Published on March 29, 2023 by Prashant Juneja

Introduction

Hydrogen is being considered as an option to reduce dependence on fossil fuels and accelerate the global transition towards net-zero greenhouse gas (GHG) emissions. Through its adoption, countries around the world would be contributing to decarbonisation targets, augmenting energy security. Hydrogen will play a major role in mitigating climate risks and help achieve governments’ commitments. The Russia-Ukraine conflict has sparked a global energy crisis, and hydrogen production is accelerating to meet energy demand. However, the transition to decarbonisation would be accelerated only when this production is powered by green sources, which would result in “green hydrogen” generation.

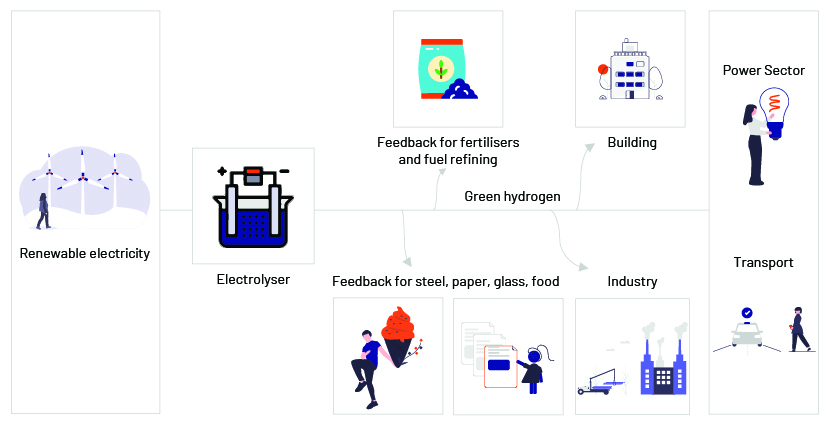

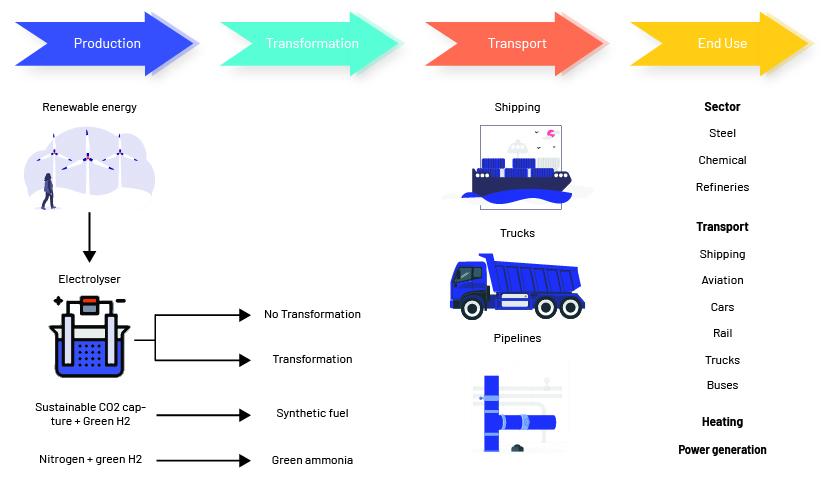

Green hydrogen can play a pivotal role in sectors such as steel, cement and chemicals, and decarbonise them completely. Hydrogen energy is versatile and can be stored easily and transported over long distances. Derivatives of green hydrogen, including green ammonia and green methanol, could be used as raw materials for industrial use and for long-term energy storage.

Green hydrogen would save millions of tonnes of carbon dioxide that would be emitted if this gas was produced using fossil fuels. However, the production cost of green hydrogen is high, and its viability is, therefore, uncertain, necessitating a reduction in renewable energy costs.

Green hydrogen demand

Global demand for hydrogen has grown significantly since 2020, particularly in the chemical and refining sectors. However, demand slowed in the heavy industry, transport, power generation and building sectors. China is the largest consumer of hydrogen, followed by the US and the Middle East. All three regions registered increases in hydrogen demand of 5%, 8% and 11%, respectively, compared to 2020, according to the IEA’s Global Hydrogen Review 2022. Europe and India are the next two biggest consumers of hydrogen.

Demand for hydrogen in 2020 was 87m metric tons (MT); the World Bank expects this to grow to 500-800m MT by 2050. In terms of value, demand is expected to grow by 9.2% per year through 2030, when the value of hydrogen production is estimated at USD130bn. However, only a small portion of hydrogen is green, and approximately 95% of hydrogen is derived from fossil fuels. Nonetheless, green hydrogen has seen renewed interest, with hydrogen gaining popularity in sectors such as steel making, cement production, heavy transport including shipping, cleaning products, refrigeration and electricity grid stabilisation. The global green hydrogen market was estimated at approximately USD2.8bn in 2022 and is projected to reach approximately USD90bn by 2030, growing at a CAGR of 54%.

Green hydrogen supply

Global hydrogen production was around 94m MT in 2021, with natural gas without CCUS accounting for 62% of total production; 18% was hydrogen produced as a by-product of naphtha reforming at refineries, and coal accounted for 19%. Although hydrogen production through electrolysis accounts for less than 1% currently, it increased by 20% in 2021 compared to 2020. As a result, low-emission hydrogen technologies are gaining traction in efforts to reduce GHG emissions and may reach a reasonable level by 2030. Electricity produced from renewable energy accounted for about 33% of total electricity produced globally in 2021, and hydrogen produced from renewable energy (i.e., green hydrogen) accounted only for about 1% of global production.

Hydrogen production currently uses fossil fuels and comes out in colours: the hydrogen produced from coal gasification is black hydrogen while that produced from steam methane reformation of natural gas is grey hydrogen. Hydrogen can also be produced from caustic soda production or chloralkali electrolysis, generating white hydrogen, a low-carbon-emitting hydrogen. Blue hydrogen can be produced through grey hydrogen, with carbon dioxide generated during the steel metal reforming process captured and stored. Hydrogen produced through water electrolysis using renewable energy is green hydrogen.

Hydrogen is a flexible energy carrier and can be produced from multiple feedstock.

Green hydrogen – challenges

Green hydrogen production faces multiple challenges that may limit the use of its full potential:

1. Cost

Renewable hydrogen is two to three times more expensive than hydrogen produced from fossil fuels. Hydrogen pipelines and storage tanks for transport are equally expensive, and renewable energy pathway costs are higher than the cost of fossil fuels for ammonia, methanol and steel production by 50-75%, 150% and 30-40%, respectively.

2. Lack of differentiation

It is difficult to differentiate between low-carbon hydrogen and fossil fuel-based hydrogen. It is also difficult to understand the origin of hydrogen.

3. Lack of a hydrogen market

There is no price index for hydrogen, making it a non-traded commodity. Due to a lack of transparency and competition, consumers pay higher prices.

4. Limited infrastructure

Transport needs to upgraded if renewable energy-based hydrogen is to be used in rural areas. Additional investment would be required for pipelines, conversion, liquefaction and storage.

5. Energy losses

Green hydrogen production requires the deployment of renewable energy at every step; this would delay the process of adoption, increase energy losses and make decarbonisation more challenging.

6. Policy

Policy previously focused more on road transport, fuel cells for electric vehicles and refuelling. The focus has shifted towards national strategies, infrastructure improvement and supply of hydrogen.

Green hydrogen initiatives and technological advancement

Green hydrogen had almost no investment in 2020; this increased to 121GW across 136 projects valued at over USD500bn in 2021.

Africa

Countries such as Mauritania, Morocco, Tunisia, Egypt and Namibia are planning to produce hydrogen to meet climate goals. In Mauritania, two hydrogen projects – NOUR and EMAN – were launched; NOUR will become one of the largest hydrogen projects by 2030, with 10GW of capacity, while EMAN will have 12GW of solar capacity and 18GW of wind capacity, producing 1.7m tonnes of green hydrogen per year.

Australia

In Australia, green hydrogen is more expensive than conventional or blue hydrogen. However, market analysts expect the cost of green hydrogen to drop by 70% in countries with affordable renewable energy. Several companies, along with government agencies such as the Australian Renewable Energy Agency, have invested billions of dollars to construct hydrogen infrastructure to replace coal-fired power plants.

Canada

Everwind and EON agreed to sign an MoU to import 500,000MT of green ammonia from Everwind’s production facility. This would become operational by 2025.

China

China is the leader in the global hydrogen market, accounting for one-third of global production (20m MT). Chinese oil and gas enterprise Sinopec plans to generate 500,000MT of green hydrogen by 2025. During the Winter Olympics in 2022, onshore wind was used with hydrogen electrolysers to produce green hydrogen to power the vehicles used at the games.

Japan

Japan plans to transform itself into a hydrogen society. It has compiled a roadmap for integration with fuel to meet 10% of its power requirement and for use in shipping and steel production by 2050. By 2030, it plans to become self-reliant in terms of hydrogen production and reduce imports of liquefied hydrogen by 100 times.

India

India’s largest energy companies – Reliance Group and Adani Group – launched green hydrogen production projects in 2021. Reliance Group plans to produce 400,000MT of green hydrogen from 3GW of solar energy, and Adani Group plans to produce the cheapest hydrogen with its investment of USD70bn. India plans to produce 5m MT of green hydrogen a year by 2030, according to the Ministry of Power.

The steel and transport sectors create additional demand for green hydrogen. 100GW of renewable energy will be required to produce 5MT per annum (MTPA) of green hydrogen by 2030; this would mitigate carbon emissions by 1.6% and reduce energy import bills by INR40bn, with a 68% reduction in natural gas imports.

European Union (EU)

The EU presented a roadmap for net-zero emissions in 2020, integrating hydrogen into its strategy. The plan is divided into three phases:

Phase 1 (2020-24): Decarbonising hydrogen production

Phase 2 (2024-30): Integrating green hydrogen into the energy system

Phase 3 (2030-50): Increasing use of hydrogen for the decarbonisation process

Germany has invested EUR6m to produce 5GW of hydrogen capacity by 2030.

UK

The British government introduced the Ten Point Plan for Green Revolution in 2021. It includes creation of 5GW of low-carbon hydrogen by 2030 and research work on hydrogen blending in the gas distribution grid by 2023. In addition, a project was launched for the national grid to introduce green hydrogen, powered by wind turbine electrolysers, to power 300 homes.

US

In 2021, the Federal Infrastructure Investment and Jobs Act allocated USD9.5bn for green hydrogen initiatives and the New York governor allocated USD290m for a green hydrogen facility. In addition, research is being conducted to blend hydrogen into the gas grid. Texas is one of the largest producers of hydrogen and has the largest hydrogen pipeline network.

Conclusion

Hydrogen produced can be used to its full potential when it is less expensive and easier to produce and distribute. However, two issues need to be resolved:

-

Constant support is required from policymakers and regulators, through subsidies and changes in policy.

-

Regular contributions are needed from stakeholders across the hydrogen value chain to make the hydrogen economy a reality. The market for hydrogen-related machinery, equipment and components is estimated to increase to more than USD200bn by 2050.

The hydrogen market is currently a fragmented one. However, this is changing through ongoing government support, adopting the right business model and introducing the best technologies. Development of the hydrogen market can diversify potential energy supplies and increase energy security for the countries importing hydrogen. Aligning policies would contribute to achieving global energy goals and increase a country’s self-reliance.

We expect a rapid uptake of green hydrogen in the coming decade, playing a major role in the decarbonisation of a number of sectors. The process of achieving carbon neutrality would be accelerated when renewable energy infrastructure is used for hydrogen production, reducing the cost of electrolysers.

How Acuity Knowledge Partners can help

We provide support on a wide range of activities including market assessment, financial analysis, thematic research, supply-chain assessment and strategy formulation across clean-energy solutions including hydrogen energy. We also help formulate strategies to increase deployment of green hydrogen, address challenges in accelerating the process of green hydrogen production and meet the net-zero targets of the industrial and transport sectors. Each output is customised, based on the client’s requirement, and made available for their exclusive use.

Sources:

-

https://www.activesustainability.com/sustainable-development/green-hydrogen-decarbonizing/

-

https://blogs.worldbank.org/ppps/green-hydrogen-key-investment-energy-transition

-

https://energy.economictimes.indiatimes.com/news/renewable/green-hydrogen-demand-in

-

https://www.weforum.org/agenda/2021/12/what-is-green-hydrogen-expert-explains-benefits/

Tags:

What's your view?

About the Author

Prashant is working as Delivery Lead for Energy & utilities domain in Acuity Knowledge Partners Private Equity and Consulting vertical. He has over 6 years of experience in energy and sustainability sector helping the clients across various domains by providing solutions for Energy efficiency, Green building ratings system, Water efficiency and Renewable energy. He has also been part of research on trending technologies like ESG, impact investment, socially responsible investment, Decarbonization trends in various sectors and clean energy technologies.

Prashant holds a MTech. Degree from Savitribai Phule Pune University and BTech from Shri Ramswaroop Memorial College of Engineering and Management, Lucknow.

Like the way we think?

Next time we post something new, we'll send it to your inbox