Published on April 27, 2020 by Ayoma Peiris

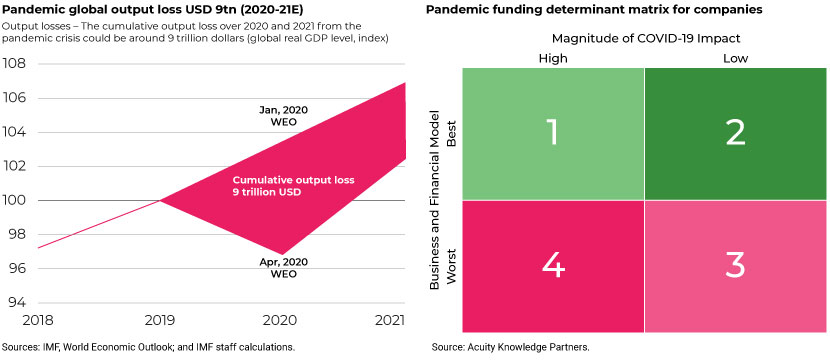

COVID-19, the current black-swan event, is causing sweeping damage to the global economies (see Figure 1). All business entities are adversely affected by the pandemic, but more so small and medium-size enterprises (SMEs). The silver lining, however, is that most banks are now well capitalised to weather such a challenge owing to the array of regulatory changes implemented after the 2007-09 crisis. Nonetheless, this by no means implies that banks are obliged to bail out all financially distressed businesses. Banks ought to be cautious when allocating their limited capital to businesses, as some enterprises are likely to disguise their inherent liquidity problems within the broader blanket of this pandemic’s effects in a move to secure additional funding. We classify companies based on (1) the strength of the business and financial model and (2) the magnitude of the COVID-19 impact (see figure 2). Banks should offer maximum support to businesses in quadrants 1 and 2, and to certain rising stars in the upper end of quadrant 3 that are likely to move to quadrant 1 or 2. However, they would need to be extra careful in funding businesses in quadrant 4.

How to identify these businesses

The traditional credit risk model will need modification. The revisions are necessary given the importance of financial institutions (FIs) to an economy to achieve a sustained recovery of both business and life in the aftermath of the pandemic. The financial systems are already challenged in terms of having to execute extensions/revisions to credit to preserve business continuity in line with proposed government initiatives.

COVID-19 necessitates an in-depth remodelling of credit risk

To facilitate the above, lenders would need to revisit borrowers’ business models and conduct a multi-faceted credit scenario analysis of the COVID-19 impact. First, they should assess effects on a company’s marketplace, i.e., examine demand characteristics. For example, social distancing is likely to subject the travel, gaming, and hotels sectors to prolonged negative demand, whereas certain retailers may see positive demand due to their dealing in essential products/services (such as groceries and disinfectants). Next, borrowers’ cost structures should be assessed, together with their supply chain constraints (e.g., businesses with lower operating leverage, such as theme parks, and dependent on supplies from severely affected regions such as China are likely to encounter heavy cash flow deficiencies). Thereafter, a company’s credit profile (e.g., availability of parental guarantees/collateral and adherence to financial covenants) before and after the pandemic should be analysed to determine whether its financial difficulties are related to the pandemic or are a result of a window-dressing exercise performed to cover inherent illiquidity issues. The credit scenario analysis should also cover government support available for the business, e.g., the US’s PPP provides funding support for small businesses’ payrolls for up to eight weeks, and the UK’s CBILS requires banks to underwrite 20% of loans granted to long-term financially viable customers.

Prompt offering of bespoke credit solutions to deepen customer relationships

At the forefront of minimising default risk in these challenging times is understanding a borrower’s predicament, i.e., lockdown scenarios resulting in supply chain disruptions, weakening sales, and drying up lines of credit leading to liquidity crunches for borrowers and, in turn, their customers and suppliers. Therefore, it is imperative that lenders agree on covenant waivers/holidays and moratoriums, and devise bespoke debt restructuring solutions (e.g., temporary overdraft limits, increased limits, guarantees, and additional invoice finance facilities) that are most suited to the immediate financing needs of individual borrowers. We believe that in these difficult times, where demand for new money is muted, it is sensible for banks to focus on existing customers and agree on refinancing/maturity extensions, as these would continue to generate interest income. Once the funds are disbursed, banks transition from providers of finance to receivers of debt payments, a delicate balance they need to achieve to encourage continued debt servicing by customers, without compromising the long-term prospects of existing customer relationships.

Prudent funding solutions to optimise business continuity

Funding to support businesses affected by COVID-19 can be facilitated via bank and government initiatives, e.g., US regulators encouraging the use of discount windows and banks’ own liquidity reserves; banks purchasing Treasury securities that are, in turn, repurchased by central banks; selected banks such as Santander foregoing executive bonuses and compensation, and dividend payments in 2020, to increase their lending capability. In determining funding decisions across the loan portfolio, lenders need to re-examine contractual risks as per original credit agreements such as (1) cross-defaults, where the corporate may have other competing debt obligations, (2) equity cure rights that may delay default due to support from the sponsor, (3) force majeure provisions and (4) if a syndicated facility, the ability and willingness of other lenders to provide financial support. In essence, we require government-banking partnerships to weather the crisis.

Acuity Knowledge Partners, through its Commercial Lending practice, is partnering with banks and financial institutions across the US and Europe to support them in this time of crisis by leveraging our expertise in credit risk modelling, including scenario analysis, stress testing, portfolio covenant monitoring and validation, together with providing early warning signals, helping them utilise more of their valuable time in strengthening customer relationships and providing innovative financing solutions to overcome COVID-19-induced business challenges.

Sources:

Paycheck Protection Program

Coronavirus Business Interruption Loan Scheme

https://csbcorrespondent.com/blog/credit-risk-time-COVID-19-and-fed

https://www.euromoney.com/article/b1kxrvx42r38r6/can-banks-withstand-the-impact-of-covid-19

What's your view?

About the Author

Ayoma is part of the Commercial Lending team at Acuity Knowledge Partners. She has over 10 years of experience, prominently in equity and credit research. She previously worked in the Projects and Transition team at Acuity Knowledge Partners. Prior to joining Acuity Knowledge Partners, she worked as Trader in a local investment bank. Ayoma holds an MBA and is a Fellow Member of ACCA (UK) and an Associate Member of CIMA (UK).

Like the way we think?

Next time we post something new, we'll send it to your inbox