Published on December 1, 2022 by Neha Rastogi

Private equity (PE) is an alternative asset class through which companies can raise funds outside the public markets. PE and venture capital (VC) fund strategies are the most popular.

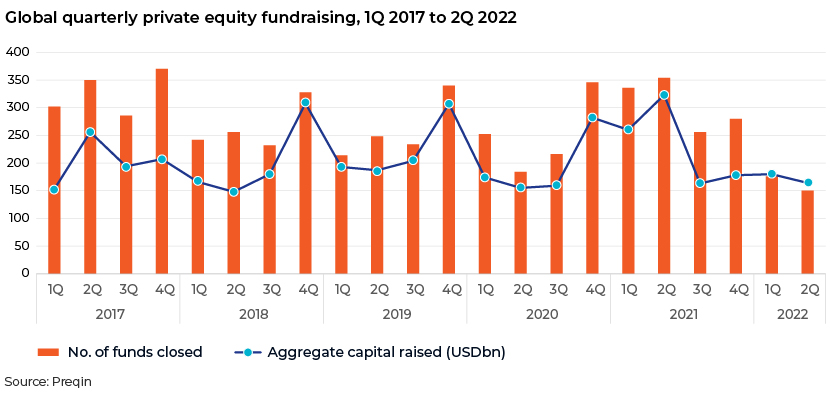

The macro environment is in constant change, and both investors and fund managers are interested in knowing the direction in which the market moves and how it would affect fund performance. Investments in PE have performed well recently, even amid the turbulence.

Although economic turbulence is not a positive factor, and the market suffers significantly due to turbulence, the past decade has shown that PE outperforms amid crises, for example, the recession that followed the dot-com crash in the early 2000s, the global financial crisis of 2007-09 and the 2020 pandemic-related market events. PE underwent a more moderate drawdown and a faster recovery than public equities. In fact, long-established funds have become substantially larger, and a broad range of new entrants have joined the market. Amid the Ukraine-Russia conflict, PE has shown a strong performance, with fundamentals remaining intact so far in 2022.

PE had a banner year in 2021. The funds continued to strengthen, growing in demand and steadily outperforming. Fund managers maintained this resilience by deploying capital in a larger number of deals.

In 2021, deal size was, on average, more than USD1bn, an all-time high, with a sound internal rate of return (IRR) after a considerable economic crisis.

What made PE a winner in past recessions:Past performance shows the strength of PE amid a recession. Firms are well prepared for an impending economic crisis:

1. Better access to capital and flexibility in deployment

Flexibility in deploying capital amid a recession can be crucial for warding off bankruptcy. With better access to capital and the freedom to deploy it, PE enables portfolio companies to seize growth opportunities amid a recession or other crisis. Research by Hamilton Lane estimates that the consequences of “catastrophic loss” for PE-backed companies (described as a severe event that results in a decline in peak value by 70% or greater with nominal recovery) are less than half of those for public companies.

2. Active management and hands-on approach to managing portfolio companies

PE-backed companies have a competitive advantage when there is active management of large funds and effective support, as these provide a prompt response during a slump. This helps businesses develop competence and initiate transformation programmes. A study by McKinsey suggests that functioning teams have a substantial impact on fund performance, especially in post-recession periods.

3. Experienced professionals

PE firms are often sector experts that help companies grow. They are well prepared to assess challenges and plan strategies. Experienced professionals can use accessible dry powder to ease a company’s financing concerns and help them renegotiate loan terms and debt commitments.

4. Illiquidity in downturns

Although the illiquid structure of PE may seem contradictory, the fund prevents panic selling during a distressed period. Being a long-term investment, handled by experienced professionals, PE protects investors from regular volatility. It also converts downturns into new opportunities.

5. Limited partners (LPs) are more sophisticated and have access to better tools

Most LPs invest additional capital in PE using the “denominator effect” when the value of one segment of the portfolio has decreased significantly and has pulled down the total value of the portfolio. Funds can invest in companies at lower valuations, build space to expand multiples post-recovery and create more opportunities. Lower multiples also permit funds and their portfolio companies to acquire minor entrants, complementing active platform investments at lower, sometimes distressed, valuations.

How Acuity Knowledge Partners can help

We provide end-to-end support to PE firms on the investment side and horizontal support across middle-office and back-office functions. We also support middle-office and back-office teams of PE firms by providing bespoke Private Equity Solutions such as fundraising, investor relations, and fund operations support. We collaborate with professionals, augmenting their bandwidth.

Sources:

Tags:

What's your view?

About the Author

Neha is part of Private Equity team at Acuity Knowledge Partner with more than 4 years of experience in assisting Private equity clients with deal sourcing, deal assessments and strategic research support. Her expertise spans across due diligence, financial modelling, competitor benchmarking, relative valuation, etc. She has done MBA from Bharati Vidyapeeth University.

Like the way we think?

Next time we post something new, we'll send it to your inbox