Published on January 24, 2023 by Pratik Bhagat and Alankar Ranade, CFA

-

After a dismal 2022, fixed income investors have a lot to look forward to in 2023, as yields for almost all instruments are trading at historic highs

-

Although the inflation trajectory seems to be reversing, the level is still too high for comfort, and history shows it takes much longer to bring it back to central-bank target levels. Consequently, the market and central banks expect rates to keep rising for most of this year

-

US Federal Reserve (Fed) officials have indicated they are willing to accept a shallow recession as collateral damage in their efforts to tame inflation. This makes the near-term economic outlook uncertain and adds volatility to the markets in 2023

-

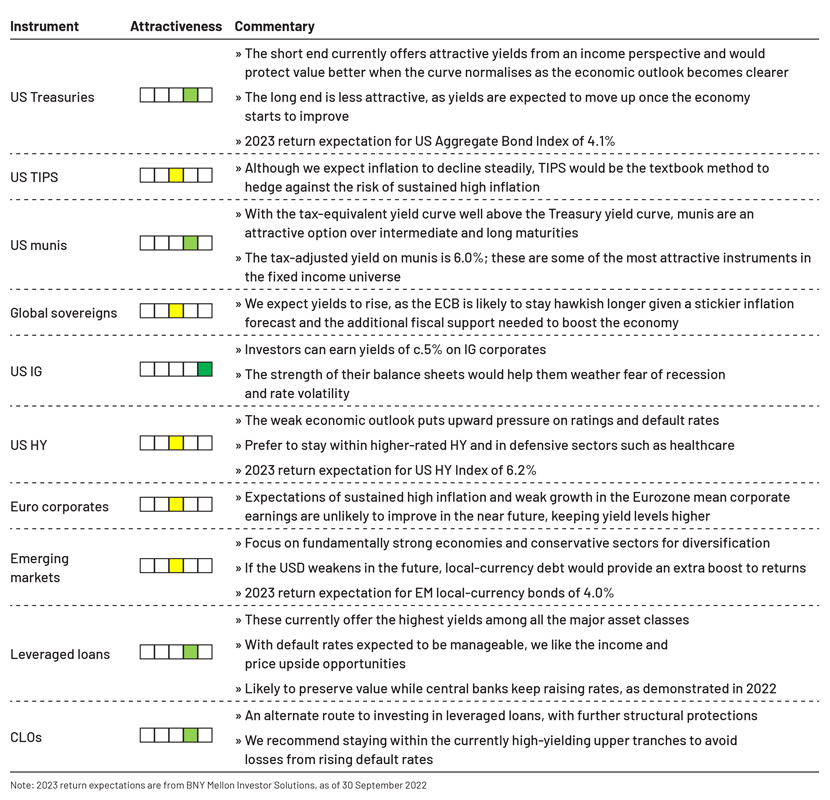

In this scenario, higher-risk assets such as weaker high-yield (HY) credits are likely to be stressed, and we could see higher default rates. Therefore, we recommend higher weighting to high-quality assets such as government bonds and investment-grade (IG) credits for their strong yields and value protection

Inflation is unlikely to return to 2% in 2023 – expect more hikes

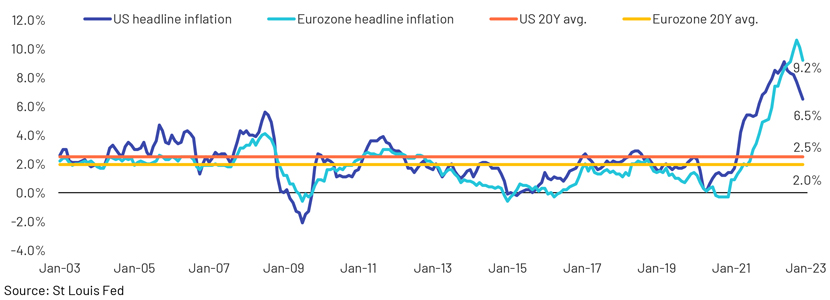

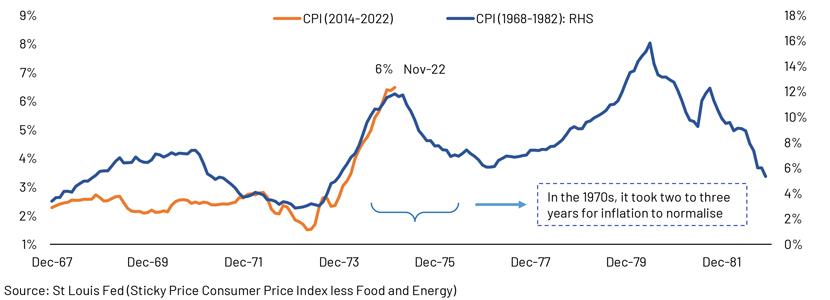

The global economy continues to lose momentum, owing to aggressive rate hikes to curb inflation, an energy shock in Europe, Zero-COVID policies and a volatile property market in China. US inflation appeared to have peaked in June 2022 (Consumer Price Index: 9.1% y/y), before declining for a sixth consecutive month in December 2022 to 6.5%, while the Eurozone’s inflation started to mellow from the peak of 10.6% in October 2022 to 10.1% in November 2022, the first decline in 2022. However, the inflation rate remains well above the Fed’s target of 2% and is expected to remain higher in 2023. Consequently, the major central banks are likely to continue with monetary tightening.

US and EU prices have surged in parallel

History suggests it could even take two to three years for inflation to return to the 2-2.5% range

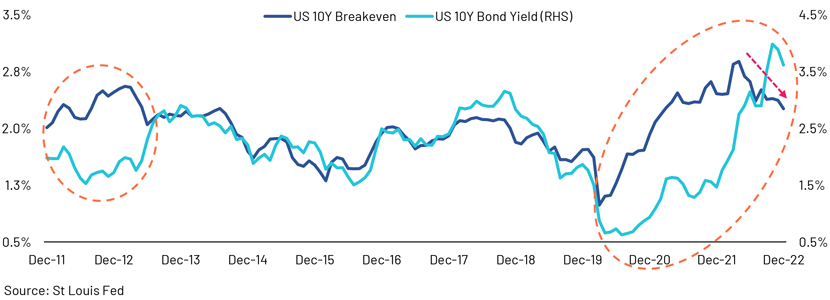

Gap between 10Y breakeven and 10Y bond yield has now closed

The US 10Y breakeven vs yield gap narrowed in 2012-13, with inflation reducing and bond yields moving higher as tapering started. We expect the gap to have closed over the past 18 months, in line with the trend in 2012-13.

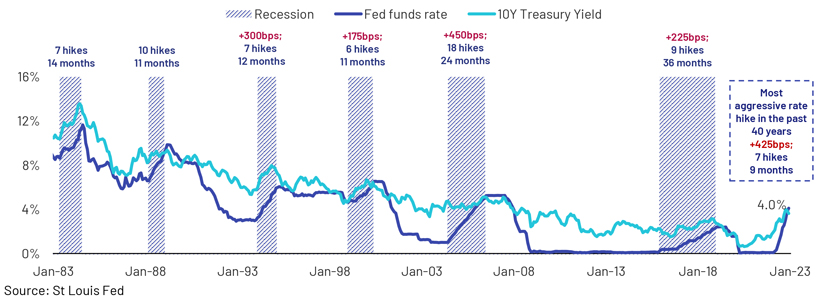

Policy rates – expected to stabilise in second half of 2023

Most central banks, including the Fed, effected the most aggressive policy-rate tightening in history: four straight 75bps hikes from June to November 2022, followed by a 50bps hike in December 2022. However, Fed Chair Jerome Powell made it clear that despite pushing up benchmark rates by 425bps cumulatively since March 2022, the Fed has not reached a "sufficiently restrictive" level of monetary policy. A reasonable path could see a less aggressive Fed with a 25-50bps rate hike in 1Q23 with the end-2023 rate at 5-5.50% (Fed median view: 5.1%) – this should be positive for asset prices (public and private), from rates to equities, to credit. That said, the capital market is expected to be volatile in 2023, owing to a higher cost of capital, making asset selection, valuations and entry points of paramount importance.

Fastest pace of rate hikes in the past 40 years

Our outlook for fixed income

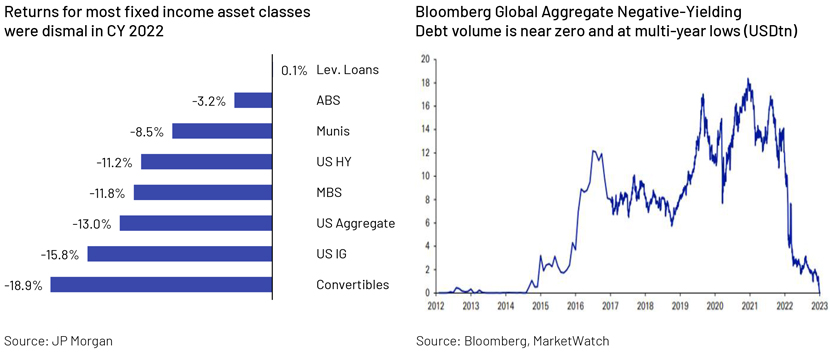

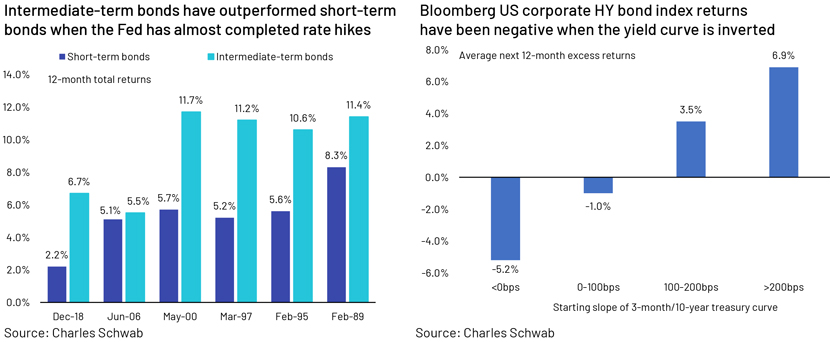

2022 was a brutal year for fixed income investing, with significant losses in most asset classes. 2023 started from a point of weakness, and there could be considerable market turmoil in the near term as expectations for inflation, rates and economic growth rise and fall before they settle. However, with most central banks having already administered their rate-hike treatment, we believe the future looks bright.

We see 2023 as the start of a new era for fixed income investing for the following reasons:

-

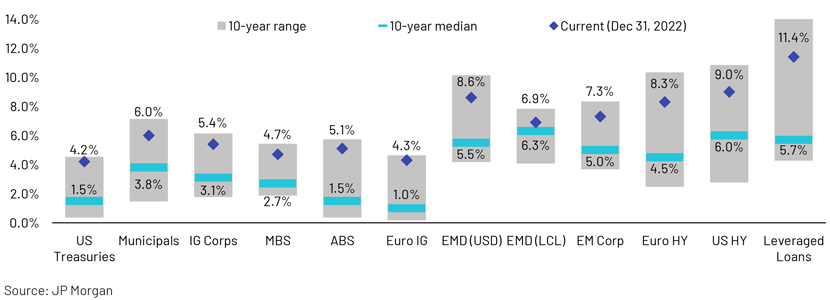

No more hunt for yield: After the recent central-bank actions and the subsequent sell-off in both rates and credit, valuations of fixed income instruments are attractive from a carry perspective, and well above the median of the past decade. This will likely end investors’ hunt for yield over the past decade due to ultra-low monetary policy.

-

Reasonable alternatives without outsized risks and liquidity concerns: After 2022, yields on different fixed income asset classes are now trading significantly above their 10-year median levels. The US Treasury yield of 4.2% is far higher than the S&P 500’s dividend yield of 1.8%. This allows investors to invest in appropriate instruments and not stretch their risk parameters unnecessarily through credit and duration risk. Traditional fixed income instruments are yielding higher than dividend yield and on par with riskier and less liquid private debt. This makes a case for fund flows to be directed towards traditional fixed income asset classes given their attractive risk/return profiles and liquidity compared to other riskier assets, which were in vogue during the period of ultra-low interest rates.

-

Safe-haven assets: Clouds of recession are looming in the major developed markets (the US, the UK and Europe). Against this backdrop, we believe high-quality fixed income assets, such as government bonds, IG credit and liquid credit should preserve value better while earning decent yields and setting up investors to gain over the next tightening cycle.

Despite expectations of a global economic slowdown and volatile markets over the near term, there is a high likelihood of recovery and the start of economic normalisation over the intermediate term. Considering the forward-looking nature of markets, we believe the above mentioned risks are already priced into current yields and further downside is limited. This makes conditions ripe for asset managers to increase capital allocation towards fixed income assets.

Moving up the quality chain – prefer IG over HY

Within the fixed income universe, high inflation and weak growth prospects are likely to hit riskier asset classes (lower HY, leveraged loans, subordinated debt and distressed debt) harder, and these asset classes could be a “value trap”, as default rates are expected to rise. Fitch expects US and European HY default rates to rise to 3.0-3.5% and 2.5%, respectively, in 2023, from below 1.5% in 2022. For this reason, we believe investors would position themselves conservatively within the fixed income space, especially considering the historically attractive yields available on lower-risk assets (sovereign, munis and IG corporates).

All fixed income instruments trading near 10-year high yield-to-worst levels (as of 31 December 2022)

Munis are attractively positioned

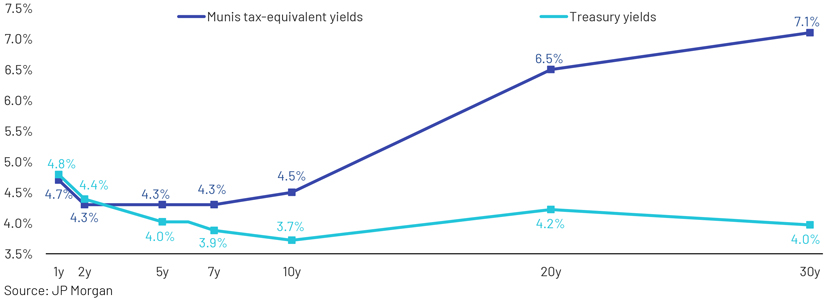

Munis had one of the worst years on record, with c.USD100bn of outflows in 2022. However, this trend is expected to reverse in 2023 given the limited upside on rates and attractive yields on munis. The tax-adjusted yield on munis stood at 6% compared to 4.2% for US Treasuries and 4.7% for the US Aggregate Bond Index. In munis, too, the intermediate part of the yield curve looks more attractive and less vulnerable to rate hikes and an economic slowdown.

Intermediate- and long-term muni tax-equivalent yields are far above Treasury yields (as of 31 December 2022)

Views on fixed income asset classes:

Acuity Knowledge Partners’ unique experience in supporting asset managers

Over the past decade, fixed income investors have embraced credit risk for yields, as yields on higher-rated and strong fixed income asset classes were negligent to negative. However, the brutal movement in the credit and rates markets has turned this situation on its head. The fixed income landscape in 2023 looks filled with opportunities for bond investors, the likes of which they have not seen since the Global Financial Crisis. Having said that, the markets will likely remain volatile, making fixed income asset selection, fundamental analysis and risk management capabilities paramount.

Acuity Knowledge Partners has been providing buy- and sell-side clients tailor-made solutions across the fixed income spectrum for two decades. Our experienced team of 350+ fixed income and credit research subject-matter experts have the breadth and depth to cover every sector of the global fixed income market and provide rigorous fundamental analysis and valuations across developed and emerging markets. Our offshore teams help their onshore counterparts by taking on tasks across the value chain and providing the bandwidth necessary for onshore teams to work on high-value-add tasks.

What's your view?

About the Authors

Pratik has over 8 years of experience into Fixed Income research. He is skilled in credit research, including financial modelling, report writing, investment recommendations, and bond and index spread analysis. Currently, Pratik supports European buy-side firm with credit and fixed income market research. He has a strong reputation among client traders and portfolio managers for a high percentage of correct rating calls. He holds a postgraduate diploma in Business Analytics form Great Lakes Inst. of Management (India) & Stuart School of Business (IIT, Illinois), and an MBA in Finance.

Alankar has 15 years of experience in investment research and has been supporting high-yield analysts (buy side and sell side) and credit rating analysts for a number of years. He currently supports sell-side analysts of a major trade desk, covering high-yield issuers in EMEA. Alankar holds an MBA in Finance and a bachelor’s degree in Engineering.

Like the way we think?

Next time we post something new, we'll send it to your inbox