Fast-track your credit lifecycle to originate, underwrite, and monitor more loans

CreditPulse is an LLM-based tool that helps create summarised commentary for fact-based analysis for credit risk report writing. Basis user-defined prompts, the tool generates commentary for report sections such as business description, management bios, financial performance, ownership structure, and industry analysis. CreditPulse benefits from the combination of generative AI and Acuity’s deep domain expertise to deliver highly analytical credit reviews for effective risk governance.

-

AI-powered credit report generation

Leverages advanced large language models to provide detailed and accurate credit analysis and commentary, making the decision-making process easier.

-

Superior data extraction capabilities

Can extract data from multiple sources such as PDFs and webpages, increasing flexibility for diverse use scenarios.

-

Customisable templates

Provides pre-configured and customisable templates to generate standardised credit reports, ensuring consistency and efficiency in format.

-

End-to-end effective portfolio management

CreditPulse along with Acuity’s end-to-end loan portfolio monitoring capabilities, helps in enhancing oversight with early warning indicators to effectively manage risk.

-

User-friendly interface

Features an intuitive and easy-to-use interface, ensuring that both technical and non-technical users can navigate efficiently, using the tool's capabilities.

-

Individual-company repository

Enables users to store all company-related documents, including filings and financials, in one centralised location for easy access and organisation.

-

Configurable Reporting Templates

Simplifies client and internal reporting requirements using robust, built-in automated reporting tools.

-

ESG Module

Enabling users to design their own bespoke ESG templates which can be based on ESG reporting framework including SFDR, GRI and SASB. This enables users to intuitively manage its quarterly/annual ESG reporting requirement.

-

Audit Trail

Enabling users to open the source file from where information or data has been extracted to be able to review and authenticate the same.

Why choose CreditPulse?

-

Boosts credit-analyst productivity

20-30% increased productivity by enabling credit analysts to focus more on analytical aspects

-

Improved front office effectiveness

2x additional time for revenue-generating activity and improved speed to market

-

Consistency and accuracy

Ensures consistency across credit templates, with high accuracy on commentary and audit trails

-

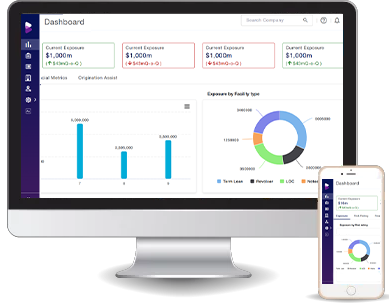

Improved risk governance

Portfolio-level dashboard to help monitor fundamental credit performance

Customer Testimonials

“I’d like to share my team’s experience in working on CreditPulse. The tool has been very helpful for the team in completing the credit reviews on time and reducing the number of overdue memos. CreditPulse helps extract relevant information for the memo, saving 20-25% of the time and effort. The timely execution has helped us receive positive feedback from the client as well.”

Portfolio Manager

Top 5 Regional Bank in the US

“CreditPulse helps us reduce the overall time spent on writing reports by scanning through the filings and reports etc., fetching relevant information basis prompts and presenting them in a coherent and readable format. The user interface is intuitive and easy to use. We can focus on analytical aspects more and improve the quality of our reports by using CreditPulse.”

Senior Credit Analyst

Top European Bank