Published on June 9, 2022 by Shanteri K Rao

Personalisation: the key to client retention

Personalisation in the retail space dates back to the 18th century, and it has now gradually entered the wealth management space. St James Hatters, pioneers in hat making, would deliver customised hats. Later, in the ecommerce era, Amazon Inc. would offer product recommendations on its website to users based on previous purchases. Today, companies use big data and provide their clients with tailor-made content.

As wealth managers collaborate with big tech, their business models are being transformed to present personalised offerings rather than one-size-fits-all solutions. Given the current demographic shifts, personalisation is likely to drive client-advisor interactions and ensure the survival of wealth managers amid intense competition. The World Wealth Report 2020 and 2021 stated that 80% of ultra-high-net-worth individual (UHNWI) clients in their 40s expected personalised services from their wealth manager and are willing to pay a premium for value-added services.

Wealth managers would, therefore, need to learn how to engage clients with content so they believe their preferences are taken into consideration.

Why do clients want personalised services?

This is driven by a need to control one’s environment. A Texas University study conducted by Laura Frances in 2008 found that customers exposed to tailored content in online advertising had a more enjoyable experience and engagement than those exposed to standardised content.

Personalisation also helps reduce information overload (also known as infobesity), a situation where excessive information hinders making effective decisions.

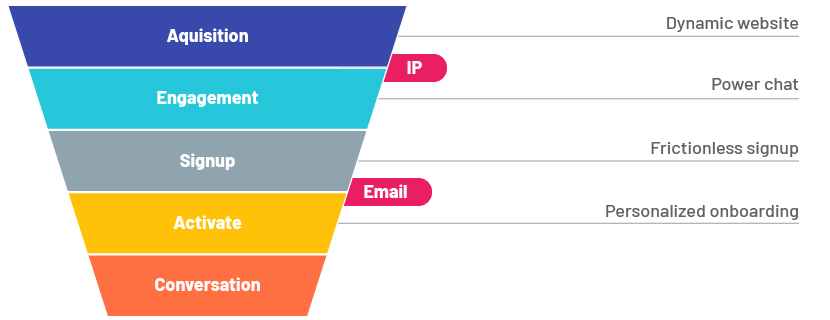

Experts such as Guillaume Cabane, former VP Growth at Drift, suggest using data to offer personalised content and create a frictionless experience.

Direct marketing service company Epsilon found that 80% of consumers surveyed were willing to conduct business with a company that offered a personalised experience. Refinitive Wealth Management Report 2020 states that 90% of the wealth managers surveyed had updated their segmentation models to factor in a personalised approach as a key to future success.

What is needed to personalise wealth management services?

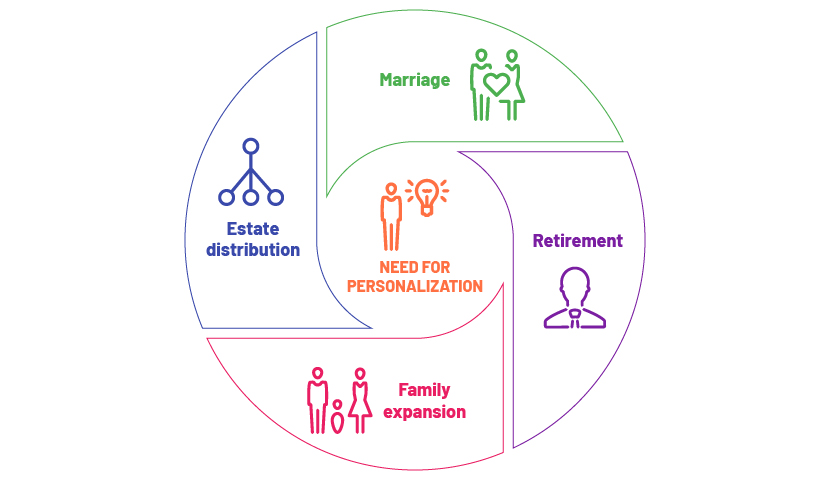

Individuals have unique goals and needs, and the decision-making journey related to the management of finances tends to be non-linear and complex. Especially during critical life stage changes, clients would expect their wealth managers to render a personalised service. The following are a few key transition points that offer opportunities for personalisation:

Source: capgemini.com

Surprisingly, it was found that over 50% of the HNW clients surveyed were dissatisfied with the manner in which they were being offered personalised wealth advice.

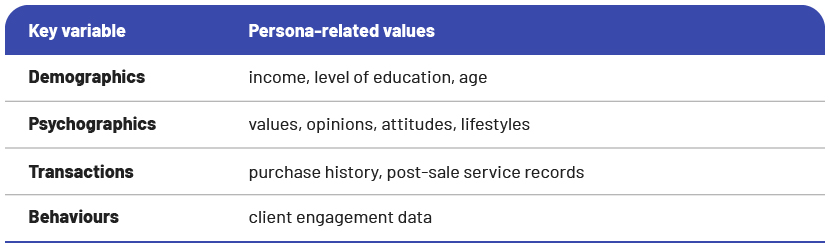

Thus, in order to strengthen relationships and client loyalty, wealth managers could develop specific client personas and manoeuver marketing strategy to provide personalised offerings. Personas are user models that emulate the characteristics of the larger target audience. Once personas are identified, companies could develop unique product/service packages to suit the attributes of the respective persona. This enhances the likelihood of a company attracting a specific category of clients and forging long-term relationships with them.

For example, Vanguard has a different set of offerings for specific target markets. Its Personal Advisor Service collaborates with certified financial planners to create personalised plans for individual investors and develop wealth management services for UHNWIs. Likewise, Vanguard’s Digital Advisor performs automated money management, portfolio management and portfolio rebalancing for tech-savvy clients.

The following are key variables companies could refer to when developing personas:

Source: Power of Personalisation-Refinitive

As the wealth management sector moves from traditional AuM-based KPIs to more inclusive matrices such as customer lifetime value and annual recurring revenue to measure a company’s success, wealth managers would have to embrace personalisation and tailor their value proposition to a client’s risk profile.

How can wealth managers offer clients a personalised experience?

The survival of a wealth management practice starts with understanding client behaviour and preferences, and personalising product and service offerings accordingly. A survey found that 45% of the wealth managers questioned were ineffective in personalisation due to unorganised and inconsistent client data[7]. Companies with robust data analytics are, therefore, able to integrate their internal enterprise data and gain deeper insights into client profiles, enabling personalisation of products and services.

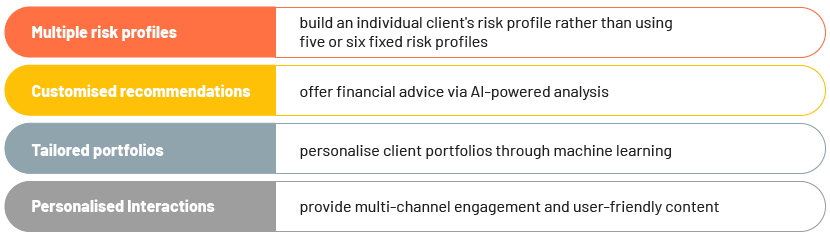

Wealth managers could incorporate personalisation in wealth management in a number of ways:

Source: Capgemini World Wealth Report 2020

For instance, API-based Fenergo Client Data Master showcases a single client view via data integration and allows advisors to personalise a client’s lifecycle. Likewise, AI-powered Charles Schwab’s Project Bear records client reactions towards market volatility and allows wealth advisors to manipulate their clients’ behaviour to facilitate goal achievement.

Similarly, HSBC Asset Management has developed a Wealth Dashboard for its clients; this provides a holistic view of their wealth portfolios including investments and insurance. With a user-friendly interface, this dashboard enables clients to easily access and monitor their portfolios and receive the latest financial news and insights.

Citigroup provides its relationship managers with a guided tool called Citigold Total Wealth Access. It helps them manage client investments in real time and rebalance them through comparison with in-house models.

How Acuity Knowledge Partners can help

We efficiently support wealth managers to evolve in this rapidly changing market. Our managed solutions are implemented by skilled, financially adept personnel who deliver solutions across the presales, client services and digital marketing landscapes. Our marketing and reporting solutions suite helps us support and enhance bespoke collateral such as collectives/fund investment research reports, competitor analysis, fund factsheets and presentations, commentaries and talking points; we also provide support on design and slide library management solutions such as Seismic, UpSlide and Shufflrr.

We use the latest in automation tools to elevate your wealth management collateral in the most hassle-free manner, providing solutions that are pivotal to increasing output volumes and staving off competition. Additionally, our Digital Marketing arm covers web solutions across the digital marketing value chain, enabling advisors to maintain a unique digital footprint. By creating an offshore model that is similar to that of our clients, we are able to deliver economies of both scale and scope and ensure that strategic goals are met.

Source:

Consumer control and customization in online environments: an investigation into the psychology of consumer choice and its impact on media enjoyment, attitude, and behavioral intention (utexas.edu)

9 Personalization Strategies (Backed by Unique Research) (superoffice.com)

Top 5 wealth management trends for 2020 (refinitiv.com)

A hyper-personalized wealth management client journey is becoming table stakes (capgemini.com)

Tags:

What's your view?

About the Author

Shanteri K Rao has over 7 years of experience in developing content for personal finance, wealth management and mutual funds. At Acuity, her responsibilities as a Delivery Lead include creating high-quality and insightful content via blogs, whitepapers, thought leadership pieces, investment commentaries and attribution reports. Additionally, she is actively involved in working with teams to identify efficiencies and improve work flow, training team members on trending concepts in asset management domain, and implementing industry best practices in the Acuity team for content development. Previously, she has worked with leading Indian fin-tech startups like Paytm Money and Cleartax where she assumed the role of lead content strategist..Show More

Like the way we think?

Next time we post something new, we'll send it to your inbox