Published on September 5, 2023 by Ashutosh Pandey

Key takeaways

-

Inpatient volumes are declining; hospitals are investing to meet increasing outpatient demand

-

Credit metrics of not-for-profit healthcare providers weaken as high wages and labour shortages remain the biggest challenges

-

Leverage may increase with providers needing to raise capital at high interest rates to fund deferred capital expenses and expand outpatient services

High wages and costly supplies continue to pressure margins in FY23. In 1Q23, higher operating costs, driven by increased personnel expense and costly supplies, led to margin erosion. This trend is continuing from FY22, when costs increased 10-15% y/y. On the other hand, reserves improved in 1Q23 due to favourable returns on investments. Moody’s downgraded 24 US healthcare providers to B3 negative or lower in FY22, representing a "material deterioration" in the sector's credit quality. The pandemic affected the financials of all healthcare providers, including the manner in which they offered their services, resulting in increased demand for outpatient care. US not-for-profit (NFP) healthcare institutions were able to survive the turbulence with the help of government support but are stressed now due to inflationary pressure and labour shortages.

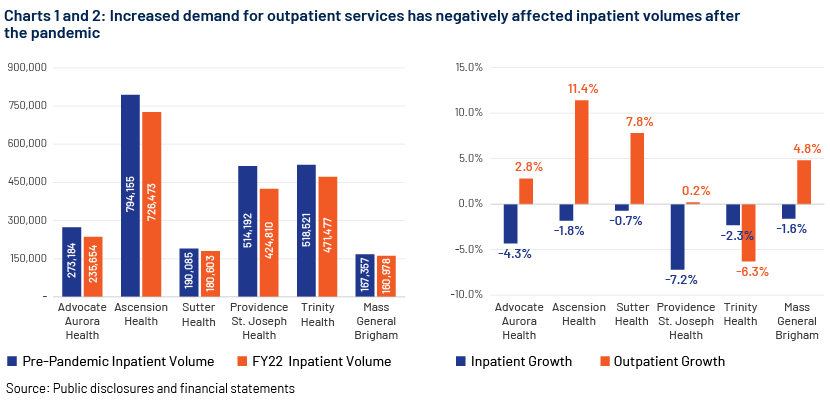

Shift in patient behaviour after the pandemic evidenced by growth in outpatient volumes

Patients avoided vising hospitals for minor health issues and elective surgeries amid the pandemic. This trend is continuing as more and more patients opt for ambulatory services and avoid hospital admissions. This is evidenced by the trend in inpatient and outpatient volume growth in FY22. Volumes grew, and outpatient growth continued to outpace inpatient growth in 1Q23. While the impact on revenue is difficult to ascertain at this point in time, we note that healthcare providers have increased investment in new centres to meet higher outpatient demand.

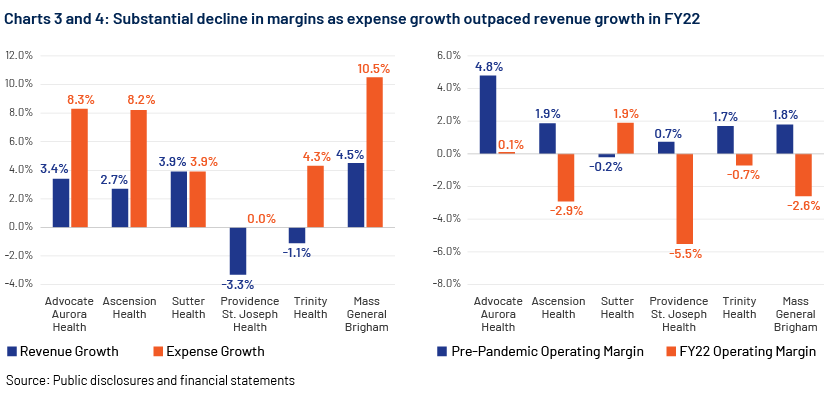

Low margins due to labour shortages, higher wages and costly supplies

NFP healthcare providers were able to continue their services due to government support in the form of funds received under the Coronavirus Aid, Relief, and Economic Security (CARES) Act and the Medicare Accelerated and Advance Payment Program (MAAPP). MAAPP advances were to be adjusted for services by the end of 2022, while CARES funds were in the form of welfare aid. Most of the government support mandates expired in FY22, and market-driven challenges started affecting the financial positions of providers. Expense growth outpaced revenue growth for most healthcare service providers in FY22. The primary contributors to expense growth were personnel- and supply-related costs. Healthcare staff demanded higher wages as compensation for increased work pressure and to manage inflation. Supply-related costs increased as demand for healthcare products (medicine and equipment) remained high. Persistent labour shortages only worsened the situation for healthcare providers. Inflationary pressure remains a problem in FY23, with quarterly financials indicating a 10-15% increase in these costs, on average, for most healthcare providers.

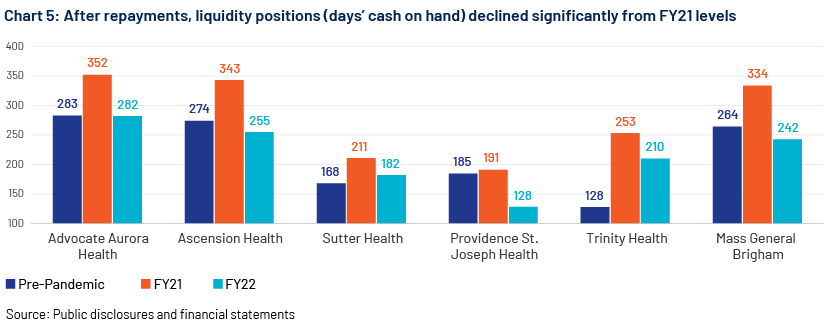

Liquidity declined as institutions repaid their MAAPP advances

The temporary liquidity support provided amid the pandemic was to be repaid by 2022. Repayment began in the second half of 2021, and most healthcare providers had repaid advances fully by the second half of 2022, affecting their liquidity significantly. Liquidity remains under pressure given the negative investment returns due to the poor performance of capital markets and the weak operating performance of providers, The liquidity position of most entities has improved in FY23. However, this increase is mostly in the form of investment gains and not liquid cash (most entities maintain a large part of their liquid reserves in the form of investments). If the capital markets deteriorate from current levels, liquidity would decline, as cash generation from operations is still limited.

Higher capital expenses to maintain operations

Providers deferred non-essential maintenance and capital projects in an effort to continue operations amid the pandemic, but these cannot be delayed further. Additionally, with increased demand for outpatient services, capital requirements are likely to increase. In the current high interest environment, raising capital to maintain operations would increase the interest expenses of service providers already contending with thin margins. Capital expenses increased in 1Q23, but providers remain apprehensive about new capital projects.

Management taking steps to address challenges

Providers are looking to engage more full-time employees to reduce their personnel costs, as contractual staff tend to be significantly costlier than in-house staff. Some healthcare entities are shifting more non-clinical tasks away from providers to technicians and other staff to improve their operational efficiency. Many are offering non-monetary benefits to employees, such as flexible scheduling, travel programmes and improved work-life balance. They are also expanding their ambulatory services and telehealth programmes to meet demand.

Medicaid expansion will benefit healthcare providers

Four states – Missouri, Oklahoma (implemented), North Carolina and South Dakota (implementation pending) – adopted Medicaid expansion under the Affordable Care Act (ACA) from 2021. Hospitals are generally reimbursed less under Medicaid than commercial insurance, as wider health coverage reduces the costs of care that are reimbursed (care with no patient or insurer payment). The Medicaid expansion has been shown to improve the financial performance of hospitals and other health providers, according to a Kaiser Family Foundation analysis of more than 150 studies, although the effects could vary by type of provider. This is credit-positive for the sector, as, losses under the expansion due to costs not being reimbursed are expected to decline.

The bright spot

Margins for US NFP healthcare remain low by historical standards, and a recovery is likely to be slow amid the continued labour shortages and operational challenges. However, contractual labour costs, the primary driver of the large increase in operational costs, have started to decline in FY23. Healthcare providers are also increasing hiring of full-time employees, which would further reduce personnel costs. Additionally, amid looming recession, inflation is declining and capital-market volatility is reducing, impacting the value of investments held by healthcare providers positively. This resulted in increased liquidity for most providers in 1Q23. These positive trends continuing would help the US NFP healthcare sector recover and stabilise.

How Acuity Knowledge Partners can help

We have been supporting financial institutions focused on municipal bond investments and trading for nearly two decades. We provide client with scalable and customised solutions, leveraging our experience in municipal asset class. Our proprietary technology solutions help clients enhance their coverage and free up onshore bandwidth to focus on more value-added tasks.

Sources:

-

Comprehensive annual financial reports

-

Continuing disclosure reports

-

Providers turn to telehealth, non-monetary benefits to help ease labor pressures

-

Medicaid expansion stands to reduce uncompensated care, a credit positive for hospitals

What's your view?

About the Author

Ashutosh has over nine years of experience in credit research, with expertise in US municipal markets and not-for-profit corporates. He currently supports a US-based global investment manager, with a focus on taxable and tax-exempt US municipal debt. Ashutosh provides investment recommendations and commentary on the credits through periodic review and keeping a track of developments. He holds a Master of Business Administration in Finance and a Bachelor of Technology in Electrical and Electronics Engineering.

Like the way we think?

Next time we post something new, we'll send it to your inbox