Published on December 14, 2023 by Vipul Gupta and Sahil Bansal

The US housing market, believed to be bigger than the US stock market, has come under pressure again, as the Federal Reserve (Fed) has raised the Fed funds rate aggressively to curb inflation. Outstanding mortgage debt, which was at c.USD13.3tn in 2022, is estimated to grow to c.USD13.8tn by end-2023 and c.USD14.1tn in 2024 in the US, according to a Mortgage Bankers Association (MBA) estimate.

Amid an uncertain geopolitical environment, the Fed has hiked the key rate 11 times from February 2022 to October 2023 to contain inflation as a result of pent-up demand amid the pandemic and supply-chain disruptions following the start of the Ukraine-Russia conflict. This has led directly to a cooling of the mortgage market and a significant drop in new-mortgage applications. In the event that the Fed does not hike rates, the MBA expects total mortgage origination to improve 19% to USD1.9tn in 2024, after a 26% decline to USD1.6tn in 2023 from USD2.2tn in 2022.

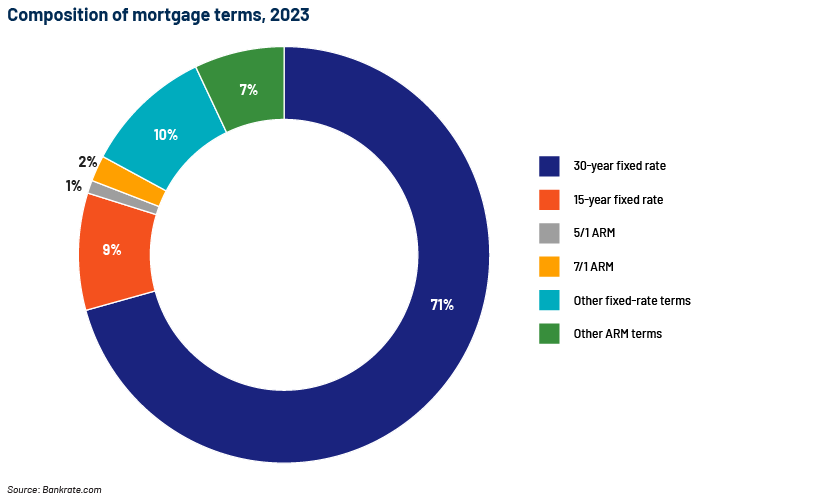

The following chart shows the current composition of mortgage terms and originations in the US:

Trends expected to shape the mortgage sector by end-2023 and in 2024

1. Interest rates expected to remain high until 2Q 2024

-

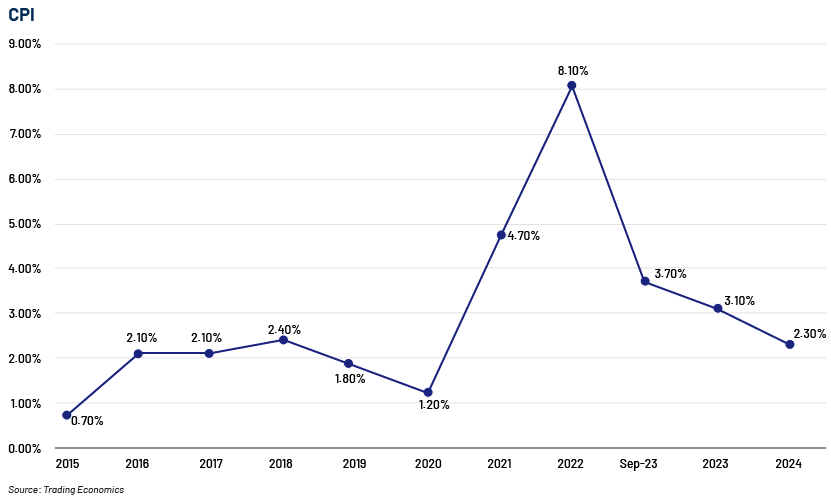

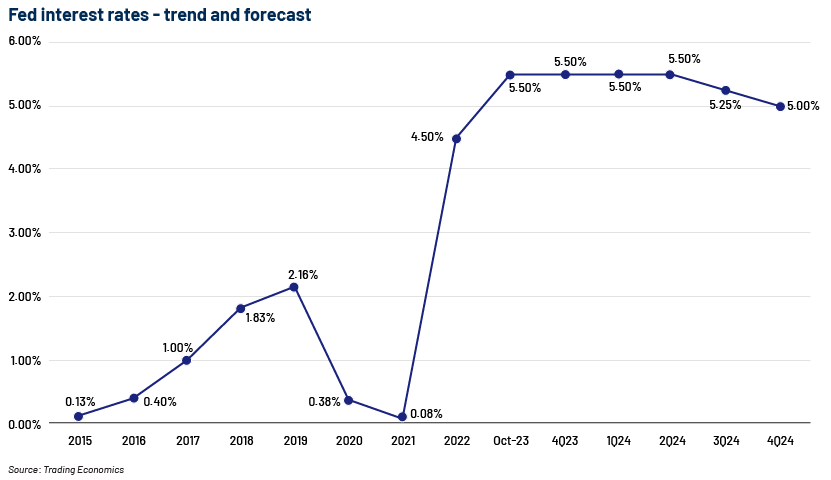

The interest rate is at its highest in 22 years – within a range of 5.25-5.50%, after a series of 11 hikes by the Fed by more than five percentage points in the past 16 months. This was halted in June, September and October this year, after the economy showed signs of an overall slowdown (e.g., inflation cooled to 3.40% in September 2023, driven by a decline in energy prices and weak consumer demand) and bond yields rose to levels not seen since 2007. Data published by the Department of Labor in September 2023 pointed to important underlying growth catalysts – subdued rent and lease growth compared to expectations, and a decline in air travel and other transport, medical services and gasoline prices. However, core inflation, excluding food and energy, ticked up, partially pulled back by healthy payroll growth especially in the healthcare, leisure and hospitality sectors. Energy prices may rise in the near term on the back of the conflict in the Middle East, challenging the Fed’s 2% inflation target.

-

The following graph is a snapshot of past and likely future trends expected in US inflation:

-

The following chart shows the historical trend in Fed rates and forecasts for 2024:

-

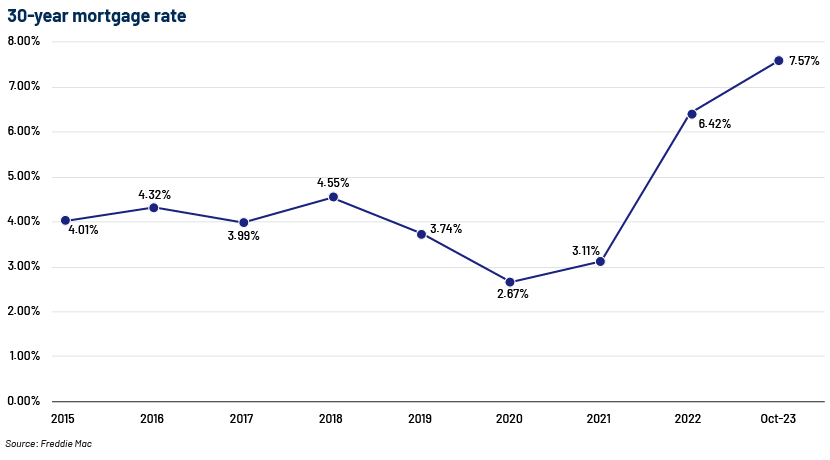

The following chart shows the trajectory of the 30-year mortgage rate, which closely tracks the Fed’s rate:

-

The volume of mortgage applications in the US mortgage market plummeted to the lowest in nearly three decades on the back of the highest interest rates (c.8.0%) in the past two decades. In terms of mortgage performance, the overall delinquency rate and foreclosure starts remained low, according to 2Q 2023 MBA estimates.

-

Demand for collateralised debt is expected to remain muted in the near term.

-

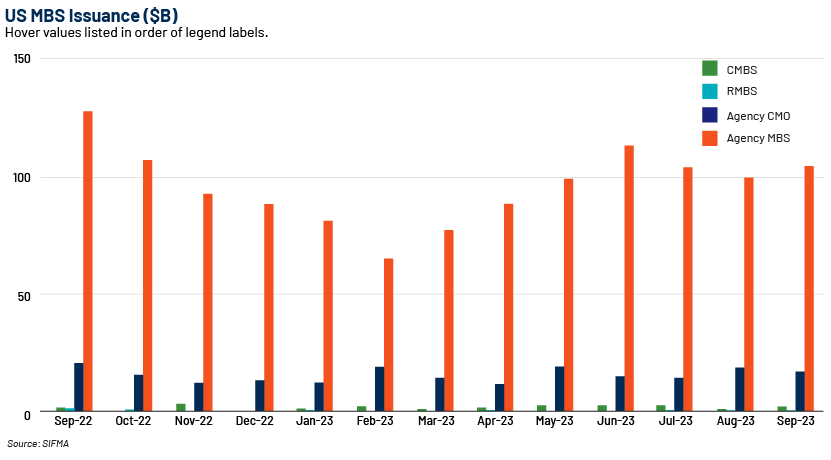

September 2023 MBS issuance stood at USD991.3bn, -45.4% year-on-year, according to a SIFMA estimate. The following chart shows the trajectory of agency and non-agency MBS issuance:

2. Home sales expected to remain subdued

-

The US mortgage sector derives revenue mainly from home-unit sales. The number of units sold and homeownership rates are key proxies of the health of the economy. Another important performance metric for the mortgage sector is the availability of fresh units. Amid the escalating-interest-rate environment, the cost of constructing a unit has edged up materially, limiting new supplies. Housing investment may continue to decline since the housing market has yet to find a new lower equilibrium.

-

The rise in mortgage rates has side-lined buyers as higher rates have crushed affordability, hitting the home-sales market. However, housing prices remain steady, with the reduction in supply seeming to have outweighed the decline in demand. The House Price Index increased 0.8% in July 2023, according to the Federal Housing Finance Agency.

-

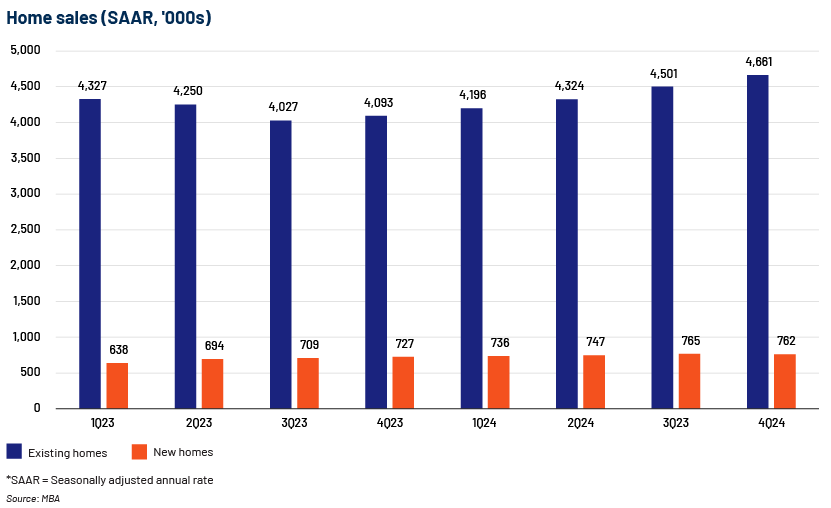

The following graph shows the sales trends for residential units and new constructions in 2023 and forecasts for 2024. Demand for homes is projected to rise if there are no more rate hikes by the Fed in 2024.

-

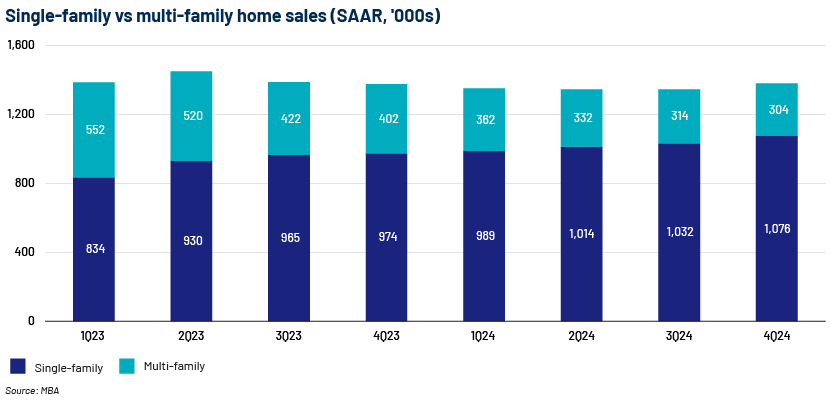

Multi-family home sales continued to drop further, sliding below 500,000 units in 2023, while single-family home sales picked up marginally in 2Q 2023 and 3Q 2023 but remained subdued. Overall activity is expected to pick up marginally next year (see chart below).

-

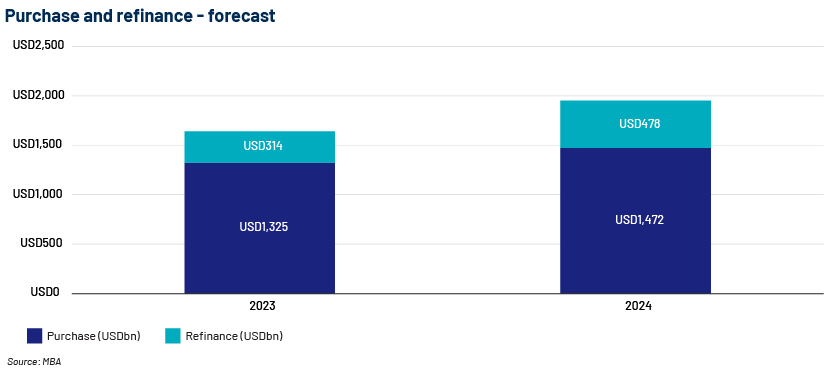

The following graph shows the trend in purchase and refinance originations in 2023 and forecasts for 2024. Refinancing has declined rapidly and is expected to remain low in the short term and pick up in the second half of 2024.

3.GDP growth expected to remain volatile

-

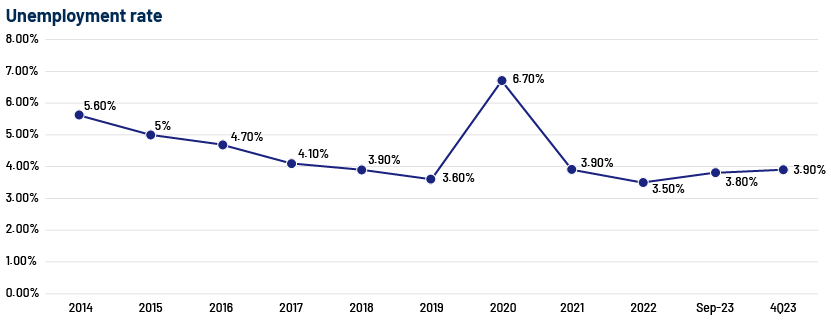

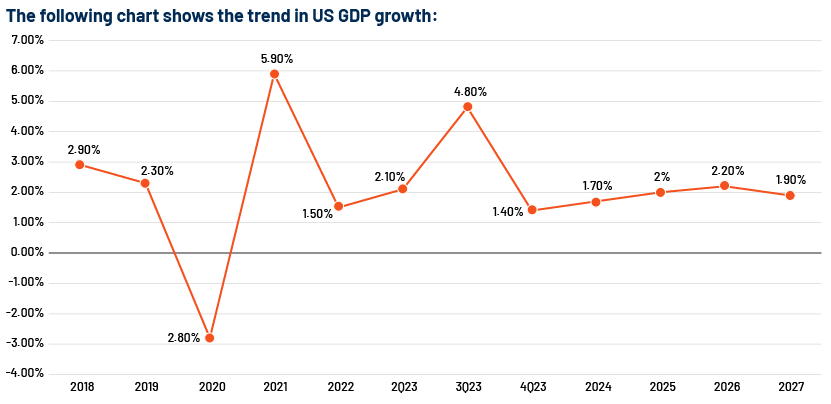

GDP is a major demand driver in the mortgage sector. 3Q 2023 GDP growth was surprisingly stronger than that in 2Q 2023, fuelled by consumer spending, government spending and an increase in non-residential fixed investment, according to early estimates of the US Bureau of Economic Analysis. This may reverse gradually as US consumption begins to soften and limit government spending owing to a reduction in discretionary outlays to avert the debt-ceiling crisis. Residential investment has softened significantly, due to high interest rates. On the other hand, commercial and industrial lending by banks continues to slow in the wake of the US banking crisis. The US unemployment rate is expected to remain at 3.8-4.0% by end-2023.

Source: economic-forecast-oct-2023.pdf (mba.org)

Source: economic-forecast-oct-2023.pdf (mba.org)

4. Third parties continue to optimise and streamline additional parts of the mortgage process

-

Many major banks and non-bank lenders have recently invested in either proprietary or third-party technologies across the value chain to smoothen their processes. These include modernising the front-end platform, workflow management, document extraction and management, appraisal management, automated compliance, employment verification and decisioning.

-

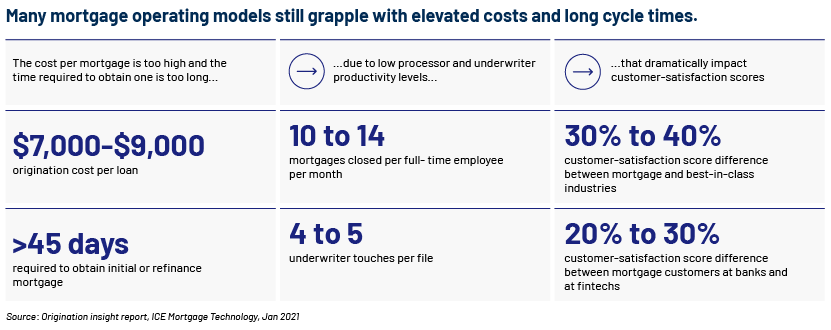

Many mortgage originators still follow traditional processes that can be easily automated; traditional processes result in high costs and long cycle times, as shown below.

5. Other trends to watch for at end-2023 and in 2024

-

Non-bank lenders’ market share continues to grow, driven mainly by a few players with a strong digital focus — a notable shift in mortgage industry trends. More and more technology-focused lenders are remapping front-to-back operating models, including streamlining document management.

-

Higher regulatory burden on lenders. With the implementation of Section 1071 of the Dodd-Frank Act, lenders need to furnish lending data to the Consumer Financial Protection Bureau (CPFB) on a regular basis.

-

Next-generation “subservices” introduce more efficient digital platforms. Subservices refer to experienced outsourcing partners that do not own the right to perform a service but perform it (including all administrative, compliance and financial activities) on behalf of a master servicer for a monthly per-loan fee. The market is experiencing a shift from in-house servicing to outsourcing, driven by increased regulatory scrutiny.

-

Companies bundle home-buying services, including mortgages. Customers are looking for bundled home-buying solutions. Research by the National Association of Realtors indicates that close to 95% of home buyers would consider a one-stop-shop model for their home-buying journey.

Strategies lenders are adopting to manage the current challenges

-

To cope with the increased cost of borrowing, banks have raised lending rates for retail borrowers and are focusing more on adopting new technologies to reduce costs. In line with market sentiment, and the drop in demand, banks are also streamlining their workforces. Mortgage giants, such as Wells Fargo & Co. and Rocket Co., trimmed their staff in 2022, while online lender Better.com has laid off about half its workforce since December 2021.

-

Credit unions and private lenders are offering more competitive rates than are traditional lenders. This is mainly because credit unions are typically responsible to their members rather than to shareholders. Moreover, although they offer the same products that a bank does, they are not subject to the same federal regulations, enabling them to serve riskier customers.

-

Many retail lenders are looking for offshore partners to reduce costs associated with hiring, training and onboarding staff and reduce office rent and maintenance overheads. Outsourced teams with relevant expertise that offer flexibility, agility and innovation can be deployed at a fraction of onshore costs. For instance, during the pandemic, Bank of America added close to 3,000 jobs in India to support an increase in retail and small business loans in its home market, the US.

-

Lenders are going beyond the traditional focus on sales and customer service and prioritising customer experience in response to the preference of retail borrowers. A BCG study confirmed that by personalising a customer’s journey, a bank could increase revenue up to USD300m for every USD100bn of assets it owned. Personalisation could also help improve loan-recovery practices. For instance, a 2018 McKinsey study indicated that engaging digital-only borrowers through their preferred channel of communication could increase loan instalment repayment by over 10%.

Mortgage-sector outlook

-

Banks do not expect a rate cut until 1H 2024. Their risk management strategies are expected to revolve around managing higher costs of funds and enhanced due diligence for new originations and refinancing.

-

Mortgage rates in the US mortgage industry are expected to remain high in the coming quarters. Rising mortgage rates mean fewer would qualify for a mortgage, leading to lower application volumes and prompting mortgage lenders and brokerages to reduce costs.

-

Ongoing geopolitical issues, such as the Russia-Ukraine and Israel-Palestine conflicts, may alter the abovementioned estimates.

How Acuity Knowledge Partners can help

We have nearly 20 years of experience in supporting global banks across the loan lifecycle. Our retail lending services offer origination, processing, underwriting, closing and post-closing support across consumer mortgage and other retail products, covering the range of basic to complex tasks. Leveraging a mix of people, process and technology, we provide tailor-made solutions to our 90+ banking clients in the retail, business, middle-market, real estate and leveraged finance segments.

References:

-

https://www.newyorkfed.org/medialibrary/interactives/householdcredit/data/pdf/HHDC

-

https://www.attomdata.com/news/most-recent/attom-q1-2022-u-s-residential-property

-

https://www.bankrate.com/mortgages/mortgage-statistics/#statistics

-

https://my.ibisworld.com/download/us/en/industry-archives/1354/0/0/pdf/

-

https://www.reuters.com/markets/us/banks-raise-fed-terminal-rate-forecasts-after

-

https://my.ibisworld.com/download/us/en/industry-archives/1295/0/0/pdf/

Tags:

What's your view?

About the Authors

Vipul Gupta has over 16 years of experience in working with leading global organisations in the banking and commercial lending domains. His expertise spans a broad range of credit analysis, financial modelling, portfolio management, leveraged lending, industry coverage and onshore client-facing roles. Vipul holds an MBA in Finance and a bachelor’s in mechanical engineering.

Sahil Bansal has over 7 years of experience in credit rating and underwriting. Working as a Delivery Lead with the Lending Services team at Acuity, along with handling the portfolio monitoring, he is actively involved in training, mentoring, MIS related activities and quality control of deliverables . Previously, he was associated with Credit Rating Agency as an Analyst in assigning external ratings to corporates having bank funding. Sahil holds a Post Graduate Diploma (Banking & Finance) and a Bachelors in Commerce.

Like the way we think?

Next time we post something new, we'll send it to your inbox