Introduction

Introduction

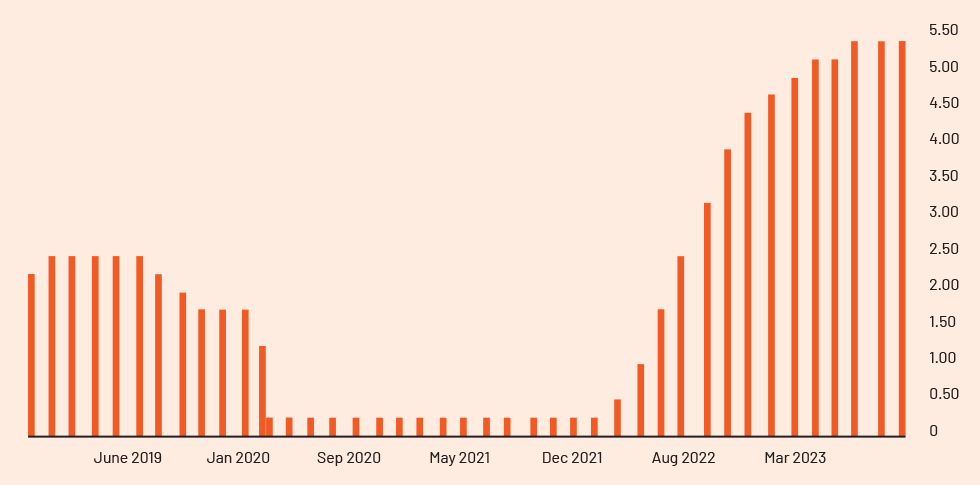

Interest rates play a major role in CRE, as they shape investment decisions and the overall dynamics of the market, impacting the price of and demand for real estate. With inflation soaring in 2021 and 2022, the US Federal Reserve (Fed) increased the interest rate at the fastest pace in generations.

The pandemic made the hybrid working model a normal way of working, with a significant impact on office leasing. However, 3Q 2023 brought mixed results for the office market, with considerable progress on return-to-office plans, growing tenant requirements, declining sublease additions and a tightening market for high-end space pointing to stabilisation in 2024. Such factors have driven banks/financial institutions to explore new ways to add cost-effective scale to their existing due diligence and portfolio-monitoring processes. Many banks/financial institutions are already working closely and successfully with strategic offshore partners, to manage growth both efficiently and cost-effectively. . In this white paper, we provide practical guidance, showcasing how banks/financial institutions implement successful offshoring programmes.

Why offshore?

In the current market scenario, commercial banks and financial institutions face multiple challenges at different stages of the loan lifecycle, such as:

Turnaround time for quote

Value creation

Cost savings

Increased volume

Portfolio monitoring

Globally, lending institutions are partnering with offshoring vendors that offer solutions designed to address these questions

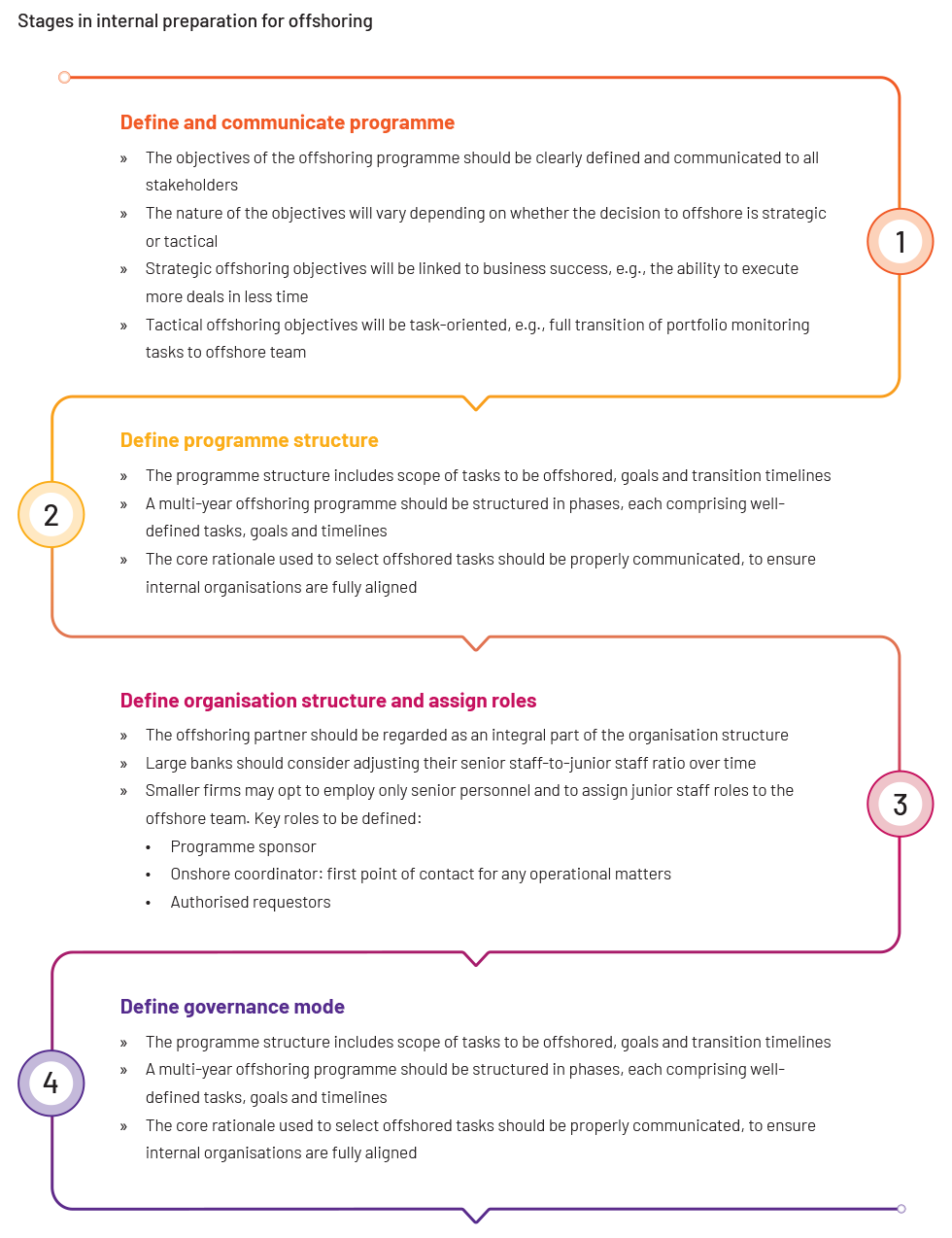

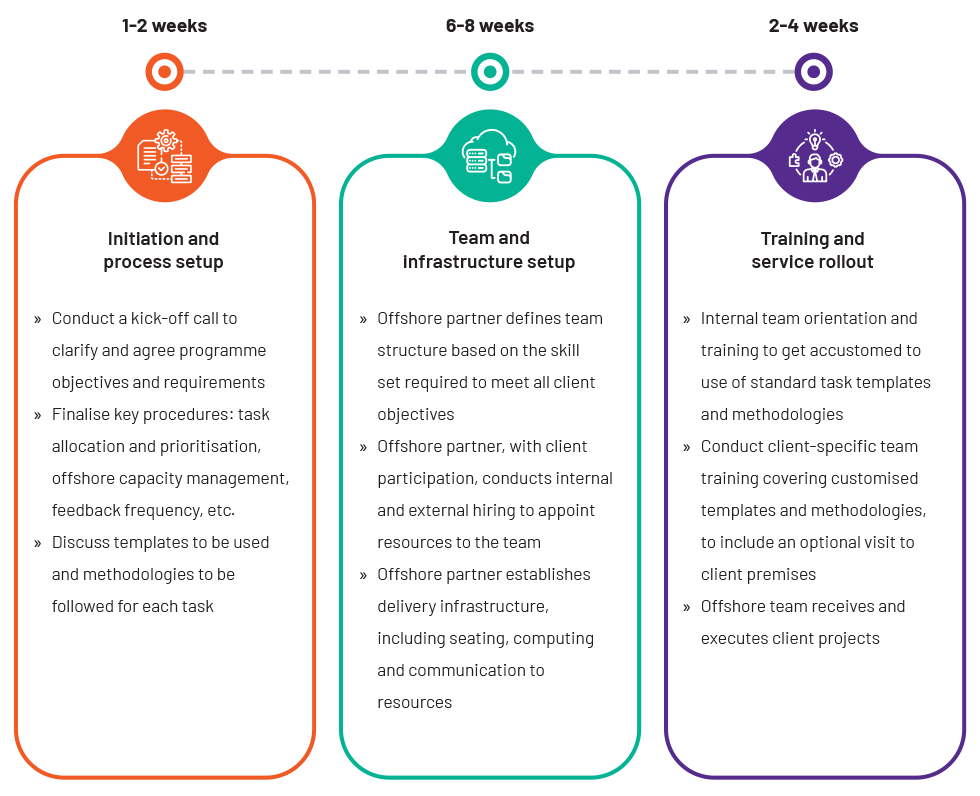

Steps to implementing a CRE offshoring programme

CRE case study – Support for construction loans portfolio

In 2023, a leading mid-size US regional bank approached us to design an offshoring solution that freed up its in-house resources for more value-added activities. A key requirement was that the offshore team undertake the responsibilities of drafting construction draw memos and updating the subsequent systems that support the client’s CRE credit and portfolio management’s team.

We established a dedicated offshore team for the client that consisted of three Acuity analysts with extensive experience in the CRE domain. The offshore team undertook several diligence and portfolio value-enhancement projects apart from compiling regular memos on a tight delivery deadline. The client, impressed with its offshoring experience with us, introduced us to several of its other business units to expand support. We added three more FTEs to extend our support in streamlining covenants for the client’s construction and CRE loan books and conducting quarterly loan reviews.

Conclusion

The extent and pace of change being witnessed in this sector have undoubtedly forced decision makers to explore new strategies not only to adapt, but also to succeed in the face of new realities. We believe banks will benefit significantly by including offshoring in their basket of response strategies.

Having established a number of sustainable and mutually profitable offshoring relationships, Acuity Knowledge Partners has demonstrated its awareness that operating successfully in the CRE sector requires specialist vendors who understand the nature, operations and commercial realities of a client’s business and possess demonstrable expertise in managing the offshore business of such firms.