Published on November 22, 2024 by Richa Prakash

The global financial messaging space has taken centre stage since the migration to ISO 20022 was announced. This migration from Society for Worldwide Interbank Financial Telecommunications (SWIFT) MT format standards to the ISO 20022 standard, also referred to as MX standards, is expected to be adopted fully by November 2025. Although the MT standards are still widely used and are deeply rooted, acting as the backbone for financial messaging, the transformation from MT to MX is inevitable. After November 2025, the former format would be decommissioned completely, and ISO 20022 would be the only standard acceptable for reporting and payment instructions between financial institutions.

The legacy MT format is deeply rooted in financial institutions (banks, credit unions), corporates and businesses, fintech companies, payment service providers (PSPs) and the SWIFT network itself; therefore, this migration cannot be easy or quick. A few alternatives, such as the SWIFT Translator from MT to MX and MX to MT could give a breather but only temporarily, due to the following issues inherent in the transformation and translation of messages:

Data-rich standards require more complex and scalable systems: ISO 20022 formats carry enriched data with much more information in a message to support data sources, regulatory reporting, AML checks and even several languages, improving communication and making straight-through processing (STP) easier. These striking features cannot be supported by the older limited systems, which need to be scaled up at least to accommodate the new minimal requirements.

Data duplication, truncation and misinterpretation: Since the new format carries far more data than the MT format, data conversion from the MT format to the MX format would require a large amount of data incorporation in every message. Similarly, conversion from the ISO 20022 format to the MT format would result in substantial data loss and data truncation due to limited functionalities in MT formats. This coding and decoding of data from MT to MX and MX to MT may also lead to misinterpretation of data and, above all, lead to sending incorrectly formatted messages, especially due to the emergence of new rules governing translation.

Additional layers of redundant activities and the need for secure retrievable data storage: Due to the restructuring of data, every time a message is received or sent using a translator, some amount of data is either added or omitted, as discussed earlier. If data is omitted from the MX-format message, not making it compatible with the MT format, this data must be stored safely so it can be retrieved and used when converting MT-format messages to MX format when sending responses. This creates not only an additional layer of work but also the need for secure storage.

Global acceptance with unmatched technology: SWIFT provides the largest and most widely used method of secured communication messaging. On any given day, this banking system alone processes over 25m financial transaction messages. This figure is self-explanatory in determining the depth of importance of this service. The technology is globally accepted, standardised and offers a non-competitive product. Institutions sticking to MT formats may see the bear move in their customer database, as many corporates are already looking forward to better and easier reconciliation and liquidity management services, possible with the data-rich ISO 20022.

Enhanced sanctions-screening aspects: With the amount of high-end data expected to flow under the new message format, new and efficient ways are required for sanctions screening. Hence, existing systems need to be reinforced so that they enable total screening to screen the enriched MX-formatted messages.

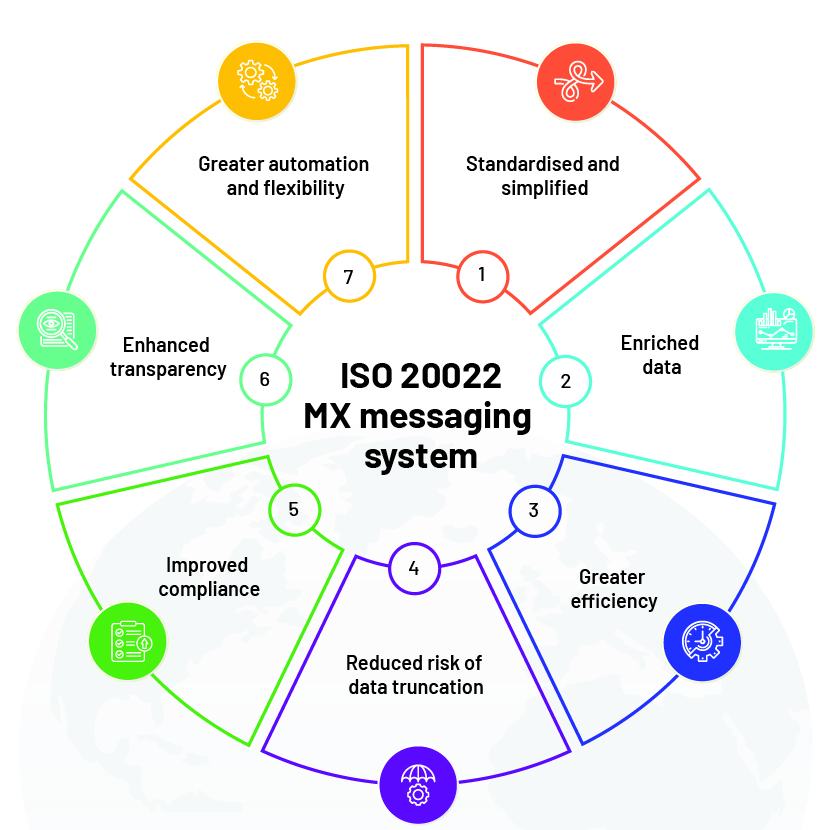

Benefits of changing from SWIFT's MT to MX

Ensuring organisations are prepared before the deadline, and the need for regressive testing before the final launch

Preparedness for the new era of ISO 20022 can be ensured only by conducting a number of tests in all the related dimensions, such as unit testing, system testing and integration testing, followed by rigorous user acceptance testing. Regressive testing would minimise the occurrence of unfamiliar and abrupt scenarios when this new system takes over.

Preparedness also involves keeping abreast of technology updates, process changes, training, backup for potential disruptions and ways to capitalise on this change in the long term.

How Acuity Knowledge Partners can help

We are equipped with a deep understanding of old and new formats, enabling us to provide our clients with a robust hybrid model so they can reduce costs, increase productivity and improve the end-client experience. We operate in a controlled environment that guarantees the appropriate segregation of duties and delegation of authority. We enter into stringent service-level agreements for all key operations to ensure efficiency and effectiveness, helping augment the client experience. Leveraging our deep industry and domain experience, we help clients streamline their functions by value-stream mapping and incorporating best practices.

Sources:

-

ISO 20022: The transformation from SWIFT MT to MX message formats – Brickendon Consulting

-

The Benefits of Provisioning Synthetic Data for Workflow Testing (genrocket.com)

What's your view?

About the Author

Richa has pursued B.Tech(IT) from Bharati Vidyapeeth, Pune and MBA(Finance) from Institute of Marketing and Management, Delhi. She is a CDCS certified with around 11 years of rich experience in international trade finance, customer service & relationship management. She has a rich experience of various trade process and platforms migrations along with several process automations in trade finance operations.

Like the way we think?

Next time we post something new, we'll send it to your inbox