Published on August 8, 2022 by Anup Dhanuka

As the world is grappling with concerns of a global recession led by European energy crisis and inflationary pressures, there are doubts emerging over sustainability of strength of Dubai’s red hot property market as interest rates across the globe are rising at an unprecedent pace. Dubai’s property market took a sharp U turn post pandemic where both volumes and pricing rose strongly in 2021, partially driven by pent-up residential demand for larger homes. As per JLL, average residential prices were up 9% in 2021. The momentum has carried into 2022 as well where demand is still strong, and pricing is steady. There has been some pent-up element in the demand. However, despite that, we believe that the demand will remain steady going forward driven by several factors and the recent sell-off in the property stocks are unwarranted.

Historically, we have seen that rising rates are negative for real estate demand as mortgages become expensive. So, what is different this time and what gives us confidence in the sustainability of market trends? Several factors – pricing/volumes are nowhere close to a bubble territory, more balanced demand-supply dynamics, visa reforms making UAE an attractive destination and emergence of new nationalities as buyers. Let’s understand these factors a bit more.

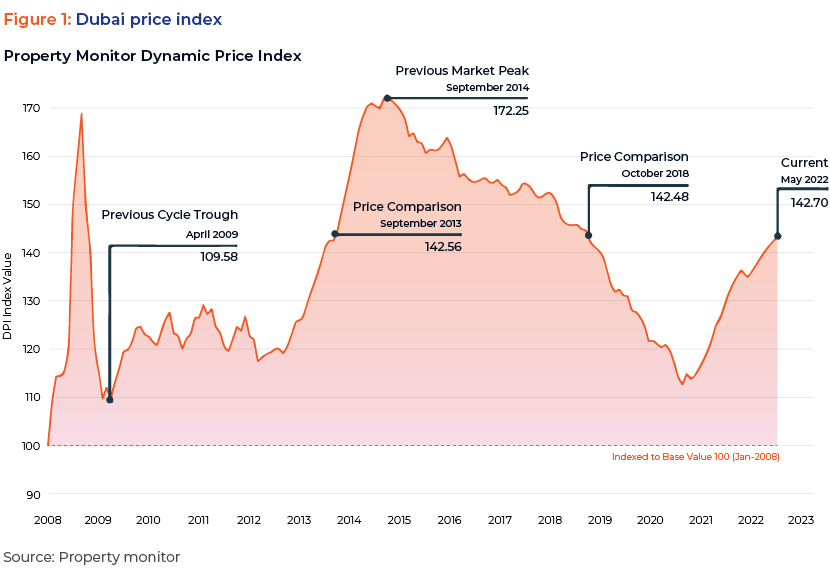

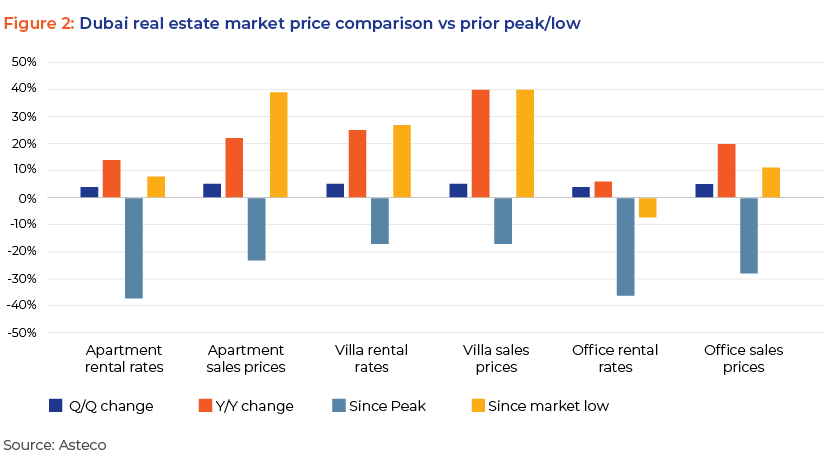

When we compare current pricing dynamics vs prior peaks, we see that the market hasn’t fully recovered yet. Prices, despite seeing a sharp rise in 2021, are still below 2012-14 peak levels, implying that we aren’t close to a bubble scenario. Apartment sales prices in Q1’22 were up 22% y/y but are still 23% below the peak achieved in Q2’14. Similarly, Villa sales prices are up 40% y/y but are still 17% below the Q2’14 peak. On commercial real estate side, office sales prices were up 20% y/y in Q1’22 but are still 28% below the peak price achieved in Q1’15 and office rental prices are up 6% y/y and have a long way to recover to Q3’15 peak as price are still 36% below that.

Along with the prices that are still reasonable, demand -supply dynamics are also much better this time. Since the start of the pandemic, real estate players have adopted a rationale approach towards launching newer products and have been focusing on clearing old inventories. This has resulted in normalization of supplies in a historically oversupplied market.

Additionally, Visa reforms taken over past 3 years bode well for the overall economy and real estate as these should drive the increase in expat population. In 2020, during pandemic UAE launched 1-year remote work visa to provide skilled professionals an opportunity to experience UAE’s lifestyle. In 2021, the golden visa norms were relaxed to include more categories. Major reforms came in 2022 when UAE cabinet made several favorable changes to entry and other visas. Golden visa amendments allowed visa holders to sponsor family members. Golden residence visa is now being offered with a real estate investment of AED 2m along with option to avail loan facility from specific banks which wasn’t the case earlier. New entry visas are introduced without requiring a host or sponsor for the first time. All entry visas are valid for 60 days with multiple entries. New job/business entry visas have also been launched without the requirement of a host. Also, a new 5-year multi-entry tourist visa has also been introduced which does not require a sponsor and allows the person to stay in the country for up to 90 continuous days.

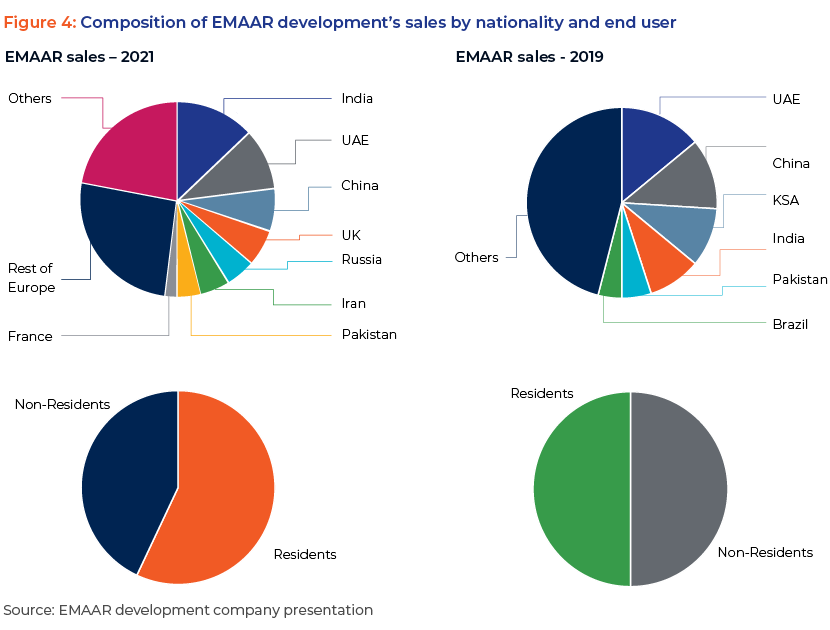

At the same time, pandemic has broadened the investor base for Dubai’s property market as a host of new nationalities are emerging as serious buyers. Taking EMAAR development as proxy for the market, we look at the composition of the demand by nationality which gives us more confidence in the stability of the trends in coming years. EMAAR’s strong sales in 2021 was driven by more residential demand vs. 2019 where the share of non-residents was higher. At the same time, new nationalities have emerged as buyers. Contribution of Indians in total sales has increased from pre-COVID levels and at the same time Russia, UK and several other European nations have emerged as serious buyers post pandemic while China is yet to come back to pre-pandemic levels. The trends are encouraging for demand to sustain and by no means reflect any kind of bubble building-up.

To conclude, we remain confident in Dubai real estate market’s strength going forward, albeit at a normalize pace and the concerns arising out of global macroeconomic environment are unwarranted.

How Acuity can help

Partnering with Acuity and leveraging on our sector-specific experience allows our clients to rapidly increase internal analyst bandwidth and expand coverage. For brokerage/advisory firms, a partnership with Acuity reduces the cost per research output. By having Acuity take on 30-75% of your coverage initiation and maintenance-related process, your team stays focused on client-servicing and increasing revenue. For asset and wealth managers, Acuity’s experience covers the entire idea generation and idea validation spectrum. Our analysts (with backgrounds in Finance, MBA, CFA) can conduct thematic research, perform sector research, scan broker research, investigate first-cut ideas, construct databases, and provide regular sector coverage support. All outputs produced by Acuity are customized for a client and are available for their exclusive use. This gives our clients a unique edge that is also sustainable.

References:

https://www.jll-mena.com/content/dam/jll-com/documents/pdf/research/emea/mena/jll-the-uae

https://www.jll-mena.com/content/dam/jll-com/documents/pdf/research/emea/mena/jll-the-uae

PowerPoint Presentation (emaar.com)

PowerPoint Presentation (emaar.com)

Market Report & Dynamic Price Index - Release 032 -May 2022 (propertymonitor.ae)

Tags:

What's your view?

About the Author

Anup Dhanuka has eight years of experience in equity research, supporting both buy-side and sell-side clients. He has been with Acuity Knowledge Partners for five years and has worked with buy-side fund managers in the consumer, real estate and healthcare sectors. In his current role, he supports a buy-side fund manager with coverage of real estate and healthcare stocks in the MENA region. He holds a Post Graduate Diploma in Management from T.A.Pai Management Institute in Manipal, India.

Like the way we think?

Next time we post something new, we'll send it to your inbox