Published on June 19, 2023 by Gaurav Sharma , Akshay Gupta and Surbhi Joshi

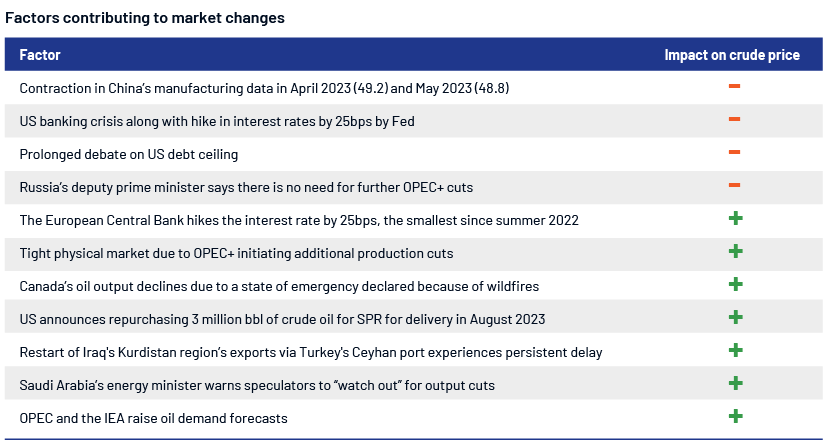

Oil prices remained under pressure in May 2023 as macroeconomic concerns such as the prolonged debt ceiling debate, interest rate hikes by several central banks, rising inflation in the US and weak economic growth in China pulled prices down. However, tight supply fundamentals from onset of OPEC+ additional production cut of 1.16 million barrels a day, Canada’s supply cut due to wildfires and high global demand forecast supported prices.

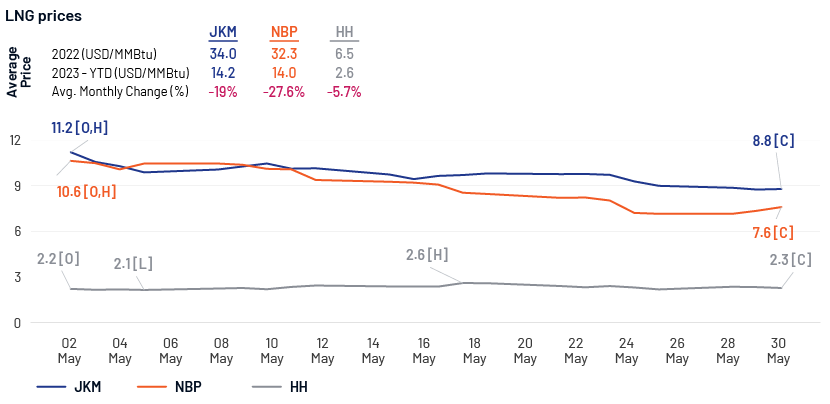

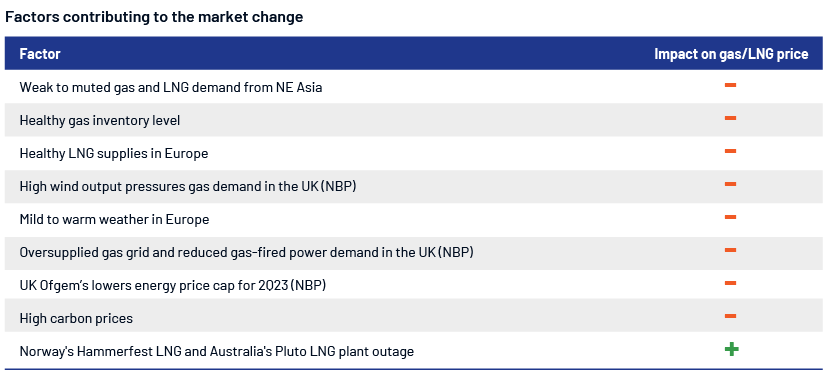

LNG price indices, too, were under pressure during the month as the Japan Korea Marker (JKM) declined on muted demand and high gas stockpiles in Northeast Asia while the UK’s National Balancing Point (NBP) declined on high LNG cargo arrivals in Europe, warmer-than-usual temperature, declining carbon prices and healthy storage levels offsetting outage at Norway’s liquefaction facility.

Monthly oil market snapshot – May 2023

Industry analysis for the month

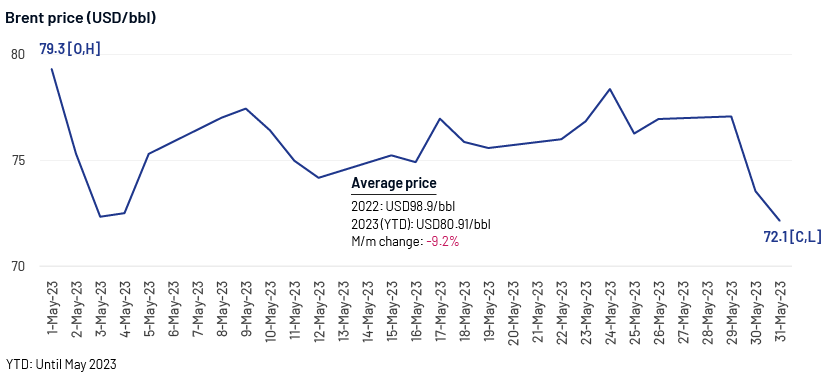

Brent prices were highly volatile amid macroeconomic concerns and tight supply-demand fundamentals.

The price fell by 9.2% month-on-month as demand concerns from US financial crisis and China’s growth uncertainty had larger impact when compared to tight supply scenario from onset of OPEC+ additional production cut.

The prices closed the month with a decline of ~9.0% at USD72.1/bbl compared to its peak and opening price.

Industry updates (key M&A/investments/deals in the month)

-

Pakistan keen on long-term deal to buy Russian oil with Chinese yuan

-

Nigeria launches USD20bn Dangote oil refinery to revive country’s oil sector

-

Chevron announces agreement to acquire PDC Energy

-

ONEOK and Magellan merger to create USD60bn pipeline giant

-

Indian ministry working on proposal to merge MRPL with HPCL

-

ONGC and Oil India in talks for 50% stake in USD3.4bn Kenya oilfield

-

INEOS completes USD1.4bn acquisition of US onshore oil and gas assets

-

Vital Energy expands Permian footprint with Delaware Basin acquisition

-

ADNOC and Apollo offer USD7.6bn for Brazil’s Braskem, one of the world’s top petrochemical makers

-

ConocoPhillips will snap up TotalEnergies' 50% stake in the Surmont oil sands field for more than USD3bn

-

Shareholders of Canada’s Baytex Energy Corp. approve USD2.5bn Ranger Oil acquisition

Acuity Knowledge Partners’ view:

We believe macroeconomic concerns such as inflation in the US and China’s demand outlook will continue to delay the expected push in oil prices as global organisations such as OPEC and the IEA expect a pickup in demand in the second half of 2023 amid a tight supply outlook due to Saudi Arabia’s additional cuts and other producers in the cartel extending cuts to 2024; this would pressure the already-depressed global oil inventories in the near future.

Monthly gas and LNG market snapshot – May 2023

Industry analysis for the month

LNG markers continued the downtrend in May 2023 as NBP and JKM prices declined by nearly 29% and 22%, respectively. The UK’s NBP started at high USD10.00s/MMBtu and ended at the mid-USD7.00s/MMBtu. Similarly, JKM prices started the month high at the USD11.00s/MMBtu and declined over most of the month to close at a 25-month low (since April 2021).

US gas benchmark Henry Hub (HH), on the other hand, increased by 2.3% during the month, reaching a peak of USD2.6/MMBtu before closing at USD2.27/MMBtu, declining 6% from its highs.

Industry updates (key M&A/investments/infrastructure/deals in the month)

-

Cheniere and KOSPO sign long-term (20-year) LNG sales and purchase agreement (SPA) for 0.4 MMTPA

-

QatarEnergy and Bangladesh sign long-term (15-year) LNG SPA to supply up to 1.8 MMTPA

-

Adnoc Gas signs a USD1bn deal to provide LNG to TotalEnergies for three years

-

TotalEnergies and Sinopec eye USD10b deal to invest in massive Aramco gas project

-

Shell sells stake in USD30bn Woodside gas project to BP

-

Equinor, Shell and Exxon agree LNG project with Tanzania

-

TotalEnergies prepares for Mozambique LNG restart

-

Novatek plans new LNG plant with 20.40 MTPA output in northern Murmansk region

-

The UAE's ADNOC moves its LNG export project from Fujairah to Ruwais

Acuity Knowledge Partners’ view:

We expect LNG prices to remain under pressure, as there are no signs of demand recovery in major consuming countries of Northeast Asia. LNG demand in the region saw a decline due to well-stocked gas across the region and accelerated growth in nuclear power plants in Japan. Moreover, sluggish economic data from China is highlighting concerns in the country. Amid the continued drop in LNG prices, we believe demand from price-sensitive markets such as India, Bangladesh and Pakistan may improve slightly in the coming months. We also expect Europe’s LNG demand to decline slightly in June 2023 on expectations of warmer temperature, high wind output, well-stocked gas, high LNG storage levels and adequate LNG supply.

How Acuity Knowledge Partners can help

We have a large pool of oil and gas experts experienced in providing strategic support across the value chain. Over the years, we have partnered with leading energy companies and have worked closely with their strategy, business development, market intelligence and M&A teams in providing the information and analysis necessary to achieve business objectives.

We also offer expertise in the power; renewables; metals and mining; and environmental, social and governance (ESG) and sustainability space.

https://www.acuitykp.com/solutions/energy-and-utilities/

Sources:

Investing, CME Group, ICE, Cheniere, QNA, Khaleej Times, Upstream Online, AFR, OG Journal, Reuters, Riviera MM, Reuters, Pravda, Investing , OG360, Edition , ET, OP , AL, OGM , Iraq, Chevron , Op , MS , ET, INEOS, GNW, GN, OP , IEA, CNBC, Brookings, BP, Bloomberg, Hart Energy, Reuters

What's your view?

About the Authors

Gaurav has close to 14 years of experience working across oil and gas value chain. He has varied experience working on various strategic research projects involving market intelligence, competitive intelligence, market sizing models, industry benchmarking and market entry strategy. At Acuity Knowledge Partners, Gaurav is leading a team to support a major LNG player in various strategic research projects. He holds a MBA degree in Oil and Gas Management from University of Petroleum and Energy Studies and a BE degree in Mechanical.

Akshay Gupta is an energy analyst with over 6 years of work experience in oil and gas domain. At Acuity Knowledge Partners, he has been a consistent member for leading and liasoning various LNG and gas projects. His current interest includes energy market studies and exploring avenues for energy transitioning. He is a post-graduate in Business Management from TERI University.

Surbhi has close to 4 years of experience in oil and gas sector, with a major focus on LNG and upstream. At Acuity Knowledge Partners, she supports a leading LNG player in various strategic research projects involving market intelligence and competitive intelligence. Surbhi holds a MBA degree from University of Petroleum and Energy Studies and also B-tech degree in Chemical engineering.

Like the way we think?

Next time we post something new, we'll send it to your inbox