Published on August 28, 2024 by Ma. Daniela Barrantes

The landscape of shareholder activism

In the world of activist investing, a crucial debate revolves around two distinct approaches: operational activism and environmental, social and corporate governance (ESG) activism. While both aim to influence corporate behaviour, their underlying motivations and strategies differ significantly. ESG activism has been gaining traction and popularity in recent years.

Activist investors are increasingly targeting companies to implement changes relating to governance, environmental practices and social responsibility. This increase is characterised by a spike in the number of campaigns, with more investors demanding transparency and ethical practices. The trend reflects a broader movement towards responsible investing, where stakeholders are interested not only in financial returns but also in the positive impact companies have on society and the environment.

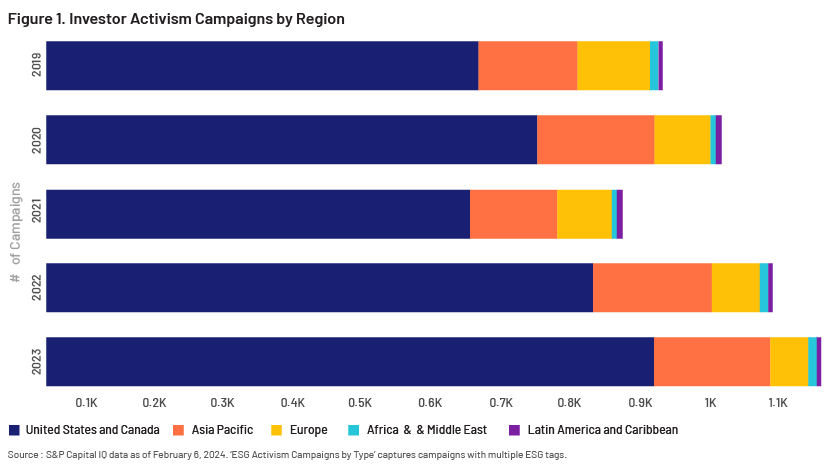

Companies in the US and Canada have since 2019 been the primary targets of activist campaigns (see Figure 1), according to S&P Global (2023). In 2023, over 79% of these campaigns were focused on North American companies, an increase from 76% in 2022 and 74% in 2021. Activity in Asia Pacific has remained relatively stable, accounting for 15% of the campaigns in 2023, compared to 16% in 2022.

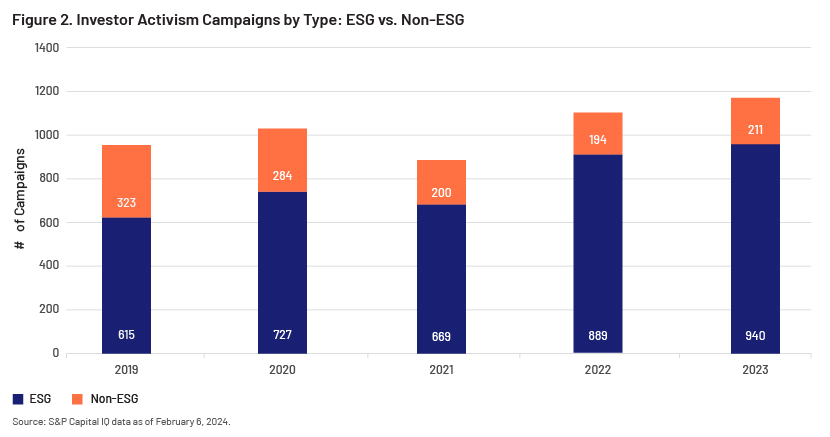

Activists were very active in 2023, initiating 1,151 campaigns, a slight increase from the 1,083 campaigns in 2022. ESG remained a dominant focus, representing 82% of the campaign goals in 2023 (see Figure 2).

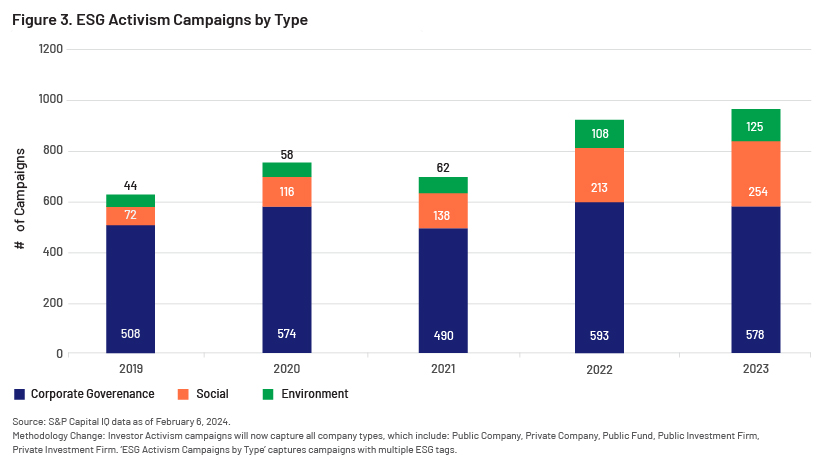

Since 2019, corporate governance has consistently been the most prevalent theme in ESG-related activist campaigns. However, campaigns focused on environmental and social issues have increased, with the number of social campaigns rising to 254 in 2023 from 72 in 2019. In 2023, 27% of ESG campaigns targeted social initiatives, an increase from 12% in 2019 and slightly up from 23% in 2022 (see Figure 3).

Note: Change in methodology: Investor activist campaigns will now capture all company types, including public companies, private companies, public funds, public investment firms and private investment firms. “ESG activist campaigns by type” capture campaigns with multiple ESG tags

Source: S&P Capital IQ data as of 6 February 2024

Predictive analytics: the corporate shield against activist investors

Predictive analytics tools are increasingly being used by companies to identify and mitigate potential risks associated with activist investors. These tools leverage data analysis and machine-learning algorithms to forecast potential activist campaigns, enabling companies to proactively address vulnerabilities and protect shareholder value.

The following are some key predictive analytics tools that could mitigate the potential negative impacts of activist investors:

| Predictive analytics tool | Ways in which it can help |

| Shareholder sentiment analysis | Investors can use sentiment indicators to identify the level of optimism or pessimism surrounding the current market or economic environment. For instance, the Fear & Greed Index (CNN Business, n.d.). is used to assess the market's mood. In the case of investor activism, these tools use algorithms to assess news articles, social media and other data sources to determine shareholder sentiment towards the company. Early detection of negative sentiment can serve as a warning to management about potential activist threats. |

| Vulnerability assessment | This process entails examining a company's financial results, governance structures and ESG metrics to identify potential vulnerabilities that could attract activist campaigns. For example, the FTI Activism Vulnerability Screener is a specialised model designed to assess the susceptibility of public companies in the US and Canada to shareholder activism (source: FTI Consulting, 2024). |

| Peer benchmarking | By evaluating a company's performance and practices relative to its industry counterparts’, these tools can detect areas where the company may be lagging in terms of industry norms, potentially increasing its appeal to activists. |

| Network analysis | Social Network Analysis (SNA) is a method for examining social structures by employing networks and graph theory. It focuses on mapping and evaluating the connections and exchanges among individuals, groups, organisations, computers or other entities involved in processing information or knowledge (source: Lunt, N, & Livingston, C, 2012). These tools examine the connections between shareholders, activist investors and other parties to detect possible activist groups or networks. By understanding these relationships, companies can better predict and address potential activist initiatives. |

| Predictive modelling | A predictive model can pinpoint potential targets for activist investment funds. Anticipating these targets is essential for companies to reduce the risk of intervention, for activists to choose the most promising targets and for investors to benefit from potential stock price increases (source: Minwu, K, 2024). This enables companies to proactively detect vulnerabilities and develop strategies to prevent activist interventions. A real-life example is the UBS-GUARD (Global Utility for Activism Risk and Defence), a new data tool designed to forecast and measure the likelihood of a company facing attention from activist investors (source: UBS, 2020). It addresses this challenge by forecasting and assessing the likelihood of activist approaches towards a company and much more. |

Why are predictive analytics tools useful and needed?

-

Early detection: Predictive analytics can offer early signals of possible activist campaigns, providing companies with crucial time to prepare and respond effectively.

-

Proactive risk management: By uncovering vulnerabilities and forecasting potential threats, companies can take proactive measures to address weaknesses and improve their defences against activist investors.

-

Informed decision-making: Predictive analytics can deliver key insights on shareholder sentiment, industry dynamics and potential risks, helping management make well-informed decisions about corporate strategy, governance and shareholder relations.

-

Preservation of shareholder value: By addressing the risks linked with activist campaigns, companies can protect shareholder value and sustain operational stability.

By using predictive analytics tools, companies can effectively manage the risks associated with activist investors, protect shareholder value and ensure a stable operating environment.

How Acuity Knowledge Partners can help

We offer comprehensive support to companies facing challenges relating to activist investing, deploying a team of data scientists and data engineers who specialise in developing and implementing predictive analytics tools. Our team has expertise in creating tailored ESG strategies, conducting in-depth shareholder sentiment analysis and developing solid defence plans. With ongoing monitoring and reporting, we ensure that companies can proactively address vulnerabilities and maintain corporate stability in the face of pressure from activist investors.

References:

-

IR Magazine & Q4. (2023). Best Practice Report: Recognizing and Predicting Activist Shareholders. IR Magazine. https://www.irmagazine.com/activism-ma/best-practice-report-recognizing-and-predicting-activist-shareholders-now-available

-

S&P Global. (2023). Investor Activism. S&P Global Market Intelligence. Retrieved from https://www.spglobal.com/marketintelligence/en/mi/Info/1023/investor-activism.html

-

UBS. (2020). UBS launches shareholder activism tool – UBS GUARD. Retrieved from https://www.ubs.com/global/it/media/display-page-ndp/en-20200706-ubs-guard.html

-

CNN Business. (n.d.). Fear & Greed Index. CNN. Retrieved 12 August 2024 from https://edition.cnn.com/markets/fear-and-greed

-

FTI Consulting. (2024). June 2024 Activism vulnerability report. Retrieved 12 August 2024 from https://www.fticonsulting.com/-/media/files/insights/reports/2024/jun/june-2024-activism-vulnerability-report.pdf

-

Lunt, N, & Livingston, C (2012). How do people experience the new NHS? Health Policy, 438-446. https://doi.org/10.1093/heapol/czs002

-

Minwu, K (2024). Understanding activist campaigns and corporate responses: A machine learning approach. Retrieved 12 August 2024 from https://arxiv.org/html/2404.16169v1#S5

Tags:

What's your view?

About the Author

Daniela Barrantes holds the position of Senior Associate Data Analyst within the Specialized Solutions division. Her professional expertise encompasses investment research, marketing, and data analysis, reflecting her diverse skillset and background.

Like the way we think?

Next time we post something new, we'll send it to your inbox