Published on September 13, 2023 by Pankaj Bukalsaria and Oliva Rath

The pandemic resulted in previously unthinkable changes to the way investment banks and financial advisory companies conduct business. Virtual client meetings, remote deal origination & execution, and global workforces working remotely are now considered the new normal. Many of the new ways of working are likely to continue in the post-pandemic world. Offshoring has evolved beyond just the conventional consideration of inherent cost advantages and is increasingly accepted as a strategic tool.

-

A strong offshoring partner that has the ability to support across a deal lifecycle can save onshore bankers and advisors significant time and effort, leading to multiple advantages

-

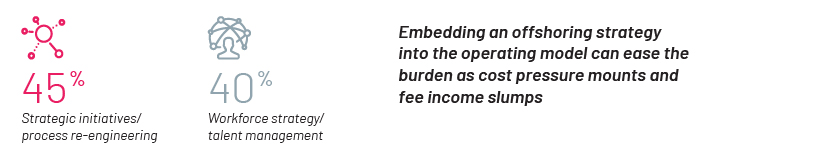

Embedding an offshoring strategy into the operating model can ease the burden as cost pressure mounts and fee income slumps

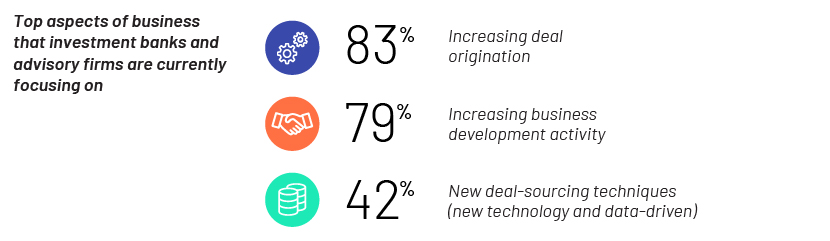

The increased focus on deal origination and business-development activities underlines the importance of offshoring which can deliver efficiencies through new tools and technologies and also help in staffing strategy and better manpower planning.

A strong offshoring partner that has the ability to support across a deal lifecycle can save onshore bankers and advisors significant time and effort, leading to multiple advantages

More than 40% of respondent cited that strategic initiatives such as process re-engineering and workforce strategies are among the Top 3 activities that their firms are currently spending time on

The increased focus on deal origination and business-development activities underlines the importance of offshoring which can deliver efficiencies through new tools and technologies and also help in staffing strategy and better manpower planning

Untapped opportunities exist for IB and advisory firms to leverage offshoring across the deal lifecycle with varying complexities of tasks

Although the practice of offshoring basic routine tasks and retaining the more complex & strategic tasks in-house has continued for a long time, investment banks and advisory firms are only now exploring how it can empower overworked and under-resourced in-house teams

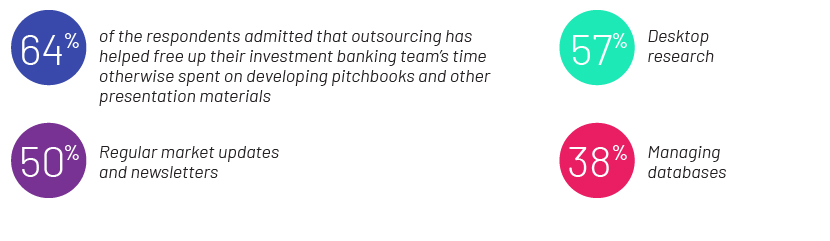

In addition to continued dependence on outsourcing partners for conventional support, there is increasing reliance on outsourcing for higher-value-added business activities

Around 30% of the respondents also acknowledged that their offshore partners have freed up their investment banking teams’ time otherwise spent on more complex tasks (financial modelling, due diligence, etc.), deal origination and customer relationship management (CRM) activities

The offshore research and analytics sector for investment banking has continued to evolve in the past two decades, and many companies have been entrusting offshoring service providers with complex tasks. Relationships with offshoring partners are becoming more collaborative when it comes to working on strategic tasks

Offshoring has evolved beyond just the conventional consideration of inherent cost advantages and is increasingly accepted as a strategic tool

Offshoring certainly translates into lower costs, and this remains the main reason for adopting an offshoring strategy. Amid macro headwinds, this strategy has become important for maintaining profitability and competitiveness.

Investment banks and advisory firms generally analyze in-house requirements narrowly, looking only at direct and immediate cost advantages as the main reason for opting an offshoring strategy. This draws our attention to how offshoring partners can augment their product and service offerings based on the requirements of investment banks and advisory firms and deliver superior quality standards to change the old perceptions. However, the pandemic has resulted in a new thought process relating to shared services, particularly in terms of offshoring in the financial services sector. It has challenged conventional wisdom and long-held orthodoxies, opening the way for better performance and greater efficiencies from offshoring

Getting offshoring right

Investment banks and advisory firms have accommodated areas such as restructuring, debt & equity capital raising, and SPACs into their mainstream business. Hence, the demand for the relevant skill sets has grown. Offshoring can fulfil the need for staff augmentation which can accelerate business growth. When choosing the right offshoring partner, investment banks and advisory firms should pick those with flexible and integrated engagement cum delivery models.

Offshoring partners who easily scaled up specialist practices during downturns and ramped up team sizes quickly as markets turned around managed to thrive and very effectively support their clients.

Offshoring partners offering value-added and complex tasks as well as ancillary services such as BIS (library services) and DTP (presentations and graphics) were able to better support clients; this, in turn, engendered client trust and resulted in more such tasks being delegated as remote working became inevitable amid the pandemic.

Those offering technology platforms, automation and AI/ML solutions targeting deal origination and execution at an investment bank, and applications generating efficiency gains in day-to-day operations, proved to be the most effective partners to the aggressively transforming investment banks and advisory firms

Market challenges and uncertainties have often inspired innovation and encouraged companies to take bold actions. Download the full survey report now

Tags:

What's your view?

About the Authors

Pankaj has over fifteen years of experience in investment banking. He oversees multiple client engagements on front office research and analytics support across Corporate Finance / M&A, Capital markets including Islamic products, and Restructuring & Debt advisory. He has significant experience in working on Oil & Gas, Metals & Mining, Fintech and FIG sectors. A significant aspect of his work involves white boarding client requirements, proposing solutions and onboarding and managing client relationships across the globe, with focus on the Middle East, Africa and Asia. Prior to Acuity, he worked with UBS IB offshore team in India, where he led the set up and transition of Global Energy team..Show More

Oliva joined Acuity Knowledge Partners’ investment banking team in 2020. Well-rounded professional with 12+ years of experience in Investment Banking and Financial Services firms.

She has supported investment bankers on various pitches involving company/industry research, preparation of strategic research reports, pitchbooks, pre-IPO reports and investor PDIEs, competitive landscaping, market sizing & segmentation, case studies, macro-economic studies, and in-depth industry insights.

Extensive exposure in cross-industries primarily including FinTech, Insurance, Asset Management, Oil & Gas, Real Estate, Industrials, and Utilities. She has hands-on experience with prominent databases like Dealogic, Capital IQ, Factiva, FactSet, Pitchbook, and Crunchbase, along with other key industry associations.

Like the way we think?

Next time we post something new, we'll send it to your inbox