Published on May 18, 2023 by Brinta Kusum De

Semiconductor chips are a ubiquitous component in this era. An interplay of disrupted supply chains due to the pandemic, extreme weather events and geopolitical tensions such as the Russia-Ukraine war has exposed the fragile networks underpinning the semiconductor industry. While the pandemic’s effect on the market is not expected to last long, extreme weather events and geopolitics are likely to stay. The complex supply situation, high interest rates and the ongoing recession contributed to the collapse of semiconductor stocks in 2022.

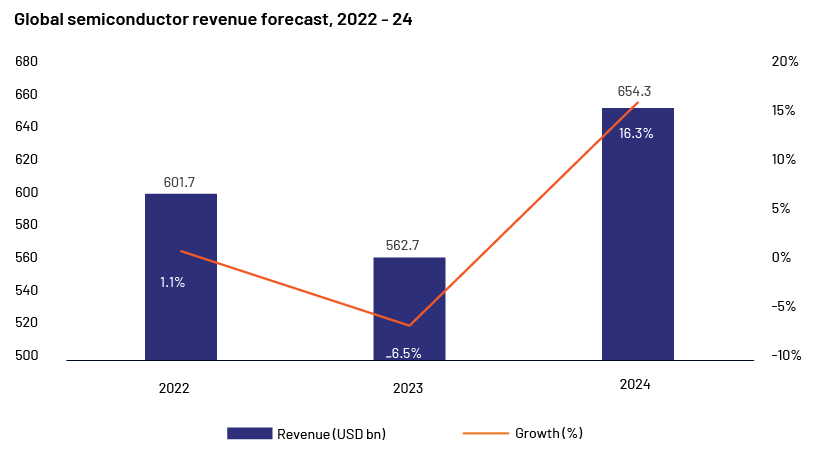

Global semiconductor revenue is expected to decline 6.5% in 2023 to USD562.7bn, according to Gartner. Market recovery is expected in 2024, with revenue reaching USD654.3bn, i.e., growing 16.3%.

“The short-term outlook for semiconductor revenue has worsened,” said Richard Gordon, Practice VP at Gartner. “Rapid deterioration in the global economy and weakening consumer demand will negatively impact the semiconductor market in 2023.”

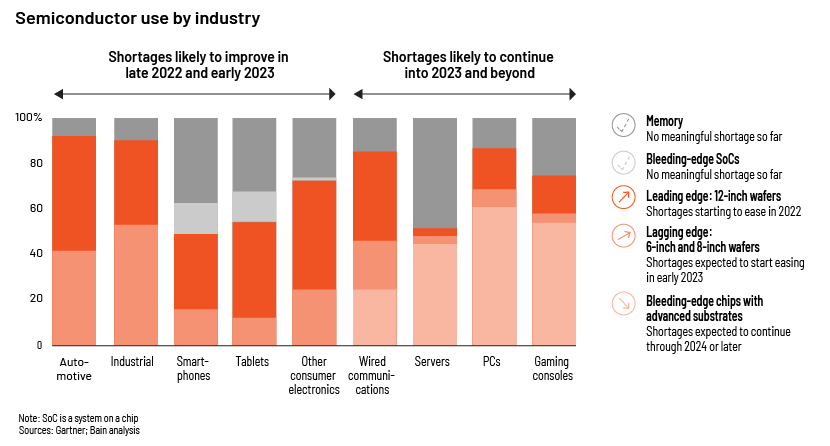

Semiconductor use by sector

The use of semiconductor components by various sectors took a hit due to the overall supply crunch, but analysts believe the situation will improve. Automotive and industrial companies are starting to see chip shortages easing, but advanced computing products are facing a challenging period.

Russia-Ukraine war having severe repercussions on the sector

The conflict has intensified existing bottlenecks in the semiconductor supply chain and chip shortages. According to a KPMG study, 56% of semiconductor companies believed (prior to the conflict) that chip shortages will last until 2023.

Due to the war and other macro-economic factors, Russia’s and Ukraine’s supply of semiconductor components has affected the sector globally.

Palladium and neon are key resources for producing semiconductor chips for most sectors, including automobiles, mobile phones and consumer electronics.

-

Ukraine is a key supplier of raw materials such as semiconductor-grade neon for the semiconductor manufacturing process. The nation yields about 70-80% of global supply. Neon is used in deep ultraviolet lithography, which accounts for 45% of neon demand.

-

Historically, the US sourced c.90% of semiconductor-grade neon from Ukraine, which is also a key supplier of critical gases such as xenon and krypton.

-

Russia produces palladium, a rare metal crucial for semiconductors and catalytic converters. The country also exports c.35% of its palladium to the US.

-

Russia is a major provider of metals such as aluminium, copper and nickel. Aluminium is used to manufacture semiconductor components and in wire bonding.

The conflict’s ripple effects could impact semiconductor capacity, increasing chip costs.

Semiconductor end markets will also face the heat, given the demand for palladium and nickel from auto manufacturers and battery makers, respectively. European semiconductor companies depend mainly on auto makers, with major device companies having 30-45% exposure.

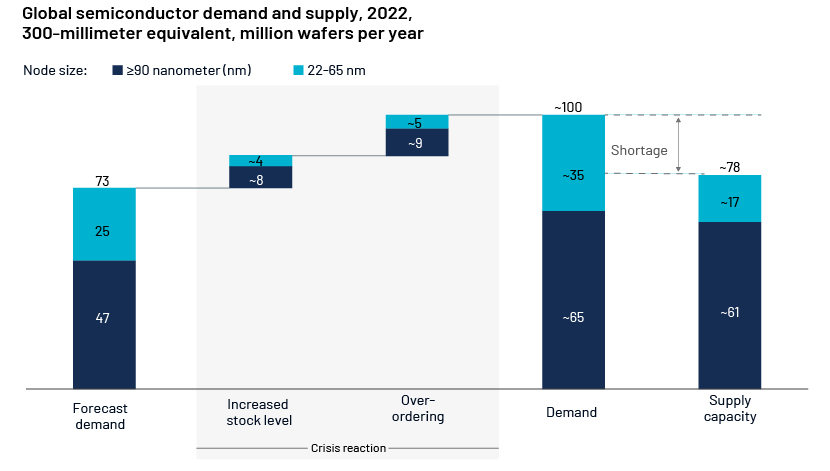

Global demand-supply gap – the result of the 2022 crisis

Supply-chain issues were prevalent before the pandemic. Other challenges such as natural disasters and geopolitical issues exasperate the problem. The sector is expected to face a semiconductor shortage in technology nodes for up to five years, according to a McKinsey analysis. The recent trend of over-ordering and increasing stock levels in automotive companies is also a contributing factor.

Leading companies feel the heat

Leading auto manufacturers such as Volkswagen, Renault, Ford, Jaguar Land Rover and Nissan have witnessed production cuts and halts in the supply chain. Consumer goods companies and smartphone makers are also finding it difficult to meet the growing demand for electronic products. The chip supply shortage has impacted Samsung’s TV and appliance production. Major technology companies such as Apple, LG and other Chinese counterparts were also affected.

SK hynix’s memory chip prices declined 20% as demand fell across applications. PC and smartphone shipments dropped, as datacentres using existing chip inventory were prioritised.

Despite concerns on macro headwinds, Advanced Micro Devices Inc. (AMD) expects the datacentre and embedded systems segments to lead, with growth expected from US hyperscale datacentres and continued share gains in embedded systems from defence, auto and networking. AMD’s sales growth is driven primarily by datacentres, embedded systems and gaming.

Taiwan Semiconductor Manufacturing Company (TSMC) planned to spend c.USD30bn on expanding production in 2022, cutting its gross margin to 49.5% from 51.5%. The company will build a second chip plant in Arizona and increase the initial investment to USD40bn. The first fabrication centre will be active by 2024; the next will focus on 3nm chip production from 2026.

The top 10 OEMs reduced their chip spending by 7.6% in 2022, according to a Gartner study. Inflation and recession pressures led to a significant decline in demand for PCs and smartphones, impacting global manufacturers in 2022.

Recession risks see a steep drop in demand from manufacturers

Analysts predict that the chip sector’s inventory correction will see the worst drop in more than a decade, leading to a decline in sales.

The last big inventory correction in the global chip sector was in 2019. Months later, chip sales surged and chip stock prices climbed through 2021 and into 2022 due to growing demand for computers amid the pandemic and geopolitical tensions. Some automakers continued to face a chip shortage in 2H22. AutoForecast Solutions predicts a total of c.18m vehicles will be removed from production plans by end-2023 (since the beginning of the chip crunch).

Chris Danely, a Citigroup analyst, reiterates that the drop will be the worst in a decade or two, possibly since 2001. Every chip company and category is likely to suffer, he believes.

The sector’s fears are based on widespread concerns about chip inventory build-up amid the pandemic. Such concerns also worry chipmakers and their OEM buyers about the recent and ongoing global recession plus the decrease in demand for electronics and datacentre servers.

International Data Corporation (IDC) projects widespread electronics products will see a drop in shipments into the first half of 2023, which indicates the reduced demand. “There is a good chance the PC market will be down double digits this year and also decline next year by a smaller margin,” said IDC Program VP Ryan Reith.

Jack Gold, an industry analyst at J. Gold Associates, said it is difficult to assess the effect on the entire chip sector – across all segments of logic and memory. Demand has slowed for PCs, datacentres and cloud, but he expects a pickup in ARM-based chips built by hyperscalers.

The recession has hit top semiconductor companies. Micron missed estimates for the first quarter of 2023 due to weak chip demand. The company expects to lay off roughly 10% of its employees and suspend bonus payments in 2023.

EY reported in January that virtually all US CEOs surveyed expect a recession in 2023, although a milder one in the US (1,200 executives from 10 countries and 6 sectors were surveyed). “There are not a great number of layoffs (in semiconductor companies) across the board, and it’s much more about hiring freeze and then for anything not considered a strategic project,” said Ron Hofmeister, EY Partner and Global Strategy and Operations Semiconductor Leader.

How Acuity Knowledge Partners can help

We have been providing strategy research and analytics support to financial institutions, global banks and technology firms (including fintech, tech advisory firms and tech-focused investors) for nearly two decades.

With a strong technology background and experience, we support areas such as market study, industry intelligence, competitor benchmarking and market sizing for the continually evolving semiconductor market and other areas of the overall technology, media and telecom market. A number of clients also collaborate with semiconductor consulting firms like us to unlock new levers of business growth and unmatched returns on investment.

Sources:

-

Accenture supply chain experts' analysis of Ukraine war, SupplyChain Digital

-

Ukraine-Russia sector considerations: Semiconductor industry, KPMG

-

Chip industry faces bad downturn with recession fears, demand lag, FierceElectronics

-

How Russia’s Invasion of Ukraine Could Aggravate Semiconductor Market Dynamics, Gartner

-

Semiconductor shortage: How the automotive industry can succeed, McKinsey & Company

-

Russia's attack on Ukraine halts half of world's neon output for chips, Reuters

-

Sunny long term chip forecast seen for engineers and their bosses | Fierce Electronics

-

Navigating the Dynamics of the Chip Market: Cyclicality is Back (gartner.com)

Tags:

What's your view?

About the Author

Brinta is a part of Strategy Research team at Acuity Knowledge Partners, with research and advisory experience across domains such as Semiconductor, fin-tech, technology, besides working on bespoke projects in the strategy domain. He has worked on projects involving competitive intelligence, market entry & growth strategy, market sizing, industry profiles and benchmarking studies in his 10+ years of total experience.

He is responsible for project execution and delivery, works closely with client teams on research tasks and also have experience in stakeholder management. He has exposure and knowledge of proprietary databases such as Capital IQ, FactSet, PitchBook, and AlphaSense, among others.

Brinta holds an MBA in Marketing from..Show More

Like the way we think?

Next time we post something new, we'll send it to your inbox