-to-decision.