Published on March 14, 2023 by Anitha Revanna and Sachith Vijayaraghavan

Augmented reality (AR) technology brings the digital world into our physical world, whereas virtual reality VR) technology lets people experience and interact with the virtual world. The metaverse is where both these technologies intersect.

In this paper, we first try to understand what the metaverse is; we later move on to its impact on the financial world and the role of compliance.

What is a metaverse?

In short, it is a simulated/virtual world.

The term “metaverse” was first used in Snow Crash, a novel by Neil Stevenson in 1992.

As it is still in its nascent state, it is difficult to assess the exact direction in which the technology is heading. In a broad sense, the metaverse is a fully immersive internet, where individuals will be able to access virtual reality and interact with people, environments and objects in it using virtual avatars. An avatar is a customisable virtual figure or icon that can be used to represent an individual.

The metaverse incorporates the complete socio-economic structure that exists in the actual world into the virtual world. The opportunities that exist with this technology are exponential and the pandemic gave this technology a boost.

What can you do with a metaverse?

Metaverse users wear VR glasses and gloves, to experience and interact with people or objects, even though they do not exist physically and are only connected via the internet. Nearly 60% of Metaverse users would prefer transitioning daily digital activities into the digital world, according to a study conducted by McKinsey in June 2022.

The following are some things that can be done in the metaverse:

-

Play games in VR

-

Use cryptocurrency/tokens to trade in virtual real estate, NFTs (non-fungible tokens), etc.

-

Companies can make and sell products, conduct promotions, host shows/concerts, etc.

-

Individuals can attend training sessions in virtual classrooms

-

Employers can create a VR workplace for their employees to work, interact and attend meetings

What companies are investing in the metaverse?

Tech giants with a strong presence in the online space see the potential for metaverse technology to become a major platform for social interaction, entertainment and commerce in the future. By investing in metaverse technology, these companies hope to stay at the forefront of innovation in the field and shape its development to align with their business goals.

Apart from these tech giants, companies in the banking and financial sector are also investing in the metaverse. The goal is to be ready and understand how to better interact with customers, stay ahead of trends and have access to future-proof technology.

Investments have been made in building technology for processing payments, transactions and investments inside the metaverse, embedding banking for metaverse users, and providing back-end support for financing virtual real estate in the metaverse. Some banks have even set up office space in the metaverse.

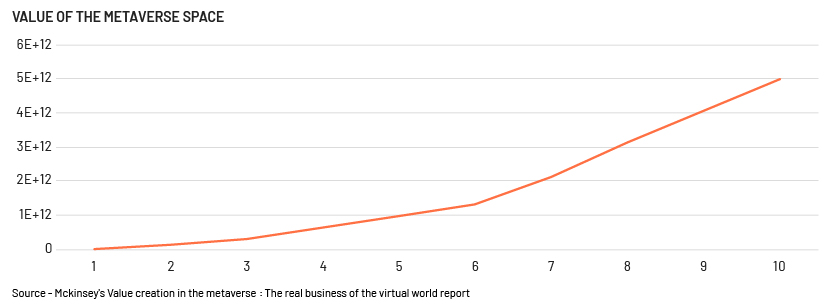

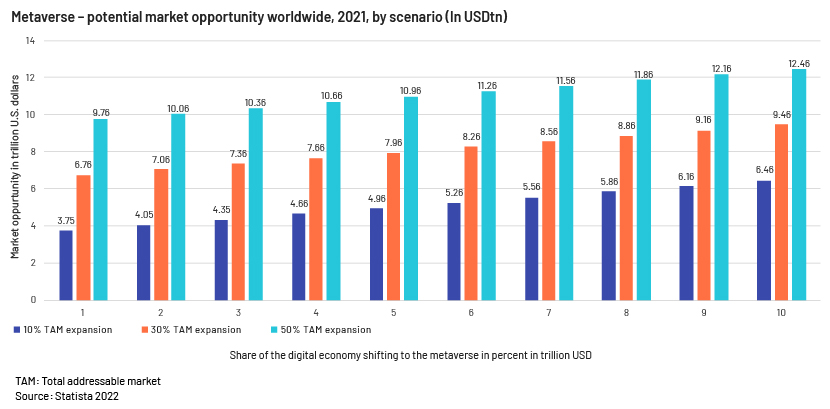

The metaverse may generate up to USD5tn in value by 2030 according to the McKinsey forecast. Financial service providers have started exploring possible opportunities in the metaverse. Wider adoption of the metaverse would mean a larger customer base for banks and better service for customers.

For example, a person who does not have a bank near him physically would not be able to use its benefits and services. However, in the metaverse, the issue of physical distance is eradicated. The individual also gets to interact on a one-on-one basis with a banking representative, albeit virtually.

Another technology that has evolved alongside the metaverse is decentralised finance (DeFi). DeFi will enable people to participate in global economic exchange without intermediaries. In effect, this is total democratisation of the financial and investment market. This technology eliminates banks and financial institutions. A customer’s liquid assets are stored in a secure digital wallet instead of a bank. It eliminates banking fees and enables safe and secure transactions.

Regulations governing the metaverse

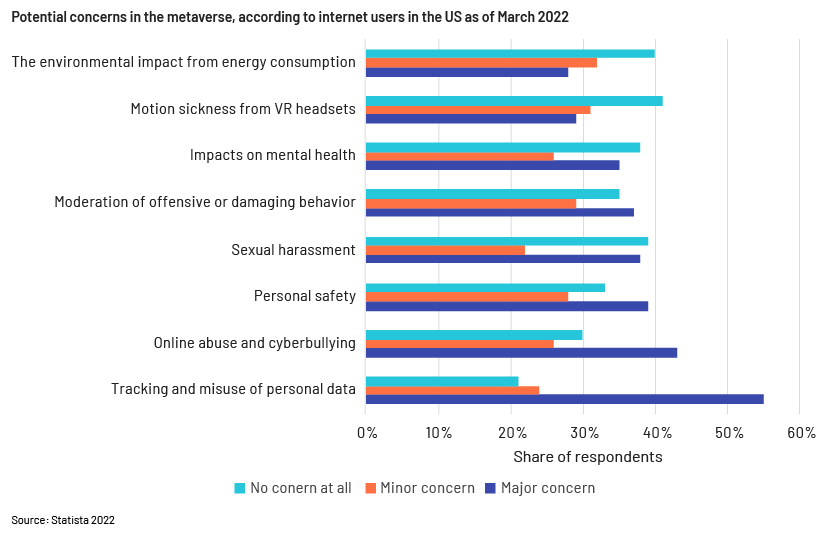

There are already cases of money laundering, crypto asset theft, identity theft and data hacks in the metaverse. Policymakers need to think ahead and be prepared to safeguard users from possible malpractice, abuse, fraud and loss. Regulators must introduce regulations that will protect vulnerable consumers without restricting technological innovation.

Data in the metaverse will generally be covered by the General Data Protection Regulations (GDPR). The GDPR will have big implications for all individuals in the metaverse, since a lot of data on participants can be collected inside a metaverse. Data-privacy concerns in the metaverse will be an additional concern, on top of those already prevalent relating to the internet. Data providers and regulators have the responsibility to make sure procedures and regulations are in place so that data is collected fairly and transparently, and firms provide privacy notices and obtain consent before tracking usage.

Policymakers need to define how ethics, consumer protection and governance will be enforced and clearly define rules relating to “virtual law enforcement”. Whom can victims call? Which jurisdiction applies? What recourse is available? These questions are complex, and they are pressing. The only solution is implementing a multi-layer approach that is forward-thinking and implementing innovative policy measures that put safety first.

To make any monetary regulation feasible in the metaverse, there need to be clear connections between virtual and real-life roles, and loyalty to many of the same philosophies that make the real economic world secure. For example, KYC obligations, tax regulations and risk managing practices will be important.

What do organisations need to keep in mind about the metaverse?

Before entering the metaverse, organisations must collaborate with their security and risk teams to identify the risks, possible stakes and vulnerabilities. They must also adequately train their developers on these risks, and test tools or apps thoroughly before they go live.

Customers should be made aware that using any new technology can make them a potential target. They should familiarise themselves with the threats online such as social engineering, fake websites and phishing, as well as best practices on how to safeguard themselves, their digital assets, wallets and identities.

To safeguard customers from data violations and solve legal gaps, facial recognition information, body language statistics, biometric records, search records and other personal information must be examined and encrypted. If this data is not protected, those who have access to it can take advantage of it and manipulate it.

Some things to remember:

-

Data protection

-

Security and privacy concerns

-

Application of anti-trust and competition laws

-

Intellectual property rights infringement

Potential legal challenges in the metaverse

-

Data protection and privacy

-

Copyright

-

Trademarks

-

Patents

-

Property rights

We need to understand that with the increased opportunities, organisations would have to deal with more responsibilities. The metaverse will provide a new venue to connect with customers. It will most likely open up unprecedented possibilities for conducting business. Along with these new opportunities, there will be new challenges, and organisations would need to follow privacy regulations while being compliant with copyright, trademark, patents, piracy and taxation regulations.

Role of compliance in the metaverse

Financial organisations in the metaverse may use blockchain technology to ensure every transaction is validated and recorded. This would enable tracing the path of each transaction. Smart contracts automatically ensure fair execution of the pre-approved terms of the transaction.

With the help of this technology, the entire list of participants can be identified from a single transaction. This would increase the security of financial transactions and considerably reduce corruption, crime and fraud online.

The role of compliance in the metaverse will be in ensuring that the virtual world adheres to laws and regulations related to areas such as privacy, intellectual property and consumer protection. This can be a challenging task because the metaverse is a complex, constantly evolving environment that spans multiple countries and legal jurisdictions.

One key undertaking of compliance in the metaverse will be to ensure that personal data is collected, used and shared in a way that is consistent with applicable privacy laws and regulations. This includes guarding user privacy by implementing appropriate safeguards, obtaining consent for data collection and use, and providing transparency about data collection and how it is being used.

Another important area of compliance in the metaverse is intellectual property. This includes ensuring virtual assets and other forms of intellectual property are protected and their use is properly licensed. It also involves ensuring that content within the metaverse does not infringe on the intellectual property rights of others.

Finally, compliance in the metaverse also involves ensuring that businesses operating within the virtual world adhere to consumer protection laws and regulations. This includes ensuring that consumers are provided with clear and accurate information about products and services, and they are protected from deceptive or fraudulent practices.

We need to understand that no one owns the metaverse. Self-governance and vigilance are of utmost importance and will play a vital role. Organisations that would like to take advantage of this platform need a firm approach to managing biometrics, intellectual properties, data protection and privacy.

Overall, compliance will be a crucial aspect of the metaverse, as it will help ensure the virtual world is a safe and fair place for all users. Organisations should reach out to legal and compliance consultants to help them understand and evaluate best practices and frameworks so they can be better prepared in terms of compliance,

How Acuity Knowledge Partners can help

We are experienced in providing global compliance services to all sectors, including the tech space. We invest time in learning how the metaverse will impact future, keeping abreast of regulations and helping companies comply.

With our focused set of offerings in the compliance space, we help companies mitigate risks, providing review support to meet regulatory expectations.

Sources:

-

Regulations In The Metaverse: What Rules Will Apply? – Global Relay

-

Here's how to prevent crime in the metaverse | World Economic Forum (weforum.org)

-

Metaverse potential market opportunity by scenario | Statista

Tags:

What's your view?

About the Authors

Anitha has 10+ years of experience in Marketing Compliance. She has previously worked with State Street Global Advisors. Her expertise spans across compliance and risk sector, focusing on compliance reviews of marketing/advertising materials and social media contents. At Acuity Knowledge Partners she is part of the central compliance team and specializes in marketing material review and social media reviews. Anitha is an MBA graduate from RV Institute of Management, Bangalore University.

Sachith Vijayaraghavan has 8 years of experience in compliance and has completed 8 years with Acuity Knowledge Partners. His expertise spans across the risk and compliance sector, focusing on compliance reviews of marketing/advertising materials and Email Surveillance. At Acuity Knowledge Partners he is part of the central compliance team and specializing in marketing material review. Sachith is an MBA from Bharathiyar University.

Like the way we think?

Next time we post something new, we'll send it to your inbox