Introduction

Introduction

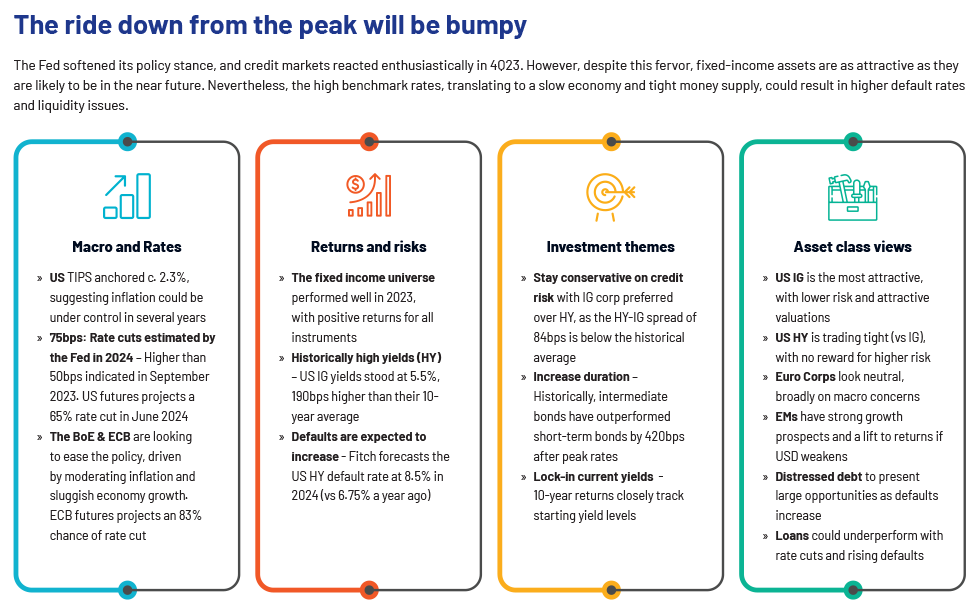

The Fed softened its policy stance, and credit markets reacted enthusiastically in 4Q23. However, despite this fervor, fixed-income assets are as attractive as they are likely to be in the near future. Nevertheless, the high benchmark rates, translating to a slow economy and tight money supply, could result in higher default rates and liquidity issues.

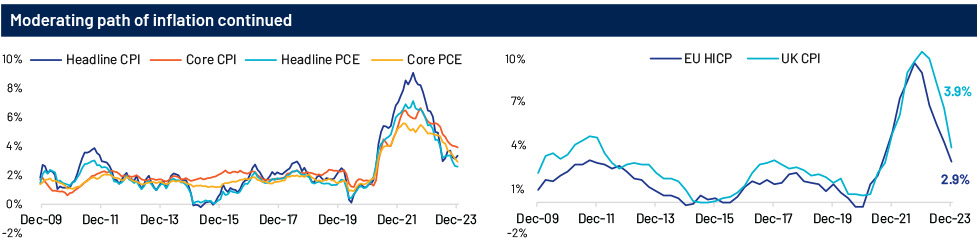

Inflation: Declining; breakeven anchored at c. 2%

Headline inflation in the US and Europe is broadly trending downwards and expected to be anchored at c. 3% for the US and c. 4% for Europe in 2024, above the respective central bank’s target of 2%

Lower food and energy prices, healing in supply chains and easing price pressure on goods are likely to support the downward trend of inflation. Housing inflation will likely be a significant factor in overall price measures, as cost of owner-occupied houses may keep up price pressures through the rest of 2024

Meanwhile, Treasury Inflation-Protected Securities (TIPS) breakeven (across tenors) is anchored at c. 2%. This suggests that the US markets are expecting inflation to fall back to 2% within a few years

TIPS remain attractive. The 30-year TIPS yield is near 2% (vs -0.5% in 2020-21), traded below 2.3% for more than 50% of the time in 2023

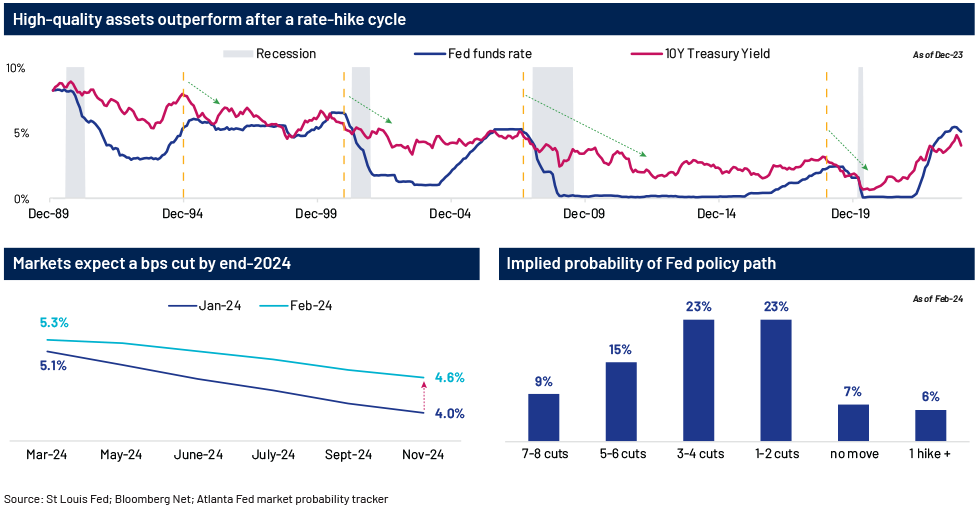

Interest rates (US): A plausible higher-for-longer environment

Markets see a ‘soft landing’ as the base case for 2024: Growth is likely to be slow, and the labour market will likely weaken, but markets do not expect a recession that typically corresponds with significant declines in risk assets

Over-expectation of a >100bps rate cut has been cut: Jan-24 stronger-than-expected data yet again fuelled concerns of a ‘higher-forlonger’ rate. In Dec-23, markets were expecting six cuts by c. 1.35% in 2024 (beginning Mar-24), but, at present, traders anticipate 3 cuts by end-2024. Financial markets no longer see rate cuts starting in Mar-24 as possible; May-24 looks unlikely, and even Jun-24 seems less certain

Fixed income assets will likely benefit from a pause in monetary policy. The 10-year yield typically falls 100bps after a rate pause amid no/ mild recessions

The final hike of each Fed cycle has historically been a turning point for fixed income investors. The rule of thumb has been to buy/lengthen duration at a terminal hike and sell/shorten duration at a recession’s end to maximise the benefits (see chart on left-hand side – the yellow line highlights the final hike of each cycle). Inflation-adjusted yields across fixed income look quite attractive, especially across corporates and municipalities.

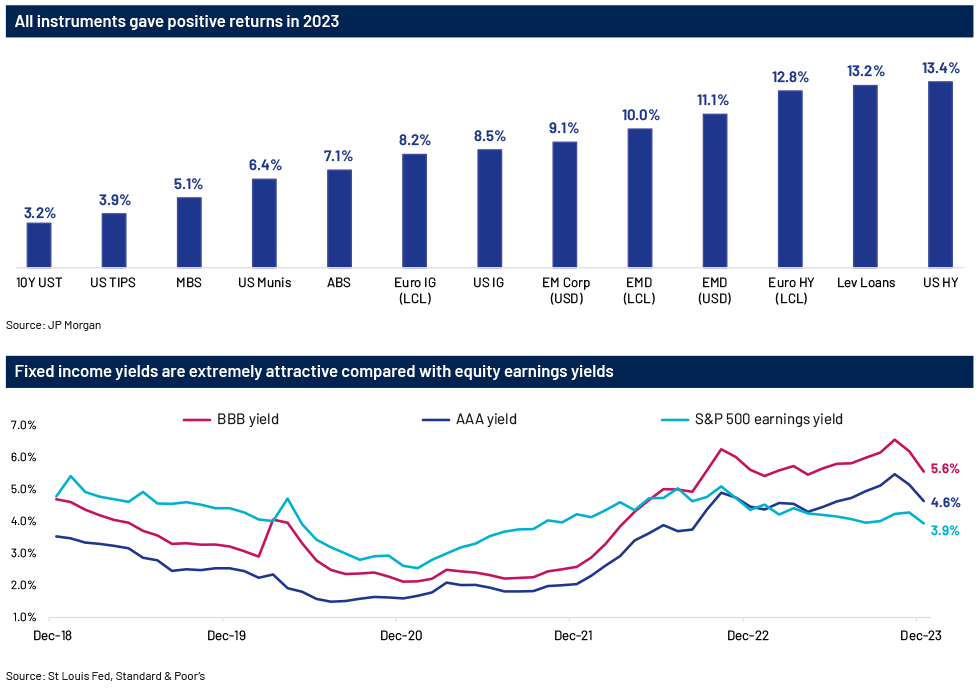

Performance of the fixed income universe

Last year saw several adverse macro and micro events: increasing geopolitical tensions, bank failures in the US, the rescue of Credit Suisse by UBS and debt-ceiling drama. Despite this, timely actions by regulators and continued positive economic data meant investors did not lose confidence, and the fixed income universe gave positive total returns across all instruments. Moreover, this was not a case of risk-averse behaviour, as higher-risk assets have returned the most over the year.

Views on fixed income asset classes