Published on July 18, 2022 by Dulith Perera

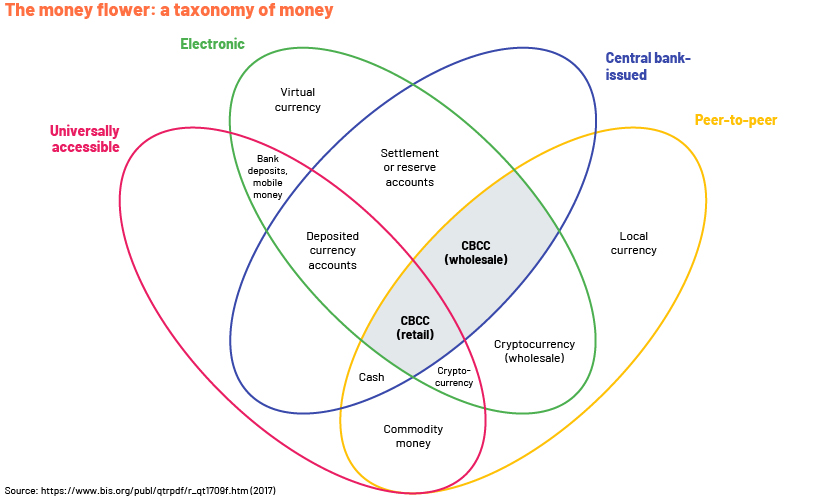

Money has been through many iterations since its invention, with coins and paper money being at the forefront for centuries. New technologies and systems have resulted in the current money supply framework, with classifications such as M0 (the monetary base of an economy), M1 (coins, notes and other money equivalents that are easily converted to cash), M2 (comprising M1, short-term time deposits and money-market funds) and M3 (comprising M2 and long-term deposits) set to experience a gradual expansion. The convenience and cost effectiveness, among other benefits, of cryptocurrencies have resulted in their influx to the international monetary system, which is on the verge of change effected by the digital revolution. Nonetheless, the volatility inherent in cryptocurrencies has given rise to questions of unreliability. This is where “stablecoins” come into play.

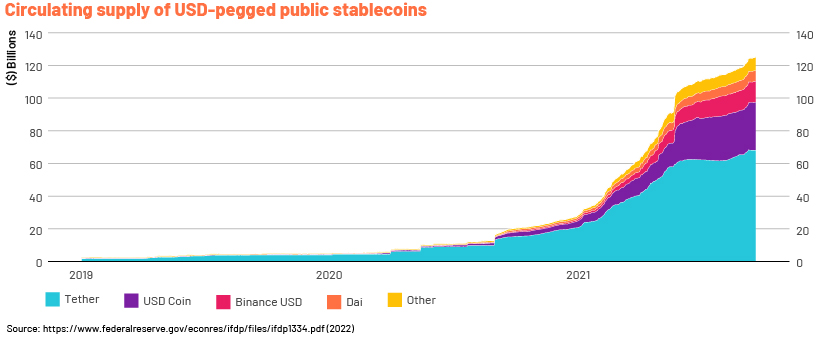

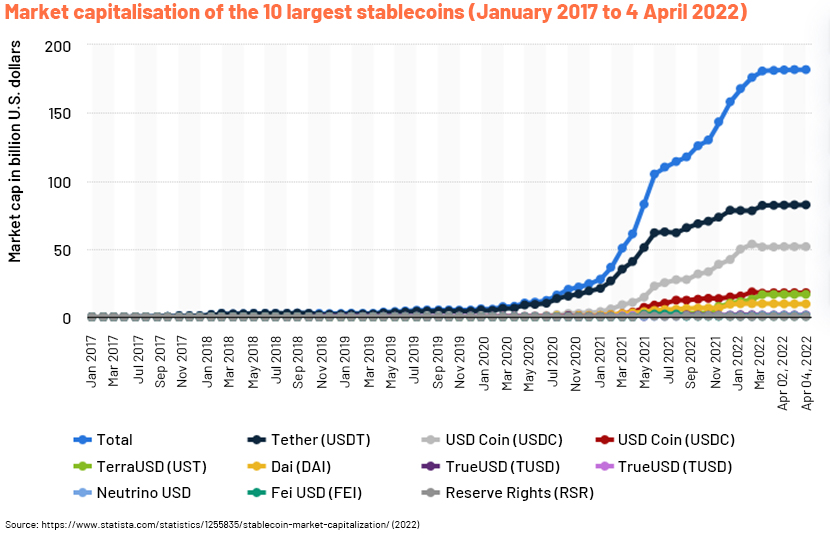

Stablecoins are formulated in such a way so as to have a value that is more fixed than the typical cryptocurrency, as stablecoins are pegged to other assets such as the USD or gold. With this salient feature, stablecoins could play a major role in digital markets while bringing in new importance to the crypto asset ecosystem. The total value of stablecoin assets surged by c.495% from October 2020 to October 2021 (according to The Block), highlighting exponential growth in demand for them over a short period of time.

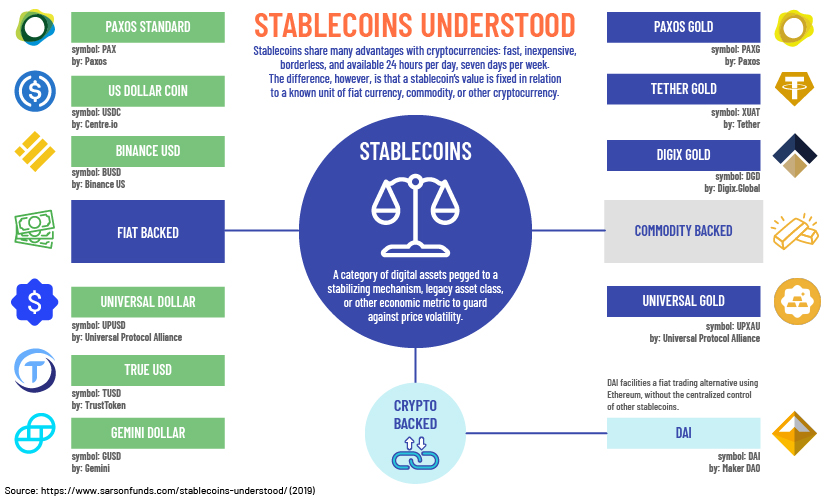

As we dive further into the ecosystem, we could see several different categories of stablecoins.

-

Fiat-collateralised stablecoins:

These are identified as the simplest structures with less fluctuation, where the stablecoins are backed at a 1:1 ratio (1 stablecoin is equal to 1 unit of currency). Examples include XSGD, USD Coin (USDC) and Tether [USDT; the third-largest cryptocurrency by market cap (over USD79bn) by April 2022].

-

Commodity-collateralised stablecoins:

These are generally backed by interchangeable assets such as gold, oil, real estate and precious metals. Hence, the innate potential of asset appreciation/depreciation could have an impact on the trading of these types of stablecoins. Examples include Digix Gold (DGX) backed by physical gold (1 DGX represents 1 gram of gold) and SwissRealCoin (SRC) backed by Swiss real estate portfolios.

-

Crypto-collateralised stablecoins:

These are complex but are characterised by decentralisation and supported by other cryptocurrencies. Examples include Dai and jFIATs.

Use cases and their promising application in banking

The myriad use cases of stablecoins could also be translated into the banking sector and lending, benefiting a large network of users.

-

Used in trading digital assets

-

Used to facilitate rapid peer-to-peer transactions with application in smart financial contracts

-

Facilitates cross-border transactions with minimal fees and without volatility

-

Allows fund transfers within a firm and provides seamless movement of internal cash between subsidiaries for liquidity risk management

-

Has positive implications for decentralised finance (DeFi), where it enables collateralised lending, derivatives trading and asset management

Stablecoins could also facilitate more credit provision by banks and financial institutions. They could replace a certain portion of the banknotes in circulation, and with the progressive substitution of physical cash with reserves-backed stablecoins, provision of credit could increase. This would primarily be due to the replacement of banknotes, where stablecoins act as instruments of credit creation through the provision of loans or security purchases. Banks could also see inflows from commercial bank deposits if firms and households prefer to hold stablecoins rather than traditional bank balances.

In 2020, Bank Frick in Liechtenstein tested SWIFT for Circle’s stablecoin, mainly to enable faster processing of USD payments. In March 2022, ANZ delivered A$DC (AUD stablecoin) to a private wealth management firm for digital assets via digital asset investment platform Zerocap, further highlighting the growing use of stablecoins.

Positive implications

Stablecoins have a number of use cases and advantages. First, they could introduce healthy competition to the banking sector. Resources in terms of people and capital tend to flow into dynamic organisations, and novel ideas will likely be generated with the inclusion of these resources. Free market competition would be encouraged, leading to the intended benefits.

Moreover, the programmability of stablecoins enables companies to adapt them to their specific use cases and satisfy consumer needs. For example, loyalty programmes could be built into branded stablecoins. By building such programmes, the loyalty factor would be integrated directly into the user experience. Customers could check their stablecoin balances and loyalty rewards on the same application, increasing convenience in a saturated marketplace where convenience is key.

The speed of financial processes would also be increased as stablecoins facilitate transactions at all hours due to the independent nature of blockchain. Additionally, the high costs associated with transactions could be mitigated, enhancing value for businesses and individuals.

Risks and regulations

Despite their growing influence, stablecoins have several limitations that need to be understood.

Operational and systemic risks

First, there are the credit, liquidity and operational risks common to traditional systems. If not managed properly, these risks could make the entire process less reliable for the broad range of users. With the widespread application of stablecoins in payment platforms, systemic risks could arise. Risks associated with the validation of stablecoin transactions could interfere with the payment system, and if a large number of users fail to access their money using e-wallets or if businesses do not receive payments, overall economic activity would be affected. Furthermore, if investors lose confidence in the system, the negative repercussions could increase.

The recent failure (in May 2022) in the algorithmic peg mechanism fixing the price of USDT also highlights the need for regulation. Moreover, the failure of Terra LUNA (sold/burnt to stabilise stablecoins when they de-peg slightly) also enhances the need for regulation. After 4pool UST crashed, depositors withdrew UST and switched to LUNA, which put selling pressure on LUNA, reducing Terra’s liquidity as the main source to buy back UST. The Luna Foundation Guard (LFG) sold BTC and depleted all reserve assets to boost UST value in response to this, but this failed, resulting in a liquidity crisis. There was a hyper-inflationary loop created in LUNA’s supply but eventually, LUNA and UST lost all value, with UST investors losing c.USD45bn in a few days.

From one end, the Office of the Comptroller of the Currency (OCC) and the Federal Deposit Insurance Corporation (FDIC) suggest bank supervision, including having stablecoin deposit insurance, while another suggested option is to regulate stablecoins as money-market funds. Additionally, the EU’s Markets in Crypto Assets regulation, which is nearing finalisation, has indicated that it requires bank-like regulations for systemic stablecoin issuers.

Ransomware attacks

Cryptocurrency funds lost as a result of ransomware attacks increased by 311% from 2019 to 2020, according to Chain Analysis, highlighting a major impediment facing these new financial instruments. The absence of global standards and guidelines, the differing ways in which anti-money laundering (AML) and combating the financing of terrorism (CFT) standards are implemented across countries, and the anonymity that can be maintained when using stablecoins are some of the factors that have contributed to illicit activity. The US Treasury continues to assess the risk of money laundering and terrorist financing via National Risk Assessments while the EU has proposed laws to ensure the traceability of crypto transactions. Consistent regulations across the board and swift implementation of rules set by the Financial Action Task Force (FATF) to prevent illicit activity are also vital to remediate these issues.

What does the future hold?

The imminent benefits of stablecoins have already encouraged industry participants such as JP Morgan (JPM Coin) and Visa to join the system. JPM Coin was initially used by JP Morgan for internal transactions and in 2021, ran in parallel with the 400-bank Liink payment network and powered securities settlement (in repos trade) across the bank’s client base. In early January 2022, the Central Bank of Bahrain teamed up with JP Morgan to test the coin, with benefits anticipated especially in cross-border payments. In March 2021, Visa also announced that transactions could be settled in USDC, with crypto.com being the first company to test this.

Central Bank Digital Currencies (CBDCs), which are digital forms of a particular country’s fiat currency, are another innovation that has been introduced with the intention of improving the stability of digital payment systems and widening access to the financial system. China, Japan and Sweden have been experimenting with these, while Nigeria and Bahamas have already rolled out CBDCs nationwide. CBDCs, unlike stablecoins, would become auditable and traceable, with central banks not allowing illicit transactions using its money. Additionally, CBDCs are minted on private ledgers while stablecoins are generally issued on a public blockchain by a company.

Regulatory bodies are also in the process of discussing the possibilities of formulating regulation. Global adoption would take time and would depend on how the wider use cases can be satisfied. Nonetheless, stablecoins are expected to play a vital role in the current banking environment.

How Acuity Knowledge Partners can help

We keep our banking clients abreast of such emerging technologies, trends and innovations, and help them assess the overall impact. The digital disruption the banking sector is facing needs to be understood and evaluated accurately in order to identify which innovations and solutions would be the most apt. We have extensive experience in providing high-value research and analytics solutions to a wide variety of clients and can help them capitalise on opportunities in this rapidly changing business environment.

Sources:

https://www.cbinsights.com/research/report/what-are-stablecoins/

https://www.federalreserve.gov/econres/ifdp/files/ifdp1334.pdf

https://www.forbes.com/advisor/investing/cryptocurrency/top-10-cryptocurrencies/

https://www.forbes.com/sites/seansteinsmith/

https://www.sarsonfunds.com/stablecoins-understood/

https://home.treasury.gov/system/files/136/StableCoinReport_Nov1_508.pdf

https://www.zdnet.com/article/ransomware-gangs-made-at-least-350-million-in-2020/

https://think.ing.com/snaps/bank-pulse-stablecoins-the-banks-of-tomorrow

https://medium.com/stably-blog/stablecoin-lending-a-lucrative-high-yield-opportunity

https://www.statista.com/statistics/1255835/stablecoin-market-capitalization/

https://www.investopedia.com/terms/m/monetarybase.asp.

https://www.investopedia.com/terms/m/moneysupply.asp

https://crypto.news/european-bank-swift-usdc-stablecoin-faster-settlement/

https://medium.com/stably-blog/top-use-cases-and-benefits-of-stablecoins-4f1ceab57d00

https://www.ecb.europa.eu/press/key/date/2022/html/ecb.sp220425~6436006db0.en.html

https://www.coindesk.com/business/2021/06/07/remember-jpm-coin-next-step-is-programmable

https://www.finextra.com/newsarticle/39473/bahrain-central-bank-trials-jpm-coin

https://techcrunch.com/2021/03/29/visa-supports-transaction-settlement-with-usdc-stablecoin/

https://www.pymnts.com/blockchain/2022/bahrain-central-bank-completes-jpm-coin-system-test/

https://www.fitchratings.com/research/fund-asset-managers/

https://www.bis.org/publ/qtrpdf/r_qt1709f.htm

https://www.citifirst.com.hk/home/upload/citi_research/AZN20.pdf

https://medium.com/stably-blog/top-use-cases-and-benefits-of-stablecoins-4f1ceab57d00

https://vulcanpost.com/791820/terra-luna-timeline-how-crash-revival-plan/

https://www.lexology.com/library/detail.aspx

What's your view?

About the Author

Dulith is an Associate attached to the Commercial Lending Division at Acuity Knowledge Partners. He is currently part of the IBOR transition team for a leading European Bank. Prior to joining Acuity Knowledge Partners, he worked in the credit department of a leading local bank. He holds a Bachelor’s degree in Business Administration from the University of Worcester and is reading for the Chartered Institute of Management Accountants qualification (UK).

Like the way we think?

Next time we post something new, we'll send it to your inbox