Published on March 6, 2024 by Shanteri K Rao

A wealth manager’s primary task involves scanning financial opportunities and deploying a client’s money in the right investments. Before arriving at a final decision, they conduct investment analysis to determine the right entry price point and the expected holding period. Leveraging portfolio accounting services can further enhance the wealth manager’s ability to track investments effectively, ensuring accurate reporting and informed decision-making.

A UK study established a significant relationship between fund returns and fund managers’ decisions[1]. In a 2019 survey of asset managers by Deloitte, 62% of the respondents confirmed that accurate data analysis led to increased investment performance[2]. Inexperienced investors may use naïve methods to evaluate data, leading to erroneous financial decisions[3]. Thus, the onus of providing correct guidance falls increasingly on wealth managers and advisors, who need to conduct proper investment analysis and use the available data effectively to gauge economic conditions and monitor financial trends.

Investment analysis: guidance for achieving client goals

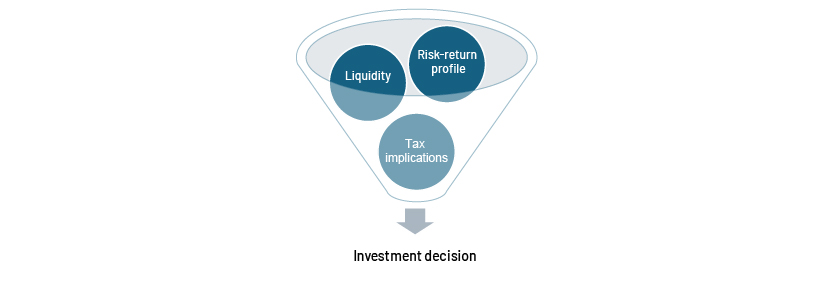

Sound investment analysis provides clarity on how a specific investment may perform in the future and whether or not it is suitable for inclusion in a client’s financial portfolio. It assesses the viability of an individual investment strategy in terms of the current environment, investor needs and preferences, the portfolio’s performance over a given period and the need for adjustments. For example, to build a mutual fund portfolio, an advisor may compare mutual funds’ risk-return profiles, expense ratios, fund-manager credentials, investment style and quality of management.

Through the investment analysis process, an advisor can shortlist optimum investments that align with a client’s unique financial specifications relating to goals, risk tolerance, investment horizon and return expectations.

Critical factors in investment analysis

Company-related factors – A company’s financial reports on revenue, profit, debt and cashflow indicate its overall financial health, and its rules and bylaws provide information on its scope of operations and potential, with a significant impact on its growth, operations and profitability. Such company-specific factors generate idiosyncratic risks within a portfolio, and an advisor would need to be aware of these while evaluating an investment decision.

Sector trends – Understanding these helps ascertain whether an underlying trend is cyclical or secular. Chauvet and Piger (2003) suggest using the Markov switching model to determine a business cycle’s peak and trough dates to understand regime changes within the economy[4]. This way, an advisor could seek positions to be on the right side of the trend or create hedges to reduce losses. Based on the client’s investment horizon, the advisor could take advantage of short-term business cycles or long-term secular upswings.

Competitor analysis – Peer-to-peer comparison helps in understanding a company’s standing with respect to revenue, profits, risks and expenses. It also shows how much the business and sector are benefiting or being limited, future trends and current market conditions. A 2022 study found that competitor analysis helped a company implement improvements within six months and that its net profit by business line increased by 200-250% within a single year[5].

Macroeconomic conditions – Inflation, interest rates, employment rates and political conditions are some of the macroeconomic variables that impact a company’s financial performance. Broadly speaking, when these factors are in negative territory, it creates headwinds to performance, driving investors away. The variables may differ from country to country. A 2022 survey by McKinsey showed that inflation and geopolitical instability remained key risks to economic growth in Europe, while interest rate risk was a major consideration for respondents from Asia Pacific[6].

Valuation metrics – These help assess the fair price of an investment and decide whether the stock price of an entity is overvalued or undervalued. This enables a wealth manager to ascertain the right time to buy or sell the stock to maximise returns and avoid losses.

Financial indicators: help to overcome cognitive bias

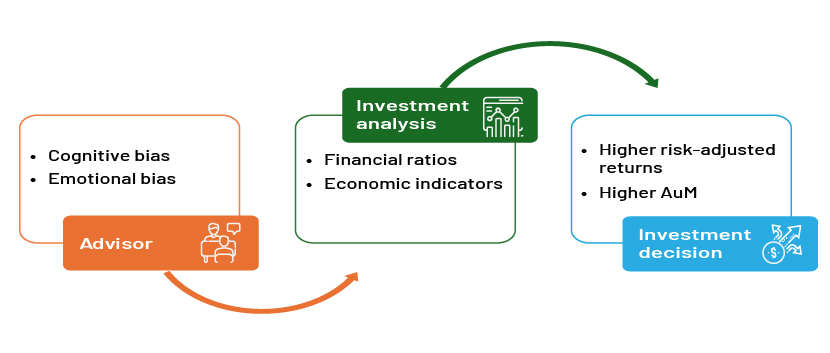

Analysing investment opportunities pragmatically helps a wealth manager or advisor to achieve client goals. Abatecola et al (2018) reported that financial practitioners often use heuristic techniques for quick and easy decision-making, but such methods may introduce systemic errors in judgment. Jaiyeoba and Haron (2016) pointed out that a number of investors fall prey to predictable negative patterns due to concentrated portfolios, family favouring and fear of loss. Other studies have found that cognitive biases such as overconfidence, regret aversion and familiarity influence financial decisions and impact return on investment[7].

It is, therefore, essential to be aware of such biases and act rationally when making investment decisions. A straightforward way in which to overcome cognitive bias is by using financial and economic indicators for investment analysis, along with effective tools for venture capital portfolio monitoring to ensure comprehensive oversight and informed decision-making.

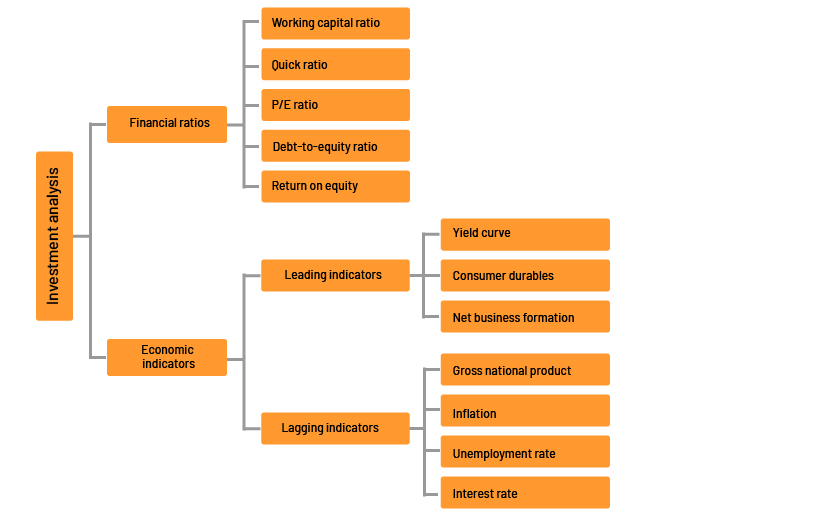

Adesoye (2021) researched banks listed on the Nigeria Stock Exchange and concluded that financial ratios such as cost to income, earnings per share and return on assets influenced investment decisions[8]. A 2021 study of Jordanian financial intermediaries reported that more than half of the surveyed participants used debt and liquidity ratios in their investment analysis and that accuracy of analysis improved when financial ratios were used[9].

The following are other financial ratios and economic indicators that can be used to understand current and future economic activity and opportunities.

How Acuity Knowledge Partners can help

We support wealth managers to evolve in this rapidly changing market. Our managed solutions are implemented by skilled, financially adept personnel who deliver solutions across the presales, client services and digital marketing landscapes. Our marketing and reporting solutions suite helps us support and enhance bespoke collateral such as collectives/fund investment research reports, competitor analysis, fund factsheets and presentations, commentaries and talking points; we also provide support on design and slide library management solutions such as Seismic, UpSlide and Shufflrr.

We use the latest in automation tools to elevate your wealth management collateral in the most hassle-free manner, providing solutions that are pivotal to increasing output volumes and staving off competition. Additionally, our Digital Marketing arm covers web solutions across the digital marketing value chain, enabling advisors to maintain a unique digital footprint. By creating an offshore model that is similar to that of our clients, we are able to deliver economies of both scale and scope and ensure that strategic goals are met.

Source:

-

[1] Microsoft Word – Fund manager change_IRFA_FINANA-D-14-00089 (city.ac.uk)

-

[2] Asset Management Survey – The gold rush route for asset managers (deloitte.com)

-

[3] Risk factors, uncertainty, and investment decision: evidence from mutual fund flows from India | SpringerLink

-

[4] Identifying Business Cycle Turning Points in Real Time (stlouisfed.org)

-

[5] Why competition analysis should inform all your strategic decision-making (finextra.com)

-

[6] The latest global economic outlook & conditions | McKinsey

-

[7] Cognitive biases and financial decisions of potential investors during Covid-19: an exploration | Emerald Insight,

-

[8] (PDF) THE IMPACT OF RATIO ANALYSIS ON INVESTMENT DECISION (2016-2020) (researchgate.net)

What's your view?

About the Author

Shanteri K Rao has over 7 years of experience in developing content for personal finance, wealth management and mutual funds. At Acuity, her responsibilities as a Delivery Lead include creating high-quality and insightful content via blogs, whitepapers, thought leadership pieces, investment commentaries and attribution reports. Additionally, she is actively involved in working with teams to identify efficiencies and improve work flow, training team members on trending concepts in asset management domain, and implementing industry best practices in the Acuity team for content development. Previously, she has worked with leading Indian fin-tech startups like Paytm Money and Cleartax where she assumed the role of lead content strategist..Show More

Like the way we think?

Next time we post something new, we'll send it to your inbox