Published on November 10, 2022 by Prashant Juneja

Invasion of Ukraine

Russia’s invasion of Ukraine has caused a mammoth humanitarian crisis, displacing over 30% of Ukrainians. The crisis is expected to worsen over the course of the year, with the UN estimating that more people in the country are likely to become refugees by end-2022.

The conflict has also dealt a severe blow to the global economy, and vulnerable communities continue to be the worst hit amid surging inflation. People have had to spend more on essentials, and for the poorer sections of society, this could pose higher risk of poverty, particularly given the high prices of food and energy. Similarly, the cost of transportation has risen as fuel prices increased. These high prices will reduce real incomes and deflate import demand.

Europe has been particularly hit by the crisis given its dependence on Russia for energy sources. In addition, Russia and Ukraine are key providers of goods in the industrial value chain, with Russia being one of the world’s major suppliers of palladium and rhodium used in the production of catalytic converters and semiconductors. A prolonged disruption in the supply of these goods can be detrimental to the industrial sector.

Role of Russia in the global oil and gas market

Europe depends heavily on Russia for coal, crude oil, fuel oil and natural gas. Russia accounted for 36% of the region’s gas imports, 30% of its coal imports and 10% of its crude oil imports prior to the conflict.

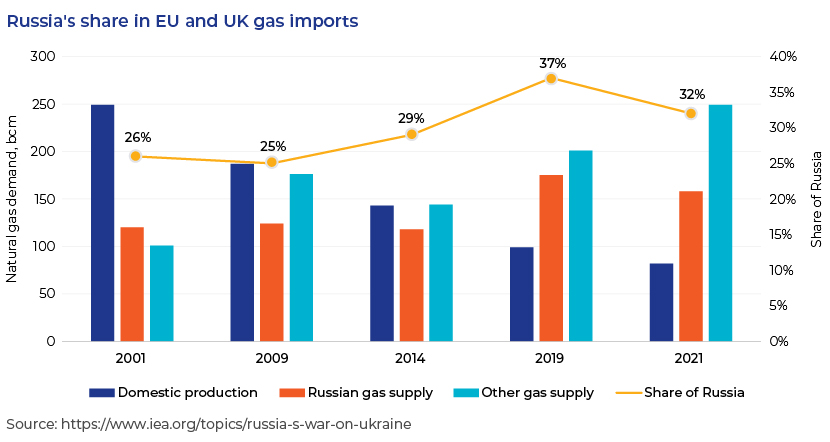

The European Union (EU), the US and the UK had seen an increase in their import of Russian natural gas over the past few years. Natural gas consumption in the US and the UK remained largely steady while production declined by a third – imports from Russia helped bridge this gap, growing from c.26% of total gas demand in 2001-09 to 32% in 2021.

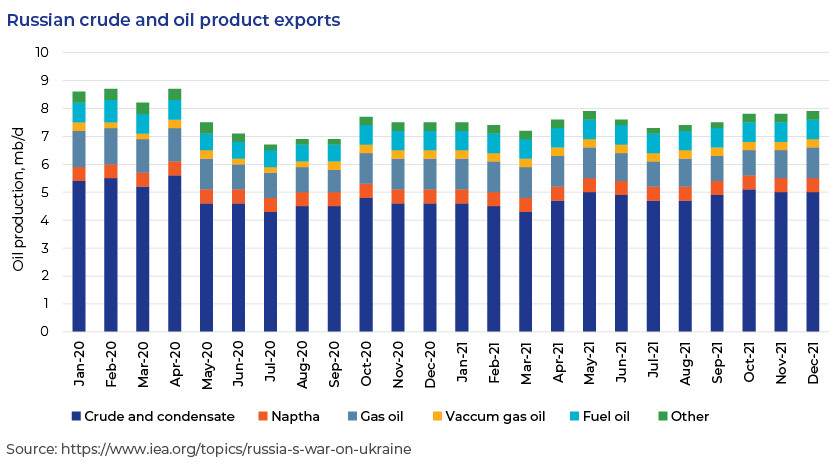

Russia is the world’s third-largest oil producer, behind the US and Saudi Arabia, and the world’s second-largest exporter of crude oil, after Saudi Arabia.

Changes in strategy by energy companies

The European Commission has been implementing plans to ensure EU countries phase out their reliance on Russian fossil fuels. By investing in clean energy and energy efficiency, EU nations are aiming to mitigate the impact of the sanctions on Russian energy exports and get back on track on their clean energy transition goals – which had taken a hit amid the conflict.

Some of the strategies adopted by various markets are listed below.

1).Natural gas

-

Much of Europe’s natural gas requirements were met through imports from Russia. The EU has brought in new proposals for alternative supplies of LNG from international markets. Many European countries have shifted to suppliers from other countries, although this has met with headwinds such as high costs

-

More countries are looking into the option of bringing nuclear power plants back into operation or boosting production at sites currently in operation

-

Expediting energy transition through wind and solar projects can partially offset the demand for gas

-

Spikes in gas prices are expected to force an increasing number of companies to move towards more renewable sources of power; this can also help reduce their carbon footprint

-

Countries are also aiming to accelerate the improvement of the energy efficiency of buildings and industries

2).Oil

-

The G7 and several other European countries have pledged to eliminate Russian oil imports and turn to other exporting countries

-

Oil prices have surged substantially since the invasion, and further cuts to Russian exports would result in further increases in oil prices. To reduce oil demand, the International Energy Agency (IEA) has proposed a 10-Point Plan to Cut Oil Use. Some of the points in this are listed below:

-

Encourage walking and cycling and make public transport cheaper

-

Promote the adoption of a hybrid culture in offices, encouraging employees to work from home for up to three days a week where possible

-

Alternate private car use in large cities

-

Encourage carpooling practices to reduce fuel consumption

-

Push the use of clean fuel vehicles (electric, hydrogen etc.) or more efficient vehicles

-

Encourage travel by night trains rather than airplanes wherever possible

-

Diversification of source strategy

Since the conflict began, companies and industries have taken steps to move on from the shock of its initial impact. The most critical aspect of this has been to find ways to strengthen infrastructure and operations as cost effectively as possible.

Companies have also realised that, for long-term survival, they would need to better focus on innovation, impact and economics. For this, they would need to have a stronger understanding of their vulnerabilities, including risks to people and financial performance. They would also need to look into gaining long-term insight and establishing better decision-making based on scenarios specific to them, such as the industry they operate in, the market or environment conditions they are exposed to and the disruptions they could face.

Intensity of impact

The impacts of the invasion have ranged from commodity market disruptions and macroeconomic consequences to a renewed focus on environmental, social and governance (ESG) factors. In addition, the disruption to global trade has highlighted the need to establish self-reliant trade blocs.

Energy transition – the making of self-reliant infrastructure

As a result of the conflict, many countries have withdrawn their ties with Russia, reducing their dependence on imports from the country. This is expected to accelerate energy transition initiatives and green energy adoption – setting them on the path to self-reliance.

While fossil fuel companies have been returning strong profitability owing to the current rise in energy prices, transitioning to green energy can ensure continued value for shareholders. Although gradual, executive teams are increasingly looking into reinvesting such profits in new businesses focused on renewable energy to ensure that their companies stay in step with sustainability goals.

Repercussions and resilience

For companies affected by the Russia-Ukraine war, the first order of business is to see that the continuity of supply is not hit and that the resilience of operations is maintained.

Executives have used the following themes to guide them through uncertainties:

-

Revolution through new technologies New technologies can serve as assets in setting new models during the current pandemic crisis and other conflict situations.

-

After-effects Emission reduction ambitions could be an impetus for countries to invest in renewables

-

Fiscal aspects Identification of where to invest in the short and medium terms will further strengthen resilience.

Energy security and the move away from fossil fuel

The Russia-Ukraine conflict has led to a considerable reduction in energy supplies, heightening energy security and energy poverty risks worldwide. The crisis also laid bare Europe’s dependence on Russia for fossil fuel.

Even before the invasion, the world was far from achieving its energy and climate goals. Energy markets showed increasing trends in global carbon dioxide emissions, and investment in clean energy technologies remained below the levels required to bring emissions to net zero within specified timelines. At the COP26 Glasgow summit held in 2021, governments had pledged to take positive steps by putting in place more stringent clean energy policies, but there is a lot that needs to be done in terms of implementing these and investing in areas that ensure the world moves towards net-zero emissions.

Europe urgently needs to re-evaluate its energy strategy considering Russia’s invasion of Ukraine, and energy companies are expected to play a crucial role in this if given the proper regulatory framework. Transitioning towards renewable energy, energy efficiency and the use of clean energy technologies will reduce companies’ and countries’ reliance on fossil fuels – and, in turn, fossil fuel exporting countries such as Russia – making them self-reliant and resulting in greater energy security.

Sources

-

https://www.iea.org/articles/energy-fact-sheet-why-does-russian-oil-and-gas-matter

-

https://www.iea.org/reports/russian-supplies-to-global-energy-markets

-

https://www.iea.org/data-and-statistics/charts/share-of-russia-in-european-union-and-united

-

https://www.mckinsey.com/business-functions/sustainability/our-insights/the-net-zero

What's your view?

About the Author

Prashant is working as Delivery Lead for Energy & utilities domain in Acuity Knowledge Partners Private Equity and Consulting vertical. He has over 6 years of experience in energy and sustainability sector helping the clients across various domains by providing solutions for Energy efficiency, Green building ratings system, Water efficiency and Renewable energy. He has also been part of research on trending technologies like ESG, impact investment, socially responsible investment, Decarbonization trends in various sectors and clean energy technologies.

Prashant holds a MTech. Degree from Savitribai Phule Pune University and BTech from Shri Ramswaroop Memorial College of Engineering and Management, Lucknow.

Like the way we think?

Next time we post something new, we'll send it to your inbox