Published on July 25, 2022 by Abhishek Modi

Micron’s 2Q results clearly indicate the tough year ahead for the semiconductor sector. The extent of the slowdown in consumer demand was evident in the company’s guidance, which was 20% below the street’s expectation for the quarter. Micron’s Taiwanese competitor Nanya Technology warned in June that its revenue may decline in 2022 as the slowdown in demand for consumer electronics spreads to cloud computing and data centre servers. Concerns about inflation, already weighing on consumer spending, are affecting enterprise spending budgets, Nanya’s President Lee Pei-Ing said.

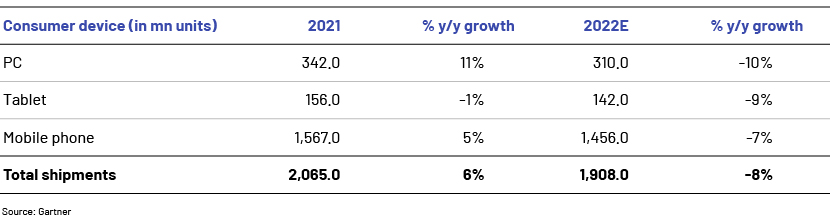

“A perfect storm of geopolitical upheaval, high inflation, currency fluctuations and supply-chain disruptions have lowered business and consumer demand for devices across the world and is set to impact the PC market the hardest in 2022”, according to a Gartner report.

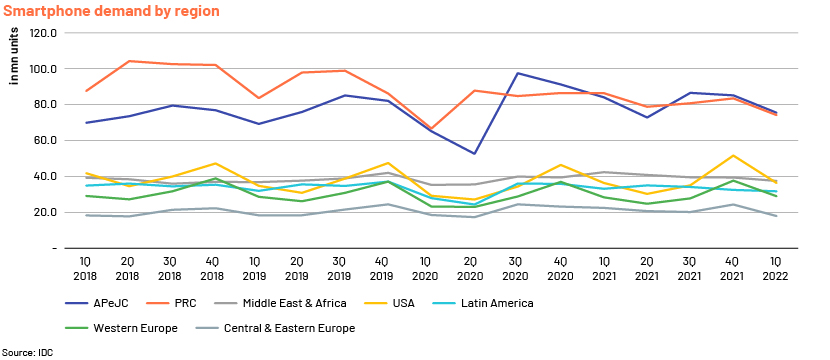

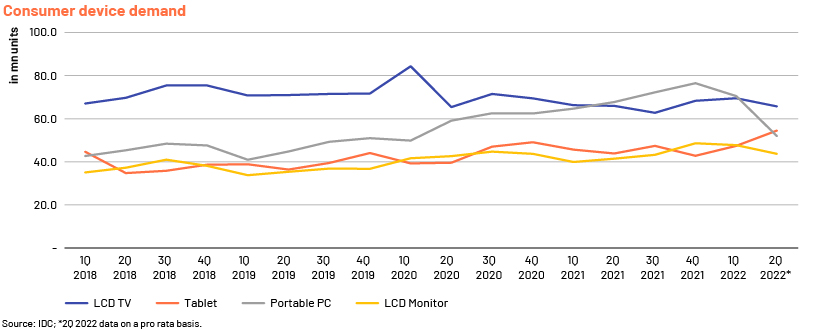

The pandemic-induced lockdown in China and high inflation have impacted demand for consumer devices as purchases of non-essential items are delayed. Demand for PCs and TVs benefited from stay-at-home orders in 2020 and 2021, but is expected to be impacted more in 2022. Gartner has reset its expectations for growth in global sales of 5G smartphones to 29% in 2022 from 47% at the start of the year. The slowdown in end demand is starting to flow through to semiconductor procurement. A recent report by Nikkei Asia states that Samsung Electronics is temporarily halting new procurement orders and asking multiple suppliers to delay or reduce shipments of components and parts for several weeks due to swelling inventories and global inflation concerns. At the end of March, the inventory of Taiwan's five largest companies was equivalent to two months of average monthly sales in the January-March period, an increase of nearly 10 days in March from the same period in the past.

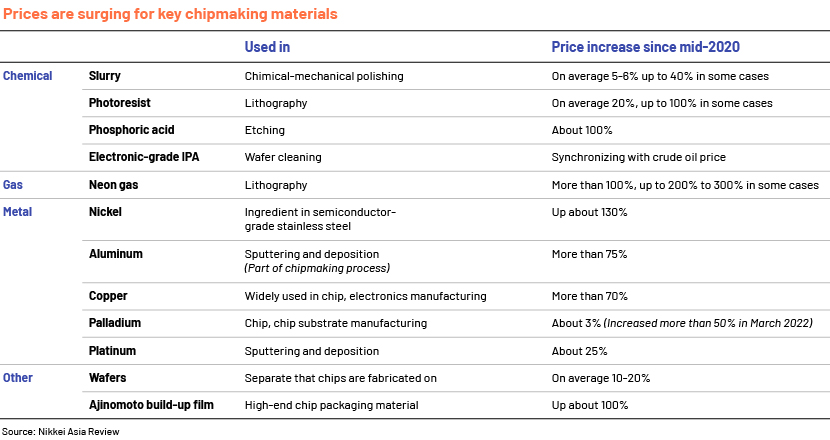

The slowdown in demand could be another setback for semiconductor companies that have been grappling with increases in raw material prices and supply-chain issues. Apart from inflation, the Ukraine crisis is also driving costs up, because both Ukraine and Russia are suppliers of rare gases and metals. Ukraine is a major supplier of neon gas used in the semiconductor manufacturing process, and prices there are already rising due to tighter anticipated supplies. Ajit Manocha, president and CEO of Semiconductor Equipment and Materials International (SEMI), said chipmakers are struggling to find replacements for raw materials purchased from Ukraine, primarily highly purified rare gases such as neon, helium and krypton. Russia controls as much as 44% of global palladium supplies, while Ukraine produces a significant 70% of the global supply of neon — two raw materials necessary for chipmaking.

Semiconductor demand from the automotive sector remains still strong, with companies such as TSMC now moving some of their capacity from consumer electronics (PCs and smartphones) to auto and high-performance computing (HPC) applications. This would help ease some of the shortage in the auto semiconductor space. Research firm CFRA says, “supply constraints are not being felt equally.” The situation of automotive semiconductors is mixed, with some automotive companies reporting an improved supply of chips. Volkswagen expects a strong second half of 2022 and progress in catching up with Tesla as easing chip shortages start to offset supply-chain bottlenecks and rising costs, the carmaker’s CEO said. According to research by Susquehanna Financial Group, the delivery times for semiconductors fell by a day in June. This is not much, but likely signals that the situation may improve in the second half of the year. The lead time for some components declined by 45%. Some of the largest declines were in microcontrollers (a key automotive component). Other microchips, such as field-programmable gate arrays (FPGAs), are still in short supply, with delivery times of more than a year. FPGA shortages mainly affect networking, optical and telecommunications gear. Some auto sector experts believe excess semiconductor capacity could materialise by the middle of next year.

As inflation remains high in 2H 2022, consumer demand could weaken further. Sector experts project that the global microchip shortage will continue until end-2023, as opposed to the initial expectation of some relief in 2H 2022. Research company IDC warned in June that in the longer term, new fabrication plants (fabs) and investment announcements would add significant capacity and could increase the risk of overcapacity beyond 2023. According to SEMI, 92 new fabs are currently in the pipeline. Considering that the chip sector is a cyclical one, the current shortages suggests a period of oversupply at some point in the future, according to Sanjay Malhotra, VP of SEMI’s Corporate Marketing and Market Intelligence Teams. TSMC’s chairman Mark Liu admitted at its AGM that the cost of building its cutting-edge US chip plant is higher than expected, while hiring is also a challenge. With the high-interest rate environment, companies with the leveraged balance sheet could face the most pressure.

The iShares Semiconductor ETF is down almost 33% YTD, but if end demand remains weak and spreads to data centre and automotive demand, it could decline further.

How Acuity Knowledge Partners can help

Global investment banks and asset managers leverage our sector-specific experience to rapidly increase internal analyst bandwidth and expand coverage. We set up dedicated teams of analysts (CAs, MBAs, CFAs) to support our clients on a wide range of activities including idea generation, financial analysis, thematic research, building databases and providing regular sector coverage. Each output is customised, based on the client’s requirement, and made available for their exclusive use. This ensures our clients a unique, sustainable edge.

References:

Gartner Forecasts Worldwide PC Shipments to Decline 9.5% in 2022

Japan's Sumco, Showa Denko to hike chip material prices 20-30% – Nikkei Asia

Xiaomi’s FCF to Decline on Weak Demand; Ratings Headroom Remains High (fitchratings.com)

Ukraine war to extend chip supply crunch: semiconductor group – Nikkei Asia

From chemicals to gases, chip suppliers reel as materials prices surge – Nikkei Asia

Omdia: Semiconductor market plateaus after five consecutive quarters of record revenue

Taiwan top memory chipmaker sees demand slowdown spreading – Nikkei Asia

DRAMeXchange – [Market View]Demand Remains Weak as Inventories Continue Moving

Unfortunately, the global chip shortage will continue | TechRepublic

VW sees chip shortage easing – report – Just Auto (just-auto.com)

Semiconductor shortage to end in 2023: Visteon chief Sachin Lawande | Autocar India

Chip delivery lead times inch down – Just Auto (just-auto.com)

What's your view?

About the Author

Abhishek Modi is a CFA charter holder with 8 years of experience in equity research. Currently, is an Assistant Director at Acuity Knowledge Partners and is proficient in semiconductor industry where responsibilities include supervise all the deliverables closely including quality assurance, workflow management and client relationshipss and provide the technical know-how to team in case of any support.

Like the way we think?

Next time we post something new, we'll send it to your inbox