Published on August 18, 2023 by Gaurav Sharma , Akshay Gupta and Surbhi Joshi

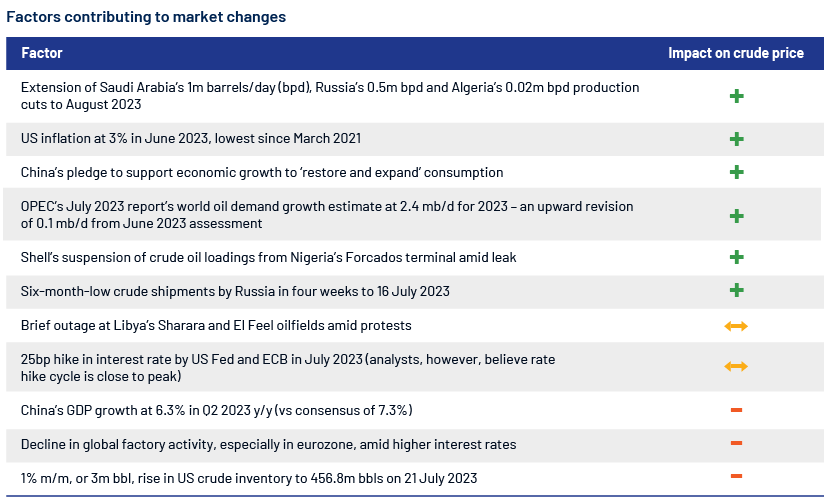

The oil market rebounded sharply (up c.15%) in July 2023, as OPEC+ output cuts started to cause supply concerns. Moreover, cooling inflation in the US, market expectation of central banks’ rate hike cycle at near peak and hints of possible stimulus measures from China added to the positive momentum. Nonetheless, headwinds, such as low purchasing managers’ index (PMI) amid higher inflation globally, persisted.

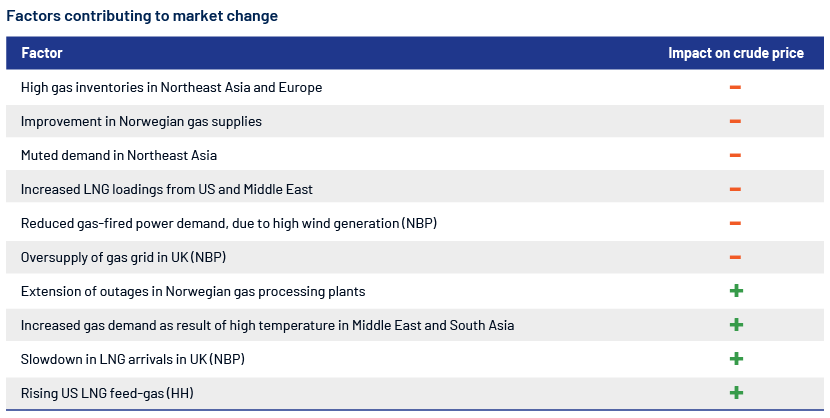

However, LNG price indices fell in July 2023 following a recovery in June 2023, as the Japan Korea Marker (JKM) declined on high gas stockpiles and muted demand in Japan and South Korea. The decline occurred despite high cooling requirements in China, due to warmer weather, and improved LNG buying in South Asian markets. The UK’s National Balancing Point (NBP) also declined amid the resumption of Norwegian gas supplies, high wind power generation, healthy gas storage and oversupplied gas grid in the UK, which more than offset the region’s increased gas demand, due to warmer weather.

Monthly oil market snapshot – July 2023

Industry analysis for the month

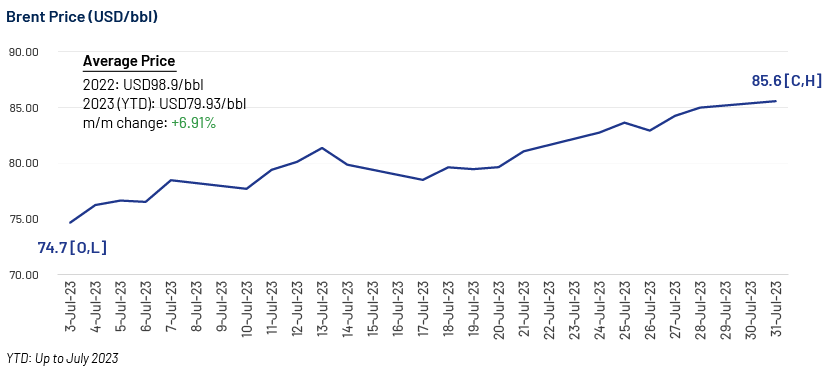

In July 2023, Brent prices opened at USD74.7/bbl – the lowest in the month – and reached USD85.6/bbl at close – the highest since April 2022. Furthermore, oil price performance in July 2023 was the best in nearly two decades, according to OilPrice.

OPEC+’s Saudi Arabia’s and Russia’s production cut announcements on 4 July 2023 had a weak impact on prices at the start. However, the supply cut along with cooling inflation in the US started to build bullish momentum later in July 2023.

Although China’s Q2 2023 GDP growth, at 6.3%, came in lower than expectations of 7.3% growth, the country’s improving oil imports and efforts to revive its economy through stimulus packages eased demand concerns to a large extent. However, the market still faced challenges from lower factory activity and high interest rates globally.

Industry updates (key M&A/investments/deals in month)

-

Oil super major ExxonMobil agreed to acquire CCUS’s solutions and enhanced oil recovery developer Denbury Inc. for USD4.9bn.

-

Crescent Energy closed the Western Eagle Ford acquisition for USD600m.

-

Northern Oil and Gas, Inc. completed the acquisition of Delaware Basin assets from Forge Energy II Delaware, LLC.

-

Eni aims to reduce its exposure to oil through asset sale in favour of gas and non-fossil fuels.

-

Callon Petroleum Company completed the acquisition of Delaware Basin assets from Percussion Petroleum Operating and the sale of its Eagle Ford assets to Ridgemar Energy Operating, LLC.

-

Patterson-UTI Energy announced it would acquire drill bit solution provider Ulterra Drilling; the transaction includes a cash component of USD370m and 34.9m shares of Patterson-UTI Energy.

-

Berry Corporation executed a definitive agreement to acquire Macpherson Energy Corporation for USD70m in cash, which would add 2,400 boe/d (100% oil), in 2024.

-

Nigeria is expected to attract USD20bn foreign direct investment (FDI) by 2024, despite discrimination against oil investment

-

India is expected to resume operations in Iraq’s ONGC Videsh block.

-

Shell signed a contract for seismic acquisition in Oman.

-

Zena Oil & Gas LLC is expected to fully acquire a portfolio of mineral leases and oil and gas wells in the US from the wholly owned subsidiaries of Beam Earth Group.

-

OMV was in talks with ADNOC over a deal that could combine their chemical divisions, Borealis and Borouge, respectively.

Acuity Knowledge Partners’ view

We believe the start of a rally in prices in the oil market from OPEC+’s production cuts will likely continue in the near future, as demand concerns have shown some signs of weakening with cooling inflation in the US and China’s recent stimulus measures. Any improvement in demand would result in declining inventories amid reduction in supply from OPEC+ and forecasts for lower US production from top agencies. It would be interesting to see whether the recent rally in prices continue owing to the above fundamentals or the weakness in the global economy overpowers price growth.

Monthly gas and LNG market snapshot – July 2023

Industry analysis for the month

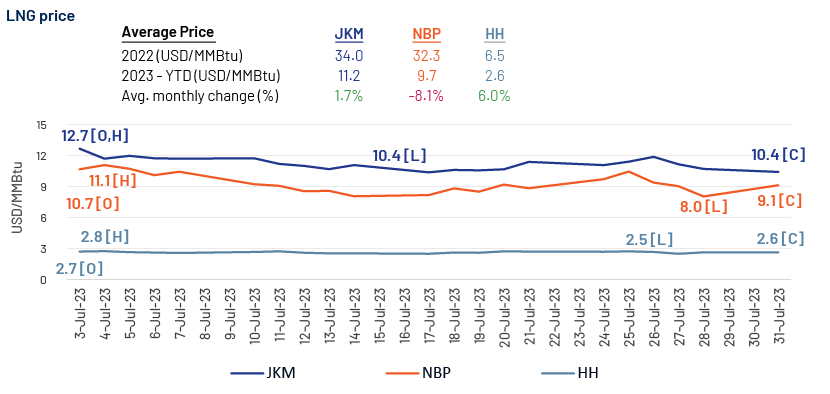

After a slight recovery in prices in June 2023, LNG markers continued their downtrend in July 2023, with NBP and JKM prices declining 17.8% and 14.3% m/m, respectively. During the month, UK NBP declined by USD1.6/MMBtu from the July 2023 opening price of USD10.7/MMBtu to close at USD9.1/MMBtu. Similarly, JKM price opened at the month’s high, USD12.7/MMBtu, and declined during the month, closing near the month’s low of USD10.4/MMBtu.

US gas benchmark Henry Hub (HH) started the month at a high USD2.8/MMBtu before declining 2.8% during the month to close at USD2.6/MMBtu at month-end.

Industry updates (key M&A/investments/deals over the month)

-

Energy Transfer entered into three heads of agreement (HOAs) to sell 3.6 MMTPA of LNG from its proposed Lake Charles export plant in Louisiana.

-

Centrica and Delfin Midstream have signed a 1 MMTPA LNG sale and purchase agreement (SPA) for 15 years.

-

Mexico Pacific inked a 1 MMTPA LNG SPA with Zhejiang Energy for 20 years.

-

PetroVietnam Gas was in talks with ExxonMobil and Novatek for LNG supply.

-

Pakistan and Azerbaijan have signed an LNG agreement, with Pakistan expected to import LNG at the world’s cheapest spot price.

-

Indian Oil Corp. has long-term LNG import deals with TotalEnergies and ADNOC LNG.

-

India to develop an LNG liquefaction terminal in Iraq.

-

TotalEnergies extended its Algerian LNG supply deal with Sonatrach to 2024.

-

UK-based National Grid is on the lookout to sell its 100% stake in the Grain LNG import terminal.

-

Nigerian president backed a USD5bn FLNG project and is eyeing a 2026 kick-off.

-

KOGAS is set to participate in a USD7bn gas development project in Mozambique.

-

Baker Hughes awarded to supply three liquefaction trains connected to Next Decade’s Rio Grande LNG project.

-

Shell sold its stake at the Masela gas field to Pertamina and Petronas for up to USD650m.

-

Eni acquired Chevron’s gas assets in Indonesia.

Acuity Knowledge Partners’ view

We believe gas and LNG prices in Q3 2023 will likely remain under pressure, generally a low-demand quarter, on account of high gas stockpiles in European and key Asian markets and expected weak economic recovery, despite easing of inflation lately. On the contrary, if demand from Asia, especially China, continues to improve, European LNG prices may increase to prevent European cargo shipment to Asia, helping Europe fill its gas storage to 90% before winters.

How Acuity Knowledge Partners can help

We have a large pool of oil and gas experts experienced in providing strategic support across the value chain. Over the years, we have partnered with leading energy companies, closely working with their strategy, business development, market intelligence and M&A teams to provide them the necessary information and analysis to help them achieve their business objectives.

Acuity also offers its expertise in power; renewables; metals and mining; ESG and sustainability. (https://www.acuitykp.com/solutions/energy-and-utilities/)

Sources

Investing, CME Group, ICE, LNG Prime, PGJ Online, Hart Energy, LNG Prime, BOE Report, Pak Observer, PGJ Online, Live Mint, Total Energies, Energy Intel, Punchng, Business Korea, PGJ Online, Reuters, Bloomberg, ISE, NASDAQ, Reuters, Nikkie, Energy Live News, Reuters, Yahoo Finance, Natural Gas World, S&P Global, Bloomberg, Montel News, Reuters, Financial Times, IMF, Reuters, Moscow Times, Reuters, OPEC, BLS, The Guardian, Forbes, FT, Reuters, Aljazeera, Reuters, Economic Times, JWEnergy, CNBC, EIA, EIA1, Oil Price, Nsenergybusiness, Energy Pedia, FT, Worldoil, Callon, Saudigulfprojects, NG, Aramco, ET, CW, Zawya, Vanguardngr, Reuters, Oil Price, Oil price, Worldoil, Worldoil

Tags:

What's your view?

About the Authors

Gaurav has close to 14 years of experience working across oil and gas value chain. He has varied experience working on various strategic research projects involving market intelligence, competitive intelligence, market sizing models, industry benchmarking and market entry strategy. At Acuity Knowledge Partners, Gaurav is leading a team to support a major LNG player in various strategic research projects. He holds a MBA degree in Oil and Gas Management from University of Petroleum and Energy Studies and a BE degree in Mechanical.

Akshay Gupta is an energy analyst with over 6 years of work experience in oil and gas domain. At Acuity Knowledge Partners, he has been a consistent member for leading and liasoning various LNG and gas projects. His current interest includes energy market studies and exploring avenues for energy transitioning. He is a post-graduate in Business Management from TERI University.

Surbhi has close to 4 years of experience in oil and gas sector, with a major focus on LNG and upstream. At Acuity Knowledge Partners, she supports a leading LNG player in various strategic research projects involving market intelligence and competitive intelligence. Surbhi holds a MBA degree from University of Petroleum and Energy Studies and also B-tech degree in Chemical engineering.

Like the way we think?

Next time we post something new, we'll send it to your inbox