Published on June 29, 2022 by Aditya Gupta

“Inflation is as violent as a mugger, as frightening as an armed robber and as deadly as a hit man.” – These words spoken by Ronald Reagan have come back to bite the world after over 40 years. Gerard Ford even tagged inflation “public enemy number one”.

So, what is inflation?

Inflation is often defined as the rate of increase in prices over a given period. It may be understood as an overall increase in prices or the cost of living in a country. From an everyday perspective, it may be calculated more minutely as a rise in expenses towards goods and services such as food, fuel and haircuts.

Whatever the context, inflation represents a loss of purchasing power. It means that the same amount of money can buy fewer goods and services over a period of time.

Current inflation scenario

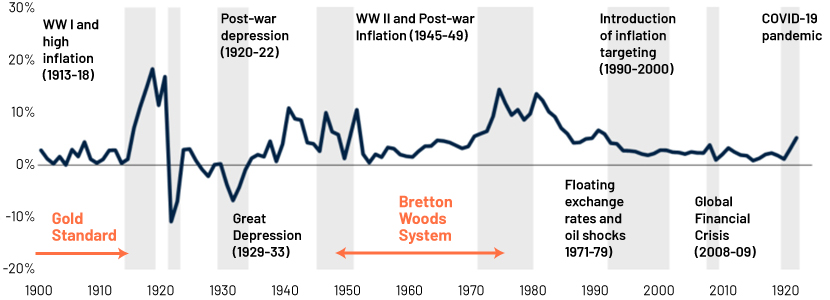

Since the early 1970s, the world had achieved a substantial decline in inflation on the back of structural factors such as major demographic changes, rapid technological development, improved policy frameworks and globalisation. However, the global inflation rate has risen steeply to over 6% since late-2020 because of singular policy support for inflation, pent-up demand, continued supply interruptions

and rising commodity prices. The price pressures were further intensified by Russia’s invasion of Ukraine in February 2022.

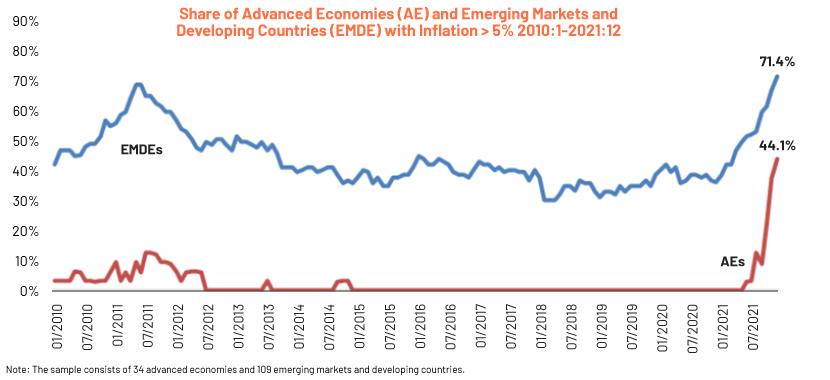

Inflation affects advanced and developing economies alike. According to the International Monetary Fund’s (IMF’s) World Economic Outlook, 15 of the 34 countries classified as advanced economies recorded 12-month inflation through December 2021 running above 5%. It has been more than 20 years since there has been such a large, widespread increase in high inflation (by modern standards).

Emerging markets and developing economies (EMDE) are facing a similar situation, with 78 out of 109 EMDEs experiencing annual inflation rates above 5%. In 2021, the proportion of EMDEs that recorded inflation of above 5% was nearly double (71%) what it was at end-2020. Inflation thus has become a global concern.

Five key drivers of the current inflation surge

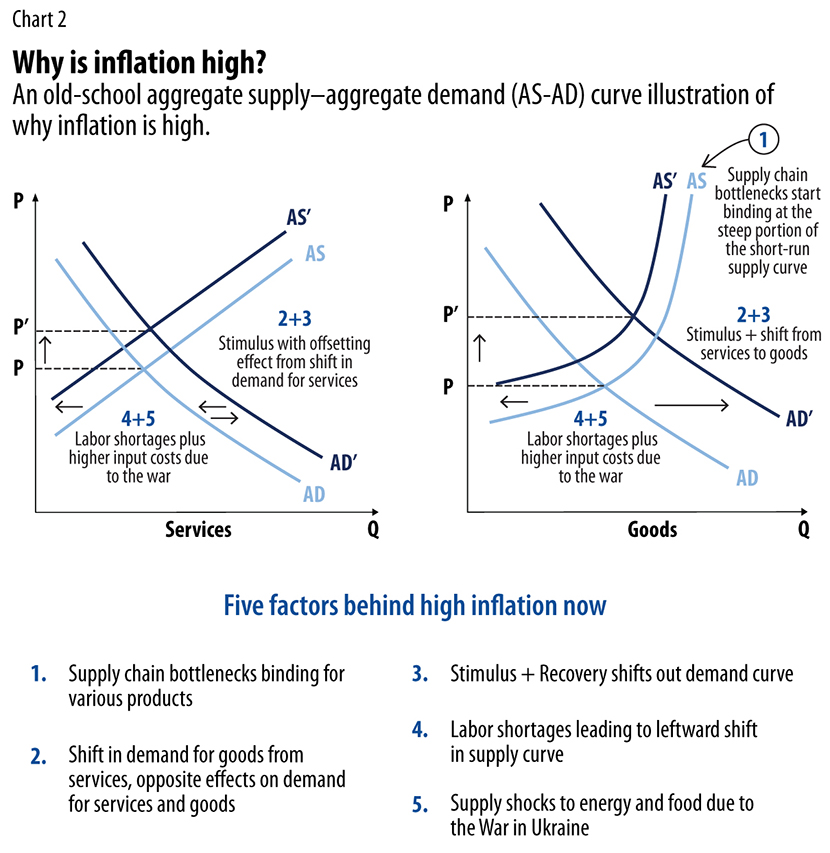

Supply chain bottlenecks:

Global supply chains were hit by the COVID-19 crisis in two different ways. In the initial phase, mobility restrictions caused short-term supply shortages due to disruptions in supply chains. However, the sharp increase in relative demand for durable goods, consumers’ hoarding and panic buying behaviours and strong overall demand following economic recovery led to supply chain bottlenecks in the later stage of the pandemic.

Shift in demand towards goods and away from services:

The pandemic resulted in a significant change in the spending habits of consumers. As a result, while service inflation rose only moderately, much of the increase in inflation in the short term reflected inflation in durable goods (including used cars). While such shifts only existed in the active phase of the pandemic, some aspects could persist given how the pandemic has changed society.

Aggregate stimulus and post-pandemic recovery:

Countries around the world announced c.USD16.9tn in fiscal measures to fight the pandemic, with advanced economies announcing relatively larger measures. The US alone announced a USD1.9tn fiscal stimulus (the American Rescue Plan). The stimulus undoubtedly helped people in tangible ways. However, there is also evidence that it likely stoked higher prices for the very people it was intended to help. The stimulus led to households running down savings accumulated during the pandemic (including from the stimulus and transfers), resulting in a surge in aggregate demand and a stronger-than-expected economic recovery. Though global supply chain concerns (and, more recently, the crisis in Ukraine) have been a major driver of inflation, the disparity between US and European inflation implies there is more to this. According to a recent study by analysts at the Federal Reserve Bank of San Francisco, the stimulus may have increased US inflation by roughly 3% by end-2021.

Shock to labour supply:

The pandemic caused labour disruptions that continue till date – more than two years since it began. Several countries still have low labour participation when compared with pre-pandemic levels. Among developed economies, the impact has been relatively larger in the US, where participation remains c.1.5% lower than pre-pandemic levels, i.e., roughly four million fewer workers.

Supply shocks to energy and food because of the Russian invasion of Ukraine:

The humanitarian crisis brought on by Russia’s invasion of Ukraine has been severe. In addition, the conflict has resulted in slower global economic growth and soaring inflation. The effects have been felt in three ways.

For one thing, price increases of commodities such as food and energy has raised inflation, lowering the value of incomes and reducing demand. Second, there has been an unprecedented influx of refugees in adjacent economies, along with disruptions in commerce, supply chains and remittances. Finally, weak investor sentiment and lower company confidence will negatively impact asset value, tightening financial conditions and potentially increasing capital outflow from emerging markets.

Countries with direct trade, tourist and financial exposures in Russia and Ukraine have been facing added pressure in addition to global spillovers. Moreover, budget deficits, trade deficits and inflationary pressures have increased in economies that rely on oil imports, although oil exporting countries (in the Middle East and Africa) have benefitted from higher prices.

The announcement in late March that the Russian Federation would seek payment in rubles for natural gas from “unfriendly countries” pushed up energy prices further in Europe. Food prices too have risen sharply; Ukraine and Russia account for about 30% of the world’s wheat exports, and the prices of the commodity have reached new highs. All of this has inevitably resulted in surging inflation for the global economy.

The fundamental causes of inflation are not the same in all nations, especially when comparing advanced economies and EMDEs. Many EMDEs do not match the criteria of “overheating”1, that is widespread in US discourse. This is especially true for the economies, where fiscal and monetary intervention in response to COVID-19 was minimal, and where economic recovery in 2021 lagged significantly behind the AE rebound. Hence, there is a need to evaluate the causes of inflation in different economies separately to devise a suitable solution.

Are higher interest rates the way to go?

The best disinflationary policies, those that look to lower inflation, are determined by the causes of inflation. In overheated economies, central banks can conduct contractionary measures to reduce aggregate demand, usually by hiking interest rates, if they are committed to price stability.

However, the most striking element of today’s inflation is its pervasiveness. The rising inflation around the world may be attributed primarily to supply side issues. Although certain supply shortages were expected as the global economy reopened following the COVID-19 lockdowns, they have proven to be more widespread and longer lasting than initially anticipated.

The evolution of global supply factors such as production or shipping constraints and input pricing is a major determinant in the persistence of inflationary pressures at the goods Consumer Price Index (CPI) and the Producer Price Index (PPI) levels. Given that these pressures are of a global nature and that they stem from supply-related factors (rather than demand), domestic monetary policy interventions would have limited impact on these sources of inflationary pressures.

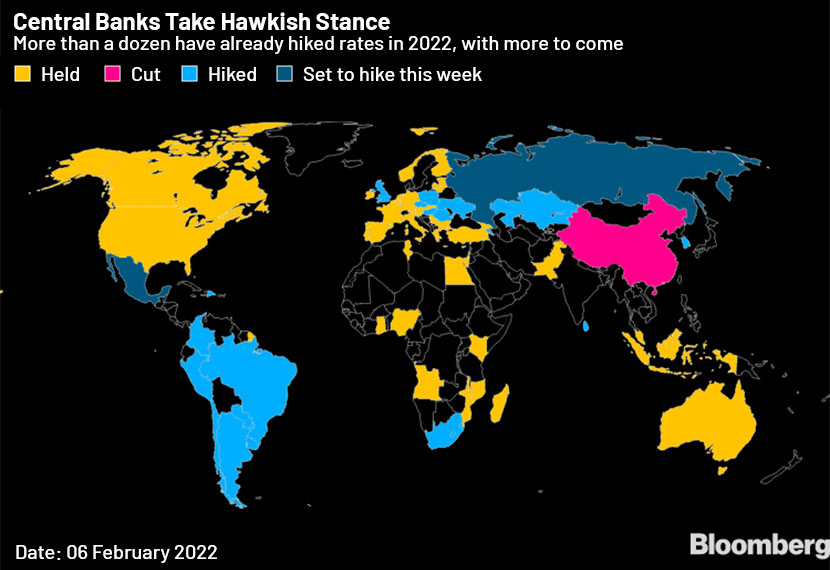

In March, the US Federal Reserve increased rates by 25bps for the first time since 2018 and followed this up with a 50bps hike in May. It also indicated at an aggressive path ahead, with rate hikes expected to be implemented at each of the remaining meetings in 2022, pointing to a consensus funds rate of 1.9% by year end.

In Canada, meanwhile, inflation concerns have driven its central bank to push ahead with a half-percentage point rate hike.

Asian economies such as South Korea, Singapore and New Zealand had already commenced their shifts away from pandemic-era monetary stimulus in 2021 due to rising inflation. At the same time, other countries, including the two largest Asian economies, China and Japan, have not indicated any intention to tighten their monetary policies.

However, there is an inherent risk to raising interest rates across the board. The whole exercise could turn out to be counterproductive if inflation starts fading on account of improving supply chains and a cooling off of commodity markets. This could lead to the monetary policy looking too tight – a situation the European Central Bank had faced a decade ago.

In the short term, EMDEs would not benefit from a more rapid and aggressive policy response from major central banks. Most would face higher funding costs, and debt crises for some would become far more likely.

Many strategists, including those at BlackRock Inc., argue that prices have been rising at a faster rate because of supply chain disruptions and that central bankers should accept this.

Conclusion

A substantial increase in interest rates across the board is a remedy worse than the problem. Lowering demand and increasing unemployment are not the best ways to solve a supply-side issue. If taken far enough, it may help to reduce inflation, but it will also wreck people’s lives.

Instead, targeted structural and fiscal policies focused at unblocking supply bottlenecks and assisting individuals in confronting today’s realities would be a more preferable approach. Food stamps for the poor, for example, should be linked to the cost of food, and energy (fuel) subsidies should be indexed to the cost of energy. A one-time “inflation adjustment” tax decrease for lower- and middle-income households would also enable them to navigate the post-pandemic transition. It may be paid for by collecting monopoly rents earned by oil, technology, pharmaceutical and other corporate behemoths who profited handsomely from the crisis.

Having said that, while such structural changes are unlikely to yield quick results, the long-term costs of postponing action are also likely to be higher. And if inflation persists, it may not be the type that can be controlled through monetary policy. Estimating the negative consequences, Bloomberg Economics states that if the Bank of England wanted to reduce inflation down to its target of 2% this year, it would have to raise rates to the point where 1.2 million people would lose their jobs.

The worldwide average interest rate is projected at 2% for end-2022, roughly comparable to the pre-pandemic level. For the time being, major central banks around the world have made moves that indicate at the most significant tightening of monetary policy since the 1990s. However, only time will tell whether these address the problem or worsen it.

Tags:

What's your view?

About the Author

Aditya Gupta joined Acuity Knowledge Partners in 2021 and has been associated with Investment Banking since then.

He has supported clients on a broad range of investment banking products including trading comps, transactions comps, financial benchmarking analysis, pitch books, company profiles, management biographies, newsletters and other ad hoc requests. He has been assisting senior team members in managing and executing various projects as well.

He has hands on experience on databases like Capital IQ, Mergermarket and Crunchbase Prior to joining Acuity, he underwent an articleship as required by the Institute of Chartered Accountants of India where he was involved in internal audit and taxation advisory, primarily for automotive..Show More

Like the way we think?

Next time we post something new, we'll send it to your inbox