Published on April 17, 2018 by Rahul Thakur

The increasing stockpile of dry powder private equity (i.e., incremental funds available for private equity, or PE, investment) is increasing. Is this due to more fund raising or a decline in PE investment? Is it mainly because of competition, high valuations, lower yields or other factors, such as subscription credit facilities?

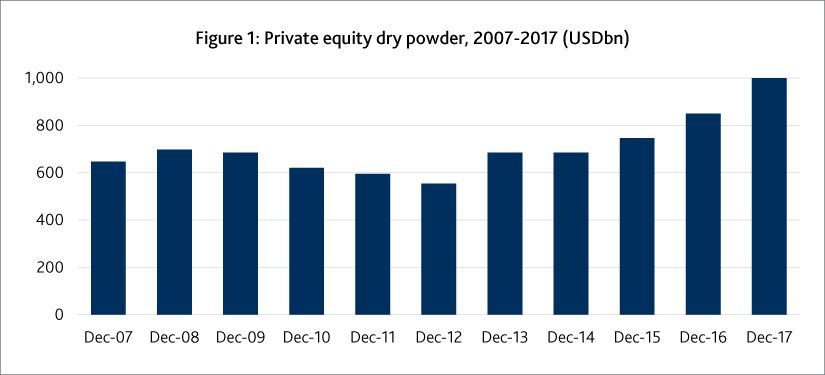

PE firms currently sit on over USD1tn of undrawn committed capital (USD1,004bn as of December 2017). This has increased consistently since 2013 (see Figure 1). In the past couple of years, over half a trillion raised from private equity fund closures coupled with seemingly low attractive investment opportunities pushed the dry powder levels to this record high.

Investors commit substantial amounts of capital to PE firms, expecting higher returns than if they invested in public markets. When PE firms find it difficult to find attractive deals and since drawdowns are generally made on an investment basis, undrawn capital (dry powder) increases.

This is not an ideal scenario for investors. Even if their money is lying idle and is generating no return, they still need to pay management fees of 1% to 2% of this committed capital to PE firms.

Potential reasons – Increased competition, high valuations, lower yields, lack of quality assets

The number of active PE firms globally has more than doubled since the early 2000s. These firms are now more mature and more competitive, with the entry of new participants and substantial capital competing for fewer deals. Outsized returns that general partners (GPs) could earn on undervalued assets are harder to find today.

Record-high levels of dry powder, substantial capital supply, higher valuations and increasing interest rates all indicate a stimulating investing environment in the near future.

This is verified by a recent PitchBook survey that found that respondents ranked “high transaction multiples” and “deal sourcing/lack of quality assets in the market” as the most important challenges for PE dealmakers in 2018. “Access to financing” was ranked as the least important, which we believe makes sense.

In a nutshell, key reasons for dry powder increasing seem to be as follows:

-

An increase in fund raising by PE firms

-

PE investments growing at a slower rate

-

Increase in competition – due to an increase in the number of PE firms and therefore the number of funds

-

High valuations and a low-yield environment

-

There can be other indirect reasons for this increase, one of these may be the growing popularity of subscription lines of credit or at least it seems to be now more public than ever.

Subscription lines of credit – a tool to close deals faster. According to Debevoise, these are typically “senior revolving credit facilities secured by unfunded capital commitments of a fund’s investors”. Subscription credit facilities are usually obtained to provide liquidity for a fund faster than if capital contributions were called for (in one day, versus in about 10 days, respectively). These are especially useful for time-sensitive investments.

PEs withdraw money for investment from such subscription lines without actually calling for capital from limited partners (LPs). This probably adds to the increasing stockpile of dry powder, as LPs’ committed money remains technically unused for longer.

What are PEs and LPs up to?

The lower-yield environment turns PEs’ focus toward the lower middle market for additional opportunities with higher returns.

They focus more on exiting current investments than on making new investments. They are increasing due diligence for new investments and are cautiously making small-ticket investments.

LPs are finding a way around this, as seen in recent news, by parking cash they have committed to and earmarked for PE funds in ETFs. This generates extra returns while they wait, enabling them to stay liquid at the same time, so they can meet demand from PEs for a drawdown anytime. We believe this is a sensible hedging strategy. Investing in such highly liquid assets helps investors to keep calm.

But is the dry-powder ‘overhang’ what it seems to be?

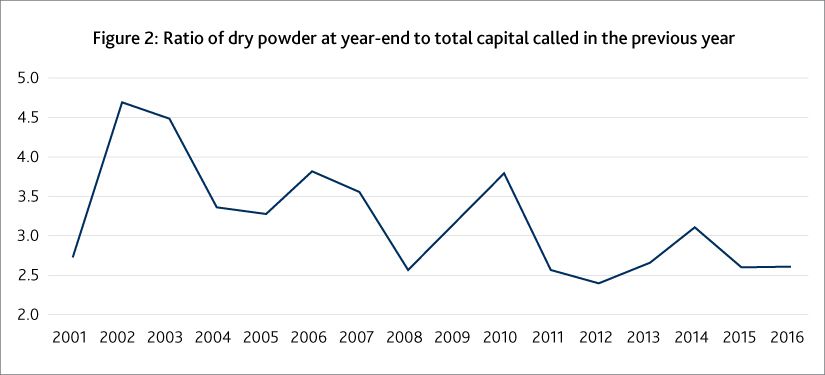

Dry powder is reaching new peaks, but capital spent by firms is rising proportionately. A recent Bloomberg article states that although levels of dry powder have spiked, PE firms are investing at a higher rate than previously, indicating that fund raising is outpacing investments, as Figure 2 shows.

The higher the ratio, the lower the investment and vice versa. Interestingly, the 2016 ratio was close to the 2001 ratio, affected somewhat by the few highs in between.

Conclusion – Not a concern; conduct better due diligence and be aware of changing economic conditions

It may not be that bad to have a significant amount of dry powder. If PEs are taking the time to invest, it may be the most feasible thing to do. We believe it is better to wait for the right opportunity than to blow cash hastily and end-up making a bad investment. Investors would ultimately be more concerned about final returns than about faster deployment of their capital. There is also no evidence to suggest that faster deployment generates more returns.

Dry powder is reaching new heights, but so is growth in PEs’ investments, although such investments are not increasing as fast and as consistently as the availability of committed capital.

Investments should increase further once the market reaches a reasonable valuation and offers higher returns. Until then, investors/PEs can keep calm, considering the current increase in committed capital as savings to meet expected future expenses (investments).

Being more cautious about making new investments results in conducting detailed due diligence and more background work, requiring greater emphasis on deal diligence, while evaluating multiple opportunities simultaneously. This is bound to exert pressure on PEs’ resources and staff bandwidth. Also, increased spending by PEs in the near future would mean increased workflow, where outsourcing partners like Acuity Knowledge Partners can assist.

Acuity Knowledge Partners is experienced in serving big PEs, having witnessed a decade-long complete investment lifecycle of a typical PE. We have the correct skill set and expertise to meet demands of PEs in both the current and in an increased investment scenario.

What's your view?

About the Author

Rahul has over 17 years of experience in business research and analysis serving investment teams at Private Equity clients. Rahul is an expert in Industry studies and market mapping, and has played a pivotal role in setting up research processes in new client teams at Acuity. He is also adept at setting up and fine tuning processes, maintaining control over quality and timeliness of team projects

He joined Acuity in 2007 and currently oversees one of the largest private equity engagements within the company along with other multiple PE engagements. His key focus areas include account management, client relationship and providing oversight to the teams’ day-to-day deliverables...Show More

Like the way we think?

Next time we post something new, we'll send it to your inbox