Published on May 11, 2022 by Ghanshyam Bhambhani

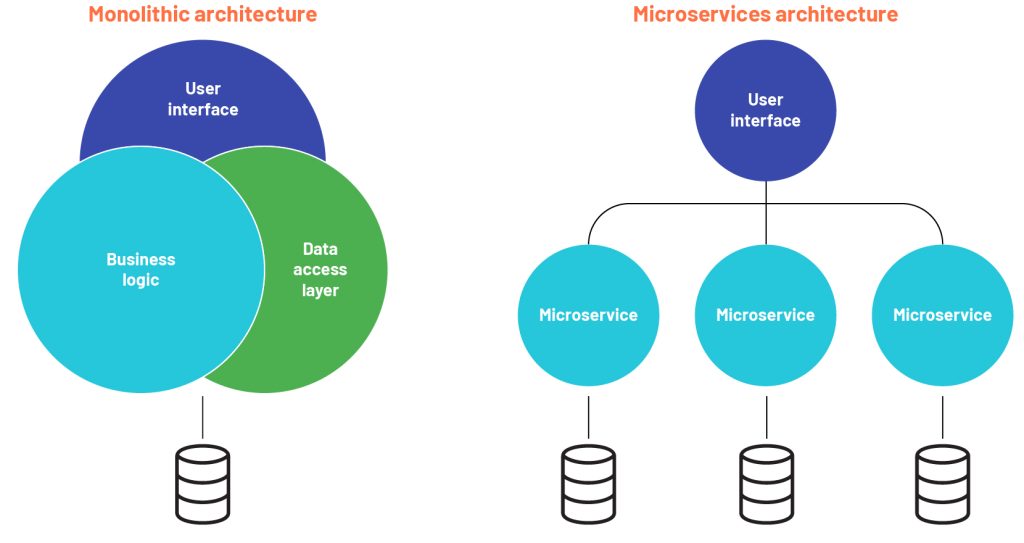

Despite all the talk of digitalisation, a number of capital markets firms are still working with monolithic and legacy architecture. As a result, industry participants are working in data silos and closed environments, and conducting manual export/import of data between Excel sheets, causing delays and errors.

For example, according to the Workspace Without Limits report (2021) published by Refinitiv, 40% of senior bankers surveyed reported delays caused by swapping data between applications, while 37% reported errors. They also mentioned that they typically use nine different applications to complete a single task. This establishes the fact that the use of monolithic and legacy architecture, which does not allow communication between applications from two different vendors, leads to greater risk and lower efficiency for firms.

A well-known approach to eliminating all the disadvantages associated with traditional monolithic systems is the use of an open architecture framework. This has increased significantly in recent years, and its importance was highlighted amid the pandemic-related lockdowns.

Capital markets firms are dealing with a number of challenges – from ongoing regulatory changes, rising cybersecurity-related incidents and falling profitability in specific pockets of the industry to increasing competition from smaller, agile and born-in-the-cloud fintechs. The use of an open architecture approach, a key capital markets technology trend, could help them deal with such challenges.

Capital markets firms need to embrace open architecture rapidly if they are to remain competitive and future-proof their operating models. Failure to do so threatens long-term survivability.

Reports indicate they are adopting this approach, in varying degrees and in different areas. Nearly a third of capital markets firms stated that their competitive strategy includes making their data more accessible to clients via open application programming interfaces (APIs), according to the 2021 FIS Readiness Report. Capital markets firms are trying to minimise the number of different technologies they use, so as to increase efficiency, reduce costs and improve resilience.

Service providers across the capital markets value chain are forging alliances to pre-package their offerings. Examples of such services include conventional and alternative datasets, news and analytics. All this is made possible by adopting the open architecture approach.

Open architecture refers to the use of microservices (to break down business activities into small modules) and APIs (to enable access to applications) for solution building. The microservices approach makes each module, or service, easier to maintain and update. These modules can be developed independently and maintained by collaborating with external and internal stakeholders. This enables financial institutions to add third-party applications to their solutions and offer flexibility and true optionality to their customers.

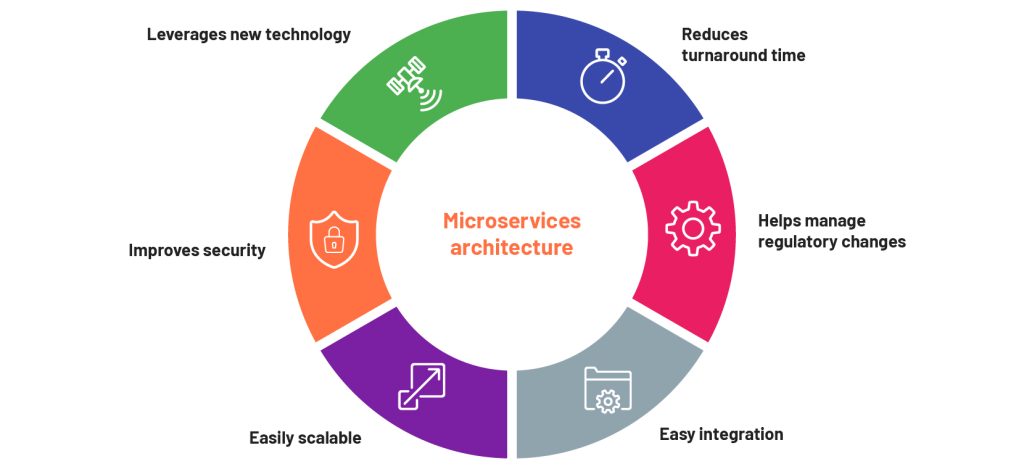

The increasing adoption of open architecture as an architecture of choice for capital markets service and technology providers is because of its advantages.

Reduces turnaround time:

It enables new features to be developed and deployed in hours. This is made possible by integrating new modules with the desired features using the API layer while keeping the core systems unchanged.

Helps manage regulatory change:

Capital markets across the globe are witnessing regulatory changes, requiring firms to modify their systems to ensure compliance. The microservice architecture enables capital markets system providers to update the systems by adding relevant modules.

For example, if new rules related to tax wrappers are changed in a specific jurisdiction, a new application to reflect those changes could be added without having to modify all the underlying systems.

Easy integration:

Open architecture makes it easier to communicate with applications of other vendors via APIs and integrate them with in-house solutions to enhance their features. This enables capital markets firms to offer services across the trade lifecycle by partnering with other vendors.

Easily scalable:

A microservices- and API-based approach makes it easier to add new features or grow applications, as changing one module does not affect the other.

Improves security:

The modular structure of the solution enables services to be isolated from each other; thus, security breaches are less likely to threaten the entire solution.

Leverages new technology:

New technologies such as machine learning and natural language processing have opened up new ways to analyse data. Open architecture, supported by technology research services, enables the processing of large and complex datasets outside the firm’s systems on a third-party service provider’s cloud.

How different areas/functions within capital markets are being impacted by open architecture

Data management:

Capital markets firms are increasingly leveraging the opportunity presented by large piles of data. However, processing the data and gathering insights from it puts significant pressure on computing resources and operations teams. Therefore, these firms are now leveraging an open architecture approach to enable third-party vendors to help them process data. This frees up a firm’s critical resources to focus on core work, i.e., alpha generation and client management.

Trading:

Trading platforms are undergoing a transformation. They are moving away from being just an execution tool to becoming highly interactive customer experience platforms comprising intelligent virtual assistants, chatbots, etc. to offer an expanded set of functionalities to different users, particularly those who place a high value on self-sufficiency and customisation. Open architecture makes it easier to add different functionalities to the trading platform.

Securities service providers:

These providers are undergoing a structural change in the way they operate, i.e., rather than playing on volumes, they are trying to be part of the entire trade lifecycle by partnering with firms engaged in the initial and middle stages. This is enabled by the use of open architecture that allows their solutions to link with the applications and data sources of their partners.

Asset management:

The use of the open architecture approach by technology vendors enables asset managers to offer multi-asset investment management solutions. This is made possible by integrating investment management applications for various assets with the vendor’s investment management platform. Here, third-party vendor partnerships, system maintenance and other functions are handled by the platform provider.

As open architecture replaces the monolithic architecture of capital markets firms, the industry would continue to see a shift in the way processes are run across the capital markets value chain, driven by modular and scalable capital market technology solutions. Middle- and back-office workflow would become less process-driven and more API-driven with the adoption of software applications performing functions such as e-KYC and e-AML. This would completely change current workflows and technology systems.

Recommendations for capital markets technology vendors

-

There are many steps capital markets technology vendors can take to remain competitive in this evolving environment. They should try to unlock value for their clients by eliminating the research, development and integration work involved in trying to use new technologies for the first time. Vendors can integrate those technology features into their solutions by incorporating third-party applications in their solutions. Furthermore, they should take over the time-consuming maintenance of systems, processes and data owned by asset managers; this would make them more accountable for tangible business outcomes.

-

Considering the upcoming battle of the ecosystems, successful vendors would be those that can open up their platforms and architecture and develop them into a thriving ecosystem with abundant growth opportunities, both for themselves and partner vendors. However, smaller capital markets firms should focus on developing and offering microservices-based applications and then integrating them with platforms offered by larger vendors.

How Acuity Knowledge Partners can help

The technology practice within our Private Equity and Consulting Group offers a range of strategy support services to technology providers. We work with Fortune 500 fintech firms and capital markets solution providers to offer insights on areas such as the technology landscape, competitors’ moves, growth opportunities, M&A and deal insights, and the regulatory landscape. Our subject-matter experts provide customised, time-bound solutions to help you swiftly map your strategic objectives and execution plan.

Sources:

https://insight.factset.com/buy-side-trends-open-architecture-multi-asset-strategies-and-esg

https://www.thetradenews.com/trumid-secures-additional-208-million-in-funding-round/

https://www.quantifisolutions.com/microservices-the-new-building-blocks-of-financial-technology-2/

https://www.celent.com/insights/490557763

https://www.itiviti.com/platform

https://www.tradersmagazine.com/uncategorized/2020-mega-deals-and-open-ecosystems/

https://ihsmarkit.com/research-analysis/ihs-markits-thinkfolio-and-northern-trust-integration.html

https://www.fortunesoftit.com/microservice-architecture-in-financial-ecosystem/

Tags:

What's your view?

About the Author

Ghanshyam has over 9 years of experience in the corporate strategy and consulting domain. Currently, he works with senior strategy staffers of the technology firms and helps them meet their strategic goals such as market entry strategy, product portfolio revamping, competitive intelligence, white space identification and many more. Ghanshyam previously worked at Bain, where he assisted clients across industries in strategic projects. He holds a Master’s degree in Business Administration and Bachelor’s degree in Computers

Like the way we think?

Next time we post something new, we'll send it to your inbox