Published on September 24, 2021 by Arjun R D

How Is Data Science Used in Finance?

Data science helps to process and examine vast amounts of financial data to uncover hidden patterns and correlations. It helps to provide financial insights using a blend of statistical techniques and algorithms. Here are a few ways wherein data science helps to transform organisations providing financial services.

Financial data science helps transform how financial institutions assess and manage risks. Financial analysts can uncover hidden risk factors and correlations to harness vast data, a capability increasingly relevant in areas such as data science in private equity.

Most leading marketers believe that personalisation significantly contributes to business profitability. Data science helps in customisation across various aspects of financial services and ensures a more suitable investment strategy.

Data science for financial markets bolsters defenses against fraudulent activities. It helps to analyse lots of data with unprecedented speed and accuracy, thereby minimising potential losses.

Data sciences help to drive improvements in the operational efficiency of financial institutions. Identifying such inefficiencies and bottlenecks leads to more streamlined operations.

The amount of global economic data that needs to be analysed is likely to reach 150tn gigabytes by 2025. Total assets managed by global investment management firms reached USD103tn in 2020. The world’s top 25 investment banks generated record fees of USD127.5bn in 2020. As financial assets are expanding, global financial institutions are required to analyse increasingly large amounts of data. In this blog, we cover the basics of data science and common applications of financial data.

To efficiently manage and analyse this vast amount of data, financial institutions are turning to financial services technology solutions, which provide the tools necessary to harness the power of data science for better decision-making.

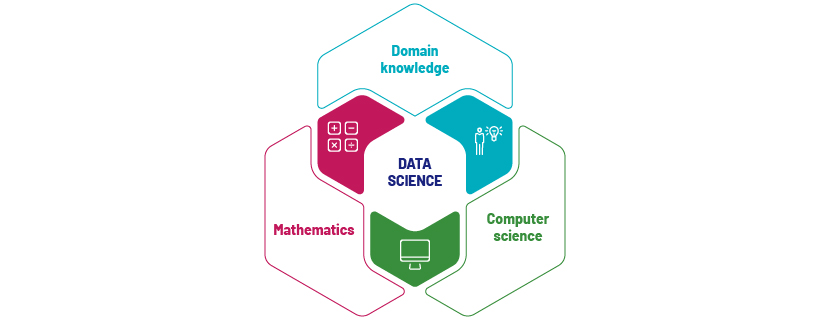

Data science is a complex field that combines mathematics, computer science and domain knowledge to derive unique insights. Financial data science leverages traditional quantitative analysis techniques enabled by enhanced computing power to analyse structured and unstructured datasets. The amount of data generated by the financial services sector increased sevenfold from 2016 to 2020.

Depending on the organisation’s lifecycle, the complexity of financial data science can vary widely. The following are the most common functions of financial services firms that use data science extensively.

-

Customer analytics

-

Risk analytics

-

Regulatory compliance and reporting analytics

-

Operational analytics

-

Capital markets analytics

1. Customer analytics – helps in customer acquisition, servicing, growth and retention

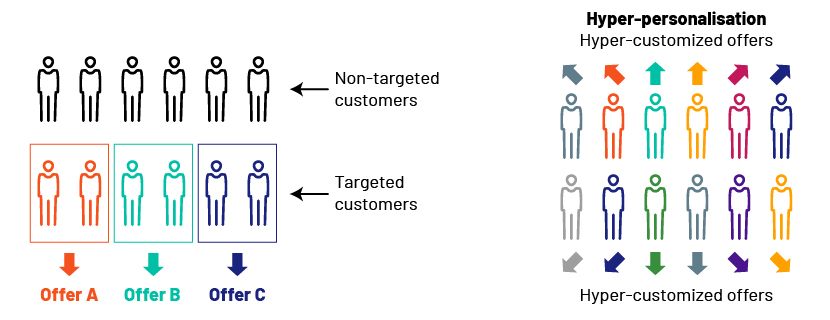

a. The customer lifecycle, spanning acquisition to retention, can be enhanced with analytics. Techniques such as lead scoring help target the right prospective clients, increasing the likelihood of conversion. Once on-boarded, customer segmentation helps understand clients better, presenting opportunities for upselling and cross-selling. Churn modelling and loyalty analytics help retain customers. The entire customer lifecycle can be managed with the help of business intelligence solutions [read more here: Effective customer lifecycle management (CLM) using business intelligence (BI) solutions].

b. Hyper-personalisation is used to market products and services to customers. Artificial intelligence (AI) helps understand human language and emotions, digital activity in real time, spending habits, demographics and geo-location to provide the best personalised financial solution. Some common applications are 24/7 assistance using AI chatbots and automated voice response built using tools such as natural language processing (NLP) and speech-recognition software. Sentiment analysis of customers’ online behaviour enables financial institutions to understand customer sentiment towards a product even before launch, helping them tweak the product to increase likelihood of success.

2. Risk analytics

Financial institutions are exposed to risk such as financial crime, cybersecurity risk, credit risk and market risk. Analysing the threat has become critical for strategic decision making.

a. Machine-learning models and anomaly-detection algorithms can analyse large transaction datasets to detect and prevent fraudulent transactions. These identify hidden patterns between user behaviour and the likelihood of fraud, and are used to prevent fraud in speculative trading and rogue trading, and prevent regulatory violations

b. Real-time analytics issues alerts on unusual financial purchases or large cash withdrawals, enabling an institution to block the account until the customer confirms them

c. Banks use customer information and data on financial transactions, credit histories and credit scores to build scoring models to decide the creditworthiness of a customer, appropriate loan amounts, etc., reducing future losses and credit or investment risk

d. Powerful machine-learning algorithms using historical and real-time customer data to continually monitor market activity enable banks to recognise warning signs. This helps monitor market risks

3. Regulatory compliance and reporting analytics

Regulatory initiatives such as the Dodd Frank Act, Comprehensive Capital Analysis and Review (CCAR) and Enhanced Prudential Standards (EPS) have forced banks to prioritise data to provide real-time access to information. While data aggregation is key to compliance, regulators are also focusing on the practice of data collection itself, according to BCBS 239, a standard to heighten the ability of financial institutions to aggregate data on risk and Basel III reforms.

a. Compliance analytics provides valuable insights for AML, sanctions, KYC, audit and financial intelligence

b. AI- and automation-driven software and self-service platforms are used to provide faster and more accurate responses to regulatory requests. These enable banks to more efficiently verify data, maintain data consistency, accelerate compliance, merge statements, generate reports based on set parameters and review documents using NLP

c. Adopting AI to support KYC can boost client acquisition and provide banks with a competitive edge

4.Operational analytics

a. Customers have multiple payment options, such as debit cards, credit cards, net banking, mobile banking and wallets. To increase the efficiency of payments, payment analytics could be used to reduce payment rejections and, therefore, costs, by identifying the cause for rejection, while cybersecurity financial services ensure secure transaction processing.

b. Acquiring banks use analytics to optimise pricing of processing and commission structures to help generate more revenue. Card issuers monetise transaction activity analysis by pushing attractive offers at the right time, cross-selling relevant products and sending timely reminders on upcoming payments

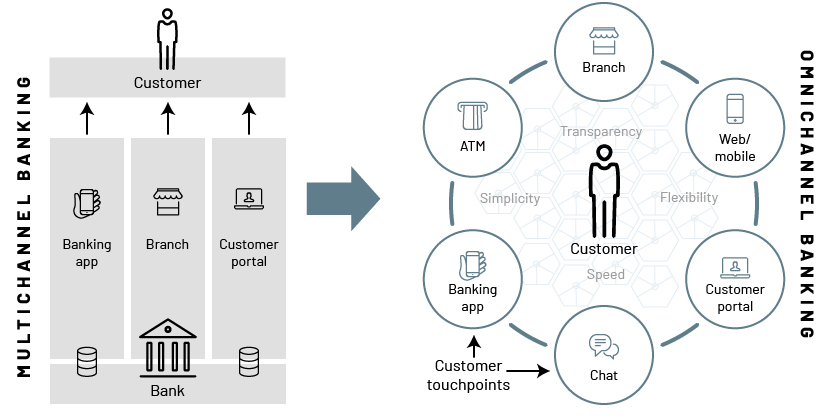

c. Analytics helps enhance the end customer’s banking experience by moving away from multichannel banking (which results in an inconsistent experience across channels) to omnichannel banking (a seamless move across channels, ensuring a consistent experience)

5.Capital markets analytics

a. Algorithmic trading involving complex mathematical formulas and high-speed computations is used to devise trading strategies by predicting markets. AI processes substantial amounts of information, including tweets, financial indicators and data from news and books, and even TV programmes

b. Machine-learning techniques are used to determine the identity of market participants

c. Robo-advisors are used to target the less profitable millennial generation at a very low cost. Algorithms at the back end analyse data points such as customer income, expenses, goals and risk appetite for suggesting a suitable investment portfolio. This enables financial institutions to build a pipeline of customers for traditional financial advice such as portfolio management services after they have sufficient resources to meet minimum requirements

Conclusion:

Data science has become an integral part of the financial services sector. Increasing digitalisation of day-to-day interactions has led to each individual becoming an active producer and consumer of large amounts of data. Banks use analytics not only to increase sales, but also to provide world-class customer services to retain customers and predict risk to minimise losses. Institutions able to conduct real-time analysis of large amounts of data using machine learning and AI tools are able to identify new streams of revenue and beat the competition, and survive periods of recession.

Sources:

-

Global Investment Banking Review 2020 – Refinitiv

-

https://www.upgrad.com/blog/data-science-use-cases-finance-industry/

-

https://worldfinancialreview.com/how-data-science-is-transforming-the-financial-services-industry/

-

https://www.ir.com/blog/payments/real-time-payments-analytics-historical

-

https://polestarllp.com/Top-Financial-Services-Banking-Analytics-Use-Cases

-

https://www.swift.com/our-solutions/compliance-and-shared-services

Tags:

What's your view?

About the Author

Arjun R D has over six years of experience in providing data analytics for financial services firms. His areas of expertise cover product analytics, sales and marketing analytics, campaign measurement, secondary research, statistical modelling and data visualization. At Acuity, Arjun provides product analytics, business intelligence and bespoke reporting solutions to a leading US bank. Previously, he provided analytical solutions to the sales and marketing practice of a leading asset management firm with over USD3tn in assets. He holds a master’s degree in Management specializing in Finance and a bachelor’s degree in Engineering specializing in Computer Science.

Like the way we think?

Next time we post something new, we'll send it to your inbox