Published on September 13, 2023 by Pankaj Bukalsaria and Oliva Rath

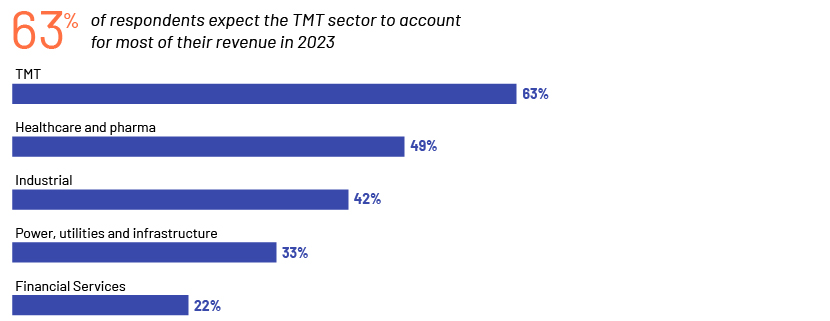

TMT, followed by healthcare and pharma, is expected to generate the most dealmaking opportunities and revenue for investment banking and advisory firms in 2023. Major companies in the TMT and healthcare and pharma sectors have solid balance sheets to cushion market pressures and make bold moves in the M&A space in 2023.

The factors that make it imperative for us to closely evaluate deal activity in individual sectors include:

-

Tailwinds are generally less evident and tend to be sector-specific. Hence, it is appropriate to evaluate market opportunities by sector

-

Some sectors rebound faster than others and pursue different strategies to thrive

-

Most investment banks and advisory firms are organised according to product, regional, and sector coverage Revenue for the different groups may vary in a given market situation

Technology, media and telecommunications (TMT)

-

We expect to see deals for building next-generation mega platforms as we move into a Web 3 world in the interactive media space

-

Aggressive technology companies are expected to take advantage of lower valuations and enter deals to accelerate business synergies

-

Financial sponsors have elevated interest in AI/ML, virtualization, and Cleantech deals

-

We also expect domestic consolidations or digital infrastructure deals to pick up in the telecommunications space. This sector has been consistent in garnering deals, as it is pivotal to many other sectors’ investment patterns and growth strategies

Healthcare and pharma (incl. life sciences)

-

The trend of mega deals in the healthcare and pharma sector is expected to continue in 2023, after it witnessed a remarkable spike in deal value in 2022, especially in the postpandemic phase

-

The sector has deep reserves of deployable capital, and companies could readily use them to fund strategic deals. The biopharma sector alone holds over USD1.4tn in deployable capital, according to an EY study, up 11% from 2021

-

Medtech and healthcare analytics companies in particular are likely to attract strong investor interest

Market challenges and uncertainties have often inspired innovation and encouraged companies to take bold actions. Download the full survey report now

Tags:

What's your view?

About the Authors

Pankaj has over fifteen years of experience in investment banking. He oversees multiple client engagements on front office research and analytics support across Corporate Finance / M&A, Capital markets including Islamic products, and Restructuring & Debt advisory. He has significant experience in working on Oil & Gas, Metals & Mining, Fintech and FIG sectors. A significant aspect of his work involves white boarding client requirements, proposing solutions and onboarding and managing client relationships across the globe, with focus on the Middle East, Africa and Asia. Prior to Acuity, he worked with UBS IB offshore team in India, where he led the set up and transition of Global Energy team..Show More

Oliva joined Acuity Knowledge Partners’ investment banking team in 2020. Well-rounded professional with 12+ years of experience in Investment Banking and Financial Services firms.

She has supported investment bankers on various pitches involving company/industry research, preparation of strategic research reports, pitchbooks, pre-IPO reports and investor PDIEs, competitive landscaping, market sizing & segmentation, case studies, macro-economic studies, and in-depth industry insights.

Extensive exposure in cross-industries primarily including FinTech, Insurance, Asset Management, Oil & Gas, Real Estate, Industrials, and Utilities. She has hands-on experience with prominent databases like Dealogic, Capital IQ, Factiva, FactSet, Pitchbook, and Crunchbase, along with other key industry associations.

Like the way we think?

Next time we post something new, we'll send it to your inbox