Published on July 14, 2022 by Prashant Gupta

Investors globally continue to shift away from traditional asset classes towards alternative investments to diversify their portfolios and generate higher and more resilient yields. With abundant dry powder after the pandemic, they are flocking towards alternative assets, especially private markets, driven predominantly by the outperformance of this asset class.

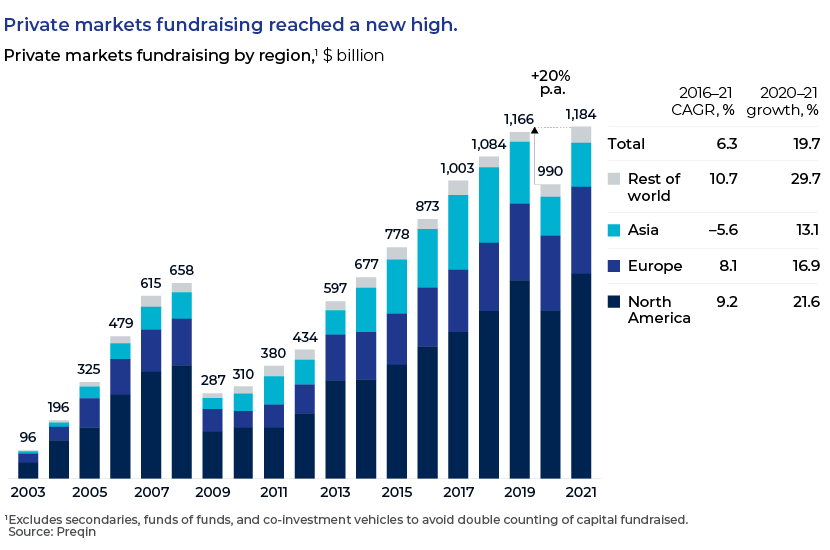

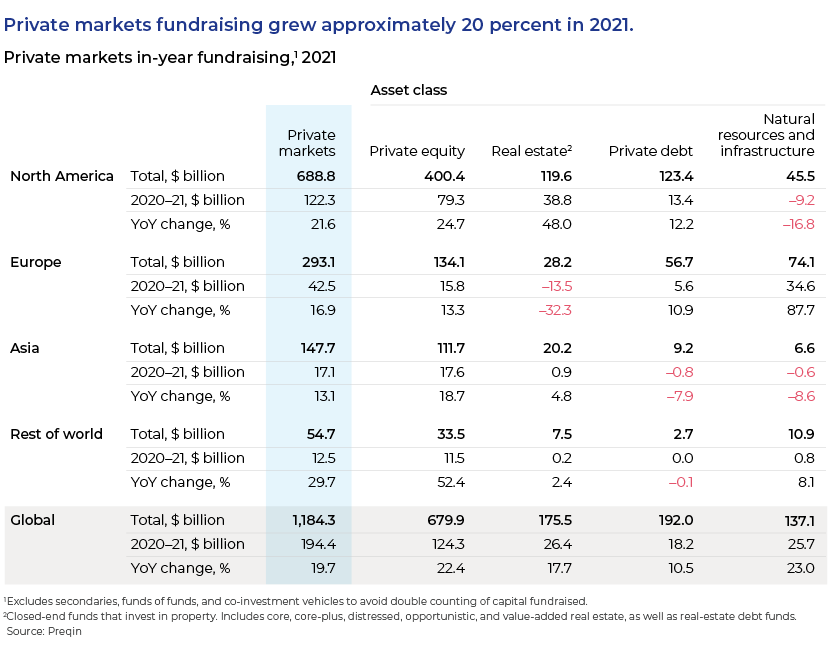

Private market fundraising reached a new high of approximately USD1.2tn in 2021 (up by c.20% over 2020), according to financial-data provider Preqin.

Private credit on the rise:

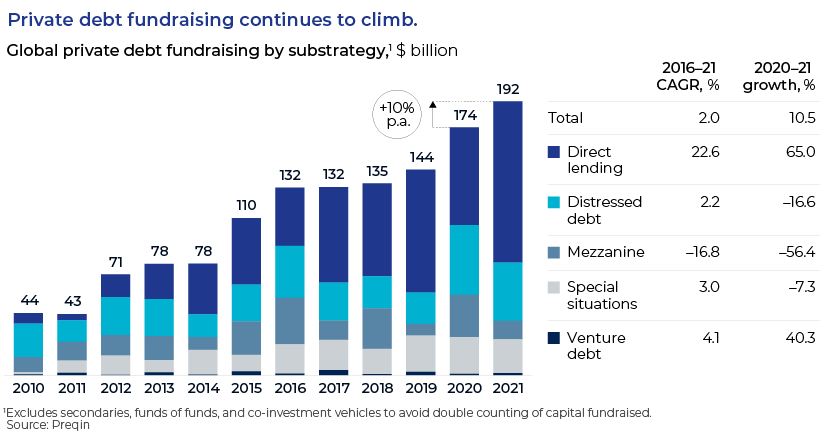

This growth can be observed across private asset classes but most notably in private credit, which has seen annual growth in assets under management (AuM) of close to 10% over the past 11 years and is the only asset class to have grown fundraising in each of these years. Fundraising across private debt strategies totalled USD192bn in 2021, 10.4% more than in 2020 and nearly 5x more than a decade ago.

This surge was fuelled primarily by direct lending, a private debt sub-strategy. Direct lending fundraising surpassed USD100bn for the first time and accounted for approximately 60% of private debt fundraising in 2021. Direct lending has accounted for 73% of the growth in private debt fundraising over the past decade, growing nearly 40% per annum, according to the Preqin report.

Why is private credit gaining traction?

Key growth drivers – demand side: Investors continue to look to private debt to gain reliable and resilient returns that exceed returns from fixed-income alternatives.

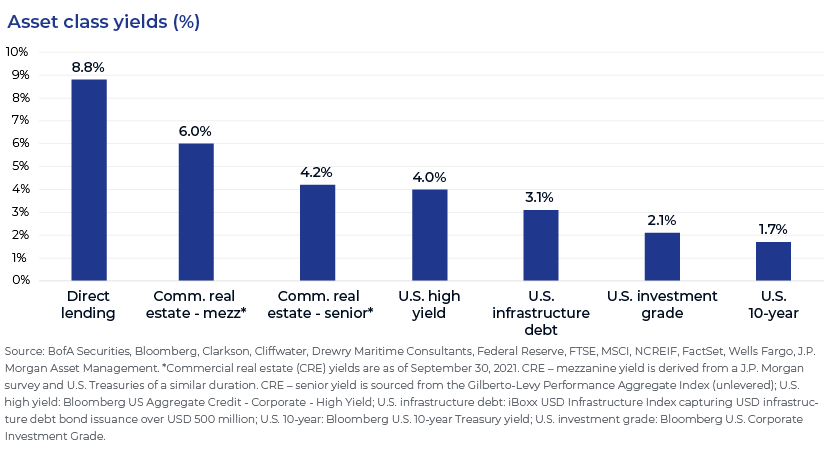

With inflation on the rise and equities affected by rising interest rates, adding a private debt asset class seems to be not only a sound diversification strategy for investors, but also a great way to secure more resilient and higher yields. Private debt, like public debt, is an effective tool to hedge inflation and protect capital in still-unknown market environments, but unlike public debt, it offers additional premium (see asset class yields below), resulting in higher spreads than for public debt, and exhibits low volatility due to its being less liquid. Moreover, the availability of floating-rate assets offers private credit investors a greater buffer against a rising interest rate environment. As a result, investors are increasing their allocations to private debt.

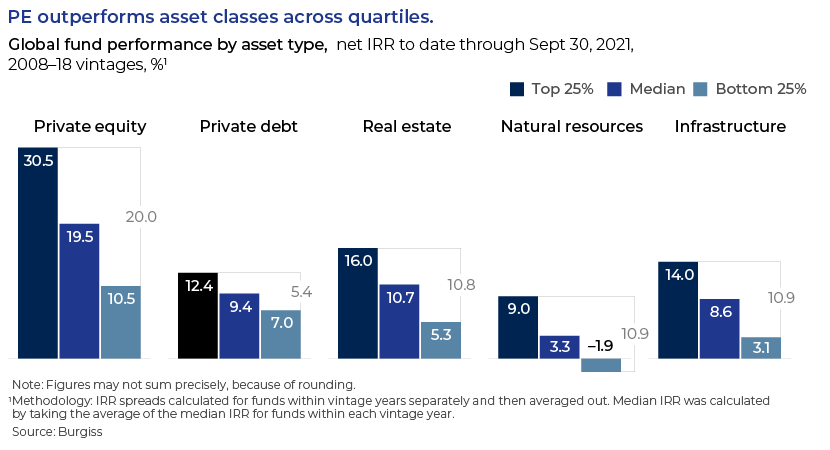

Private debt generated 10.1% pooled IRR from 1Q21 to 3Q21, almost twice the returns for full-year 2020 and the best in-year return since 2017, according to Burgiss, a provider of data and analytics solutions for investors. Over the longer term (2008 to 2018), the median IRR of 9.4% generated by private debt is almost at the same level as those of real estate and infrastructure asset classes.

Key growth drivers – supply side: Borrowers, especially those backed by private equity sponsors, continue to look to the private debt market due to the certainty of deal execution, pace of execution, convenience and confidentiality it offers.

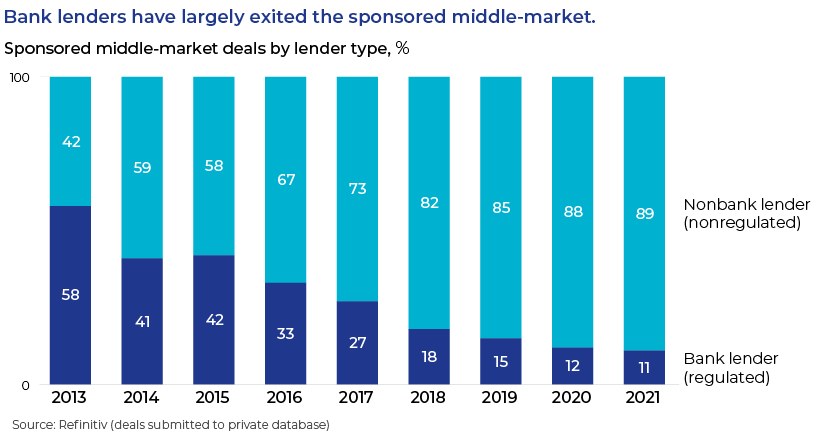

After the global financial crisis, banks have been subject to more stringent regulations and capital requirements and, therefore, less willing to lend in private markets. Banks accounted for just 11% of sponsored middle-market financing in 2021, down from nearly 70% in 2013. Public markets are also not reliable and restrict supply of capital amid uncertainty. Private lenders, however, are not subject to the same regulatory capital requirements as banks and are, therefore, more inclined to extend sub-investment-grade credit to fill the gap.

What does the future hold?

As with other asset classes, there are challenges and weakness associated with private debt. The private debt market also faces similar headwinds as the public debt market at the macro level. Challenges such as inflation pressures and a central bank’s stance could pose risks as well. At the asset class level, transparency and illiquidity are the main risks to the growing private debt market. Despite these risks, private debt weathered 2020 well as lenders quickly stepped in with amendments and capital injections that enabled borrowers to avert bankruptcy, often in exchange for equity.

Private debt is forecast to be the fastest-growing alternative asset class over the next four to five years. A recent report by Preqin suggests that as interest rates rise and government support is wound down, private debt will continue to fill the gap. Preqin forecasts that private debt will accelerate at a CAGR of 17.4% from 2022 to 2026, making it the second-largest private market asset class in 2023. Fundraising growth continues to be driven by growing limited-partner (LP) allocations, which have doubled since 2016. Given the growing prominence of the asset class, many LPs have carved out private debt as a separate allocation category. We see significant growth potential in private credit supply and demand and abundant opportunities.

How Acuity Knowledge Partners can add value

We have more than two decades of experience in offering support to global clients working in this space. We work as pure extensions of their onshore credit teams, providing end-to-end support across the research cycle. Our approach to private credit is to bucket it under capital preservation (senior debt/direct lending and mezzanine), return maximising (distressed debt) and opportunistic/niche (CLOs/CDOs and others). Through our comprehensive private debt solutions, we offer services including opportunity screening, custom research, execution support and fund operations.

References:

McKinsey Global Private Markets Review 2022: mckinseys-private-markets-annual-review-private-markets-rally-to-new-heights-vf.pdf

S&P Global: Private Debt: A Lesser-Known Corner Of Finance Finds The Spotlight | S&P Global (spglobal.com)

Trends in Private Debt| Crestbridge

What's your view?

About the Author

Prashant is a seasoned professional within the Private Market team and has been with the company for over 12 years. His extensive career spans more than 18 years, during which he has garnered a wealth of experience through a diverse range of research and analysis assignments. His clientele is impressive and varied, including top-tier asset managers, private equity firms, and bulge bracket investment banks.

His expertise is broad and deep, with a particular focus on comprehensive end-to-end credit analysis.Prashant’s skill set encompasses capital structure analysis, intricate corporate structure assessments—including guarantees and structural subordination cases—and covenant compliance analysis. Additionally, he is adept at financial modeling and valuation, asset recovery analysis,..Show More

Like the way we think?

Next time we post something new, we'll send it to your inbox