Published on March 21, 2023 by Sachith Vijayaraghavan

As the world works to cut greenhouse gas emissions and reduce the effects of climate change, "net zero" and "carbon neutral" have attracted a lot of attention. Despite the confusion, they are actually two distinct concepts. In this blog, we discuss what they mean and how greenwashing poses risks to a more sustainable future.

What is carbon neutrality?

This refers exclusively to a situation where carbon emissions are totally removed or compensated for through the use of carbon credits or other measures. Carbon neutrality requires complete eradication of all carbon emissions and does not allow for residual emissions.

Since achieving carbon neutrality demands sizeable investment in renewable-energy sources, energy-saving techniques and other types of carbon offsetting, it can be challenging. For organisations dedicated to reducing their carbon footprint and promoting a more sustainable future, however, it is a crucial objective.

What is net zero?

This refers to a situation where the quantity of greenhouse gas emissions created and the amount taken out of the atmosphere are equal. This can be done in multiple ways, such as by lowering emissions through energy efficiency, switching to renewable-energy sources or offsetting residual emissions through the use of carbon credits.

Net zero does not mean completely eliminating emissions. Even through using the most-cutting-edge technology, some sectors such as transport and heavy manufacturing may not be able to entirely eliminate their emissions. In these circumstances, achieving net zero involves compensating for any emissions with an equivalent amount of carbon removal from the atmosphere.

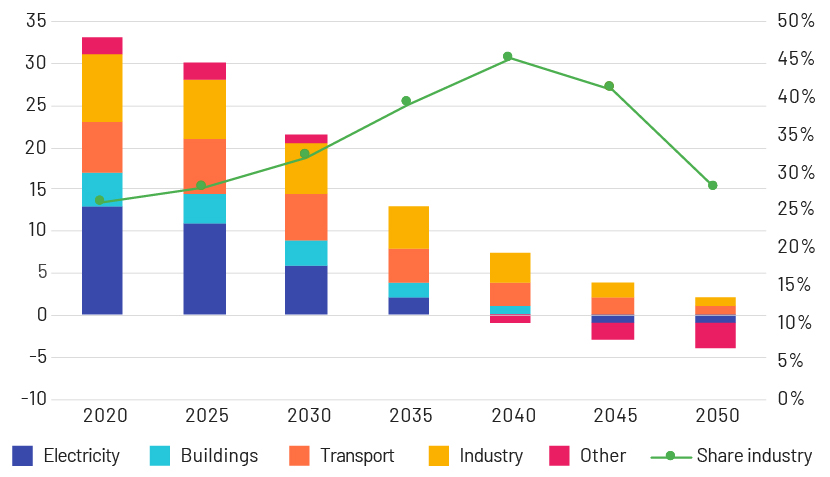

The following graph published by the International Energy Agency (IEA) depicts global carbon dioxide emissions by sector (net-zero emissions by 2050).

Greenwashing

When a business markets itself as environmentally conscious but does not really make the effort to be so or falsifies its sustainability efforts, it is known as “greenwashing”. A number of consumers have lost trust in claims made by organisations about sustainability measures as a result of greenwashing. A recent report by Bloomberg reveals how the biggest banks that are committed to net zero are also some of the biggest investors in fossil fuels. They are all members of the Net-Zero Banking Alliance (NZBA) that have pledged to reach net-zero financed emissions by 2050 under the Glasgow Financial Alliance for Net Zero (GFANZ).

This does not accuse these banks of greenwashing, but it does indicate a sector that may not be as committed to achieving net zero as it says it is. It also highlights the challenges of quantifying a qualitative aspect in investing that is being used as a loophole by firms engaged in greenwashing activity.

New guidelines

False and misleading advertising lawsuits involving "carbon neutral" and "net-zero emissions" are on the rise. ASA research in 2021 found that a number of organisations claimed to be carbon neutral and net zero without having specific definitions of these concepts or established guidelines on how corporations should pursue these objectives. This means consumers believed these claims and were being misled due to their lack of understanding.

Updated guidelines on the use of "carbon neutral" and "net zero" claims in advertising have been released by the Advertising Standards Authority (ASA); it intends to increase consumer knowledge of environmental claims and crack down on firms engaged in greenwashing.

The ASA has begun a six-month evaluation of the guidance to determine how it will affect carbon-neutral and net-zero statements in advertisements.

-

Avoid making broad claims such as "net zero”, "carbon neutral" and related phrases.

-

To prevent consumers from mistakenly assuming that production of certain items generate no or little emissions, marketers should take care to give precise information about how the organisation is actively lowering carbon emissions.

-

Claims based on future objectives, such as becoming carbon neutral or reaching net zero, should be supported by a verifiable plan for achieving those objectives.

-

This guidance outlines the need for proof of objective statements, and if claims are based on offsetting, marketers must disclose the offsetting system they are using.

-

When a claim must be included, it should be placed close enough to the primary section so that customers can see it and consider it before making a choice.

-

Portfolio compositions must be verified against the prospectus before investing in funds that claim to be green.

-

Compliance teams should look at all aspects of green investing to determine whether guidelines are being adhered to.

Risks of greenwashing

-

Damage to the organisation’s reputation

-

Loss of consumer trust

-

Legal and regulatory risks, resulting in legal action or fines

Why are net-zero emissions and carbon neutrality important?

Demand for energy and natural resources will only rise as the world's population and economies continue to expand. We can ensure this expansion takes place in a sustainable manner, reducing the negative impact on the planet and protecting it for future generations.

Achieving net-zero emissions and carbon neutrality has economic advantages as well. Organisations can lower their energy costs by investing in renewable energy and other environmentally friendly technology.

Compliance functions can assist by establishing internal policies and an overall framework for reporting and reducing emissions. Organisations can prove their commitment to their claims and build a more sustainable future by following rules and reporting obligations.

How Acuity Knowledge Partners can help

Acuity Knowledge Partners can also provide day-to-day support to help companies stay compliant with regulations related to carbon neutrality and misleading lawsuits. This could involve providing ongoing monitoring and analysis of the regulatory environment, identifying potential areas of risk, and helping companies implement policies and procedures that are designed to minimize the risk of non-compliance.

Overall, by partnering with Acuity Knowledge Partners, companies can ensure that they have the expertise and support they need to stay compliant with regulations related to carbon neutrality and misleading lawsuits, while also taking steps to reduce their carbon footprint and adopt more sustainable practices.

Sources:

-

Updated environment guidance: carbon neutral and net zero claims in advertising - ASA | CAP

-

Regulator Unveils New Rules For Advertising “Carbon Neutral” and “Net Zero” Claims - ESG Today

-

Achieving Net Zero Heavy Industry Sectors in G7 Members (windows.net)

Tags:

What's your view?

About the Author

Sachith Vijayaraghavan has 8 years of experience in compliance and has completed 8 years with Acuity Knowledge Partners. His expertise spans across the risk and compliance sector, focusing on compliance reviews of marketing/advertising materials and Email Surveillance. At Acuity Knowledge Partners he is part of the central compliance team and specializing in marketing material review. Sachith is an MBA from Bharathiyar University.

Like the way we think?

Next time we post something new, we'll send it to your inbox