Published on June 15, 2021 by Abhishek Modi

What happened?

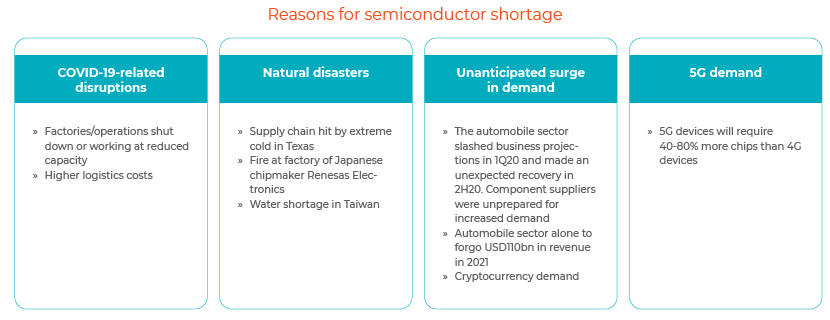

“We have never seen this kind of run rate in the semiconductor industry in the past 30 years”, said management of a semiconductor company on an earnings call. The shortage in the industry is unprecedented, driven by pandemic-related disruptions, natural disasters and an unanticipated surge in demand for products from TVs to automobiles.

The recent surge in infections in Taiwan forced some of the chipmakers to work at reduced capacity. King Yuan Electronics said it had suspended production for 48 hours, as of 5 June 2021, after 67 of its employees tested positive for COVID-19.

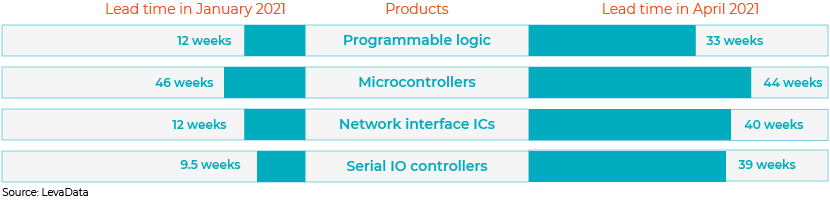

The semiconductor shortage that started with tightness in the 8” foundry has now expanded beyond 8” fabricated products to leading-edge products. Gartner expects device shortages to extend until 2Q 2022, while constraints in substrate capacity potentially extends to 4Q 2022.

Current and future trends and whom they benefit

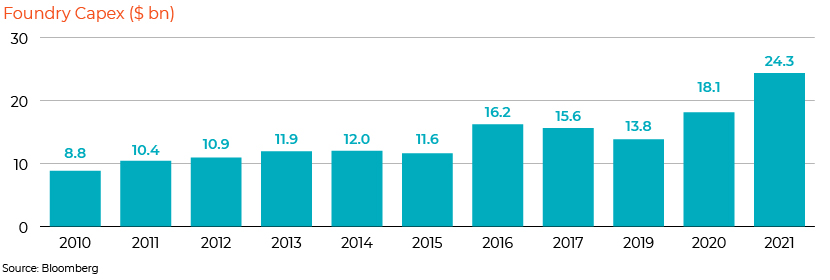

Increasing capex:

Companies are starting to increase capex; TSMC (2330 TT) has guided for USD100bn in capex in the next three years, while Samsung plans to invest USD150bn by 2030. This benefits the equipment suppliers.

Long-term agreements (LTAs):

Companies are securing LTAs with vendors. Industry sources believe UMC (2303 TT) has received capacity commitments from eight of its customers for a six-year period. Companies are also investing in their vendors to secure long-term supply. This helps component suppliers, providing better visibility on their orders.

Geopolitical dimension:

Following the US-China and Japan-Korea tensions, geopolitics is playing a role in investment decision making. The Biden administration recently highlighted the importance of a domestic supply chain in the US and announced a series of initiatives to promote semiconductor companies to produce locally. About USD50bn of President Biden’s USD2tn infrastructure proposal is also earmarked for the US semiconductor sector. We expect this trend to pick up pace in the coming years.

Acquisitions:

With companies in immediate need of more capacity, acquisitions are also likely to increase. For example, 8” foundry capacity expansion is difficult due to the current equipment shortage, and existing players are likely to build capacity through acquisition. Expansion of global 8” foundry capacity is to be capped at 2% over the next three years, according to Bloomberg.

Double ordering:

Analysis of 1Q21 earnings shows lean inventory levels, but due to the acute shortage of some equipment, companies are ordering well in advance (non-committal orders), which could lead to double ordering. Watching end-market demand and companies’ inventory levels would, therefore, be key in 2H21.

Increase in prices of end products:

TrendForce expects DRAM prices to increase by 18-23% in 2Q. Prices of other components are seeing similar increases. Such price increases will be ultimately passed on to the end consumer, making TVs and PlayStations more expensive.

How Acuity Knowledge Partners can help

Global investment banks and asset managers leverage our sector-specific experience to rapidly increase internal analyst bandwidth and expand coverage. We set up dedicated teams of analysts (CAs, MBAs, CFAs) to support our clients on a wide range of activities including idea generation, financial analysis, thematic research, building databases and providing regular sector coverage. Our expertise in working with semiconductor consulting firms further enhances our ability to address industry-specific challenges and deliver tailored solutions. Each output is customised, based on the client’s requirement, and made available for their exclusive use. This ensures our clients a unique, sustainable edge.

Sources:

Gartner Says Global Chip Shortage Expected to Persist Until Second Quarter of 2022

Structure of chip industry hinders supply chain recovery – Nikkei Asia

How a perfect storm created the global chip shortage – Nikkei Asia

Shipping during COVID-19: Why container freight rates have surged | UNCTAD

King Yuan to shut plants for 48 hours – Taipei Times

What's your view?

About the Author

Abhishek Modi is a CFA charter holder with 8 years of experience in equity research. Currently, is an Assistant Director at Acuity Knowledge Partners and is proficient in semiconductor industry where responsibilities include supervise all the deliverables closely including quality assurance, workflow management and client relationshipss and provide the technical know-how to team in case of any support.

Like the way we think?

Next time we post something new, we'll send it to your inbox