Published on August 21, 2023 by Madhu Reddy and Sachith Vijayaraghavan

Introduction

In today's business landscape, investors prioritise environmentally conscious companies that align their goals with sustainability. In January 2023, the European Parliament bought into force the Corporate Sustainability Reporting Directive (CSRD) as an expansion of the 2014 Non-Financial Reporting Directive (NFRD). These regulations require significantly more organisations, including non-European entities, to provide sustainability reports. By disclosing their environmental impact and social responsibility through a sustainability report, listed organisations aim to assist investors and stakeholders in evaluating an organisation’s social impact and sustainability performance and making informed investment decisions.

Rules on corporate sustainability reporting

Organisations currently operating under NFRD rules must transition to CSRD rules at the beginning of the 2024 financial year and publish their audited sustainability reports by 2025.

-

Large firms must report on sustainability problems such environmental rights, social rights, human rights and governance aspects, in line with more stringent reporting standards.

-

Sustainability reporting must be included in a separate section of the firm’s management reports.

-

The CSRD also adds a certification requirement and improves information accessibility.

-

The reporting must be certified by an accredited independent auditor that the sustainability data complies with the certification requirements.

-

The reporting of non-European corporations must be validated, either by an auditor based in Europe or a third-party jurisdiction.

Source: https://sphera.com/spark/corporate-sustainability-reporting-csrd-requirements-now-include-non-eu-companies-and-independent-auditing/; Ultimate Guide to the EU CSRD ESG Regulation for Businesses | Blog | OneTrust

Source: https://sphera.com/spark/corporate-sustainability-reporting-csrd-requirements-now-include-non-eu-companies-and-independent-auditing/; Ultimate Guide to the EU CSRD ESG Regulation for Businesses | Blog | OneTrust

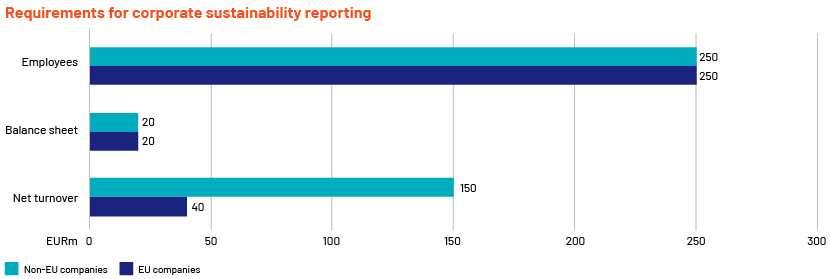

The CSRD has set standards for sustainability reporting for EU and non-EU companies. These companies are required to have balance sheets of a minimum of EUR20m or more than 250 employees. EU companies must have EUR40m net turnover and non-EU companies EUR150m turnover.

Does the CSRD apply to non-EU organisations?

The CSRD has implications for companies outside the EU as well. Qualifying non-EU organisations must file an annual sustainability report, as European organisations do. However, the European Council has the authority to accept foreign sustainability reports if they meet equivalent requirements, relieving foreign organisations from the need to duplicate reports.

Compliance and sustainability

Sustainability reporting and compliance are important for a number of reasons:

-

Improved risk management: They help organisations identify and manage their ESG risks, protecting them from financial loss, legal liability and reputational damage.

-

Increased transparency: They help increase transparency on an organisation's environmental, social and economic performance. This would help build trust with stakeholders such as customers, investors and employees.

-

Improved decision-making: They help organisations make better decisions about their environmental, social and economic performance, improving their long-term sustainability and profitability.

There are a number of challenges associated with sustainability reporting and compliance as well:

-

Data collection and management: They can be complex and time-consuming because organisations need to collect and manage large amounts of data on their environmental, social and economic performance.

-

Cost: They can be expensive because organisations would need to invest in new systems and processes.

-

Lack of awareness: There is still a lack of awareness about sustainability reporting and compliance. This could make it difficult for organisations to get started with sustainability reporting and compliance.

Compliance risks

Implementation of CSRD rules while NFRD rules are still in effect introduces compliance risks for businesses. Navigating conflicting requirements across jurisdictions can be challenging as organisations strive to adapt to the new regulations. The duplication of reports and the inclusion of voluntary sustainability reports pose risks, potentially leading to compliance failures.

Penalties for non-compliance

The CSRD is not an EU regulation but a directive. This implies that it is up to the individual member states, not the EU, to establish their own penalties for non-compliance.

The CSRD mandates that any fines must be effective, reasonable and a deterrent. The surrounding circumstances, such as the seriousness and length of the violation, and the company's history of violations, must also be taken into account. While this enables member nations to manage enforcement with greater autonomy and flexibility, it also indicates that the sanctions for non-compliance will differ from nation to nation.

How to prepare

To address these challenges, organisations need to understand the underlying data requirements and prepare thoughtfully as they adjust their policies. A compliance team would support EU sustainability reporting in several ways. They provide guidance on reporting requirements, conduct risk assessments to identify potential issues, develop and implement reporting policies and procedures, monitor compliance and respond to regulatory inquiries.

This ensures accurate and transparent reporting aligned with an organisation's sustainability goals, while improving overall sustainability performance. Having a compliance team helps organisations meet reporting obligations, mitigate risks and avoid penalties, safeguarding their financial and reputational wellbeing.

How Acuity Knowledge Partners can help

We provide expert guidance to organisations seeking to navigate the complexities of the CSRD. Our comprehensive compliance services help streamline the process of preparing sustainability reports, ensuring adherence to stringent standards and facilitating validation and certification requirements.

Sources:

-

https://www.linkedin.com/pulse/what-know-european-sustainability-reporting-standards

-

https://www.corporatecomplianceinsights.com/eu-sustainability-reporting/

Tags:

What's your view?

About the Authors

Madhu Prasad Reddy has 9 years of experience in Compliance. Previously worked with Cognizant Technology Solutions. Expertise in KYC, Code of Ethics and Email Surveillance. At Acuity Knowledge Partners he is part of the central compliance team and specializes in code of ethics. Madhu is an MBA graduate from Cambridge Institute of Technology, VTU University.

Sachith Vijayaraghavan has 8 years of experience in compliance and has completed 8 years with Acuity Knowledge Partners. His expertise spans across the risk and compliance sector, focusing on compliance reviews of marketing/advertising materials and Email Surveillance. At Acuity Knowledge Partners he is part of the central compliance team and specializing in marketing material review. Sachith is an MBA from Bharathiyar University.

Like the way we think?

Next time we post something new, we'll send it to your inbox