Published on June 22, 2023 by Maruti Patnaik

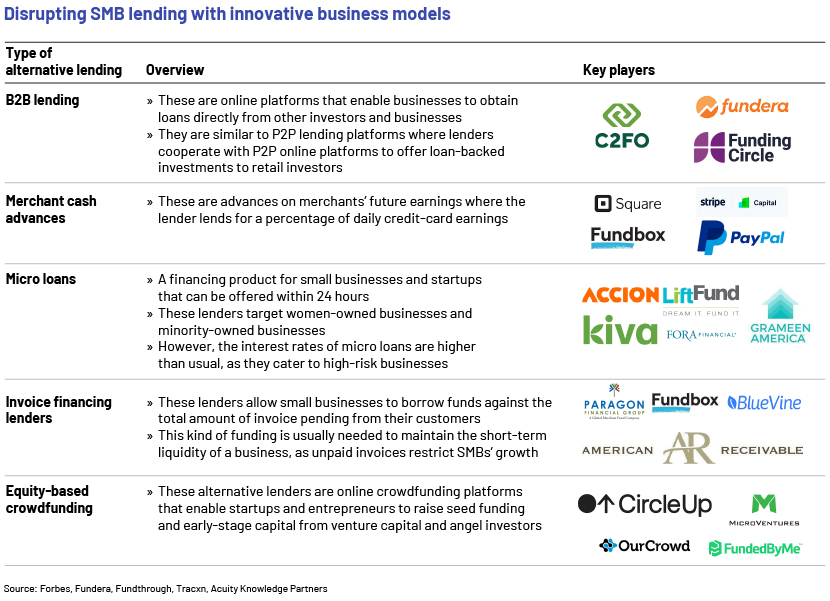

Alternative lending refers to loan options available to consumers and businesses other than those options from traditional banks. Fintechs and non-banking companies have been entering the alternative lending market to offer customised lending products that suit a particular geography, demographic or vertical. Alternative lenders are disrupting the market with innovative technology-driven models with quicker underwriting capabilities to determine appropriate loan pricing, terms and amounts.

Alternative lending – a new-found capital source for small to medium-size businesses (SMBs)

Alternative lending/alternative finance has been gaining momentum for quite some time, shifting the dynamic of loans from traditional banks to web-based innovators that offer speed, flexibility and accessibility to small businesses and startups. New entrants with new-age business models are taking the opportunity to transform the market.

Digital lenders and aggregators that offer loans to startups and fintechs are trying to attract the younger population with their online platforms that have the flexibility to compare rates, terms and maturity. Additionally, they are eliminating the existing pain point of high response time by digitalising the entire workflow – from application and onboarding to disbursements.

SMBs need substantial annual revenue, consistent cashflow, high credit scores, asset ownership, strong debt-to-income ratios and longer time in business to qualify for a traditional bank loan. New-age digital lending players, however, follow relaxed qualification criteria, especially around credit scores, annual revenue and business history, enabling high loan-approval rates. As alternative lenders have less stringent requirements than traditional banks for providing loans to small businesses, loan-approval rates of banks are lower than those of alternative lenders (approval rates of banks ranged between 14.2% and 21.3% as of February 2023, while the rate for alternative lenders stands at 27.9%).

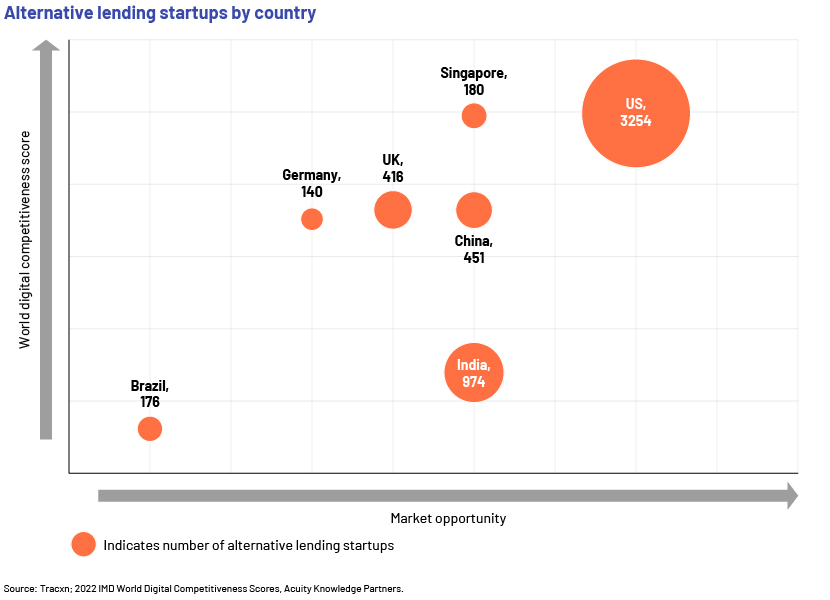

The figure below highlights that the US and India have a high number of alternative lending startups. Market opportunity in Brazil is lower than that in other countries such as Singapore, China and India. Higher competition among fintechs in the US (owing to better digitalisation and access to capital) increases resistance for new alternative lenders to enter the market, while lower digitalisation in Brazil has stunted growth of alternative lenders in the country. Relaxed regulation for fintechs in countries such as the UK, India and Singapore, coupled with better digitalisation infrastructure and less competition, makes these countries a safe option for alternative lenders.

Artificial intelligence (AI) – an imperative and game-changing ingredient for alternative lenders

Alternative lenders use more than just traditional credit scores for loan approval. The use of AI platforms and algorithms to assess their digital footprint such as rental payments, telecom bills, account transactional behaviour and social media engagement offers a better picture of the creditworthiness of SMBs. Lenders evaluate multiple data points that focus on the businesses’ financial discipline, stability, reputation and intent of repayment before offering financing.

OppFi, a 10-year-old fintech platform based in Chicago, uses an AI model, real-time data analytics and a proprietary scoring algorithm to automate the underwriting process. It also generates a customer’s credit scores by analysing, for example, online shopping habits and income and employment information. SoFi, a digital personal finance company, partnered with Pagaya to leverage its machine-learning models designed to reduce risk for lenders and make informed credit decisions.

Alternative lenders offer better personalised financial solutions than traditional banks using AI. LoanSnap Inc., a five-year-old startup based in San Francisco, leverages AI to scan financial information (student-loan interest, credit-card debt) and then factors in the data to package a mortgage-payment plan for a customer. Shopify Capital uses machine-learning models to identify eligible merchants based on their sales history and store performance.

Large banks have rigid policies and structured loan offerings not suitable for small businesses, whereas alternative lenders use AI and analytics to improve their operations around onboarding, credit scoring, customer experience and personalised offerings.

Banks – navigating the new market and challenges from fintechs

SMEs play an essential role in larger economies, particularly in developing countries. They represent up to 40% of national GDP in emerging countries. Although they still face increased resistance when trying to obtain loans from established financial institutions, traditional banks have started to explore this potential market, seeing how the alternative lending sector could pose a threat.

Banks with large asset bases have started building online lending units that cater to SMBs, but still do so in partnerships, as highlighted below:

-

JPMorgan Chase started offering online loans to its existing small-business customers in 2016 in partnership with OnDeck Capital to speed up its lending decisions.

-

Barclays launched GBP100k of unsecured lending in 2018, allowing SME clients lending limits of up to GBP25k via mobile and online banking, which they can apply for digitally, and receive within a day.

-

Standard Chartered and digital credit platform Kredivo partnered in 2021 to integrate the digital onboarding and credit application process to accelerate its SMB lending process.

-

Banco Santander is collaborating with Spain’s Openbank to launch a digital lending unit in Mexico by the end of March 2024; Santander launched Openbank digital operations in Argentina in 2022.

Although the market is seeing traditional banks evolving to cater to the organised SMB sector, as far as competition in the sector is concerned, large banks have made little progress in serving the growing SMB lending market. Alternative lenders would have an edge in setting up in the emerging sector, as they may not face high competition from traditional banks.

SME Finance Forum estimates that 131m firms, or 41% of formal micro, small and medium-size enterprises (MSMEs), in developing countries have an unmet financing need of USD5tn every year, which is 1.3 times the current level of MSME lending. This is a large market to tap into, and alternative lenders are better equipped with their flexible platforms and technology infrastructure to bridge this market gap. On the other hand, traditional banks have the advantage of already having the physical infrastructure and capital and would only require engagement with fintech and investment in setting up a division to target SMBs. Overall, banks have been passive and been making only direct equity investments in fintechs or engaging through soft-touch accelerators. Therefore, the alternative lending sector faces considerably low competition from banks in the current circumstances.

Regulation – a weak link in the SMB lending market

Fintechs disrupt core financial services and as small digital lenders scale up, both consumers and lenders are exposed to higher risks in the market. Digital lenders have smaller buffers against losses, as they tend to be more un-collateralised. This further extends their exposure to liquidity risks and creates competitive pressure on traditional banks. In addition, leaders set operational standards to attract market share and follow aggressive growth strategy. This leads to cutting corners around data privacy standards, onboarding guidelines and loan-approval criteria. Businesses could even use digital lending routes for money laundering. As a result, both customers and lenders are exposed to higher risks during economic downturns. Therefore, it becomes essential that financial regulators set entry standards, an operational framework and digital data privacy laws to protect digital lenders and consumers.

As digital lending companies gain prominence, government watchdogs are proposing norms for regulating this sector.

-

South Korea became the first country in the world to establish laws dedicated solely to digital lending in 2020. South Korean lenders are required to have capital of at least USD421,000.

-

The Reserve Bank of India (RBI) set up a working group on digital lending in 2021 to address business conduct and customer protection concerns arising from digital lending activities. In September 2022, the RBI issued guidelines to all lenders, including banks, to protect the data of borrowers using digital lending apps.

-

The Central Bank of Kenya also enacted regulation that requires digital credit providers to obtain a licence and disclose their sources of funds.

-

Providers of marketplace lending products in Australia are required to hold an Australian Financial Services (AFS) licence, and an Australian credit licence if the loans extended through the platform are consumer loans.

-

The Central Bank of Brazil announced stricter regulations for fintech firms,creating tougher standards for required capital.

-

In May 2022, the European Banking Authority stated that regulatory regimes for non-bank lending remain largely non-uniform across the EU and suggested strengthening the authorisation and admission requirements to create a more effective oversight framework.

Although many countries are striving to regulate this sector, there is a clear absence of a structured regulatory framework to govern the alternative lending market. Developed countries such as the US and the UK have fintech frameworks for financial services but are still unable to keep up with the new fintech models. Therefore, a more aggressive framework and standards are needed to monitor and manage the digital lending sector.

Flexibility is key for succeeding in the growing alternative lending sector

The number of alternative lenders to the SMB market has grown in recent years, but their survival depends on their continued investment in new technologies to make the lending processes smoother, faster and more streamlined for SMBs. Regulations and data protection and privacy standards imposed by governments are expected to become stricter in the coming years. As such, digital lenders would need to keep abreast of regulations being introduced in the market, monitor new entrants coming in with new disruptive technologies, and identify gaps that traditional banks have not yet bridged.

How Acuity Knowledge Partners can help alternative lenders

We have the expertise to support fintechs and work with digital lenders’ sales and marketing teams to track the development of infrastructure and technologies pertaining to the fintech and digital lending sector. We can also help identify strategic moves by competitors and analyse their key performance indicators. Having a better grasp of the changing regulations and evolving technologies would help digital lenders navigate the evolving market.

Our unique approach, combining process, people and technology in the fintech domain, helps deliver faster results and drives excellence for our clients. A number of our clients leverage our proprietary suite of business excellence tools and offerings to unlock new levers of business growth and unmatched returns on investment.

References:

-

https://www.fundera.com/business-loans/guides/alternative-lending

-

https://www.convergehub.com/blog/merchant-cash-advance-alternatives

-

https://www.forbes.com/advisor/business-loans/equity-crowdfunding/

-

Chase Quietly Launches Its Online Small-Business Loan Platform | American Banker

-

Digital lenders in Kenya must disclose source of funds as new law takes effect | TechCrunch

-

Digital Lending Market Size, Trends and Forecast to 2030 (coherentmarketinsights.com)

-

EBA publishes its advice on non-bank lending activities (stibbe.com)

-

Santander's Mexico arm to launch digital bank by March 2024 | Nasdaq

-

A look at nonbank loans and the alternative lending industry business model in 2022

-

Financial-Technology Firms Tap AI to Reach More Borrowers – WSJ

-

Fintech and Banks: Four Ways Banks Can Respond Better | Toptal

-

World Bank SME Finance: Development news, research, data | World Bank

Tags:

What's your view?

About the Author

Maruti has more than 8 years of experience in technology research and consulting. He currently works with the marketing and research teams of a leading fintech. He has worked on a wide range of projects within the FinTech domain and is proficient in competitive intelligence and product assessment of FinTech platforms.

Prior to joining Acuity Knowledge Partners, Maruti worked for GlobalData where he worked on areas around emerging themes such as AI, business intelligence and cloud.

Like the way we think?

Next time we post something new, we'll send it to your inbox