Published on December 12, 2023 by Sudhir Shetty and Rohit Sharma

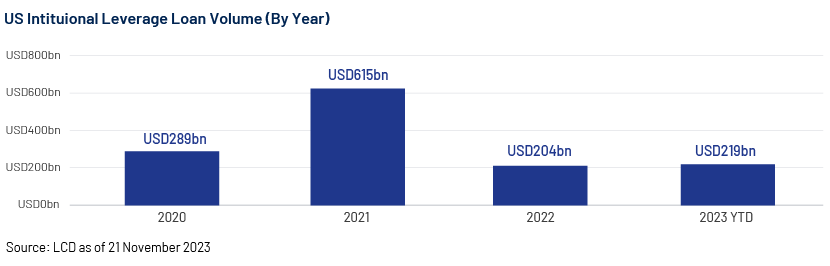

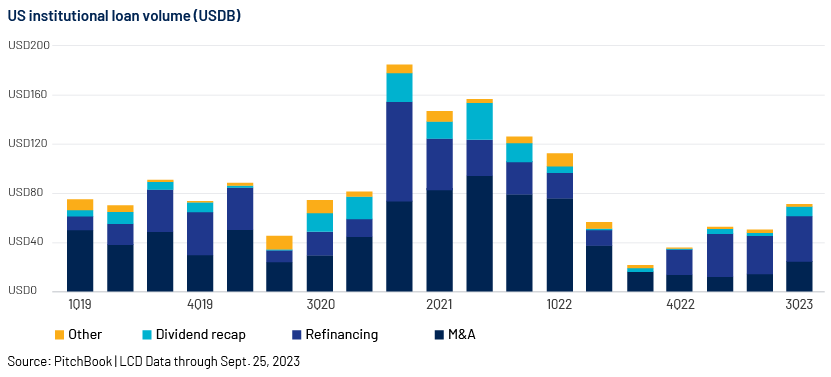

International leveraged finance markets have contracted sharply in the past two years and returned to adopting more conservative practices in areas of lending such as deal terms and pricing and exploring new avenues such as ESG and product variation. Direct lending products have also evolved from the more traditional options of syndicated loans and high-yield bonds. Leveraged lending spiked in 2021, considered to be the “golden year” for financiers, with US institutional leveraged loan volume totalling USD615bn. However, volume contracted to just USD293bn in the last six quarters (2Q 2022 to 3Q 2023), mainly due to the uncertainty as a result of inflationary pressures, geopolitical tensions, frequent interest rates hikes, disruptions in regional bank, debt-ceiling issues, muted M&A activity and international capital markets suspending new issuances.

The lending market is now governed by tighter covenants, wider spreads, low leverage and higher equity contributions. Lenders prefer financing higher-rated assets, while speculative-grade borrowers are trying to tap private credit markets for liquidity, refinancing and extending maturities of existing debt. Private equity firms are experiencing the most challenging year in a decade for monetising investments in their portfolio companies. They still expect to realise 2021 prices for their portfolio companies, while acquirers and investors expect valuations to factor in increasing interest rates, a stagnant IPO market and a weak economic outlook. Buyout firms have generated only USD584bn in 2023, c.75% less than the record c.USD1.4tn in 2021.

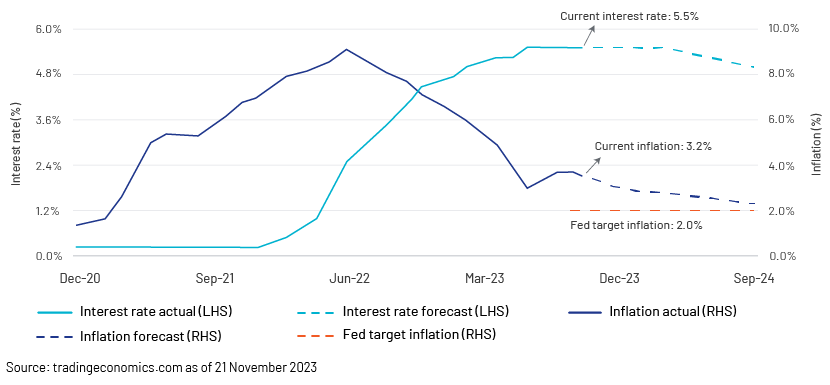

Uncertainty surrounding inflation and a higher-for-longer interest-rates scenario lead to a surge in defaults:

Inflation remained untamed at 3.2% as of October 2023, despite central banks raising interest rates. The Fed has hiked the interest rate 11 times since March 2022, now at a record high 5.5%. At its November meeting, the Fed hinted that it may keep the interest rate higher for longer to slow the growing economy and job market and achieve its 2.0% target.

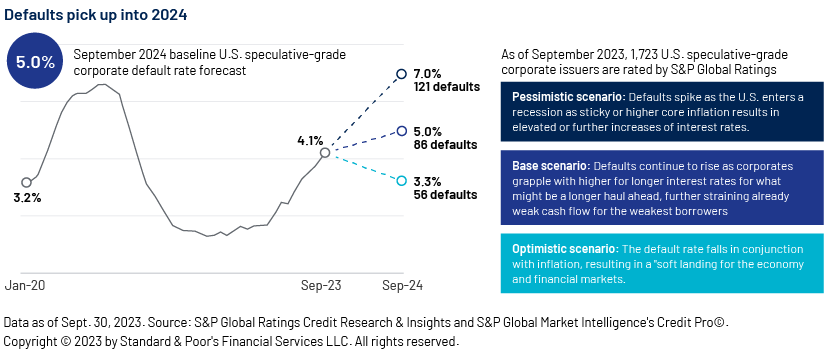

The full-year impact of the current high interest rates would be reflected in speculative-grade companies with weak financial metrics. Several of such companies depend heavily on their cash buffers to meet rising debt-service obligations. Both liquidity risk and refinancing risk are expected to increase over the next 12 months owing to restrictive primary markets and reduced access to capital.

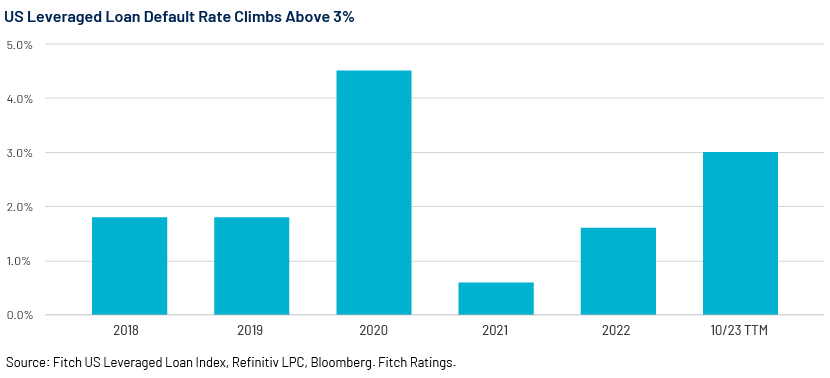

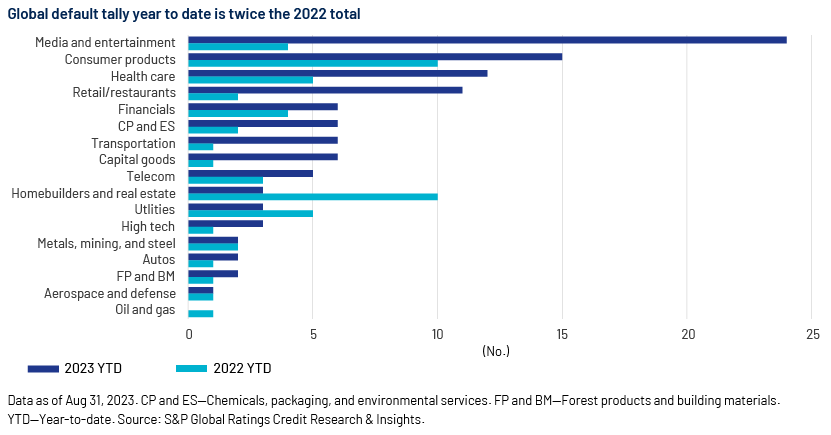

In October, the US leveraged loan trailing 12-month default rate was 3.5% by issuer count and 3.0% by volume. Default volume of 61 issuers amounted to c.USD50bn in 2023 YTD period, extremely high compared to the c.USD25bn of 23 issuers over the same period in 2022.

Speculative-grade issuers’ (rated 'BB+' or lower) credit quality is expected to worsen due to weak top-line growth and increasing costs, resulting in the default rate reaching 5.0% in September 2024 from the current 4.1%.

Stressed banks are cautious

Major banks are cautious about participating in financing risky buyouts due to concerns over debt-servicing risks that would result in bad loans on their balance sheets. Many banks faced challenges in offloading debt related to Musk’s takeover of Twitter and Apollo’s purchase of Brightspeed in 2022. The LBO loan and high-yield bond underwriting league tables have been distorted this year due to a lack of buyouts. Bank of America has dropped to #22 from #4 in 2021, and Barclays to #15 from #3 in 2022. Banks have also reduced their holdings in lending transactions, resulting in borrowers looking for groups of lenders and making the capital-raising process more complex and time-consuming.

Credit quality to deteriorate further in 2024

Fitch downgraded the US government’s long-term ratings from AAA to AA+ and Moody’s lowered its outlook on the US’s credit rating to “negative” from “stable”. Both rating agencies cited fiscal deterioration over the next three years, the soaring general government debt burden and the weakening of governance related to AA and AAA rated peers’ as reasons for the downgrades.

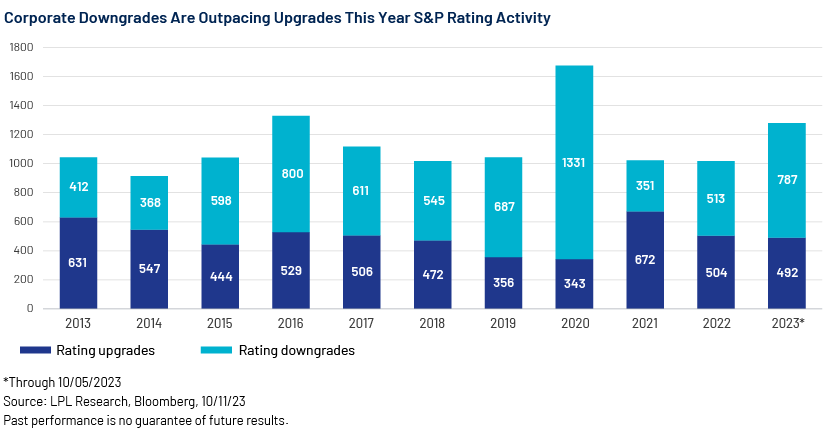

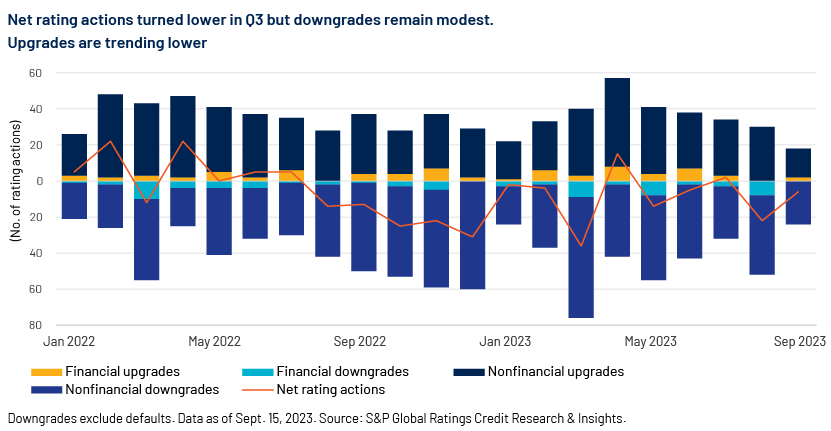

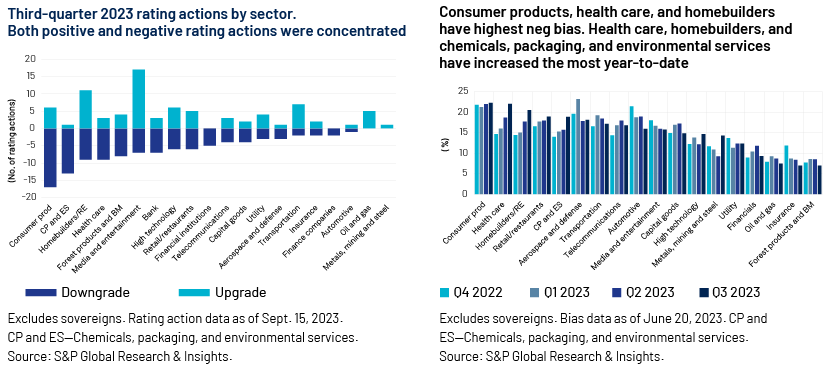

Corporate high-yield issuers are also impacted by the downgrades and will likely continue being impacted in the next few quarters. S&P and Moody’s reported 20% more downgrades than upgrades in September 2023, the 15th consecutive month of fewer upgrades than downgrades. S&P downgraded its outlook on 787 corporates versus 492 upgrades. Given the current headwinds – in particular, higher borrowing costs and debt service – 2024 could see even more downgrades than upgrades.

Higher negative bias on consumer-driven and loan-heavy sectors

Consumer-driven and loan-heavy sectors such as lower-rated media houses, print, business services, leisure and gaming, chemicals and packaging were negatively impacted in the year to 3Q 2023.

Global defaults among the top four sectors have accounted for 58% of all defaults in 2023. Most of them are the largest issuers of very-low-rated, floating-rate debt in recent years. Sixty-one percent of these sectors’ (media and entertainment, consumer products, healthcare, retail and restaurants) their speculative-grade debt has floating interest rates.

Source: Global Credit Conditions Q4 2023 Resilience Under Pressure (spglobal.com)

Source: Global Credit Conditions Q4 2023 Resilience Under Pressure (spglobal.com)

Private/direct lending as an alternate source for borrowers

Private debt constituted c.23% of all capital raised by highly levered borrowers in 2022 (2x 2021). The availability of private debt (when syndicated markets slowed) has cushioned companies in need of capital. Cash-rich private credit funds have offered amounts for riskier deals previously unheard of in traditional bank financing. Blackstone and Apollo Global Management’s c.USD4bn debt package supporting the 2022 take-private of software firm Zendesk equated to 25 times the target’s EBITDA. Private credit assets grew 460% to over USD1tn from 2010 to end-2022. However, private debt defaults (5%) are also expected to outpace syndicated loan defaults amid high interest rates into 2024. Private debt has c.10% of its portfolios maturing in 2024 and c.20% in 2025, which could well result in restructuring and write-downs in the coming months.

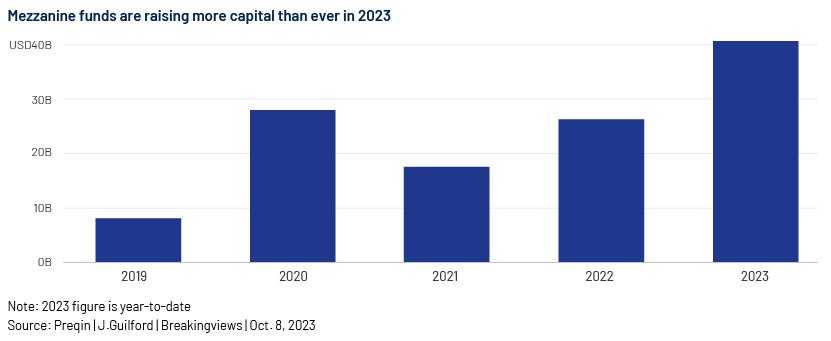

Mezzanine funding as an option for deferring interest payments

Mezzanine funds are a form of financing that ranks below traditional senior debt and is gaining momentum; they may also give borrowers the option to defer interest paymenys. The USD41bn in assets raised for mezzanine funds so far in 2023 (according to Preqin), is already 54% above that in full-year 2022.

For borrowers with weak balance sheets, mezzanine finance also results in high debt levels. High exposure to mezzanine finance provides regulators with another reason to be concerned about the rapid build-up of credit risk outside the traditional banking sector. With USD7tn of loans and bonds maturing in the next three years, according to S&P Global, companies with stretched balance sheets would need alternatives for refinancing. Direct lending debt with floating interest rates would mean that as central banks hike their rates, interest payments would spike for leveraged borrowers.

Source: https://www.reuters.com/breakingviews/private-credit-partygoers-reach-hard-stuff-2023-10-11/

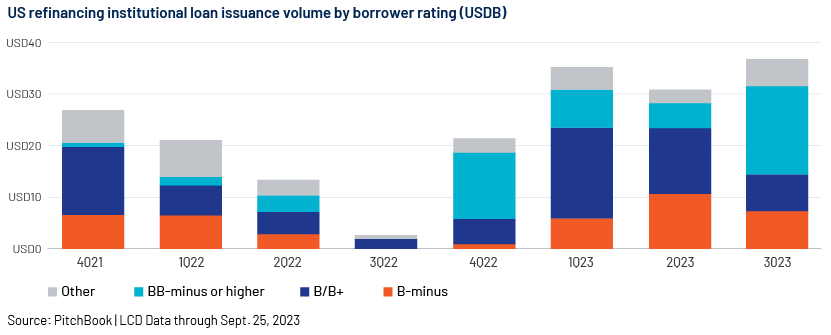

Leveraged lending market continues to build on refinancing activity

Despite the economic challenges and tight credit conditions, the leveraged finance market started to showing signs of recovery in 3Q 2023. US new-issue institutional volume totalled USD76bn, the highest in any quarter since the Fed started raising interest rates in 1Q 2022. This was primarily due to lower risk perception and a persistent secondary-market rally that boosted the weighted-average bid of US leveraged loans to its highest so far this year. Investor demand, as measured by CLO issuance and loan fund flows, grew from USD15bn in 2Q 2023 to USD26bn in 3Q 2023, mainly due to positive retail fund flows after five consecutive negative quarters.

Most of the issuances remain related to amend and extend (A&E) and refinancing activity. Extension activity reached USD26bn, the highest since the global financial crisis, and repricing was at USD39bn, the highest since 1Q 2021.

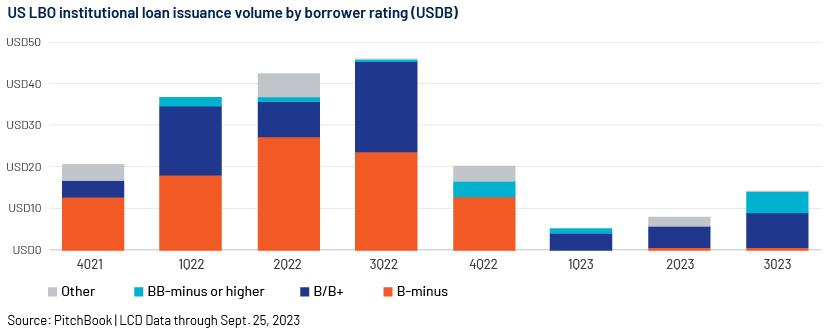

LBO/M&A remained sluggish due to valuation gaps and tighter credit terms but displaying signs of improvement, reaching USD24bn in 3Q 2023, the highest in five quarters. New LBOs prefer higher-rated assets (B/B+), which account for 96% of total LBO volume in 2023 versus 44% in 2022. A significant portion of 2023 debt issuance has been for refinancing, and speculative-grade (CCC/C) issuance in 2023 has been USD2bn globally – a low not seen since the financial crisis. M&A volume is expected to increase in 2024 considering the growing pipeline of prospective transactions, converging price expectations and increasing dry cash powder among sovereign wealth, private equity and venture capital funds.

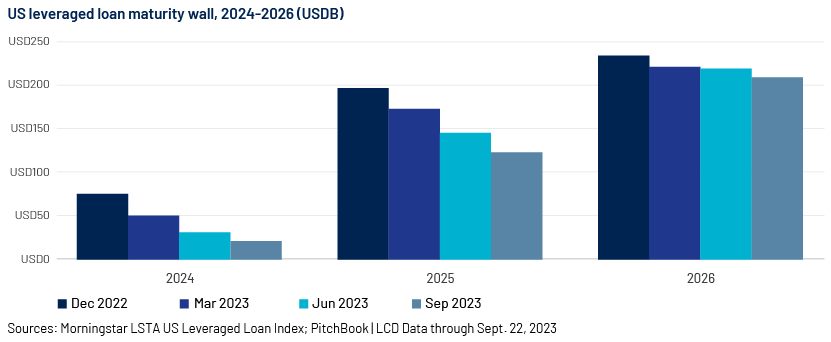

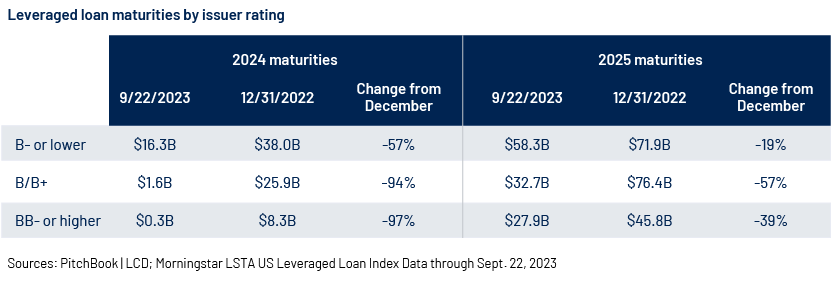

Reduction in 2024 loan maturities amid heavy refinancing and extension activity

US 2024 loan maturities dropped to USD20bn as of 22 September from USD75bn at end-2022, a reduction of 73%, due to heavy refinancing and extension activity, based on the Morningstar LSTA US Leveraged Loan Index.

This was led by higher-rated issuers (B/B+ cohort) as they reduced 2024 maturity by 94% to c.USD2bn; B- or lower-rated maturities decreased by 57% to USD16bn.

M&A to drive 2024 growth story for leverage lending?

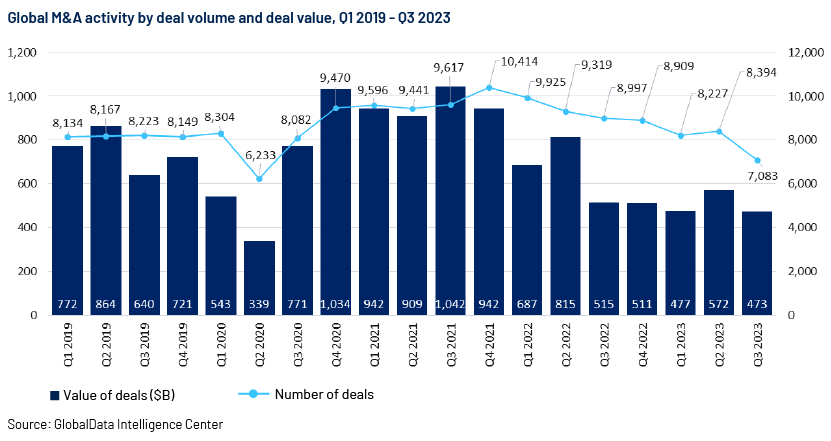

Global M&A activity decreased to USD473bn in 3Q 2023 (USD515bn in 3Q 2022), with a corresponding decline in volumes (7,083 deals until 3Q 2023 vs 8,997 until 3Q 2022) as a result of the overall slowdown in the markets.

North America accounted for most of the global M&A activity (USD242bn, 2,842 deals in 3Q 2023), although are a far cry from the 3Q 2021 volumes of 6,522 deals worth USD613bn (due to high interest rates, increased antitrust scrutiny and a looming US federal government shutdown). The performance so far in 2023 leads to expectations of stronger M&A volumes in 2024.

M&A activity in 2024 would mainly be driven by the following:

-

Strategic corporate initiatives such as ESG (energy transition and decarbonisation) and digitalisation (access to AI and other emerging technologies and upgrading talent)

-

Sovereign wealth, private equity and venture capital funds have abundant capital that could be deployed for deal making

-

Probability of confluence in price disparities (inflation, financing cost) between sellers and buyers

-

Dealmakers are keen to close deals that involve complying with evolving policies and regulations, incentivising the overall M&A environment

Outlook

The current macroeconomic headwinds (high interest rate regime, inflation, unemployment rates) along with geopolitical tensions (the conflict in the Middle East and the Russia-Ukraine conflict) could have a negative impact on leveraged borrowers (with weak balance sheets).

Defaults among borrowers across the speculative-grade spectrum are expected to peak in 2024 as weaker liquidity profiles result in inability to service debt.

However, M&A activity is expected to rebound in 2024, as private equity firms look to invest their surplus capital to fund acquisition activities. The US CLO market gained traction in 3Q 2023 and expects volumes to rebound in 2024.

Even if leveraged lending volumes witnesses a decent rebound to pre-pandemic levels in 2024, leveraged borrowers with weaker balance sheets would need to be monitored closely (with the majority of debt maturities in 2024 and 2025). The increase in credit risk (mezzanine lending) outside of traditional lending practices would also need to be watched from a regulatory perspective.

How Acuity Knowledge Partners can help

We continue to empower our stakeholders through ongoing monitoring of leveraged debt, delivering innovative solutions to new challenges, timely delivery of alerts on the latest news and detailed projections with quality credit reports to enable them to take action-oriented decisions.

Source:

-

Private equity firms face worst year for exiting investments in a decade (ft.com)

-

U.S. may need slower economic growth to beat inflation, Fed chair says | PBS NewsHour,

-

Default, Transition, and Recovery: The U.S. Leveraged Loan Default Rate Could Climb To 2.75% ,

-

US Leveraged Loan Default Rate Pushes Above 3% (fitchratings.com)

-

Big banks sit out LBO rebound after being stung by earlier buyouts

-

Moody’s Changes U.S. Credit Outlook to ‘Negative’ - The New York Times (nytimes.com)

-

Global rebound in M&A activity sets stage for busy final quarter - WTW (wtwco.com),

-

Global M&A deal value declines 8% YoY in Q3 2023 amid economic uncertainty, reveals GlobalData,

-

M&A Set to Pick Up in 2024 Despite Ongoing Headwinds (bcg.com),

-

M&A activity in US, Canada slumps to worst quarter since COVID-19 low | S&P

-

US leveraged loan issuance hits highest level since start of rate hike regime | PitchBook,

-

M&A Set to Pick Up in 2024 Despite Ongoing Headwinds (bcg.com)

-

Private credit partygoers reach for the hard stuff | Reuters; Private credit defaults could hit 5%, exceeding syndicated loan defaults – BofA (yahoo.com)

Tags:

What's your view?

About the Authors

Sudhir has over 15 years of experience working with leading global organizations in the credit-rating and commercial-lending domains. Currently, he is part of a commercial-lending team that works with a large Canadian Bank supporting their alternate finance team. Prior to this, he supported the commercial-lending teams of a large European banks and was responsible for communicating with the origination teams, writing annual and interim credit reviews, responding to risk queries and performing post-credit-sanction formalities. Prior to joining Acuity, Sudhir worked for a leading rating company and supported the US public-finance domain, both in his individual capacity and in the capacity of a team lead. Sudhir holds a Master in..Show More

Rohit Sharma has over 11 years of work experience in investment banking. He is leading ECM and Equity Advisory teams for a UK bulge bracket investment bank from past 9 years. He has a strong hold in ECM related work products which are used for corporate broking, deal origination & execution as well equity linked teams.

He has supported multiple senior investment bankers in preparation of investor decks including investor targeting, benchmarking, potential-blocks / stake sale analysis, deal case studies and sell-side research. In addition, he supports onshore Equity Advisory team catering to Utilities, Industrials and NRG sectors in providing strategic advice on matters related to their..Show More

Like the way we think?

Next time we post something new, we'll send it to your inbox