Published on January 15, 2021 by Raja Sekhar

Introduction

Tomorrow’s financial services are expected to be interconnected, embedded and often invisible. Instead of building standalone applications, financial products and features are being embedded in the consumer and business apps that we already use. Take ridesharing/online food ordering platforms such as Uber and DoorDash, for instance. A gig worker working with these platforms may use the same companies to access financial products. Adding financial products attaches new revenue streams to these platforms. In such an ecosystem, application programming interfaces (APIs) are set to become the de facto data pipelines through which businesses open up their core systems. Similar to what AWS did for computing and storage by significantly reducing cost and complexity with its pay-as-you-go model, new infrastructure companies are rebuilding several layers of the banking stack, providing financial products “as a service” and significantly lowering the cost and complexity of adding financial services.

Key trends

-

Financial products such as digital payments and lending are being increasingly integrated into vertical software-as-a-service (SaaS) solutions [e.g., Shopify launched Shopify Capital to support small and medium-size businesses (SMBs) on its platform by disbursing loans without the need for separate applications]

-

Embedding financial products helps platforms improve the overall user experience and increases the lifetime value (LTV) of their customers [e.g., Veeva, a customer relationship management (CRM) solution for pharma companies, added payments to its platform to integrate data and automate payment tracking for a simpler, more efficient process]

-

Banks and payment giants are collaborating with fintechs as part of their innovation sourcing agenda. According to a PwC survey, 94% of financial services companies stated that they were confident that fintechs would help to grow their respective company’s revenue over the next two years

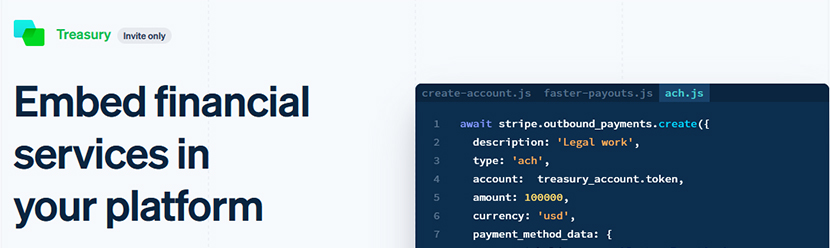

Source: https://stripe.com/treasury

Stripe Treasury is a banking-as-a-service (BaaS) API that lets users embed financial services in their marketplace or platform. The company enables standardised access to banking capabilities via APIs by expanding its bank partner network to include Goldman Sachs Bank USA and Evolve Bank & Trust as US partners

Analysis

In traditional enterprise setups, chief information officers (CIOs) oversaw the software-purchasing decisions. In an era when infrastructure setups were static and software development cycles spanned several months, this structure was manageable. But with the surge in cloud adoption, infrastructure became dynamic and software development/release cycles were shortened to days/weeks. The traditional structure did not work for digital platforms, and CIOs were left to handle only the fundamental and foundational layers of work. The rest of the decisions are now routed to individual business heads with developers and DevOps teams that have a strong role to play in the buying decision. This has created an opportunity for startups to provide new, more-targeted tools for developers. BaaS and fintech infrastructure players are building tools that allow developers to embed banking and payments solutions deep in user workflows, organically.

At a fundamental level, embedded financial services providers are abstracting away the complexity of legacy processing systems to create simple and nimble products. These products are built on plug-n-play architecture, with the added flexibility to customise according to individual requirements. Examples of products built around these systems include the following:

-

Marqeta built a cloud-based card issuer and programme management platform that can be accessed via an API, an offering that was not available from the legacy processors until Marqeta introduced it to the market. Most of the recent innovative card issuer programmes are being built on Marqeta’s platform — examples include card programmes for startup unicorns such as Affirm, Postmates, DoorDash, Square, Favor and Instacart

-

Stripe built lending and treasury products that can be accessed via APIs and seamlessly embedded in any digital platform ecosystem — Shopify expanded its partnership with Stripe to power Shopify Balance, the business account that will be built specifically for independent businesses and entrepreneurs

-

Surecomp built a trade finance API platform, APIsure, and is setting the standards for open trade finance banking. The open banking architecture enables banks, corporates and fintech companies, across the trade finance ecosystem, to break down legacy barriers and exchange data, functions and applications in real time

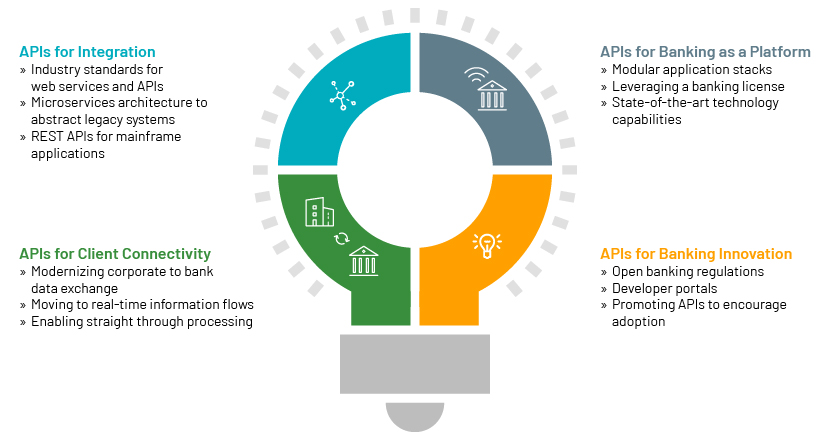

As digital becomes more pervasive and the scale of data increases significantly, it becomes crucial to develop goal-seeking and self-optimising algorithms that deliver contextual products in real time across multiple value networks/ecosystems. Hence, building a developer-friendly API ecosystem becomes fundamental to competing in a connected world. Fintechs and digital platforms are shunning the traditional partnership route with banks, primarily due to the tedious process involved in integrating and orchestrating with multiple internal applications – resulting in a longer time to market. Native digital banks are building more open and modular systems to enable seamless integration into internet value networks (BBVA and Marcus by Goldman Sachs are leading the pack by building fintech-friendly partnership avenues to create a mutually beneficial offering). In fact, large banks and traditional vendors are also developing the necessary technology infrastructure to leverage new-age processes and tools.

-

ING created an internal API layer to co-create and accelerate innovation through a collaborative developer ecosystem — providing developers access to selected, simulated ING APIs that they could use to create new and innovative customer experiences. Other big banks such as Citi and JP Morgan have also created API platforms to open up their systems

-

MasterCard launched Mastercard Innovation Engine, an API-based digital platform that enables issuers and merchants to provide digital capabilities to customers. Visa and Amex are also using APIs to reduce partner integration and onboarding complexity

Source: Celent report on APIs in banking

Key recommendations

-

Banks should embrace more fintech partnerships as part of their innovation sourcing strategy. It is often far less expensive for a bank to work with a fintech to improve its digital services than build the entire product stack on its own

-

To leverage the benefits of rapid integration with fintechs, a robust and intuitive developer experience is the basic foundation through which banks can expose internal assets and algorithms

-

Creating the right developer experience (DX) involves managing several aspects of the relationship between the developers and the API platforms, with a portal covering areas such as education, tools and platform usability

-

-

Financial institutions should also utilise new distribution channels such as on-demand and e-commerce platforms that enable better, differentiated products to spread easily and at lower customer acquisition cost. In the end, consumer experience is key, and instead of separating banking services from the other services that customers use, bundling products (that fit the context) would increase adoption and reduce costs significantly.

“The world is changing very fast. Big will not beat small anymore. It will be the fast beating the slow” – Rupert Murdoch, Chairman, News Corp

Sources:

https://www.ing.com/Newsroom/News/ING-launches-Developer-Portal.htm

Celent report: API banking

https://www.pwc.com/gx/en/industries/financial-services/assets/pwc-global-fintech-report-2019.pdf

https://thefintechtimes.com/tribe-payments-predicts-embedded-finance-will-dominate-by-2030/

https://developer.ing.com/openbanking/home

What's your view?

About the Author

Raja Sekhar is a Delivery Manager in the Technology Practice within the Private Equity and Consulting Group at Acuity Knowledge Partners. He has over eight years of experience in working with strategy teams of Fortune 500 companies. Currently, he supports Strategy and insights team of a large Fortune 300 FinTech corporation headquartered in the US. Raja has extensive experience in assisting Venture capitalists and Innovation arms of FTSE100 corporations in identifying disruptive startups and supporting digital transformation agendas. He holds a Bachelors of Engineering degree from BITS-Pilani.

Like the way we think?

Next time we post something new, we'll send it to your inbox