Published on May 7, 2024 by Rakesh Jamdhade

Key terms

The term “wall-crossing” stems from the phrase “Chinese wall”, widely used by investment banks to mean a virtual barrier that investment companies use to restrict exchange of data and prevent misuse of material non-public information.

A “Chinese wall” separates the “private side” from the “public side”.

The “private side” has access to their clients’ material non-public information not available to the “public side”.

“Material non-public information” refers to facts about a company’s upcoming events/actions that it has yet to announced publicly and that if acted upon could give the person in possession of it an unfair advantage.

The what, why and how of “wall-crossing”

Wall-crossing in general implies granting or controlling access to certain sensitive information on a trade with a financial institution. It is the process of providing insider information on a company intentionally to investor firms, bringing such information “over” the “Chinese wall”.

It involves limiting the number of individuals who have permission to access and receive information that could possibly be market-sensitive or confidential in nature. It happens when a company wants to obtain views on a prospective corporate action. During the entire process, investor firms are required to keep the information confidential so that no trading occurs in an uninformed market.

Companies often collaborate with their broker-dealers during significant events such as an initial public offering (IPO) or a further public offering (FPO), for which they need to gauge the interest of potential or existing investor firms and understand their perspectives before the transaction occurs; this is referred to as “market sounding” or “pre-marketing”.

At each market sounding, there is a disclosing market participant and investor firms receiving the market sounding:

Disclosing market participant (DMP)

refers to the company or advisor (acting on the company’s behalf). They make disclosures about an upcoming transaction to gauge interest of investor firms, helping them determine the important aspects.

Market-sounding recipients (MSRs)

are investor firms that receive insider information from a DMP on an upcoming transaction and respond to this information.

It is vital that investor firms agree to keep the transaction confidential. For this, they need to sign a “non-disclosure agreement” (NDA) that allows them to "wall-cross", meaning that they can become “insiders” and gain access to material non-public information.

Risks associated with wall-crossing

Although wall-crossing is a useful practice and is widely accepted in financial markets, the major risk involved is “misconduct or misuse of material non-public information”.

There have been cases where employees or senior officials of investor firms have engaged in market misconduct through insider trading, after agreeing to be wall-crossed. Hence, investor firms need to ensure that certain key obligations are met from a compliance and control point of view before they participate in wall-crossing.

To prevent misuse of insider information, the Market Abuse Regulation (MAR) was introduced with requirements for investor firms and issuers. The DMP and MSRs must abide by the rules and regulations of the MAR; these include maintaining records of insiders for five years and presenting such records to regulators if required.

Violation of information barriers

In January 2024, one of the world’s largest investment banks was fined by the Securities and Exchange Commission due to its failure to enforce information barriers. In this instance, executives from the syndicate desk (the private side) disclosed material non-public information to certain institutional investors that used such information to take a short position in the stock.

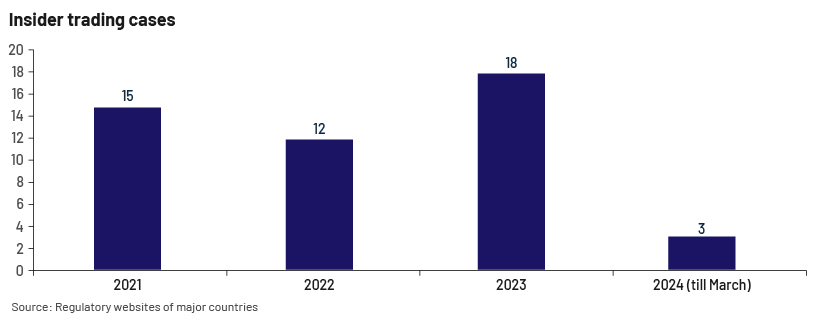

The graph below shows the number of enforcement actions taken by regulators due to financial companies’ failure to supervise the flow of insider information:

The role of compliance in wall-crossing

-

Need-to-know basis:

It is vital that insider information be shared with a limited number of people who need to know in order to complete the market-sounding activity. The compliance department needs to govern who has access to insider information and manage the risk of inappropriate disclosure.

-

Designated person:

There should be a designated person or point of contact, usually the chief compliance officer (CCO), at the MSR. This individual is responsible for reviewing, controlling and monitoring the entire market-sounding process.

-

Pre-trade controls:

Firms should ensure that they have effective controls in place to prevent trading when it is known that they have access to insider information. Such controls include adding the issuer company to a “restricted list”, adding insiders to the “insiders list”, monitoring “electronic communications” and observing “personal account dealings”.

-

Post-trade surveillance:

This ensures that the firm does not trade restricted issuers. An efficient process should be in place to identify and assess potentially suspicious trades, such as monitoring trades executed prior to and/or after insider information is announced by the issuer and reviewing an unusually high number of trades by the same person.

-

Record-keeping:

Regulators require information relating to market-sounding communication between parties to be recorded. This information includes the market participant’s name, the person receiving the insider information, the date of the market sounding and transaction information that is the subject of the market sounding.

-

Employee training:

Employees with access to insider information during wall-crossing need to be instructed and trained on their duties and obligations. Firms should also provide regular refresher training on this topic.

How Acuity Knowledge Partners can help

We are a trusted partner in the global market, offering compliance and other services. We enable our compliance clients to manage increasing demands on their teams by providing customised managed services solutions; these include specialised skills and technology to effectively manage and control the risks of wall-crossing. This has resulted in operational efficiency, resilience and significant cost savings. We have managed high volumes for clients, particular since the pandemic, when compliance teams have seen a significant increase in workload relating to tasks such as trade surveillance, communications surveillance, distribution compliance and transaction monitoring. For more details on our compliance offering, see here: https://www.acuitykp.com/solutions/central-compliance.

Sources:

-

Best practice note – Identifying, controlling, and disclosing inside information | FCA

-

Enforcement news | Securities & Futures Commission of Hong Kong (sfc.hk)

Tags:

What's your view?

About the Author

Rakesh Jamdhade has over 11 years’ experience of working with Investment firms for Compliance department. His expertise spans across Trade surveillance and ESG compliance monitoring. Prior to joining Acuity, he was associated with BNP Paribas and Accenture. He holds a Master’s degree in Business Administration, specializing in finance. At Acuity Knowledge Partners, he is part of Corporate and Forensic Compliance team and specializes in Best Execution, Fair allocation and ESG monitoring.

Like the way we think?

Next time we post something new, we'll send it to your inbox