Published on December 18, 2023 by Johnson Fernandes

In the world of investing, success often hinges on making well-informed decisions based on accurate information. Whether you’re a seasoned investor or a novice looking to dip your toes into financial markets, understanding the significance of fund flows can be a valuable asset in your investment arsenal.

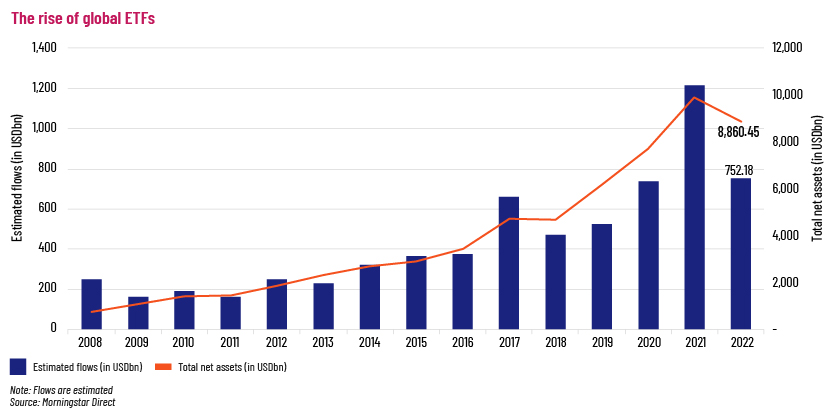

While the allure of quick gains may tempt investors to overlook the importance of fund flows, it is crucial to recognise that these movements can offer profound insights on the behaviour of market participants. Take for example the global rise of exchange-traded-fund (ETF) investing. ETFs have experienced a meteoric rise in popularity vs mutual funds (MFs) over the past two decades due to their highly transparent, low-cost and tax-efficient structure. The steady increase in flows into ETFs globally has contributed to the significant expansion in assets under management (AuM) of this financial instrument. By diligently tracking fund flows, astute investors can gain a deeper understanding of market sentiment, identify emerging trends and make more informed investment decisions.

What are fund flows?

Fund flows refer to the movement of money in or out of MFs and ETFs. Outflows occur when investors redeem their shares from a fund, while inflows happen when investors purchase new shares. Fund flows are a critical indicator of investor sentiment and confidence in the underlying assets. It is important to note that fund flows do not reflect the performance of the fund but only the movement of money into or out of it.

Fund flows can be measured in absolute dollar terms or relative percentage terms; relative percentage terms are often a better indicator, as they take the fund’s AuM into account. For example, if the David Fund and the Goliath Fund both received USD50m in fund inflows during the first quarter of 2023, it may appear that they have similar flows on an absolute basis. However, when you consider that the David Fund had USD300m in AuM while the Goliath Fund had USD1.2bn in AuM, it becomes clear that the David Fund witnessed organic growth of 17% while the Goliath Fund witnessed organic growth of only 4%.

Fund managers aim to attract more fund flows to increase AuM since fees are often based on AuM. Therefore, higher AuM typically translates into higher fees for the fund manager.

Categorising fund flows accurately is key

To accurately interpret market trends, it is crucial to categorise fund flows correctly. These flows can be categorised by a variety of factors, including asset class, style, region of investment, investor type, Morningstar fund rating, domicile, where they are available for sale, vehicle type, cost, active or passively managed, factor exposures and fund families.

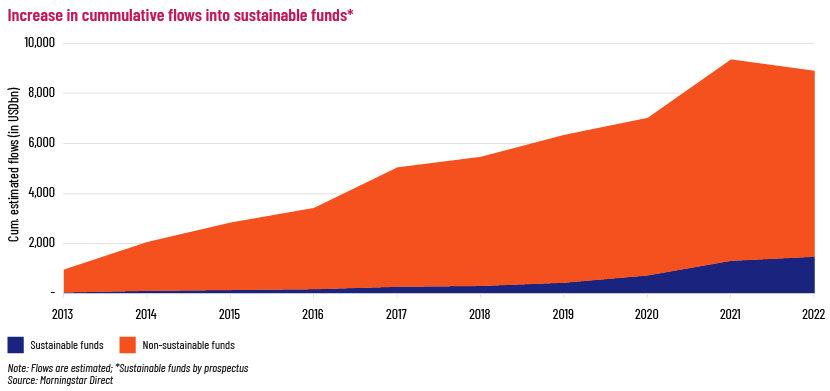

Analysing fund flows can help identify long-term trends, such as the growing popularity of sustainable investing over the past decade. The chart below illustrates a notable trend in sustainable investing, evidenced by the consistent rise in funds over the years. However, it is important to keep in mind the broad and sometimes vague definition of sustainability, as some companies may engage in "green washing" to appear more sustainable than they actually are.

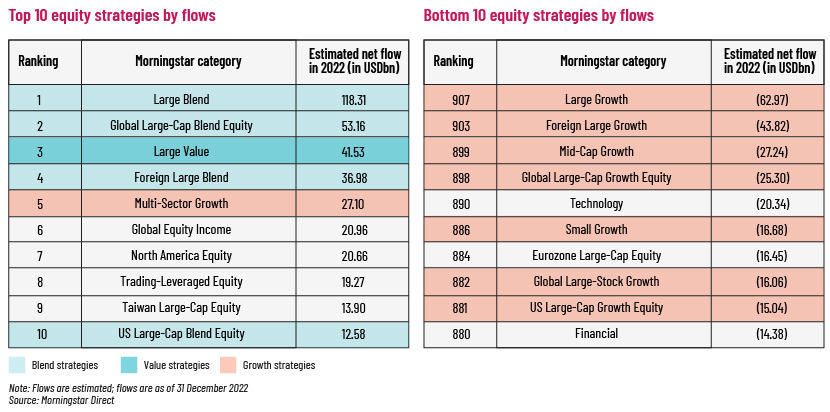

Categorising funds by style (value, growth and blend) can also reveal patterns in different market conditions. For instance, in 2022, when the equity markets were volatile, value, growth and blend styles performed differently. Of the 908 Morningstar categories, blend- and value-oriented styles outperformed while growth underperformed in the equity markets. This trend can be partly explained by the rise in inflation and the Federal Reserve's rapid rate hikes to control it. Investors moved out of growth stocks (dominated by technology companies) and into value for safety.

Finally, the correlation and causation between Morningstar ratings and mutual fund flows is another interesting finding. Diane Del Guercio and Paula A Tkac, in their study Star Power: The Effect of Morningstar Ratings on Mutual Fund Flow, found that Morningstar ratings significantly influence the investment decisions of retail mutual fund investors. Funds whose ratings drop to a 3-star rating experience outflows, while those upgraded to a 5-star rating receive disproportionate inflows.

Not all that glitters is gold

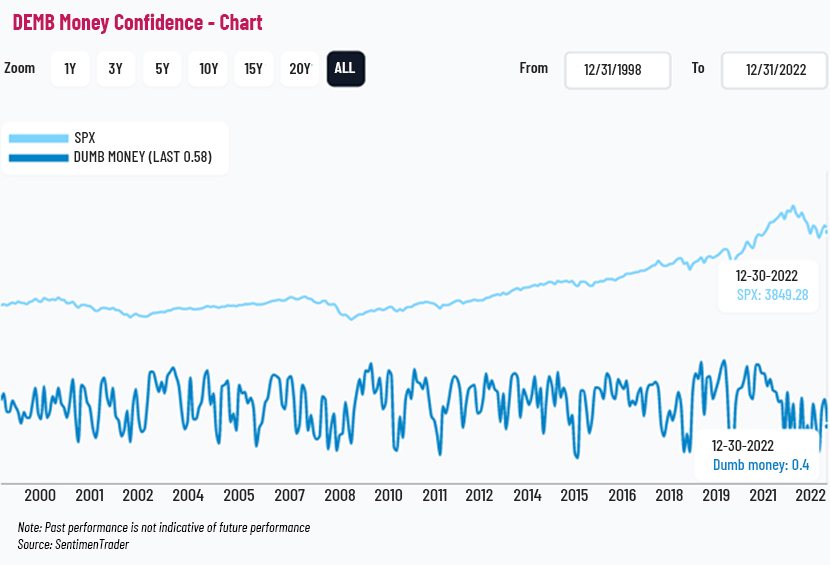

It is typically a good sign when investors place money in a mutual fund, as it demonstrates their trust in the fund. However, it is important to properly categorise the type of fund and the source of the inflows. Institutional inflows have historically been considered to be a positive sign, while retail inflows are more cautious. This dichotomy is often referred to as "smart money vs dumb money”. Institutional investors are typically more quantitative and sophisticated, using criteria such as risk-adjusted return and tracking error when allocating funds. In contrast, retail investors are more sentiment-driven and prone to herd-like behaviour. As a result, retail investors are often the last to spot trends and may end up holding the bag when the trend reverses. To follow the "smart money", investors may want to do the opposite of what "dumb money" is doing. There is even a Dumb Money Confidence indicator that tracks the flows of retail investors.

Another time when inflows may not always be a positive sign is when small-cap funds receive too many inflows and grow too large. Small-cap funds typically invest in small to medium-size companies with low free float market cap. This means that there are a limited number of shares available to purchase with the large amount of capital the fund has, leading to an increase in the average buying price.Furthermore, as small caps have low float, the fund may hold a large stake in the company, increasing systemic risk. Therefore, investors should be cautious when investing in small-cap funds experiencing significant inflows.

Benefits from following fund flows

-

Provides insight on investor sentiment

-

When investors are optimistic, they invest more, leading to higher inflows. Conversely, when they are cautious or uncertain, they may withdraw funds, causing outflows. By tracking these flows, analysts can understand investor sentiment, assess market trends and make informed investment choices.

-

-

Helps identify market trends

-

Monitoring fund flows helps investors understand evolving preferences and predict future trends. For example, there has been a shift towards low-cost index funds in the past decade, reducing demand for expensive active funds. Sustainable funds also gained popularity amid the pandemic as investors sought environmentally friendly options.

-

-

Beneficial when launching new funds

-

Asset flows provide fund managers with insights on demand and marketing allocation. Analysing flows helps identify new fund opportunities to meet investor needs and capitalise on emerging trends. For example, if there is consistent inflow to a sector or asset class, a new fund could target it. Emerging thematic trends could also inspire new fund launches.

-

Limitations of fund flow analysis

-

Unable to cut through the noise (randomness)

-

Fund flows can be heavily influenced by randomness, particularly in the short term. This makes it challenging to identify meaningful trends or predict flows accurately. Factors such as stop-loss triggers, short covering and option expiry dates can cause sudden, misleading flows that do not reflect true investor sentiment or market conditions. To analyse fund flows effectively, these factors need to be considered and multiple information sources need to be used to obtain a well-rounded market view.

-

-

A lagging indicator

-

Fund flows are lagging indicators, reflecting past investments, not future ones. The market may have already shifted by the time the data is released. Additionally, data collection, analysis and publication take time, resulting in potentially outdated information. Relying solely on fund flow data could result in investors missing early opportunities or investing in trends that have already passed.

-

-

Predicting asset flows is only as good as estimates

-

While tracking fund flows provides valuable insights, predicting asset flows is not foolproof. Accuracy depends on data quality and underlying assumptions. Predictions are influenced by market conditions, investor behaviour and economic indicators, which are challenging to forecast precisely. Fund managers should exercise caution and consider factors in addition to estimated asset flows when making investment decisions.

-

-

Rebalancing can give the wrong idea

-

Rebalancing is a common practice; this refers to fund managers adjusting their portfolios to maintain a target allocation. However, this could distort investor sentiment. For instance, selling equity holdings to maintain a 60/40 portfolio may seem like a significant outflow from equity funds, but it is actually routine rebalancing. Similarly, a purchase may appear to be a sudden inflow, but it could be part of a broader rebalancing strategy. It is crucial to understand the impact of rebalancing on fund flows and not interpret it as reflecting investor sentiment.

-

In conclusion, following fund flows can provide valuable insights on investor sentiment, changing preferences and the potential success of new funds. However, it is important to recognise the limitations and potential pitfalls, such as the influence of randomness and the lagging nature of the data. By using fund flows as one tool in a broader analysis of the market, investors could gain a more well-rounded understanding of the forces at play and make more informed investment decisions. As with any investment strategy, it is important to exercise caution, stay vigilant and be mindful of the risks involved.

How Acuity Knowledge Partners can help

We have an extensive background in capital markets, which helps us offer a number of financial marketing services. Our team comprises seasoned market specialists with substantial experience in asset management, product research and project delivery. We provide customised and integrated solutions that facilitate competitor comparisons, performance reporting and fund flow analysis for mutual funds and ETFs, enabling the creation of marketing assets with enhanced flexibility. We also help with managing Seismic slide libraries, are licensed operators of tools such as Morningstar Direct and eVestment and are able to ensure our clients' financial marketing material and fund brochures remain current.

Sources:

-

https://www.morningstar.co.uk/uk/news/217256/4-reasons-it-pays-to-know-your-flows.aspx

-

https://faculty.haas.berkeley.edu/odean/Papers%20current%20versions/Which%20Factors%20Matter.pdf

-

https://www.ft.com/content/81c4105e-1c3d-4728-8223-204e4ecd5721

-

https://www.ishares.com/us/insights/flow-and-tell-2022-in-review

-

https://unctad.org/system/files/official-document/diae2021d1_en.pdf

What's your view?

About the Author

Johnson Fernandes comes with over 5 years of experience in Equities and Fixed Income. Being on the sell side, he specializes in analyzing Market Trends and Asset Flows for various financial vehicles including Mutual Funds and ETFs. Working as a Market Research Specialist at Acuity, Johnson possesses extensive expertise in competitor analysis and performance reporting, along with proficiency in various databases, all geared towards serving institutional clients. He has regularly provided research content and findings to various publications and is also an active contributor to many of the CFA Society events. Johnson is a CFA Charterholder.

Like the way we think?

Next time we post something new, we'll send it to your inbox