Published on January 5, 2023 by Gunjan Lahoty and Daanish Sharma

The world and financial markets had a tumultuous start to the 21st century. First, the dot-com bubble burst, and they saw the largest financial crisis in more than 70 years. This was followed by the European debt crisis and when things appeared to have turned positive, the pandemic. Amid every crisis, support from developed nations’ central banks prevented the financial markets from collapsing under the pressure. Now, however, with inflation at its highest in 40 years (at above 8%), these central banks have had to shift their focus back towards maintaining price stability, ending the era of extreme monetary stimulus.

Central banks have been raising interest rates and may have to continue doing so to cool inflation, the unintended consequence of which could be a global recession. Banks with exposure to leveraged companies would have to monitor new and existing credits more diligently due to the potential deterioration in asset quality and the volatility in asset prices caused by market fear of increasing default. Default rates are expected to rise further in 2023.

What does this significant change mean for the leveraged finance market in 2H23?

Rate and volume of default

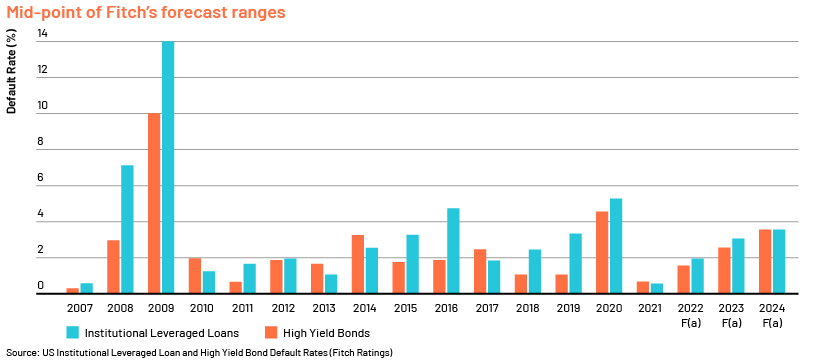

Fitch Ratings has forecast that the US institutional leverage loan default rate will increase to 2-3% in 2023 (in line with the 15-year average of 2.5%), versus previous forecasts of 1.5-2%, reflecting growing macroeconomic headwinds, including expectations of a US recession. In the US markets, S&P Global Ratings anticipates the speculative-grade trailing 12-month corporate default rate to reach 3.75% by September 2023. The rate for 2023 equates to roughly USD45bn in terms of volume, the third largest since Fitch began tracking in 2007, well below volumes in 2009 and 2020. The agency expects about 60 defaults in 2023, nearly double the 36 defaults averaged over 2016-19 and a sharp acceleration from the 21 defaults year to date in 2022. Loans issued in 1Q23 had an average leverage ratio (debt/PF adjusted EBITDA) of 4.7x, according to LCD data, one of the lowest readings in the past 10 years. Leverage ratios reached a peak of 5.3x in 2021, when demand for floating-rate debt spiked. Even activity relating to M&A (which carries higher leverage multiples) surpassed levels before the global financial crisis due to macroeconomic headwinds and the rising cost of debt.

For the first time in seven years, the leverage ratio (debt/EBITDA) of new-issue US leveraged loans has fallen below 5x due to the absence of leveraged buyouts (LBOs) in the broadly syndicated market. Many of the LBOs have moved to private credit from the traditional syndicated loan market as borrowers prefer to finance their deals with direct origination loans, to bypass the long process of undertaking a syndicated debt facility that is more vulnerable to financial market volatility, pricing uncertainty and delays in deal execution.

As the base rate has increased significantly and spreads have widened, leveraged loan new-issue yields have widened to an all-time high this year. The three-month term SOFR crossed 5% in April 2023, versus 4.6% at the start of 2023 and less than 1% a year ago. This has resulted in an increase in yield for loans to borrowers to 10.55% at issue in the broad single-B category, the highest level in the past 23 years and more than double that in 2021 (4.86%). Despite deals in the syndicated loan segment returning in 1Q23, risk appetite in the bank loan market remains muted, as indicated by the trends.

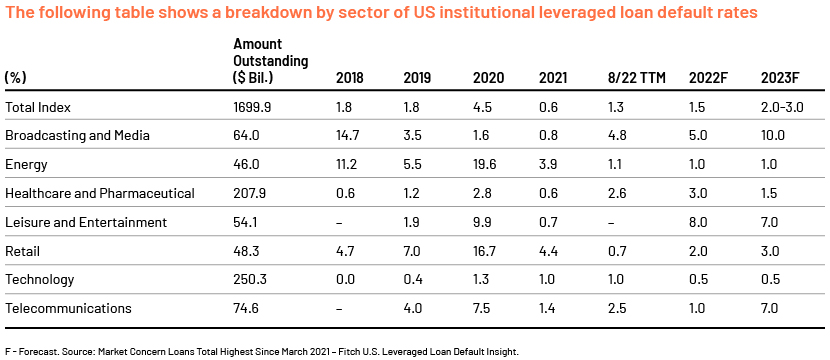

Sectors impacted: Media and telecommunications are likely to account for c.30% of default volume in 2023, resulting in default rates of 10% and 7%, respectively, primarily due to rising inflation, alternative distribution patterns, changes in the nascent technologies used by consumers and a slower recovery than expected from the effects of the pandemic. The technology and healthcare sectors are also likely to account for a significant share of default volume. Companies in these sectors already had high leverage and were further impacted by obsolescence owing to rapidly changing technology.

Fitch Ratings’ Market Concern total for US institutional leveraged loans rose to USD228.0bn in October 2022 from USD201.3bn in September 2022, the largest one-month increase since the start of the pandemic. The Market Concern total has increased by 39% since end-1Q22 and is the highest since end-2020.

Fitch Ratings’ September 2022 Other Market-At-Risk Issuer list shows new additions, with technology leading with 41% of new additions, healthcare/pharmaceutical with 23%, building/materials with 17% and banking/finance with 9%. Nearly 30% of the issuers at the top of the list, accounting for 19% of volume, have a term loan falling due before end-2023. These sectors need to be watched closely, as they may generate significant defaults in 2023.

Regulatory and economic factors

Introduction of new Basel reform:

After a gap of almost one year owing to pandemic-related delays, Basel 3.1 (also known as Basel 4) was implemented on 1 January 2023. It brings with it new government regulations and modifies the way in which banks account for base capital, credit risk and mandatory disclosures that may not be noticed by individual customers.

Impact of LIBOR transition on US CLOs

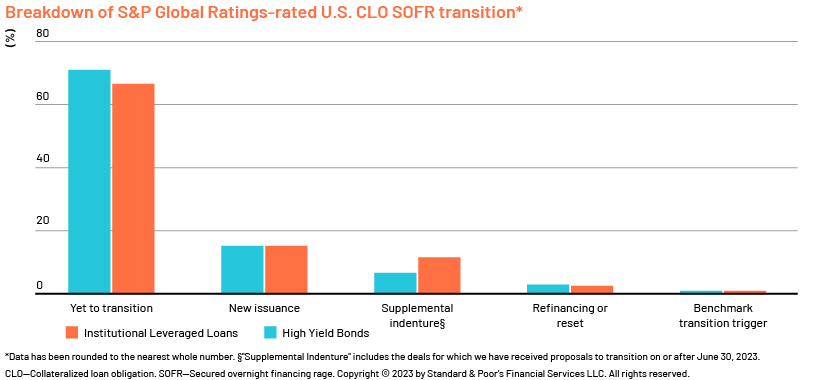

Since 1 January 2022, new deal issuances have not been using LIBOR as a benchmark rate. US collateralised loan obligations (CLOs) are in a state of transition to a new benchmark rate before the 30 June 2023 Adjustable Interest Rate (LIBOR) Act deadline. The Federal Reserve Board has endorsed a suggested rate of term secured overnight financing rate (SOFR) + credit spread adjustment (CSA) of 26 basis points (bps). As of 1 June 2023, approximately 31% of US CLOs (rated by S&P Global Ratings) were CME term SOFR-based, with the remaining 69% of the deals yet to make the switch (see chart below).

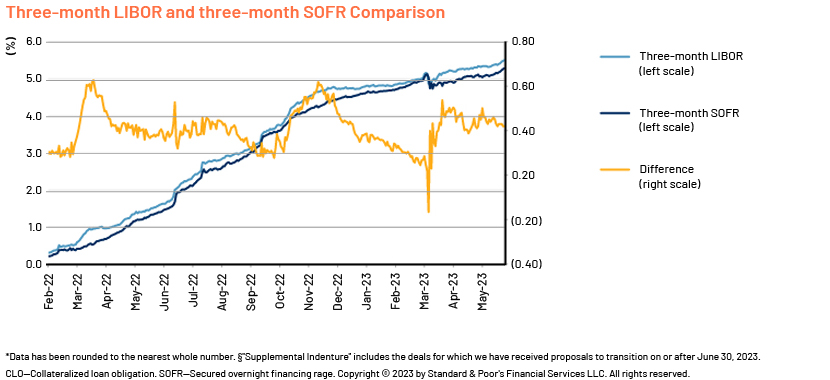

Due to the current economic environment, the pace of corporate loan issuance and refinancing has been slower than initially expected. The credit spread adjustment chart (below) shows the daily comparison between three-month LIBOR and three-month CME term SOFR rates starting from February 2022.

Geopolitical and macroeconomic uncertainties

Factors such as the conflict in Ukraine and its impact on energy prices, elevated inflation, corporate borrowers’ inability to pass on these prices to consumers, supply-chain disruptions due to the Russia-Ukraine war and lockdowns in China along with tightening monetary policy will likely continue to influence global financial markets. The Federal Reserve may keep interest rates on an upward trajectory to curb inflation. Market participants expect interest rates to have peaked at 5.0-5.25% in 2Q23. With a higher-interest-rate regime expected to be the norm in 2023 and a potential recessionary environment in 2H23, lenders would need to be cautious when providing new credit and more vigilantly monitor existing credit portfolios.

Sustainability and ESG debt financing

The issuance of environmental, social and governance (ESG)-linked debt financing (where the interest payable is tied to the delivery of ESG targets) increased four-fold to USD530bn in 2021, according to Bloomberg. With issuance of bonds with sustainability-linked pricing ratchets, issuers pay a lower coupon on their debt if pre-agreed ESG key performance indicators (KPIs) are achieved (or pay a higher coupon if targets are missed).

ESG debt financing is currently at a nascent stage in US leveraged lending markets. However, given the steps taken by the European loan market towards sustainability, this is a space to watch in 2023 as to whether the US debt capital markets can align their debt-financing goals with these sustainability targets to achieve a win-win situation.

The big question is how deep the recession expected in the latter half of 2023 will be. With demand cooling, how would highly indebted companies manage their cashflow, especially with refinancing options not being as cheap as they used to be? Banks would have to monitor their credits very carefully, and this would require enhanced expertise.

How Acuity Knowledge Partners can help

We continue to empower our stakeholders through ongoing monitoring of leveraged debt, delivering innovative solutions to new challenges, timely delivery of alerts on the latest news and detailed projections with quality credit reports to enable them to take action-oriented decisions.

Sources:

-

Finance outlook 2023 – Economist Intelligence Unit (eiu.com)

-

2023 U.S. Lev Loan Default Forecast Raised to 2.0%-3.0%; 2024 Projected at 3.0%-4.0%

-

Leveraged Loan Default Volume In The U.S. Has Tripled This Year (forbes.com)

-

Fitch U.S. Leveraged Loan Default Insight (Market Concern Loan Total Soars; YTD Default Rate

-

How leveraged loans can truly embrace ESG (fidelityinternational.com)

What's your view?

About the Authors

Gunjan Lahoty is a qualified Chartered Accountant and Company Secretary with more than five years of experience in financial analysis and credit underwriting. Currently , part of the Leveraged Lending team at Acuity Knowledge Partners handling US Corporate Clients. Prior to joining Acuity, she was part of Commercial Banking Credit Stewardship team of leading UK bank handling portfolio of Corporate and Commercial Clients.

Daanish Sharma has completed all 3 Levels of the CFA Program and has more than 3 years of experience in the Financial Services Industry. He is currently part of the Leveraged Lending team at Acuity Knowledge Partners handling US Corporate Clients. Prior to joining Acuity, he was part of Cirifort Enterprises Private Limited where he was a content writer for developing financial literacy courses

Like the way we think?

Next time we post something new, we'll send it to your inbox