Published on May 2, 2024 by Piyush Shrivastava

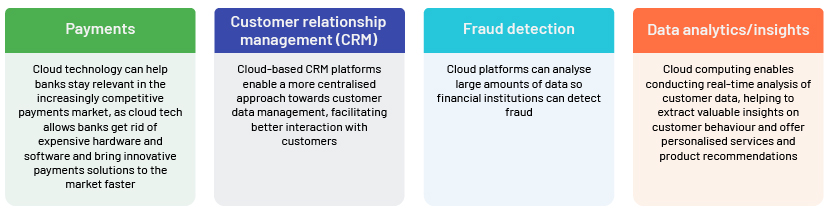

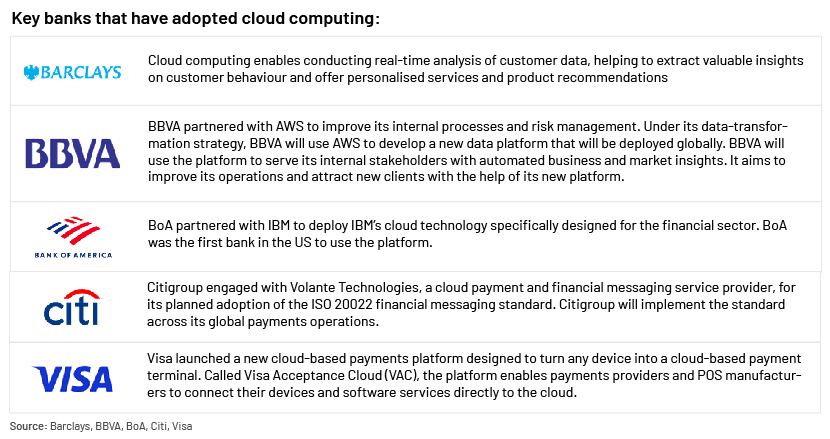

The rising influence of fintechs and neobanks has created a sense of urgency for banks around the world to keep up with the advancements in banking technologies. Banks are working to reduce costs and increase efficiency of their business processes to compete with emerging fintechs. A primary reason for banks upgrading their technology infrastructure is the rapid pace of digitalisation due to the limitations imposed amid the pandemic. This is where cloud technology comes in, with the potential to transform key areas of the banking landscape including payments, CRM, fraud detection and analytics.

Key areas of application:

Benefits

Cloud-based technology is witnessing significant growth due to its benefits for merchants. The following are some of the key benefits of adopting cloud-based technology:

-

Faster payment processing: Cloud providers offer the necessary tools for faster and compliant payment processing. For instance, cloud POS plays a pivotal role in strengthening the adoption of cloud technology by the global payments sector. It offers seamless connectivity to cloud servers, ensuring faster payment processing and lower installation costs.

-

Cost reduction: Operating on cloud technology is less expensive than working with traditional IT infrastructure, which includes costs of server maintenance and on-premise data storage. Cloud computing also helps businesses keep pace with the constantly evolving technological landscape, reducing expenditure on hardware that will likely become redundant in the future.

-

Scalability: Cloud-based systems are mostly developed using application programming interfaces (APIs), which are highly flexible in terms of scalability and customisation, enabling businesses to easily modify or expand their setup as needed.

-

Improved security: Contrary to general belief, cloud-based systems are more secure than physical IT infrastructure, as most cloud payment systems are already compliant with advanced data security standards such as PCI DDS. Deploying a cloud network also saves expenditure on experts on compliance-related matters.

-

Positive environmental impact: Adopting cloud computing reduces banks’ and fintechs’ overall carbon footprint.

Challenges

Despite the benefits of cloud technology, there are critical challenges that banks need to consider before adopting it:

-

Privacy and security: Cloud service providers deploy the most advanced security features in their cloud offerings. However, there have been instances where hackers have gained access to sensitive information stored on the cloud. Despite its being touted as the best alternative to hardware IT infrastructure, a large number of banking executives are sceptical about outsourcing the storage and maintenance of their customer and business data.

-

Unexpected downtime: Unplanned server outages could be disastrous. Customers expect banking and payment services to be available 24x7 throughout the year, and financial implications of an outage could be significant. Repeated outages could damage the reputation of the business as well.

-

Speed/latency: Latency is defined as the time taken to transfer data from a server to the user. In the banking landscape, speed is considered to be an important factor in enhancing the customer experience. Banks or fintechs that use a third-party cloud service provider depend on the provider’s efficiency to service customers. High latency could lead to delay in the completion of real-time transactions, damaging a bank’s business and reputation.

-

Managing multiple cloud providers: If a firm employs the services of multiple cloud providers, there could be a high likelihood of interoperability issues or a lack of flexibility. When more than one cloud service provider is involved, financial institutions need to ensure that all of them follow the same security protocols and standards to ensure a smooth functioning.

Conclusion

Cloud technologies are building a strong foundation for global growth in the banking and payments space. Cloud-based technology would continue to emerge as an economical alternative for banks and fintechs versus maintaining expensive legacy physical infrastructure. Despite the challenges relating to the adoption of cloud technology, increasing competition would continue to prompt businesses to adopt cloud technologies that would eventually enhance the customer experience and increase revenue for retailers and merchants.

The global payments sector continues to evolve, and cloud POS is at the centre of this evolution. Our next blog will show how cloud POS is boosting the development of cloud payments.

How Acuity Knowledge Partners can help

We are well placed to help companies formulate strategies to grow their business, having provided strategy research support to stakeholders in the banking and fintech sectors for the past 20 years. With our strong experience in banking and fintech, we provide support in areas such as industry intelligence, financial analysis, competitor benchmarking and market sizing for the continually evolving banking and payments market. Our services deploy technology, research and data expertise, ensuring that the research we provide is technology-backed, is based on exhaustive data points and is driven by the best insights.

Sources:

-

https://gocardless.com/guides/posts/guide-to-cloud-based-payments/#

-

https://appinventiv.com/blog/cloud-computing-service-for-banking/amp/

-

https://www.rishabhsoft.com/blog/cloud-computing-in-banking-and-finance

What's your view?

About the Author

Piyush is part of Acuity Knowledge Partners - PE & Consulting team, wherein he has worked on projects for numerous clients across sectors including technology, banking, and payments. His functional expertise includes strategic research, industry trend analysis, company profiling, company strategy analysis, competitor benchmarking, and GTM market studies

Like the way we think?

Next time we post something new, we'll send it to your inbox