Published on June 14, 2023 by Alankar Ranade, CFA

-

After months of negotiations, the bill to raise the US debt ceiling was finally resolved last week, with President Biden signing the Fiscal Responsibility Act of 2023 (FRA).

-

However, we have not escaped without harm, as the Act is expected to cause a modest hit to the US economy over the next two years.

-

Financial markets are also likely to face tight liquidity conditions in the short term as the US government introduces a slew of Treasury issuances to replenish its coffers, emptied for use as Extraordinary Measures in recent months.

-

However, the most serious unresolved issue is Fitch’s “rating watch negative” on the US government; a downgrade could cause a major blow to almost all the world’s financial markets.

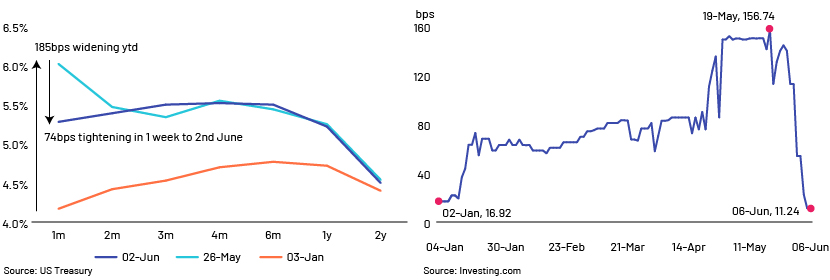

Concerns about the US debt ceiling have kept global capital markets on tenterhooks in recent weeks. However, with the FRA now becoming law, the risk of a default has been dealt with, likely calming nerves all round. One-month CDS spreads tightened 80bps and one-month Treasury yields tightened 74bps over the week to 5 June.

Yields and CDS spreads tightened sharply after announcement of agreement

A snapshot of the Fiscal Responsibility Act of 2023

-

Debt ceiling remains suspended until 1 January 2025: Removes the immediate risk of default and kicks the can down the road

-

Spending caps in budgets: Non-defence discretionary expenditure to be flat y/y in fiscal 2024 and increase 1% in fiscal 2025

-

Restarts student loan repayments: Student loan repayments will resume from September 2023

-

Cuts Internal Revenue Service (IRS) funding: Reduces USD20bn in funding from the USD80bn granted in the Inflation Reduction Act

-

Claw-back of unused COVID funds: Estimated at USD28bn. Part of this is likely to be used to offset cuts in IRS funding

While the removal of a major overhang, namely a US default, is a relief, the resolution of the debt-ceiling problem is, funnily, likely to have a negative impact as well. In the short term, the key issue would arise during budget negotiations for FY24 (most likely in October 2023). As seen previously, budget negotiations after a debt-ceiling issue could be tricky, and the inability to pass a budget before 1 January 2024 would lead to a shutdown. However, this would not have a material impact such as GDP contraction or market volatility.

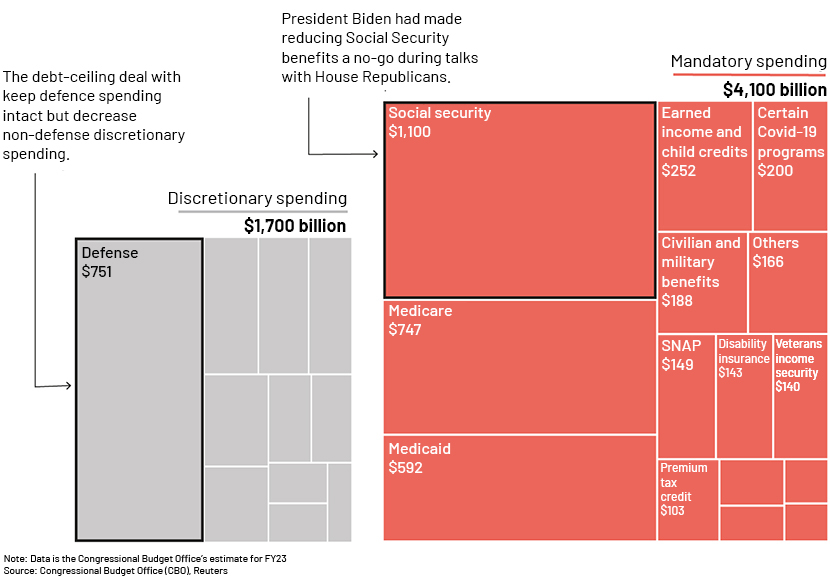

The Act cuts only non-defence discretionary expenditure

The resolution is a solution, but not a silver bullet

The US government’s general account at the Treasury has reduced to USD50bn (vs USD700bn as of end-2022) due to its use for Extraordinary Measures amid the debt-ceiling negotiations. Morgan Stanley estimates that the government would make T-bill issuances of approximately USD730bn over the next three months and USD1.25tn over the next seven months to replenish its coffers, which could keep Treasury yields high. Such issuance would also tighten bank liquidity, raising borrowing costs for companies and affecting the growth and earnings outlook.

The Act’s financial impact on the US economy would come primarily from the cap on non-defence discretionary expenditure, which makes up about 15% of overall federal expenditure. The CBO estimates that the cap will lower this spending by USD64bn in 2024 and USD107bn in 2025 from its May 2023 baseline projections, reducing fiscal support to the economy. However, the actual effect is estimated to be fairly modest, at a 0.2% reduction in 2024 GDP growth. The CBO had projected fiscal deficit/GDP at 5.8% in 2024 and 6.2% in 2025. The cap would narrow the deficit to 5.5% and 5.8%, respectively.

Risk of a US government rating downgrade

Last month, Fitch placed the US’s credit rating on “rating watch negative” due to “increased political partisanship that is hindering reaching a resolution to raise or suspend the debt limit despite the fast-approaching x date”. Around that time, Moody’s analysts also indicated that they could change their outlook on the rating to “negative” in the event statements by political leaders indicated that a default of debt payments was likely. Despite suspension of the debt ceiling, Fitch has not removed the rating watch. It believes increased partisanship in US politics that stretched reaching a solution until the last minute lowers investor confidence in the US’s ability to resolve a similar standoff in the future and to tackle the fiscal challenges from growing mandatory spending. The rating watch will be resolved in 3Q23, after considering medium-term fiscal and debt trajectories and the quality of policymaking in the interim.

The commentary language is similar to S&P’s when it downgraded the US’s rating by one notch to AA+ in 2011, after a similar debt-ceiling episode. At that time as well, the government had managed to raise the ceiling and avoid a default, but protracted political negotiations and limited measures to address fiscal challenges were the reasons cited for the downgrade. This was the first challenge to the US’s risk-free status, and the US markets suffered significant losses at the time. Over a period of seven weeks, the S&P 500 had fallen more than 12% and high-yield bond index spreads had widened more than 160bps. Interestingly, Treasuries gained during this period, with the 10yr yield declining 70bps, indicating that investors still saw Treasuries as THE safe-haven asset.

The apocalyptic downgrade scenario

While the first downgrade in 2011 by S&P was a major headwind to the risk-free status of US government debt, a downgrade by Fitch now would be even more serious, as it would bring down the “average rating” of the three agencies (Moody’s, S&P and Fitch) by one notch to AA+, which would further increase the government’s borrowing costs.

Additionally, US Treasuries are the prime risk-free asset for almost all financial markets (debt, equity, currency, structured products and bank liquidity) globally. A rating downgrade and losing the coveted AAA status could result in a sell-off, as asset managers and pension funds mandated to hold AAA securities would need to sell their holdings. Hence, a downgrade would severely impact the functioning and liquidity of these markets. US Treasuries also account for a significant share of forex reserves of most countries, and the USD is not only the global reserve currency, but also the primary currency for international trade (about half of global trade is invoiced in USD). Hence, a US downgrade could disrupt economies around the world by limiting their ability to carry out international trade.

Watch the Fed and brace for volatility

The coming months are expected to be volatile as markets resolve their questions about the stability of the substructure (US Treasuries) and its impact on the entire superstructure of financial markets. This, along with volatility arising from the Fed’s rate-hiking cycle, would keep investors busy. Investors would not only evaluate risks, but also screen for substantial opportunities to profit.

How Acuity Knowledge Partners can help

Our more than two decades of experience in supporting global financial institutions and expertise across fixed income asset classes place us well to partner with buy- and sell-side institutions to identify and support their research teams to take advantage of this opportunity.

Sources:

What's your view?

About the Author

Alankar has 15 years of experience in investment research and has been supporting high-yield analysts (buy side and sell side) and credit rating analysts for a number of years. He currently supports sell-side analysts of a major trade desk, covering high-yield issuers in EMEA. Alankar holds an MBA in Finance and a bachelor’s degree in Engineering.

Like the way we think?

Next time we post something new, we'll send it to your inbox