Published on July 6, 2021 by Shanteri K Rao

A 2020 Natiaxis global survey found that nearly 21% of financial professionals believe that they will be facing strong competition from robo-advisors in the next five years, while 17% of financial professionals are of the opinion that they might even lose clients to industry disruptors1. Wealth managed by robo-advisors increased by 30% y/y in 2020 globally and is expected to reach USD1.1tn by 20242. According to Sage Wohns, the founder CEO of Agolo, the industry will see machine learning-augmented workflows across both wealth and asset management3 sectors by 2025. This phenomenon largely reflects the consolidation taking place in the wealth management industry, with technology forming the base of the transformation.

However, the role of human advisors would still be relevant, mainly due to retail investors’ confidence in human advisors and their need for personalised advice. According to McKinsey, 80% of new wealth management clients would want their advice to be data-driven, personalised and continuous4. Furthermore, a 2020 research report from CFA Institute found that 73% of retail investors preferred a human advisor5 more.

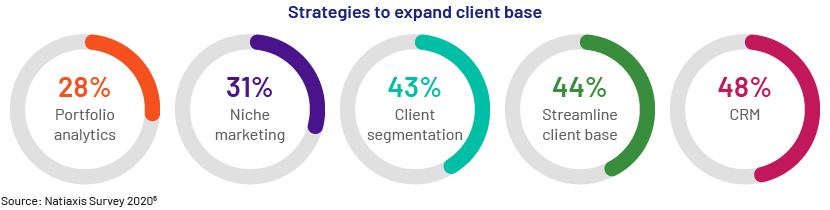

In order to deliver personalised advice, it is necessary for relationship managers to implement an operating model that offers comprehensive information about the client. A survey found that the following business strategies might help advisors expand their client base:

Furthermore, unlike the traditional client review process held annually, financial professionals need multiple interactions and frequent communication with clients these days to gain their trust, reassure them about the efficacy of investment ¬¬strategies and keep them calm at all times. A 2020 Natixis Global survey of financial professionals found that c.54% of the surveyed professionals regarded frequent and proactive client communication during turbulent times as a critical success factor to boost asset under management and enhance profits. Evidently, nearly half of the retail investors agreed that they would be willing to pay a higher fee for personalised advice and products.7

However, with limited resources and an ever-demanding client base, digitising client engagement appears to be the smarter option if you are looking to scale up and cater to a larger target market in an effective and efficient manner. In fact, the CFA Institute found that nearly 50% of retail investors trusted a human advisor more owing to increased use of technology8 . Additionally, digitising also provides multiple touch points, improves existing procedures and renders a more compelling client experience.

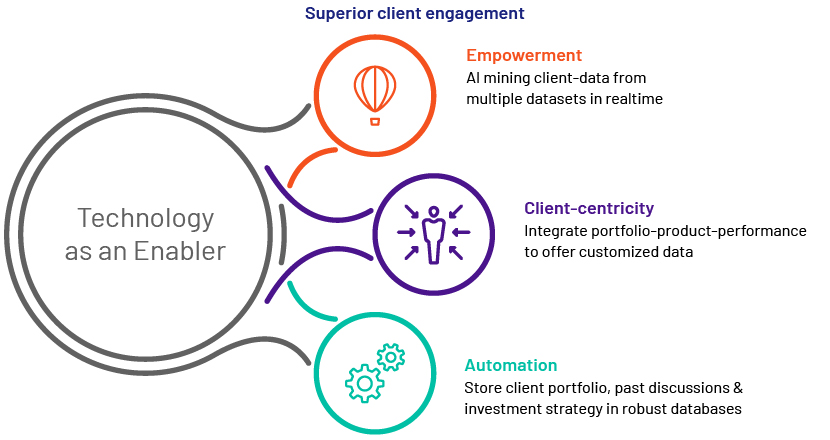

Alessandro Tonchia, co-founder and head of strategy at Finantrix, believes that digital technology is at the core of superior client engagement. He outlines the following attributes9 of digital technology:

However, leaving the status quo and embracing technology may not happen overnight. In fact, you might even face challenges, such as fragmented internal data, lack of automated marketing tools, low adoption rate and inadequate training of admin staff10. An efficient customer relationship management (CRM) tool will provide the much-needed assistance.

CRM: A door to gain deeper insights

CRM acts like a catalyst that empowers one to fulfil tasks in an efficient manner. By pulling in data from different stages of the value chain, such as client acquisition, onboarding, compliance and client servicing, a well-integrated CRM will enable a professional to take data-driven decisions and provide customised services.

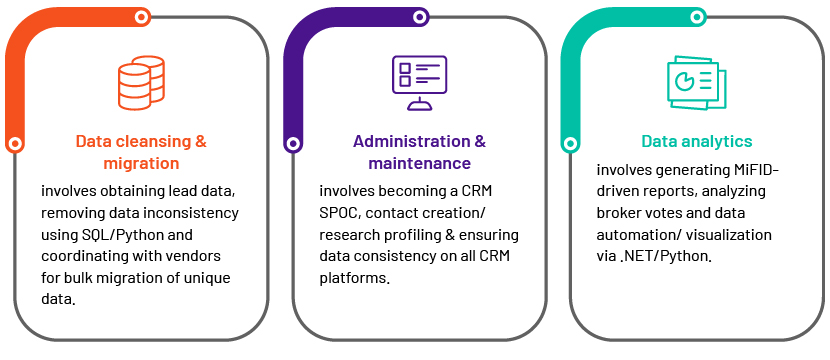

Acuity Knowledge Partners, one of the leading providers of high-value research and business intelligence for over 15 years, offers bespoke solutions under its CRM arm that address the various pain points of relationship managers/wealth advisors and enable them to have more client interaction time. Acuity’s comprehensive end-to-end CRM capabilities include the following:

Along with expedited streamlining of data, you also get help in regulatory-driven reporting that not only saves 40-50% of the overall cost, but also leads to better management decisions.

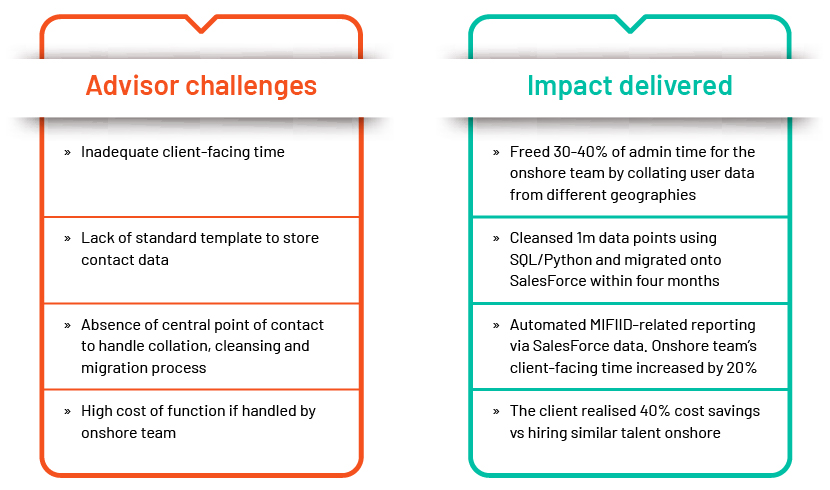

The table below illustrates how Acuity Knowledge Partners empowered a European investment bank via CRM support:11

The bottom line

As client expectations move from straight-jacketed investment offerings to personalised advice, getting a 360-degree view becomes more of a necessity than a luxury. In such a scenario, increasing your client-facing time along with providing faster response is one factor that will differentiate you from the rest of the crowd. Having an efficient CRM solution by your side will not only offer you an integrated view of the client, but also support and automate your day-to-day database management needs.

Bill Gates rightly said: How you gather, manage and use information will decide whether you win or lose.

Sources:

2Why robo-advisors may never replace human financial advisors (cnbc.com)

3Like It Or Not, Technology is Changing Wealth Management - Here's How - Plug and Play Tech Center

4McKinsey On Wealth Management – The “Netflixing” Of Advice (forbes.com)

9https://www.fintechmagazine.com/venture-capital/three-ways-technology-galvanising-client-engagement

Tags:

What's your view?

About the Author

Shanteri K Rao has over 7 years of experience in developing content for personal finance, wealth management and mutual funds. At Acuity, her responsibilities as a Delivery Lead include creating high-quality and insightful content via blogs, whitepapers, thought leadership pieces, investment commentaries and attribution reports. Additionally, she is actively involved in working with teams to identify efficiencies and improve work flow, training team members on trending concepts in asset management domain, and implementing industry best practices in the Acuity team for content development. Previously, she has worked with leading Indian fin-tech startups like Paytm Money and Cleartax where she assumed the role of lead content strategist..Show More

Comments

28-Jul-2021 04:59:37 am

Good Efforts..Keep it up !!

Like the way we think?

Next time we post something new, we'll send it to your inbox