Published on December 15, 2023 by Navaneet Gandhi

Introduction

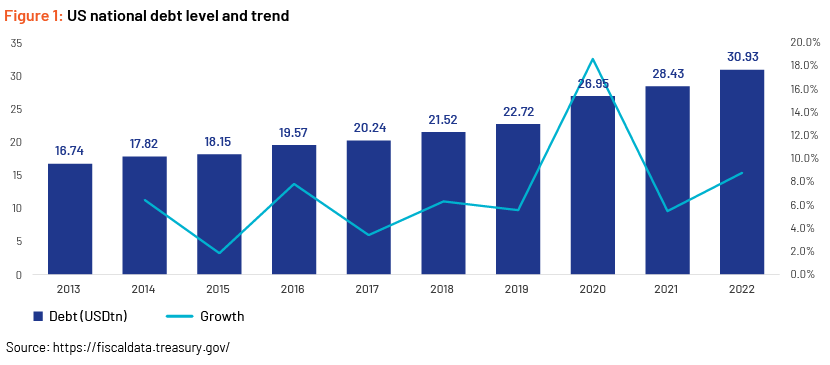

The US faces a significant challenge in managing national debt, which has been increasing steadily over the years. National debt stood at USD30.93tn as of 2022, almost double that in 2013 (Figure 1), raising concerns about its impact on the economy, financial stability and future generations.

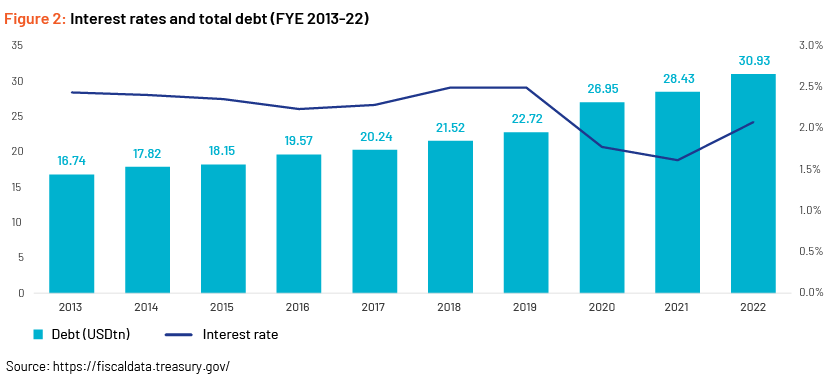

National debt has increased every year over the past 10 years, while interest expenses have remained stable due to low interest rates and investor perception that the US government has a very low risk of default. However, interest expenses are now increasing due to higher interest rates and inflation.

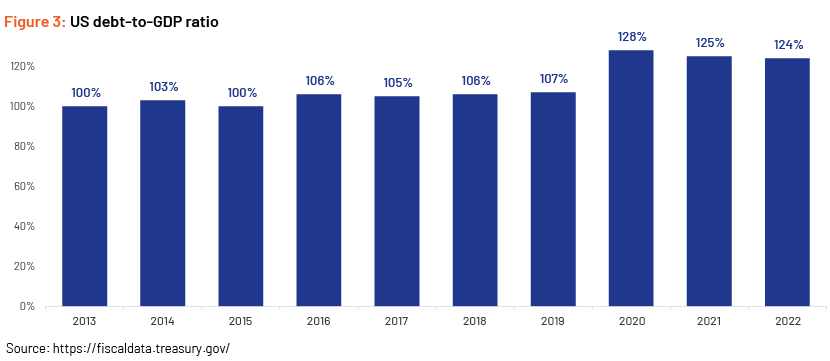

The US’s federal debt-to-GDP ratio was 107% in late-2019 and increased to nearly 136% in the second quarter of 2020 with the passage of a coronavirus relief package. The ratio indicates a country's ability to pay back its debt.

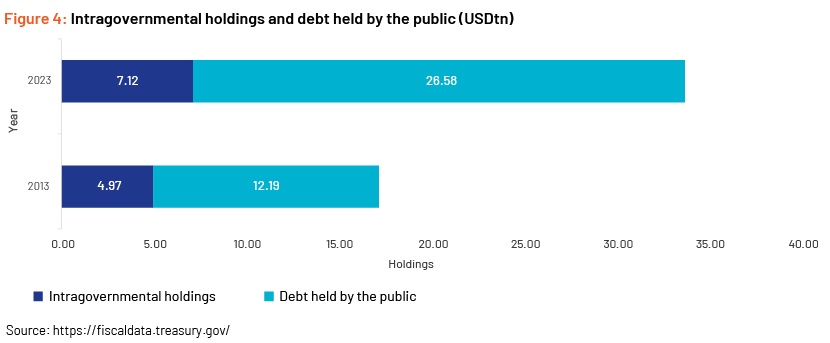

Most economists argue that “debt held by the public” should be more of a concern because it would be far more detrimental to the US economy if the federal government were to default on debt traded on open markets. Intragovernmental holdings are also critical, considering they represent the money required to sustain important government programmes. Debt held by the public has increased 118% from 2013 to 2023, while intragovernmental holdings have increased by 43% over the period.

In this blog, we delve into the strategies employed by the US Public Finance Department to manage this increasing debt burden.

Understanding national debt

We first need to understand what constitutes national debt. National debt is the total of the federal government's outstanding borrowings, accrued through budget deficits over time. It includes debt owed to both domestic and foreign creditors, individuals, institutions and other governments.

Debt-management goals

The US Public Finance Department's debt-management strategies are guided by specific goals:

-

Reduce borrowing costs: By managing national debt effectively, the government aims to secure lower interest rates on borrowings, reducing the overall cost of servicing debt

-

Ensure market stability: The government aims to maintain a stable and liquid market for its debt securities to ensure continued investor confidence and funding availability

-

Minimise risk: US Public Finance seeks to mitigate risks associated with national debt, including interest rate risk and refinancing risk

Debt issuance and types of securities

To fund national debt, the US Treasury issues securities such as the following:

-

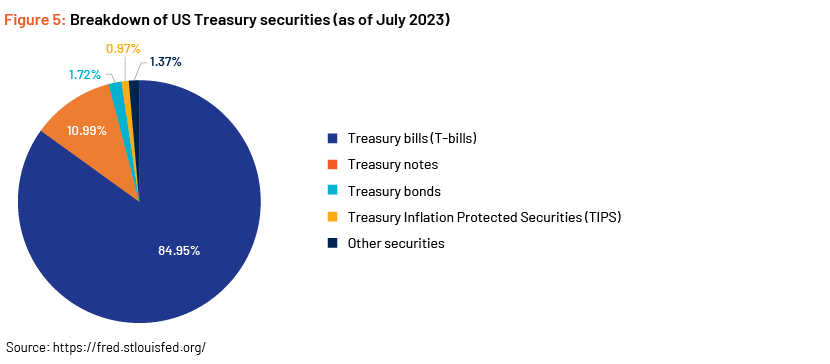

Treasury bills (T-bills): Short-term securities with maturities of one year or less, commonly used to manage short-term cashflow needs

-

Treasury notes: Medium-term securities with maturities ranging from 2 to 10 years

-

Treasury bonds: Long-term securities with maturities exceeding 10 years, used to finance large-scale projects and cover long-term obligations

-

Treasury Inflation-Protected Securities (TIPS): Bonds indexed to inflation, providing protection against rising consumer prices

The composition (Figure 5) is primarily a mix of T-bills (85%) and Treasury notes (11%), which account for almost 96%.

Debt refinancing and rollover

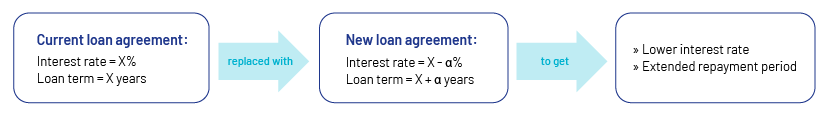

Debt refinancing refers to exchanging one type of debt for another with better terms. Its main aim is to optimise the government's debt structure and reduce borrowing costs. This strategy is frequently used when market interest rates have fallen since the debt's initial issuance.

Explanation:

-

Reducing interest costs: The US Public Finance Department can issue new debt to pay off existing debt with higher interest rates when it sees a chance for refinancing at a lower rate. Thus, the government effectively lowers the cost of paying off its debt, freeing up money for other budgetary objectives

-

Improving debt sustainability: Debt refinancing can also help national debt become more sustainable in the long term. By lowering interest rates, interest payments will be less onerous, making it easier for the government to handle its debt obligations in the future

-

Monitoring market conditions: When refinancing debt, timing is everything. To capitalise on the best opportunity for refinancing, the US Treasury Department regularly analyses market conditions, particularly changes in interest rates. The government may save significantly on interest payments by strategically scheduling debt refinancing

New loan agreements could be entered into, with terms involving lower interest rates and extended repayment periods

Debt rollover refers to issuing new debt to pay off older debt that is nearing maturity. Its main aim is to manage the government's debt maturity profile and ensure a steady stream of debt obligations over time.

Explanation:

-

Manage debt maturities: The US Public Finance Department releases new debt to replace existing debt as the government's debt instruments near their maturity dates. The government "rolls over" the maturing debt in this way to maintain a steady flow of debt obligations so as not to be faced with an unexpected increase in repayment obligations

-

Mitigate refinancing risk: Rolling over debt reduces the refinancing risk introduced by a large amount of debt maturing at once. The budget and financial markets would be pressured if the government is suddenly required to repay a sizeable portion of its debt. Spreading out debt maturities through rollover reduces the likelihood of being suddenly burdened with debt repayment

-

Ensure flexibility in debt management: The US Treasury Department has flexibility in how it manages its debt portfolio. Through issuing fresh debt with new terms and maturities, the government is able to adjust to changing market conditions and investor preferences

It is crucial to keep in mind that both debt rollover and refinancing require rigorous study and assessment of market circumstances, interest rate trends and the government's overall debt management objectives. To ensure responsible and effective debt management, the US Public Finance Department continues to assess these factors. The government aims to maintain fiscal stability amid debt-related problems by using debt refinancing to reduce borrowing costs and debt rollover to manage debt maturities.

Debt buybacks and exchange

The US Public Finance Department relies heavily on debt buybacks and swaps to effectively manage the federal government’s outstanding debt portfolio. Debt buyback refers to the government buying back its own outstanding debt securities from investors before they mature, reducing the overall amount of outstanding debt. The debt load is, thus, made more manageable by repurchasing debt with higher interest rates or premium yields. Debt buybacks also enable the government to control the average maturity of its outstanding debt, possibly lowering refinancing risk while managing its debt maturity profile. However, debt buybacks depend on the state of the market and investor mood, and prudent timing is essential for securing favourable terms.

Debt exchange, on the other hand, refers to the government exchanging current debt instruments for new ones with new terms or features. By exchanging older debt with less favourable conditions (such as higher interest rates) for new debt with more favourable terms (such as lower interest rates), the government can optimise the structure of its debt. Debt exchange supports debt-management objectives by enabling flexible targeting of particular debt instruments for exchange and reducing total borrowing costs. Depending on its objectives, the government may choose to lengthen or reduce the average maturity of the outstanding debt through a debt exchange. The US Public Finance Department effectively manages its debt portfolio by strategically implementing debt buybacks and exchanges, maintaining a well-structured debt profile and encouraging fiscal responsibility.

The role of the Federal Reserve

US debt management is influenced significantly by the US Federal Reserve (Fed). As the nation's central bank, the Fed’s monetary policy decisions and actions impact government debt, interest rates and general financial stability.

-

Monetary policy and interest rates: The Fed's interest rate decisions have a direct impact on how much the government must borrow to pay its debts. The government may have to pay more in interest if the Fed hikes rates

-

Open-market operations: The Fed's purchases and sales of government securities impact yield of and demand for government debt; these affect market conditions and the government’s cost of borrowing

-

Quantitative easing (QE): To boost economic activity and reduce long-term interest rates, the Fed may resort to QE during economic downturns by purchasing government securities

-

Market stability and confidence: Investor confidence in government debt instruments can be influenced by the Fed's open communication on monetary policy, supporting market stability and attracting investors

The Fed’s involvement in debt management is essential if the US is to maintain stable borrowing costs, market conditions and general financial stability.

The debt-ceiling debate and its effects

The debt-ceiling debate centres on the statutory cap on the total amount of US government debt. Congress chooses between raising or suspending the cap, which could entail the risk of a government shutdown, a potential default on existing debt commitments, a deterioration in investor confidence and an increase in borrowing rates. The uncertainty of the outcome of the debate may impact market volatility, economic outcomes, consumer and company confidence, investment choices and global trade. The discussion highlights the importance of sound debt management and long-term economic responsibility. It is crucial to find long-term solutions to minimise budget deficits and carefully manage national debt in order to protect the nation's finances and international position.

Long-term sustainability and fiscal responsibility

Ensuring long-term debt sustainability and fiscal responsibility is essential for the US government. Policymakers face the challenge of balancing the need for investment in infrastructure, education and social programmes with managing debt responsibly.

Conclusion

Managing national debt is a complex and critical task that the US Public Finance Department handles with careful planning and strategic considerations. Debt-management strategies play a vital role in keeping borrowing costs low, ensuring market stability and safeguarding the country's financial wellbeing. As the nation faces evolving economic and demographic challenges, a prudent and sustainable approach to debt management becomes increasingly imperative to ensure prosperity.

How Acuity Knowledge Partners can help

We have more than two decades of experience in supporting global financial institutions to scale up their public finance underwriting practices and drive value for their clients. By leveraging dedicated teams of experienced analysts in our offshore delivery centres, clients benefit from operational efficiency and cost optimisation. Our Public Finance team, with their state-of-the-art modelling capabilities, are well versed in covering the municipal financing and public sectors.

References:

-

https://fiscaldata.treasury.gov/americas-finance-guide/national-debt/

-

https://www.visualcapitalist.com/cp/us-debt-31-4-trillion-owed-in-2023/

-

https://fiscaldata.treasury.gov/americas-finance-guide/national-debt/

-

https://tradingeconomics.com/united-states/government-debt-to-gdp

-

https://fiscaldata.treasury.gov/americas-finance-guide/national-debt/

-

https://fiscaldata.treasury.gov/datasets/debt-to-the-penny/debt-to-the-penny

-

https://www.newyorkfed.org/medialibrary/media/research/staff_reports/sr304.pdf

-

https://www.sifma.org/resources/research/us-treasury-securities-statistics/

-

https://www.cnbc.com/2023/05/18/debt-ceiling-deadline-what-debate-means-for-your-money.html

Tags:

What's your view?

About the Author

Navaneet is an Investment Banking Associate at Acuity Knowledge Partners, having around 3 years of experience in financial services sector. Currently, he is a key member of Public Finance team, supporting a U.S. based Investment Bank with a focus on Municipal Finance for. Navaneet has hands-on experience of working on key projects covering Investment Research and Financial Analysis. He holds a Master’s degree in Business Administration specializing in Finance from Bharati Vidyapeeth University, Pune and completed Applied Financial Risk Management (Executive Development Programme) from IIM (Kashipur).

Like the way we think?

Next time we post something new, we'll send it to your inbox