Introduction

Executive summary

Acuity Knowledge Partners conducted a global online survey from March to April 2023 of 75+ seasoned senior executives from boutique advisory firms, mid-market investment banks, corporate and investment banks, and independent advisory firms operating in the global investment banking sector.

The survey explored a range of topics relating to the investment banking sector, including the current state, challenges and opportunities faced and outlook.

Investment banks and advisory firms remain cautiously optimistic despite a muted 1H 2023 and expect the markets to moderately revive in 2H

The global economy remains fragile in 2023 given the persistent market volatility. Developed economies are witnessing a slowdown in 2023 amid

Consequently, most investment banks also predict sluggish economic growth for the full year 2023. Investment banking fees of the major firms plummeted in 4Q 2022 and continued to decline in 2023. While the fixed income, currencies and commodities (FICC) and equity businesses generally benefit from volatility in asset markets, persistent unpredictability may create stronger headwinds for prospective dealmaking and underwriting, pressuring capital and liquidity buffers.

M&A activity to keep revenue streams open

While M&A activity remained muted in 1H 2023 due to market uncertainty and volatility, it led to more attractive valuations; this may boost the deal pipeline in 2H 2023. With valuations reset, less competition for deals, and new assets coming to market (including from distressed situations), we believe many C-suite executives and boards will adopt M&A as part of their strategy in the coming months and years.

The twin evils of geopolitical tensions and economic uncertainty have certainly created headwinds but have also generated ample dealmaking opportunities. Whether an investment bank provides financing, advisory services, or both, it would be uniquely positioned to source and facilitate many strategic deals.

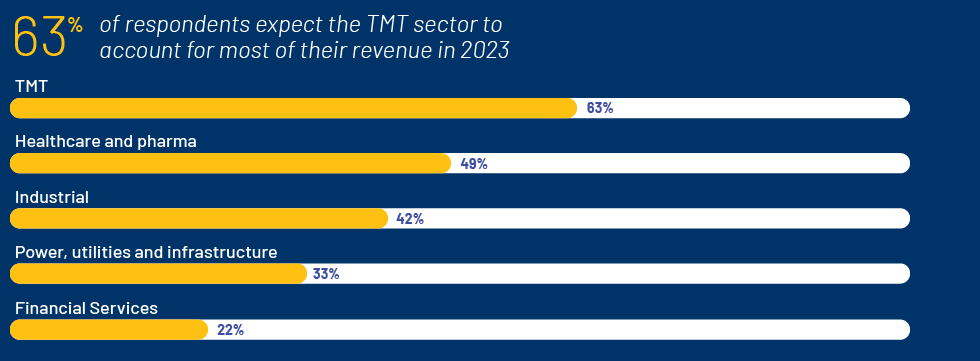

TMT & Healthcare dominate the dealmaking space

TMT, followed by healthcare and pharma, is expected to generate the most dealmaking opportunities and revenue for investment banking and advisory firms in 2023. Major companies in the TMT and healthcare and pharma sectors have solid balance sheets to cushion market pressures and make bold moves in the M&A space in 2023.

The factors that make it imperative for us to closely evaluate deal activity in individual sectors include:

» Tailwinds are generally less evident and tend to be sector-specific. Hence, it is appropriate to evaluate market opportunities by sector

» Some sectors rebound faster than others and pursue different strategies to thrive

» Most investment banks and advisory firms are organised according to product, regional, and sector coverage groups. Revenue for the different groups may vary in a given market situation

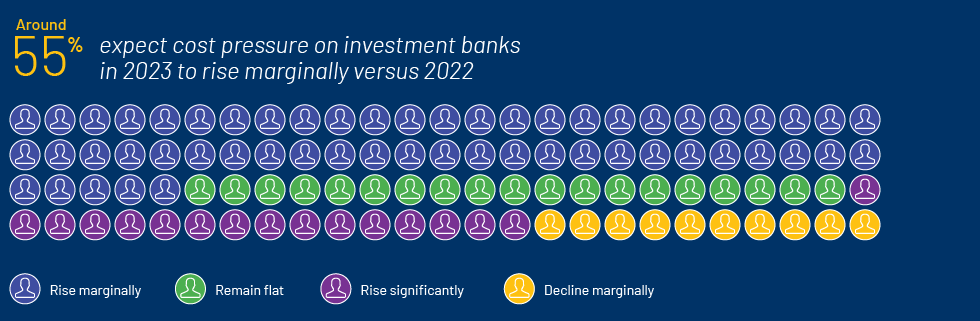

Watchful of headwinds as they unfold, investment banks look for operational repositioning and growth avenues in the meantime

Investment banks and advisory firms have been pragmatically exploring ways to improve operational efficiency as they assess the drag from rising regulatory pressure and extended periods for deal closure on direct and indirect costs. Any amount of cost escalation would need to be checked at an early stage to prevent a large impact as investment banks walk a fine line amid dynamic conditions.

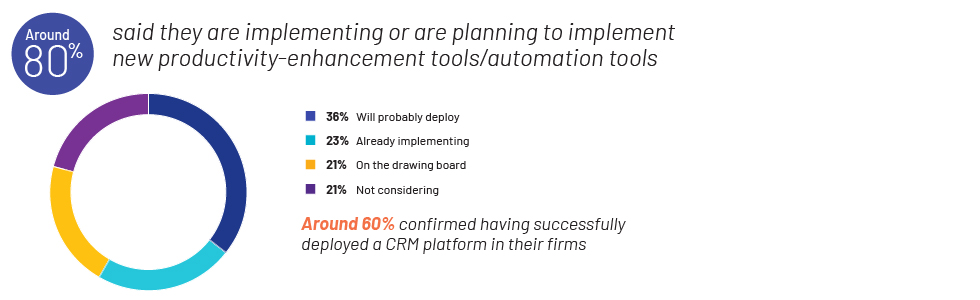

Automation critical for productivity enhancement

Client demands are ever-evolving and amid these challenging market conditions that have been compressing margins, investment banking and advisory firms continue to make progress in building new service ecosystems for their customers.

Our survey also revealed that most companies have been implementing or are planning to implement new productivity-enhancement tools/automation tools in 2023.

Offshoring to drive efficiencies

The pandemic resulted in previously unthinkable changes to the way investment banks and financial advisory companies conduct business. Virtual client meetings, remote deal origination & execution, and global workforces working remotely are now considered the new normal. Many of the new ways of working are likely to continue in the post-pandemic world. Offshoring has evolved beyond just the conventional consideration of inherent cost advantages and is increasingly accepted as a strategic tool.

» A strong offshoring partner that has the ability to support across a deal lifecycle can save onshore bankers and advisors significant time and effort, leading to multiple advantages

» Embedding an offshoring strategy into the operating model can ease the burden as cost pressure mounts and fee income slumps

The increased focus on deal origination and business-development activities underlines the importance of offshoring which can deliver efficiencies through new tools and technologies and also help in staffing strategy and better manpower planning.

Conclusion

This survey aimed to assess the sentiment and outlook of the global investment banking sector and identify opportunities for improving efficiency and maintaining strategic focus. Key findings are as follows:

» Respondents remain cautiously optimistic about the investment banking and advisory business in 2023, and about 58% expect only a mild dip in opportunities, resulting in slow or flat revenue growth.

» Primary deal drivers in 2023 are expected to be ample dry powder available with private equity firms, market consolidation and restructuring, digital transformation and ESG capabilities. 71% of the respondents believe the large amount of dry powder available with financial sponsors will be the main driver of deal activity in 2023.

» The respondents believe the TMT and healthcare and pharma sectors will drive deal volumes, with 63% expecting TMT to lead the pack.

» The current top priority for investment banks and advisory firms is to build a robust deal pipeline. Around 80% of the respondents highlighted that their current focus is on deal origination and increasing business development activities.

» Firms are placing increased importance on operational efficiency and cost optimisation to achieve long-term business success. More than 40% cited that strategic initiatives such as process re-engineering and workforce strategies are among the Top 3 activities that their firms are currently s

» To manage costs and boost deal pipelines, firms are exploring avenues such as deploying productivity/automation tools, using artificial intelligence (AI) to identify potential opportunities, implementing strategic initiatives and portfolio reviews, engaging in M&A and consolidation, and offshoring

Market challenges and uncertainties have often inspired innovation and encouraged companies to take bold actions. History has proven that firms emerge stronger and more resilient from crises, such as the financial crisis of 2008 or the pandemic. Our mission is to equip you with the necessary tools and resources to win in the long term.