Published on September 26, 2024 by Shubham Rastogi and Puja Singh

Executive summary

Sustainable finance has become a foundation of the global financial system, integrating environmental, social and governance (ESG) criteria into investment decisions. This approach not only promotes long-term economic stability but also addresses pressing global challenges such as climate change and social inequality. This blog aims to provide an in-depth analysis of sustainable finance regulations in 2024, along with insights on emerging trends, challenges, and opportunities.

The importance of sustainable finance is underscored by increasing interest of investors, businesses and regulators. More and more investors are looking for opportunities that align with their values and that promote sustainable development. Businesses are recognising that incorporating ESG factors into their strategies can enhance their resilience, reputation and long-term profitability. Regulatory bodies are also stepping up efforts to develop sustainable finance regulations that promote transparency, accountability, and consistency in ESG practices.

Sustainable finance is essential for driving the transition to a low-carbon economy and achieving the United Nations’ Sustainable Development Goals (SDGs). By directing capital towards projects and companies that prioritise sustainability, investors can help mitigate environmental risks, promote social wellbeing and ensure good governance practices. The increasing focus on ESG factors reflects a broader recognition that financial performance and sustainability are interconnected. As we approach the end of 2024, we believe understanding the evolving regulatory landscape is crucial for businesses, investors and policymakers.

The state of regulation governing sustainable finance

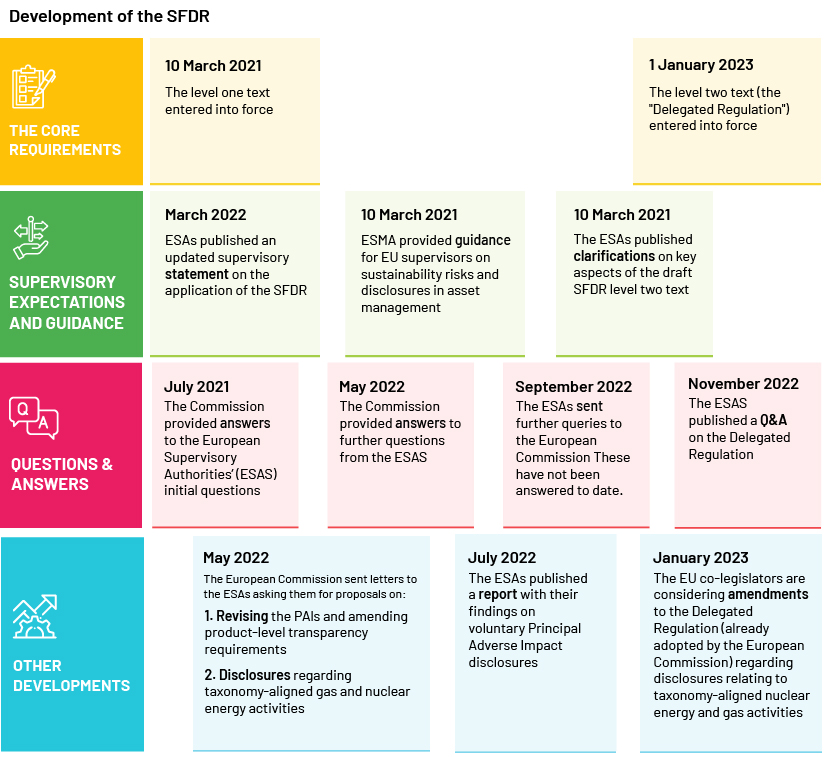

The regulatory landscape for sustainable finance is evolving rapidly, driven by global and national initiatives. The European Union (EU) has implemented significant regulations, such as the Sustainable Finance Disclosure Regulation (SFDR) and the Taxonomy Regulation, to enhance transparency and prevent greenwashing. These regulations require financial market participants to disclose how they integrate ESG factors into their investment decisions and classify environmentally sustainable activities.

The SFDR, for instance, aims to enhance transparency in the market for sustainable investment products, while the EU Taxonomy provides a classification system for environmentally sustainable economic activities. The Corporate Sustainability Reporting Directive (CSRD) expands the scope of non-financial reporting, ensuring that companies provide comprehensive information on their ESG performance.

The US Securities and Exchange Commission (SEC) is finalising rules to standardise climate-related disclosures. Meanwhile, China and Japan are refining their frameworks to promote green finance and corporate governance reforms. Voluntary standards such as the Task Force on Climate-related Financial Disclosures (TCFD) and the Global Reporting Initiative (GRI) continue to support ESG integration.

However, the lack of harmonisation across jurisdictions remains a challenge for multinational companies and investors. Despite these challenges, aligning with regulatory requirements presents opportunities for innovation and a competitive advantage, essential for a sustainable and resilient global economy.

Emerging trends

Several regulatory changes are expected in 2024, to further shape the sustainable finance landscape. The EU is expected to refine existing frameworks and introduce new regulations to address emerging challenges. For example, the European Green Bond Standard (EGBS) was implemented in December 2023, providing a robust framework for issuing green bonds. This standard aims to enhance transparency and credibility in the green bond market, ensuring that funds raised are used for genuinely sustainable projects.

Another significant trend is the increasing focus on biodiversity and nature-related financial disclosures. The Taskforce on Nature-related Financial Disclosures (TNFD) also released its final recommendations in 2024, guiding companies in assessing and reporting their impacts on nature. This development reflects a growing recognition of the importance of biodiversity in sustainable finance and the need for new comprehensive reporting standards. The following table details the sustainable finance market in the past two years:

| Market size, 2022 (in USDbn) | Market size, 2023 (in USDbn) | Change (in %) | |

| Sustainable finance market value | 5,800 | 7,000 | ↑ 20 |

| Sustainable bond issuance | 847 | 872 | ↑ 3 |

| Net inflows to sustainable funds | 161 | 63 | ↓ 61 |

In terms of geography, regions such as Switzerland are also making significant strides. From January 2024, large public-interest companies in Switzerland are subject to mandatory climate reporting under the Ordinance on Climate Reporting. This move aligns with global efforts to enhance climate-related financial disclosures and mitigate greenwashing. The UK is expected to introduce new and stricter regulations to support its net-zero goals, corporate climate disclosures and sustainability reporting.

The SEC also finalised its climate disclosure rules in March 2024, requiring publicly traded companies to disclose their greenhouse gas emissions and climate-related risks. This regulatory shift aims to provide investors with better information to assess climate risks and opportunities, promoting more informed investment decisions.

Challenges and opportunities

Implementing sustainable finance practices presents a range of challenges and opportunities. One of the primary challenges is the lack of standardised metrics and methodologies for assessing ESG performance, which leads to inconsistencies in reporting and difficulties in comparing data across companies and sectors. This inconsistency can hinder investors’ ability to make informed decisions. Additionally, greenwashing, where companies falsely claim to be environmentally friendly, undermines investor trust and the credibility of sustainable finance. Ensuring the integrity of ESG claims requires robust verification processes and third-party audits. Another significant challenge is the availability and quality of ESG data. Reliable data is crucial for informed decision-making, but obtaining comprehensive and accurate ESG data can be difficult, especially in emerging markets. Regulatory and policy uncertainty further complicate the landscape, as varying requirements across jurisdictions create challenges for companies and investors trying to navigate ESG compliance. Moreover, short-termism in financial markets, which prioritises immediate gains over long-term sustainability, can hinder the adoption of sustainable practices.

Despite these challenges, sustainable finance presents substantial opportunities. Growing demand for sustainable investments is driving innovation in financial products and services, such as green bonds, sustainability-linked loans and ESG-focused exchange-traded funds (ETFs). These innovations provide investors with diverse options to align their portfolios with sustainability goals. Integrating ESG factors into financial decision-making enhances risk management by identifying and mitigating potential ESG risks early. Companies that demonstrate strong ESG performance can attract a broader base of investors and access capital more easily, while also building a positive brand reputation.

Furthermore, sustainable finance contributes to the UN SDGs, addressing global challenges such as poverty, inequality and climate change. By directing capital towards projects and initiatives that promote social and environmental wellbeing, sustainable finance supports the development of resilient and inclusive communities. Alignment with SDGs not only has a positive impact on society and the environment but also opens up new avenues for growth and innovation. By overcoming the challenges and leveraging the opportunities, sustainable finance can drive meaningful change and support the transition to a more sustainable and resilient global economy.

Outlook

The regulatory landscape for sustainable finance is expected to continue evolving. Policymakers are likely to introduce more stringent regulations to address emerging risks and opportunities. Businesses can prepare for these changes by staying informed, investing in ESG capabilities and engaging with stakeholders to understand their expectations.

Sustainable finance is likely to see increased collaboration between regulators, financial institutions and other stakeholders to create a more resilient and sustainable financial system. Companies that proactively adopt these new regulations would be well positioned to thrive in the evolving landscape.

One key area of focus would be the integration of climate risk into financial decision-making. As climate change-related effects become more pronounced, regulators are likely to require more detailed and forward-looking climate risk assessments from financial institutions. This shift would drive the development of new tools and methodologies for assessing and managing climate risks, enhancing the resilience of the financial system.

Another important trend is the growing emphasis on social and governance factors in sustainable finance. Regulators are likely to introduce new requirements for reporting on social issues such as labour practices, human rights, and community impacts. This broader focus on ESG factors would encourage companies to adopt more holistic approaches to sustainability, considering not only environmental impacts but also social and governance aspects.

Several organisations have successfully navigated the regulatory landscape in sustainable finance. One notable example is Dutch bank ING, which has integrated ESG criteria into its lending practices and investment strategies. ING’s commitment to sustainability has not only enhanced its reputation but also attracted significant green investments. Another example is French multinational Schneider Electric, which has implemented comprehensive sustainability reporting and achieved significant reductions in its carbon footprint. Schneider Electric’s approach serves as a best practice for other companies aiming to align with regulatory requirements and achieve sustainability goals.

Conclusion

Sustainable finance is transforming the financial landscape by integrating ESG principles into investment decisions and corporate practices, promoting long-term value creation and a resilient economy. The growing emphasis on sustainability highlights the interconnectedness of financial performance and societal wellbeing. As demand for sustainable financial products and services increases, driven by regulatory pressures and stakeholder expectations, sustainable finance is poised to drive positive change in global markets.

Addressing global challenges such as climate change, social inequality and governance issues, sustainable finance supports the UN SDGs. By directing capital towards projects that promote environmental stewardship, social equity and ethical governance, they foster a more sustainable and equitable world. However, overcoming challenges such as the need for standardised ESG metrics, reliable data and robust regulatory frameworks is crucial. Collaboration among investors, businesses, regulators and stakeholders is essential for building a sustainable financial ecosystem.

In essence, sustainable finance represents a fundamental shift towards a more sustainable economic model, where financial success aligns with positive societal and environmental impact. Its continued journey would shape a better, more sustainable future for all.

How Acuity Knowledge Partners can help

Acuity Knowledge Partners' wide range of customised analysis and support covers the entire spectrum of financing products along the sustainable finance investment lifecycle and enables investment banks and advisory firms to establish and grow their sustainable finance practices:

| Coverage and solutions | |

| ESG advisory | Green/social bonds Nature-based solutions research |

| Sustainable bonds | Blended finance ESG/sustainable transaction detailing |

| Green loans | Impact finance ESG institutional/framework analysis |

| ESG strategy | ESG reports Decarbonisation assessment |

| Our focused support | |

| Identifying sector-wise ESG taxonomy | Climate change framework analysis |

| Mapping climate targets | Analysis of sustainable initiatives |

| Climate bonds – opportunity analysis | Climate bonds – market updates |

| Benchmarking ESG standards and regulations | ESG newsletter |

| ESG scoring | Climate revenue share |

| SDG trackers | Building/analysing – portfolios or index |

| ESG thematic study | ESG indicators and controversies |

| SDG impact analysis | ESG rating |

Our ESG domain expertise helps banks ramp up their onshore verticals, focusing on incorporating ESG in client analysis, saving a significant amount of senior bankers’ time. We also standardise templates and provide coverage across APAC, EMEA, the US and Sub-Saharan Africa.

Sources:

-

Perspectivas Regulatorias ESG 2024: EE.UU. y APAC | Clarity AI

-

Grand Compliance – Blog – Regulatory Risk and Compliance in 2024: An Extensive Guide

-

ISFCOE-Sustainable-Finance-Legal-and-Regulatory-Study-2024.pdf

-

Green Economy Outlook: Sustainability Trends for 2024 | JPMorgan Chase

-

Introduction to Sustainable Finance: Principles and Framework | Ateneo Graduate School of Business

-

World Investment Report 2024: Chapter III – Sustainable finance trends (unctad.org)

-

Global Progress Brief – 2024 | Sustainable Banking And Finance Network (sbfnetwork.org)

-

2024 Sustainable Finance Policy and Regulation Outlook | NatWest Corporates and Institutions

-

Four trends shaping sustainable finance in 2024 (corporateknights.com)

-

Sustainable Finance Market Share, Trends & Forecast 2034 | FMI (futuremarketinsights.com)

-

Financing for Sustainable Development Report 2024 | DESA Publications (un.org)

-

ISFCOE-Sustainable-Finance-Legal-and-Regulatory-Study-2024.pdf

-

Regulatory Outlook 2024 | Sustainable finance (deloitte.com)

-

2024 Sustainable Finance Policy and Regulation Outlook | NatWest Corporates and Institutions

-

Unpacking Sustainable Finance Disclosure Regulation (kpmg.com)

-

(2) 2024 Global Sustainable Finance Outlook – key trends to watch out for | LinkedIn

-

SEC.gov | SEC Adopts Rules to Enhance and Standardize Climate-Related Disclosures for Investors

Tags:

What's your view?

About the Authors

Shubham brings nearly 3 years of experience in ESG research and benchmarking, underpinned by a robust academic background in finance. His expertise encompasses the development of ESG competitor intelligence, Sustainable financial transactions, strategic management, and ESG benchmarking. Additionally, he is well-versed in ESG ratings.

Puja has 7 years of extensive experience in ESG, Climate Change & Sustainability and she is supervising the ESG team at Acuity. She also has diverse experience in conducting ESIA, EHS compliance audits, ESG Risks and Controls, EHS & ESG Due Diligence assessments. Prior to joining Acuity, she was working with companies like KPMG Global Services, EY India and ERM India. She has expertise in provisioning extensive research requirements for clients through preparation of Peer Benchmarking, Target Compilation, Sustainability report, Sustainable Finance Updates and Sectoral ESG Thematic Detailing Engagement.

Connect with the experts at contact@acuitykp.com

Like the way we think?

Next time we post something new, we'll send it to your inbox