Published on September 30, 2021 by Vivek Lohumi

The full impact of the pandemic has yet to be determined, but the rapid rollout of vaccines has fuelled investor confidence, driving a faster global recovery than expected.

From individual preferences to government policies and the investment patterns of retail investors to big firms, strategies are being repositioned to weather the crisis. Investment in healthcare technology (healthtech), however, has remained robust.

Healthcare is a vital sector in any economy, from the perspective not only of protecting public health, but also of being a defensive sector in which to park funds. Technology helps gain access to health information on a real-time basis and develop tools and applications for the healthcare system, and many tech companies are foraying into the healthcare space to create synergies.

Global digital health

M&A investment overview

Transactions reached a record high 131 in 1H 2021, driven by rapid growth in the vertical software segment. Vertical software accounted for 88 deals in 1H 2020, a 20% increase from 2H 2019, followed by health IT services and BPO services.

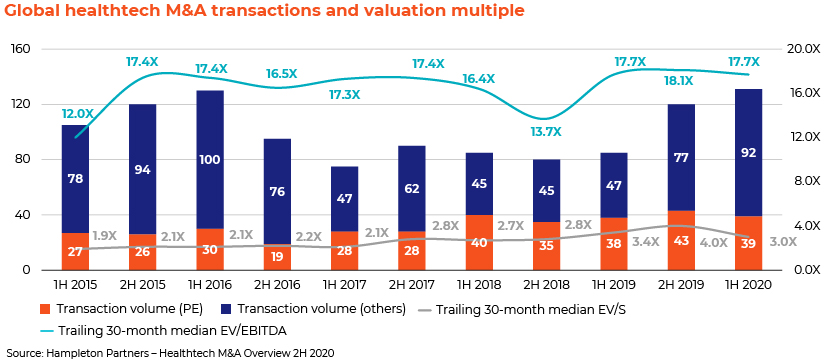

After a significant drop in transaction volume in 2016-17, deals picked up and reached a high in 1H 2020, although valuation multiples were slightly lower than in 2019, when a number of exceptionally-high-EBITDA-multiple deals were entered into.

US digital health funding (2011 to 1H 2021)

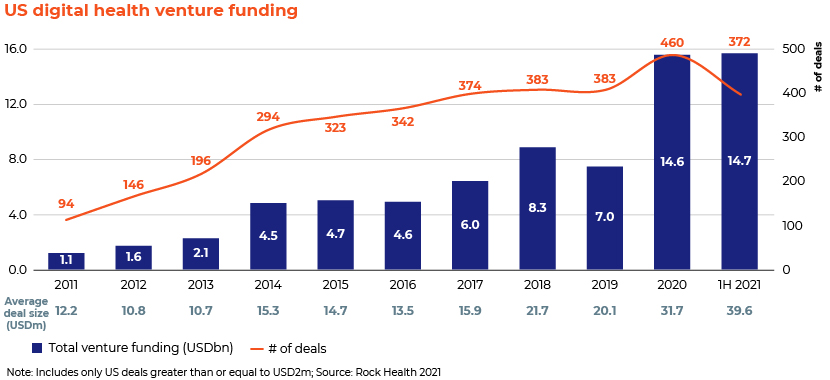

US digital health funding reached record levels in 2020 (and is expected to increase in 2021) on larger average deal sizes and more companies funded. Funding for a number of areas is increasing, with mental health being the largest with USD1.5bn in funding, followed by cardiovascular disease and diabetes. Oncology, despite losing its dominance, remained attractive for investors.

Digital health transactions in the US, by investor type (2016 to 1H 2021)

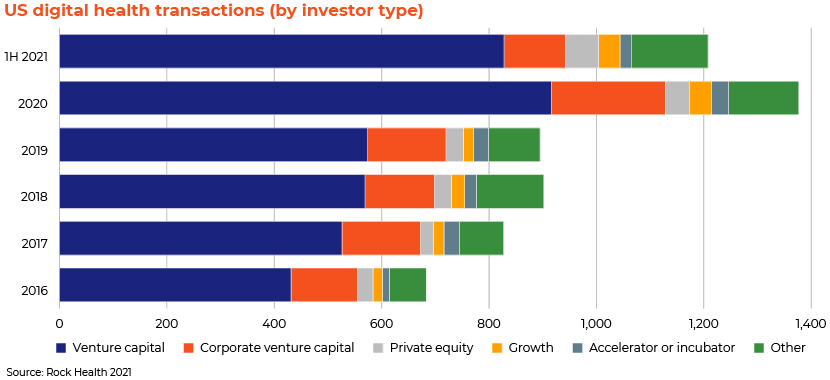

Corporate venture capitalists (CVCs) account for a large part of digital health investments, less than venture capitalists (VCs), but more than private equity (PE) investors.

CVCs accounted for 46% of investment in healthtech in 2020, versus 49% in 2016, as PE and growth capital investor interest increased. CVCs still dominate the deals, while PE and other investors find options within the subsector.

PE firms remain the main investors, but their share has declined since 2018. The complex business model is a major challenge for PE firms wanting to enter good deals, benefiting CVC groups that understand the business.

Notable healthtech solutions developed by tech giants

Many tech companies have forayed into the healthcare market to develop new solutions, accelerated by the pandemic that has driven the need for digital adoption.

-

Google: Google started investing in healthcare a long time ago; its cloud platform (Google Cloud) recently collaborated with Amwell Partner to transform patient and clinician telehealth experiences. Google has also rolled out electronic health record (EHR) navigation tool Care Studio (a clinician-facing search tool that helps organise a patient’s medical records) and announced an AI tool to determine skin problems.

-

Amazon: Amazon acquired online pharmacy PillPack for USD750m in 2018 and subsequently launched a pharmacy in November 2020, expanding its presence in the US.

-

Apple: In December 2020, Apple launched Fitness+, a subscription-based workout service built around the Apple Watch providing home-based workout programmes and tracking fitness goals.

-

Sony: Sony has introduced a number of solutions such as remote monitoring, medical imaging (the NUCLeUS™ smart imaging platform), surgical cameras and wearable devices (mSafety).

-

Microsoft: Microsoft transformed its healthcare portfolio through the Microsoft cloud last year, providing capabilities to manage health data for healthcare organisations while supporting end-to-end security, compliance and interoperability of health data. It has also introduced a new vaccine management platform.

US digital health transactions, by active CVC group

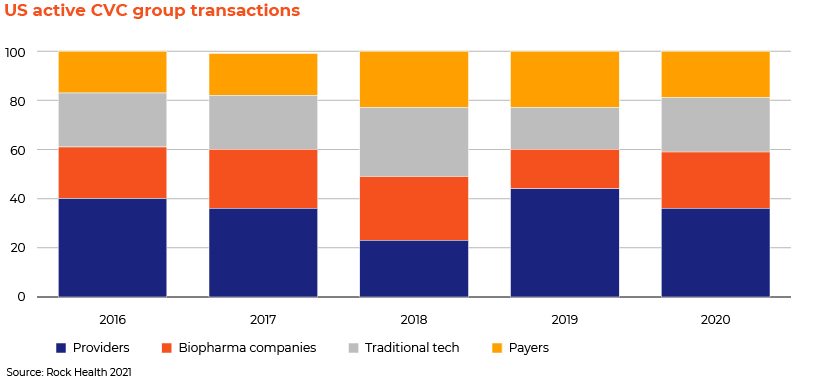

CVCs in the US are investing significantly. Within CVCs, transactions with biopharma companies and traditional tech groups increased 2.5x and 2.3x, respectively, in 2020. Provider and payer companies are also steadily acquiring healthtech companies.

A number of tech companies are now meeting the needs of healthcare companies. This has led to an increase in the number of digital health business models that need to be evaluated.

Conclusion

PE firms’ investment in healthtech is rising, as evidenced by the increasing share of late-stage investment. Rising digital adoption and growing consumer inclination towards telemedicine/virtual treatment may continue to increase demand for healthtech solutions.

How Acuity Knowledge Partners can help

We are experienced in helping PE/VC firms make sound investment decisions. CVCs have an advantage over other buyers in terms of understanding digital health business models, and we help them see the complexities inherent in niche business models and identify value targets based on the requirement.

Our strong team of professionals support investors with screening, due diligence and investment monitoring in a number of healthcare domains. For more details, please see our white paper on evaluating targets for investment in the healthtech subsector.

Sources

-

Deloitte Insights: Trends in health tech investments

-

Hampleton Partners: Healthtech M&A overview 2H 2020

-

Business Insider: Big tech in healthcare

-

Beckers Hospital Review: Recent big tech partnerships in healthcare

-

Harvard Business Review: How tech companies can help fix U.S. healthcare

-

Rock Health: H1 2021 Digital health funding

-

McKinsey: Private equity opportunities in healthcare tech

-

CityA.M.: Regulatory and legal challenges faced by Heathtech start-ups

Tags:

What's your view?

About the Author

Vivek has over three years of experience in the financial services sector. He is a key member of Acuity's Private Equity practice and supports mid-sized private equity clients with their research requirements.

Previously, he was associated with an Indian brokerage house and was involved in fundamental equity research for Indian companies – covered three initial coverages of leading Indian firms along with financial models and sector specific reports.

Expert in research, M&A deal support & valuations, market studies, benchmarking & mapping exercises. He is hand-on with preparing financial models, DCF, relative valuation, etc.

Like the way we think?

Next time we post something new, we'll send it to your inbox